Credit Cycle Dysfunction Has An Endpoint

It is important for investors to fully understand that current conditions are unprecedented in their own lifetime investment experience.

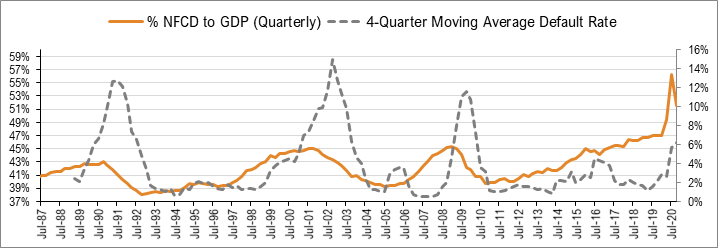

The scale of the credit cycle has continually expanded over

Best practices are meant to be shared. That’s why we observe the market and then share our insights on what’s happening, to give you context. We’ve organized every blog into categories, so it’s easier for you to find the answers that matter most to you.

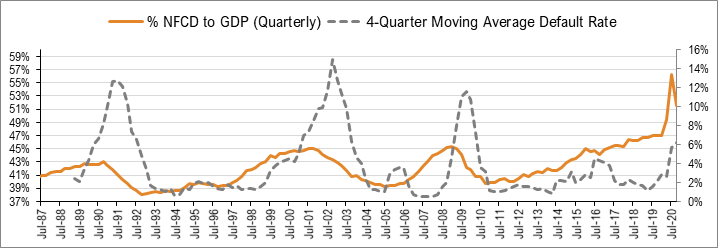

It is important for investors to fully understand that current conditions are unprecedented in their own lifetime investment experience.

The scale of the credit cycle has continually expanded over

CB Investment Management has partnered with financial tech platform, Pontera, formerly known as FEEX. Pontera specializes in providing full access to all trading and managing of held away accounts (i.e.

Last week the central banks displayed how far they are from resolving current challenges, and some made stunning inaccuracies in their assessments and statements.

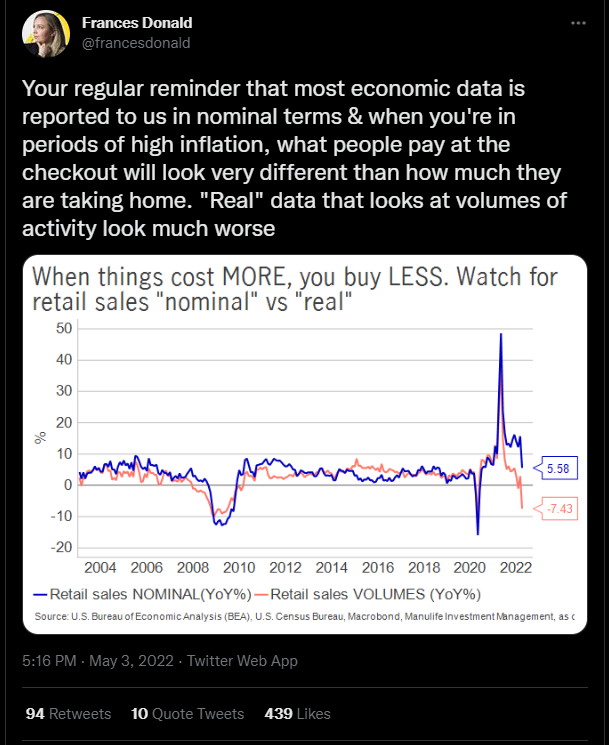

Consumers and investors have had to react to a new economic paradigm in 2022, as initiated by yet another extreme shift in central bank policy. It is becoming increasingly clear

Make sure you have a robust full cycle strategy in place. This week the focus is on Paul Tudor Jones, the Best Investor system for outperforming Billionaires, and understanding John

