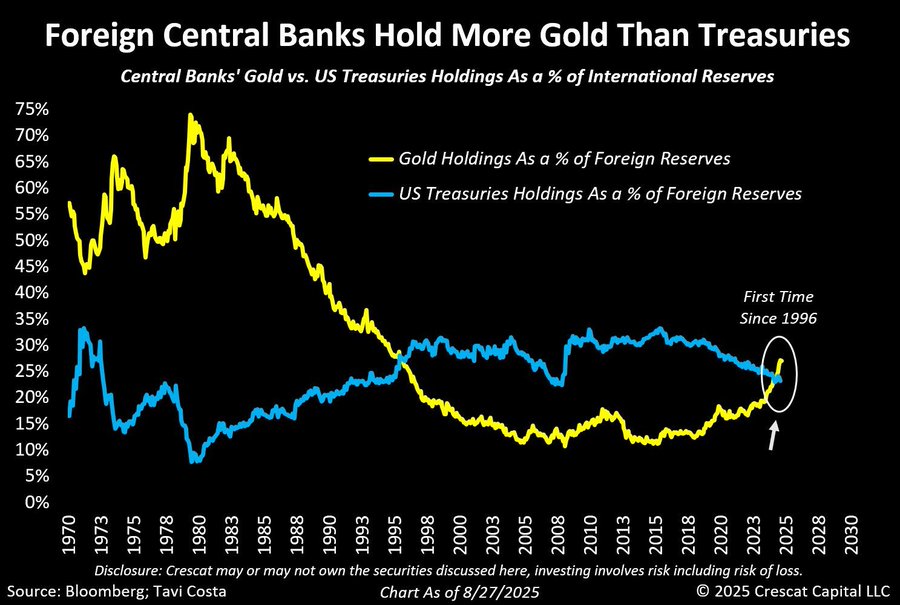

Globally, Gold is Replacing Treasuries In Asset Reserves. The math is simple.

Your allocation is threatening your lifestyle. The 60/40 Equity/Bond formula won’t do it. Stocks And bonds had negative real returns for more than a decade through the 1970s and today the challenge is greater. The debt trap is becoming inescapable.

At the same time the opportunity is outstanding if you understand the game you are in.

3 videos and the math will get you up to speed. It is crucial that you protect the purchasing power of your savings immediately.

