Policy Predicament. Investment Instability Inevitable.

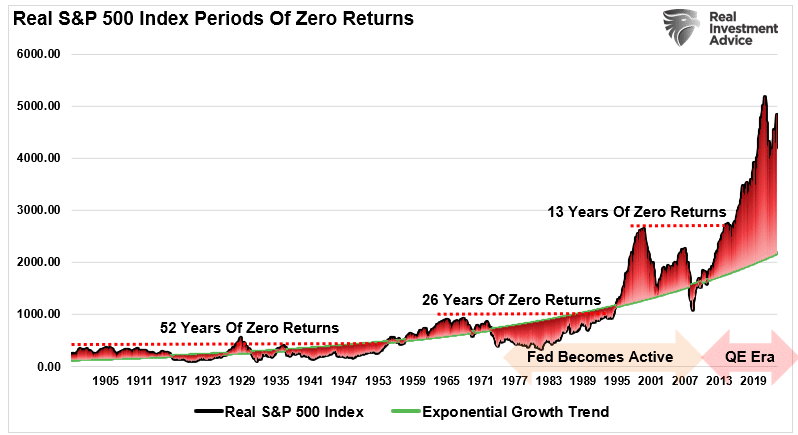

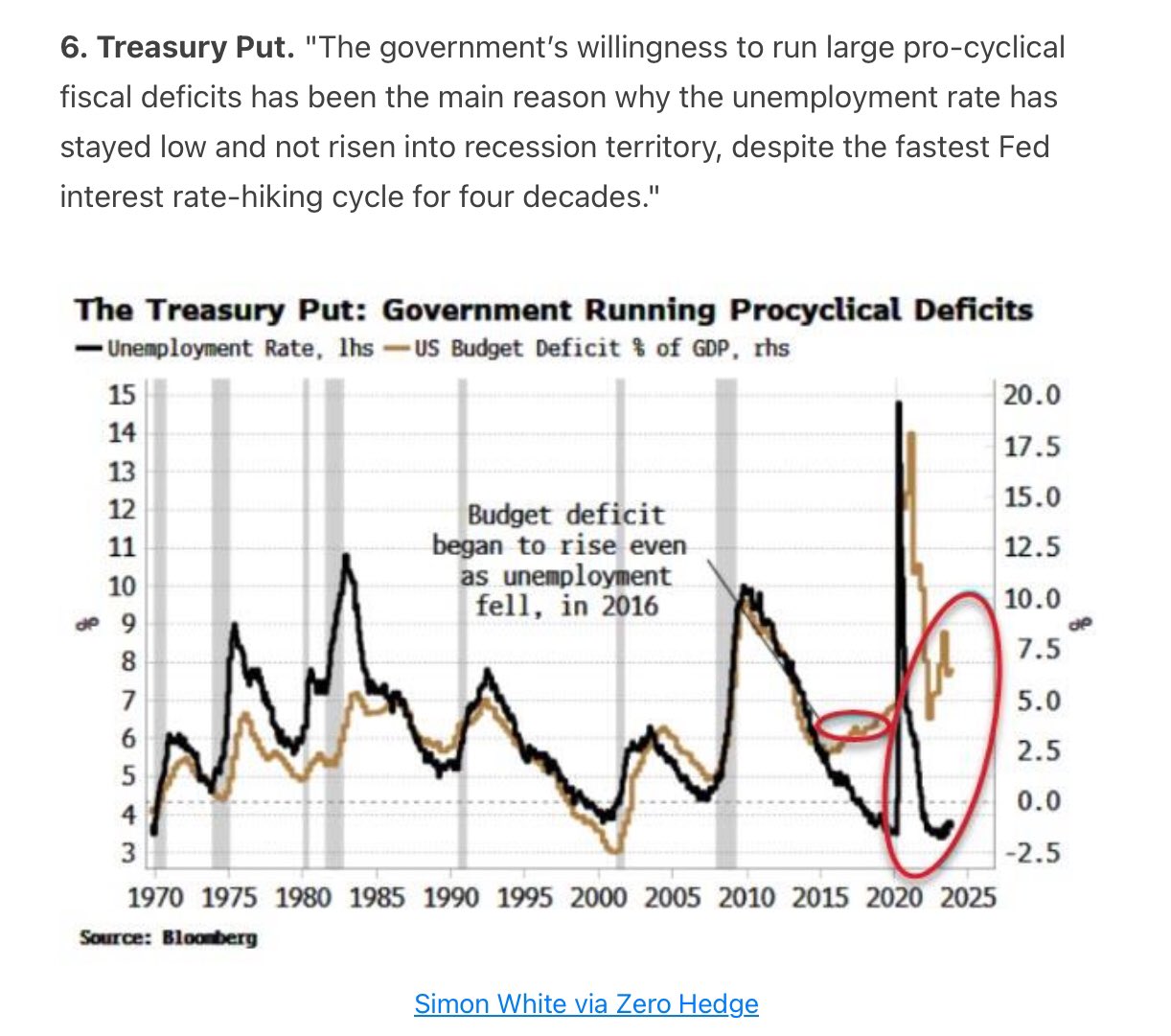

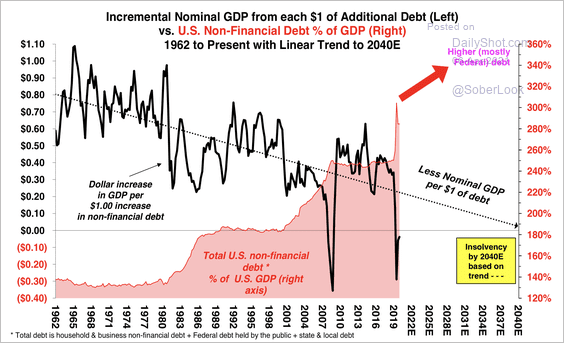

How you invest needs to adjust for the Policy Predicament. Not only has the Fed become part of the problem, but the scale of economic problem keeps getting bigger along

Best practices are meant to be shared. That’s why we observe the market and then share our insights on what’s happening, to give you context. We’ve organized every blog into categories, so it’s easier for you to find the answers that matter most to you.

How you invest needs to adjust for the Policy Predicament. Not only has the Fed become part of the problem, but the scale of economic problem keeps getting bigger along