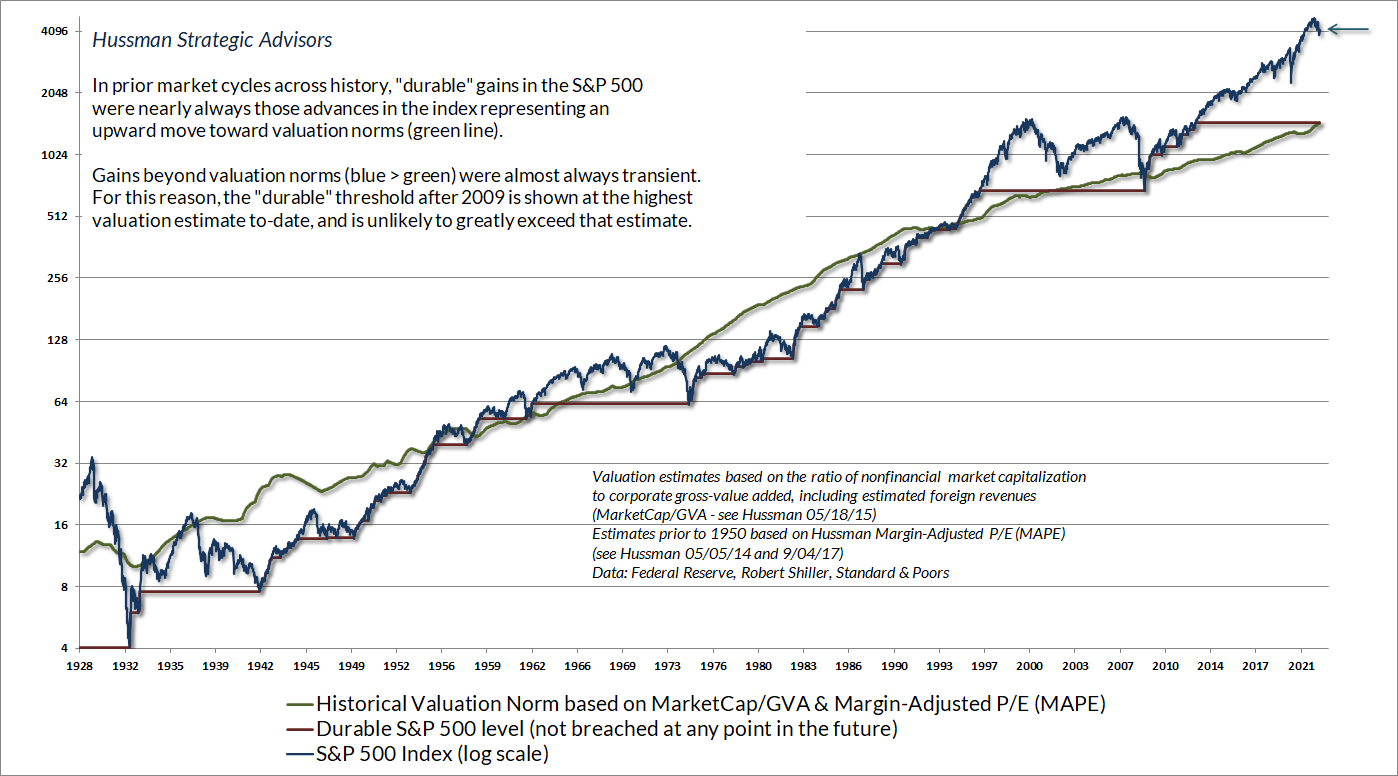

Investor behavior and portfolios are struggling to transition from the biggest bull market in 100 years to a transformed environment, Stagflation. Investor allocations follow the markets and peaked with the

Jerome Powell’s statements last week reinforced the Fed’s full policy reversal from the most reckless policy stance in history as confirmed by data on money supply, debt, QE, and real

How can you be confident that your current investment approach is on track for the low risk AND high returns of the most successful investors?

The “Best Investor” approach

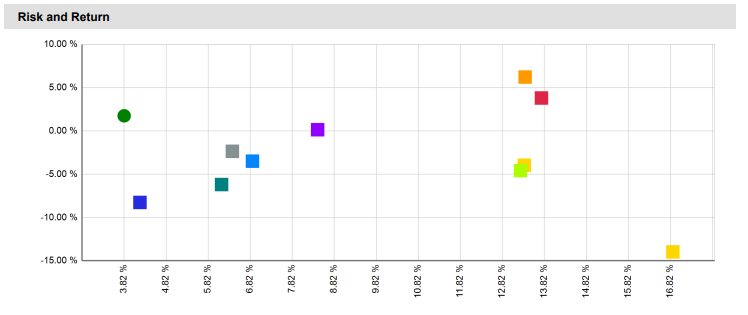

One of the most important new developments of the current year has been the shift in correlations between stocks and bonds. The chart below shows that the monthly return correlation

The yield curve inversion is very consequential for equities. Look at the track record and the strength of this signal. Not only did the yield curve have a lower high

Invest Like The Best reveals the proven strategies of the world’s top investors, showing you how to achieve higher returns with lower risk through disciplined, data-driven decision-making. If you’re ready to break free from conventional, flawed financial advice and take control of your wealth with transparent, repeatable best practices, this book is your roadmap to smarter investing.