“Sea Change” – Expanding Debt Trap And Instability

In recent years the Federal Reserve has been alternating between opposite extremes in policy. An expanding debt trap comes with ever more violent cycles. How can investors manage this optimally?

Best practices are meant to be shared. That’s why we observe the market and then share our insights on what’s happening, to give you context. We’ve organized every blog into categories, so it’s easier for you to find the answers that matter most to you.

In recent years the Federal Reserve has been alternating between opposite extremes in policy. An expanding debt trap comes with ever more violent cycles. How can investors manage this optimally?

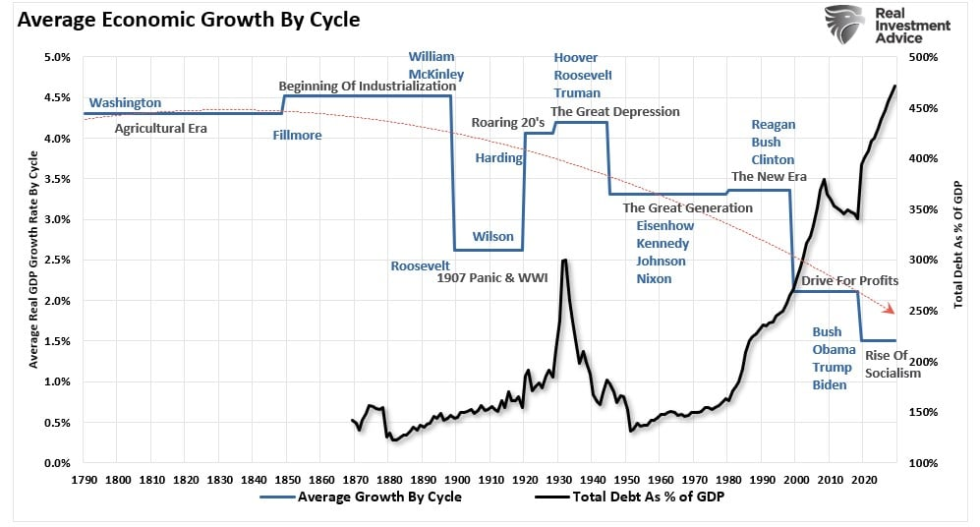

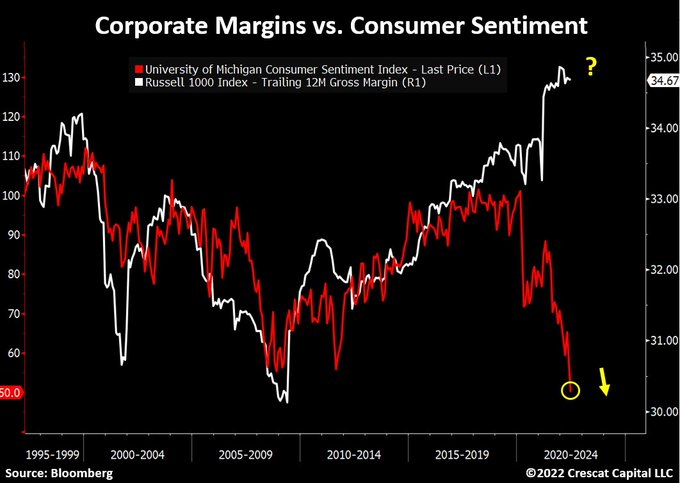

With a recession likely dead ahead, the focus will quickly shift to not only how deep the recession will have to be to get to the inflation target, but also

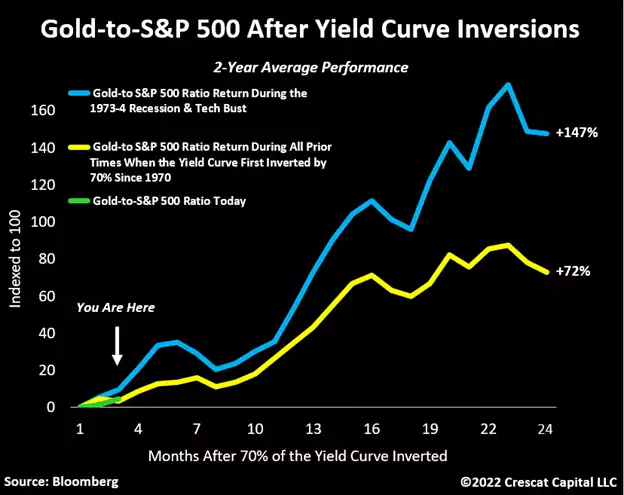

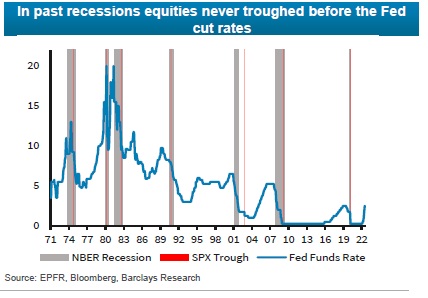

The equity rally since October can be attributed to peak cycle inflation and improving interest rates prospects. These are necessary but insufficent conditions for a durable equity market rally. Corporate