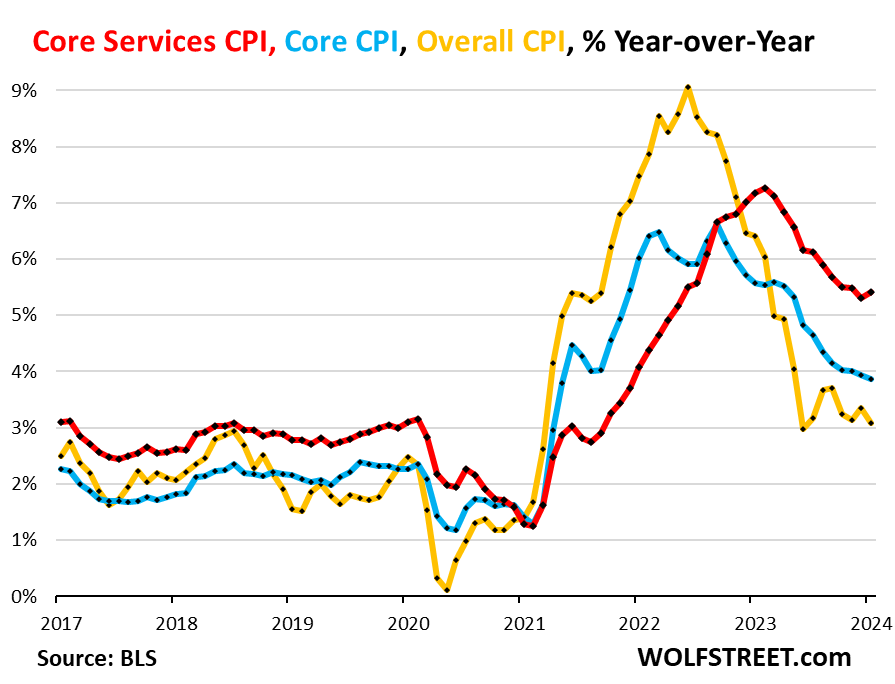

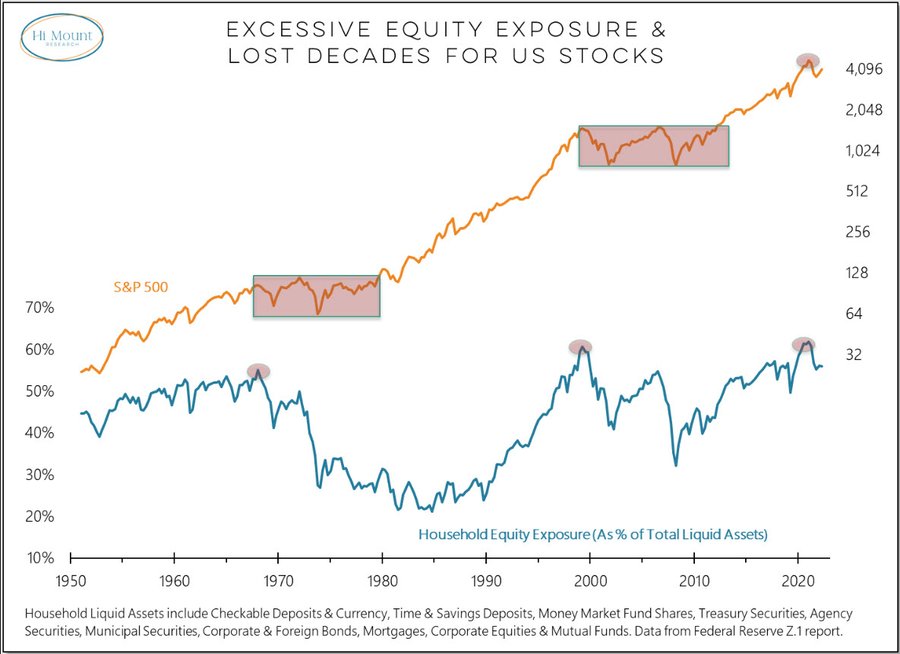

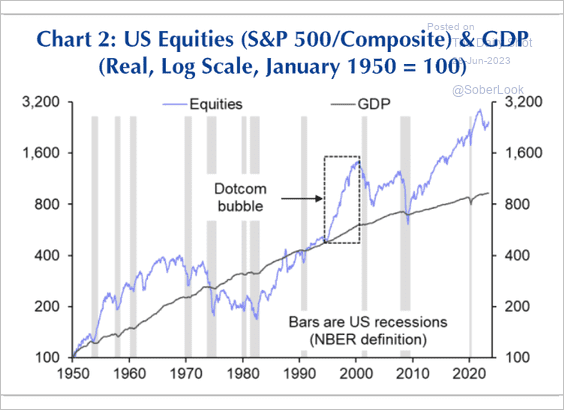

Stagflation is a major risk for equities and it’s easy to miss. Why? Because Keynesian policy on steroids initially produces the opposite short term results as described above. So far