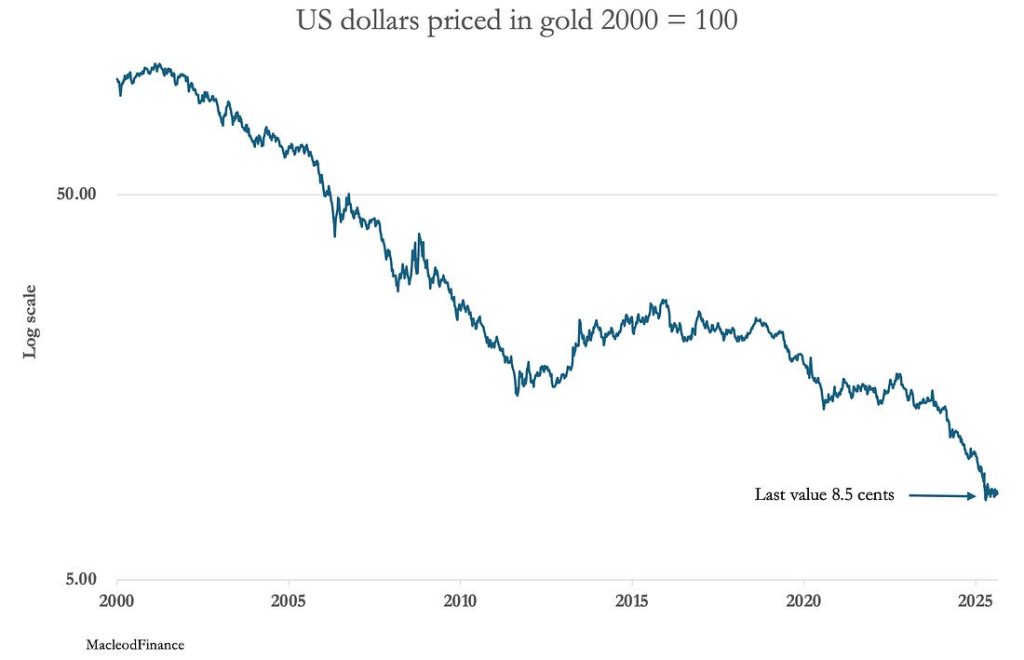

The collapse of fiat money systems always starts with inflation being disguised by devaluation of the fiat currency.

The dollar has lost 91.5% of its value relative to gold just in the last 25 years and the decline is accelerating. That’s a 8.8% p.a. rate of loss relative to gold and it’s accelerating. To be clear, you have lost purchasing power relative to gold unless you compounded in dollars by more than 8.8%!

Policy makers won’t be able to sustainably raise interest rates above 8.8%. Checkmate for the dollar.

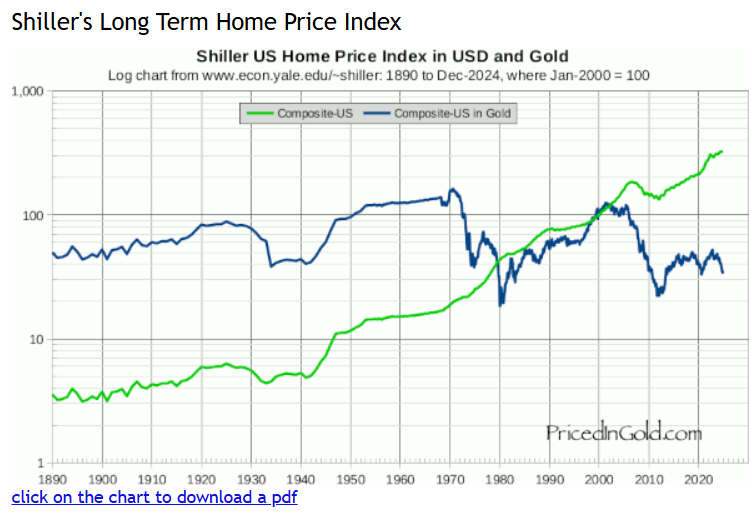

Investors think they are getting richer in dollar terms, but in reality they are getting poorer valued in gold.

Fiat money allows astonishing distortions in wealth perception to develop. It also leads to poor long term asset allocation decisions.

The chart below shows how much your investment in housing has made going back to 1890. It is a completely different picture whether you measure your wealth in dollars or in gold.

While in dollar terms houses seem to be a good investment, compared to gold, houses have been a bad investment since 1970 and 2000 in particular. Housing is even worse if you make proper allowance for the much higher running costs.