Check you premise and question short term market behavior. The pivot obsession seems to be a temporary market factor. Guessing the timing of the interest rate pivot on each data

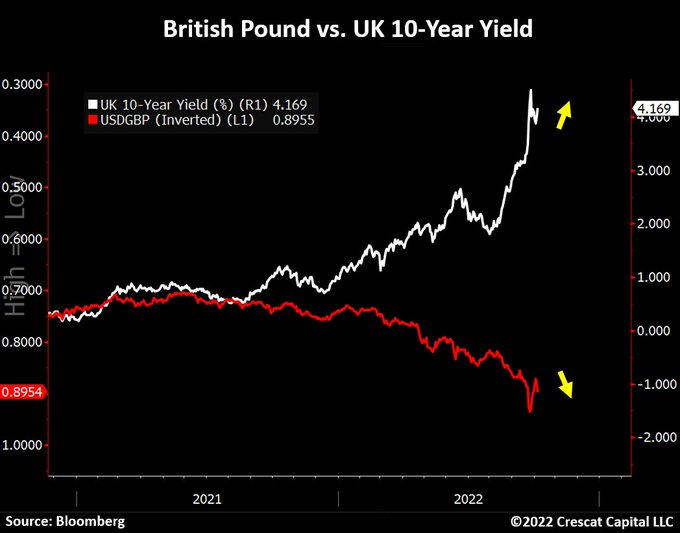

Government Insolvency is now in play.

Long Term Government Bonds are becoming uninvestable.

How can you ever really enjoy and relax about your current wealth and investment future unless accountability to capital preservation is hard wired into everything you are doing? Capital preservation

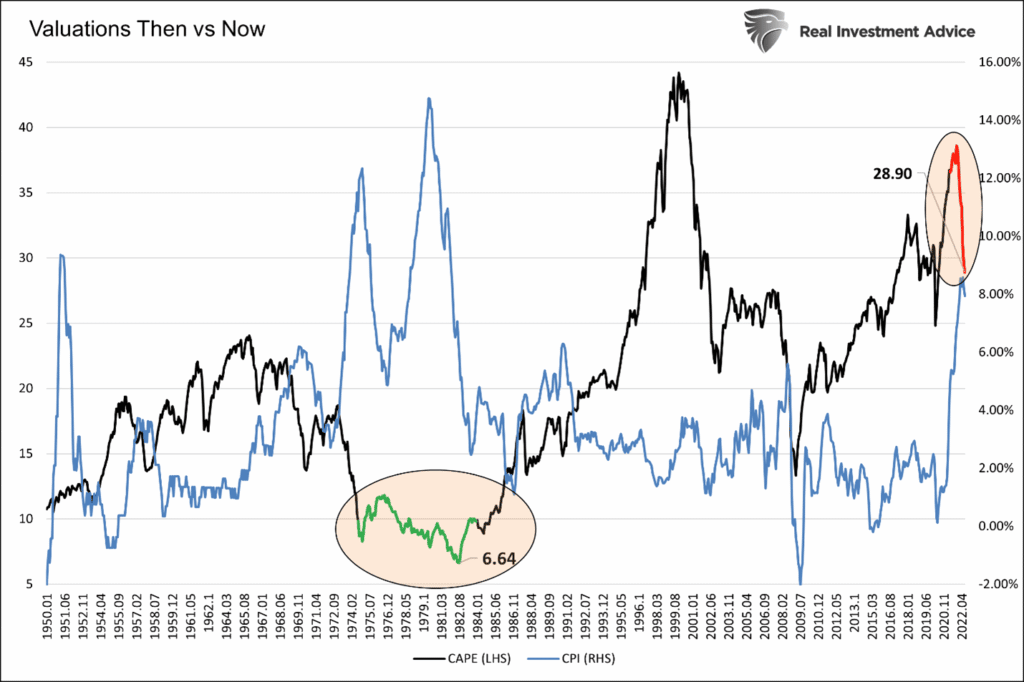

The chart shows that inflationary conditions, as seen last in the 1970s, are highly damaging for equity valuations. The average valuation for equities is more than 50% below the current