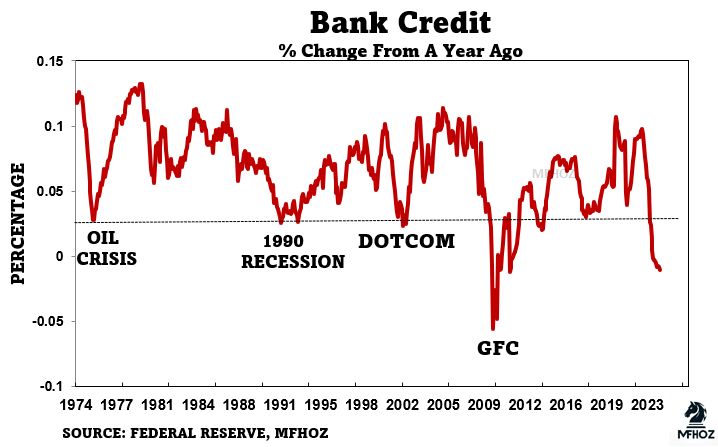

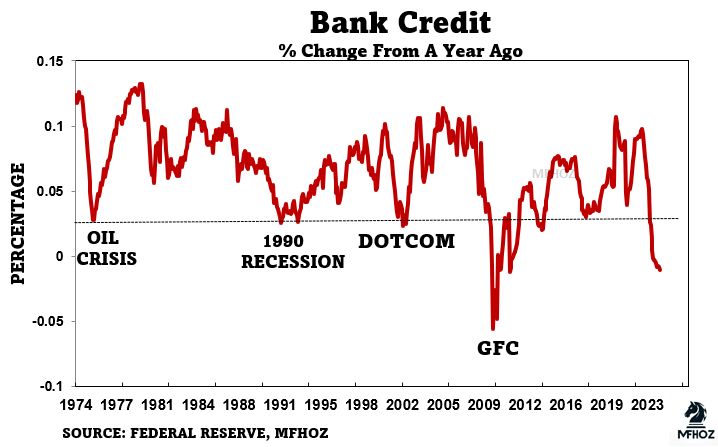

Inflation does not seem to be likely to sustainably reach the 2% target. At the same time there are new factor in relative value, and a new kind of globalization

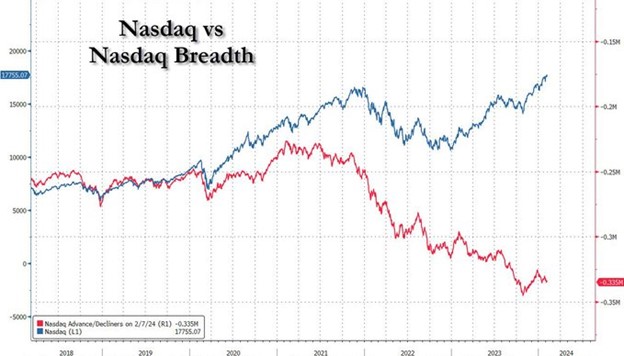

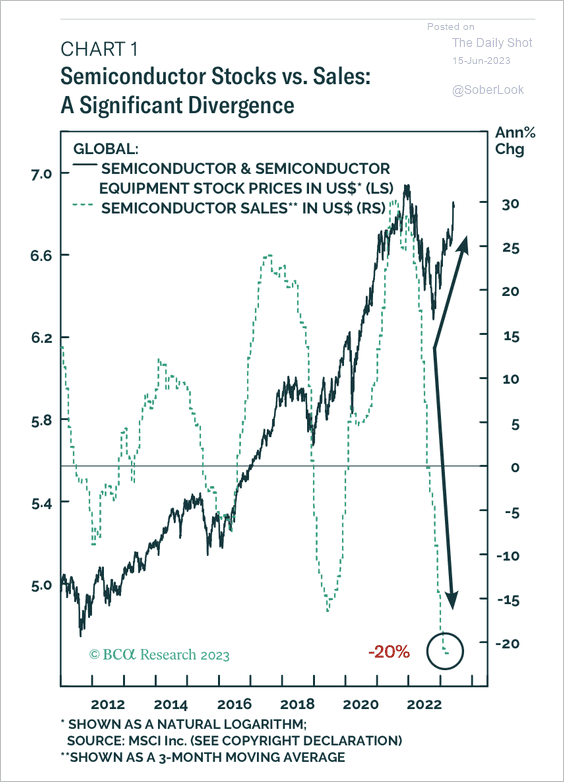

The current rally has created record divergence in performance of stocks. Massive liquidity flows, yet very weak earnings overall.

The market’s own measure of future inflation has reversed to the upside following the astonishing fiscal stimulus in the second half of 2023.

It is crucial to protect your own Best Interest when it comes to financial services. No less an authority than Warren Buffet dismisses the value of most financial advisors on

“Modern Monetary Theory (MMT) is not modern and is not a theory. It has been implemented all over the world and only created massive inflation and poverty.” Daniel Lacaille

As 2024 begins, economic weakness provides a fertile background for aggressive policy action. Intervention support seems costless in the current environment. So the recent intervention is likely to continue to

Unlike the Volcker Fed, today’s Fed supports persistently growing excess liquidity and low real interest rates. Durably containing inflation will be a challenge.

Nasdaq 100 index correlations with other assets have been disrupted by a surge in mega-cap technology stocks. There is an extraordinary divergence of Semiconductor sales from stock prices, and the

Invest Like The Best reveals the proven strategies of the world’s top investors, showing you how to achieve higher returns with lower risk through disciplined, data-driven decision-making. If you’re ready to break free from conventional, flawed financial advice and take control of your wealth with transparent, repeatable best practices, this book is your roadmap to smarter investing.