Economic policy in increasingly on tilt and muddled at best. Perhaps the issues of inflation and interest rates will resolve themselves and turn out to be temporary, but stable and

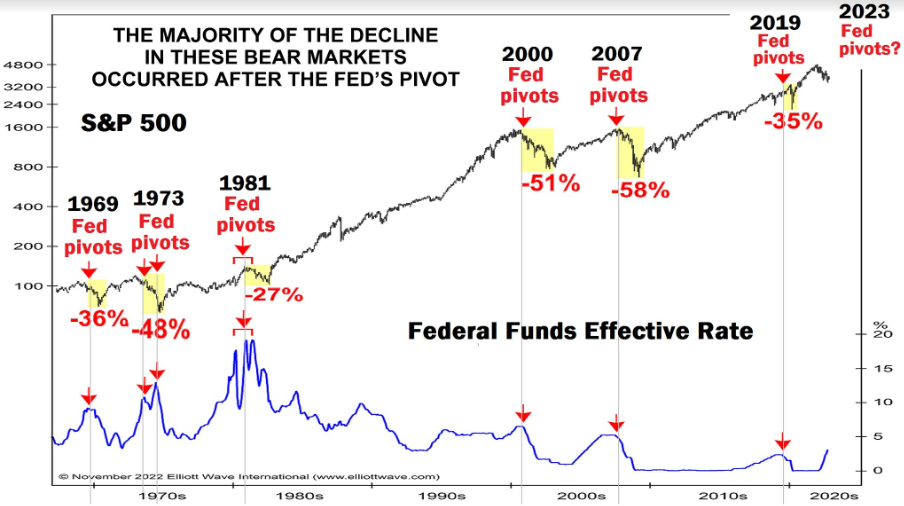

Typically stocks bottom well after the first interest rate cut, which may much longer than investors realize.

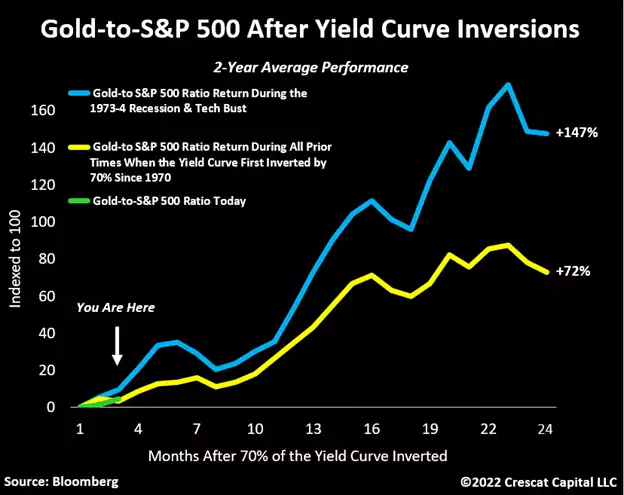

Given the debt levels, it will be much more difficult to reach

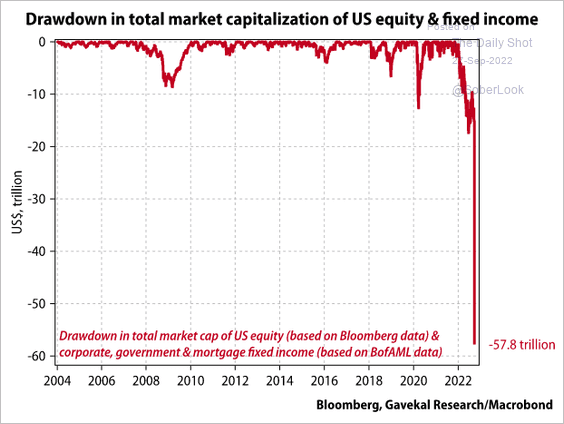

The standard equity and bond allocation has been disastrous in 2022.

Investors who do not manage risk and drawdowns, have challenging compounding consequences.

Invest Like The Best reveals the proven strategies of the world’s top investors, showing you how to achieve higher returns with lower risk through disciplined, data-driven decision-making. If you’re ready to break free from conventional, flawed financial advice and take control of your wealth with transparent, repeatable best practices, this book is your roadmap to smarter investing.