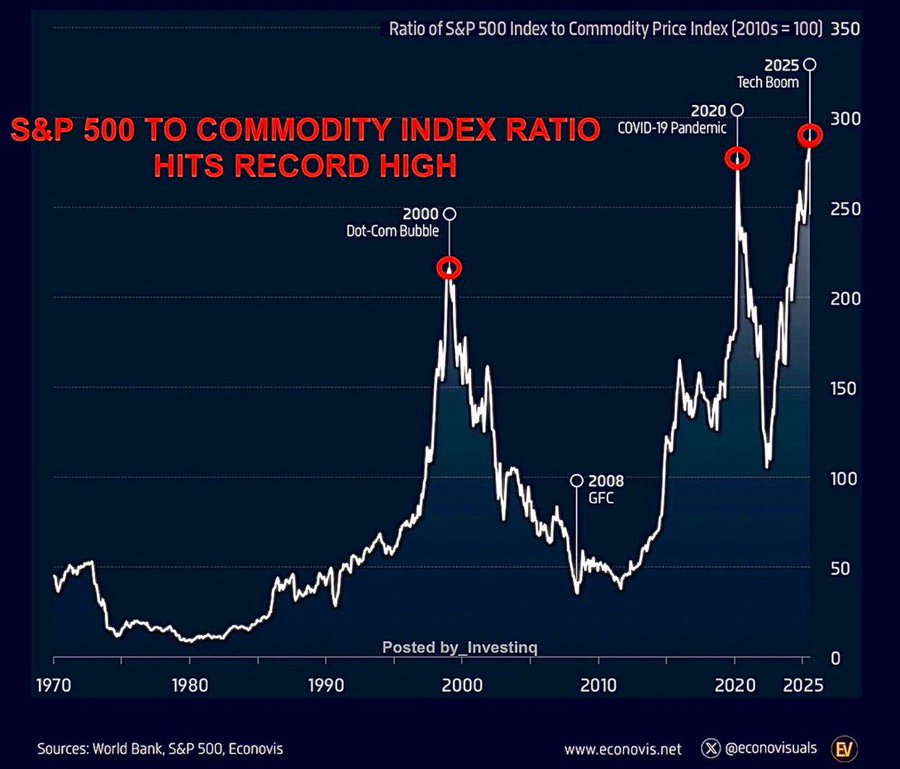

Similar conclusions apply to stocks. The following link shows that the Nasdaq has underperformed gold over the last 25 years https://cb-investment-management.com/measure-your-wealth-in-gold-or-become-an-inflation-victim/.

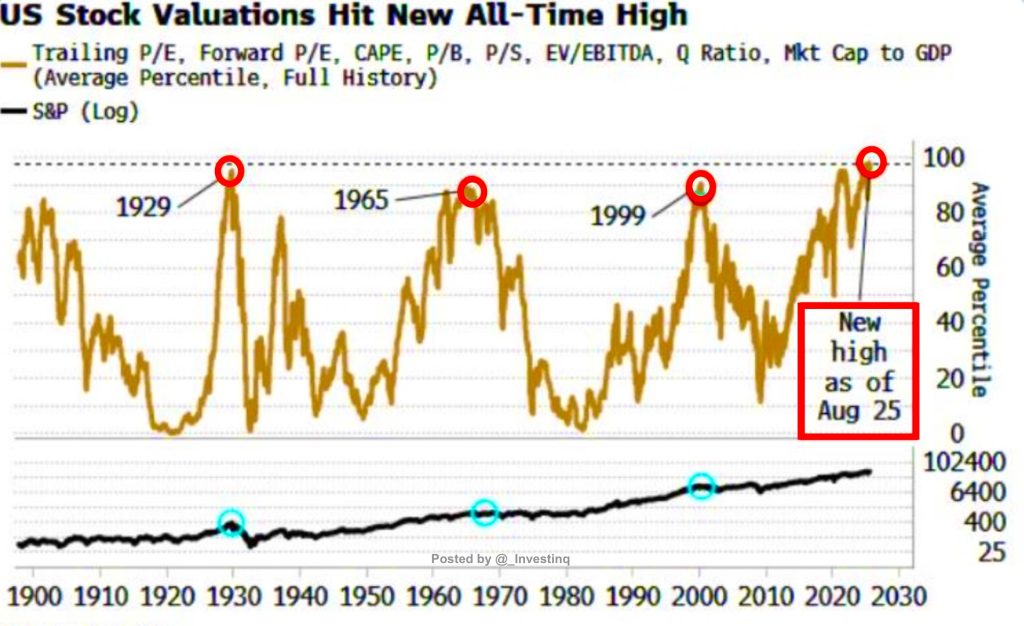

Financial assets have never been so highly valued in dollar terms. Even in US dollar terms the expected long term returns have become dismal as we have shown. Measuring the stock market versus gold is crucial for asset allocation as we have discussed. We have made the case that the expected long term return for gold relative to stocks is substantial. Gold has outperformed stocks for the last 4 years but investors don’t seem to realize.

Most people have not fully noticed that their lifestyle has declined as their purchasing power has fallen. The dollar illusion is deceptive, but at some point people lose confidence as they realize that the system has and will continue to impoverish them.

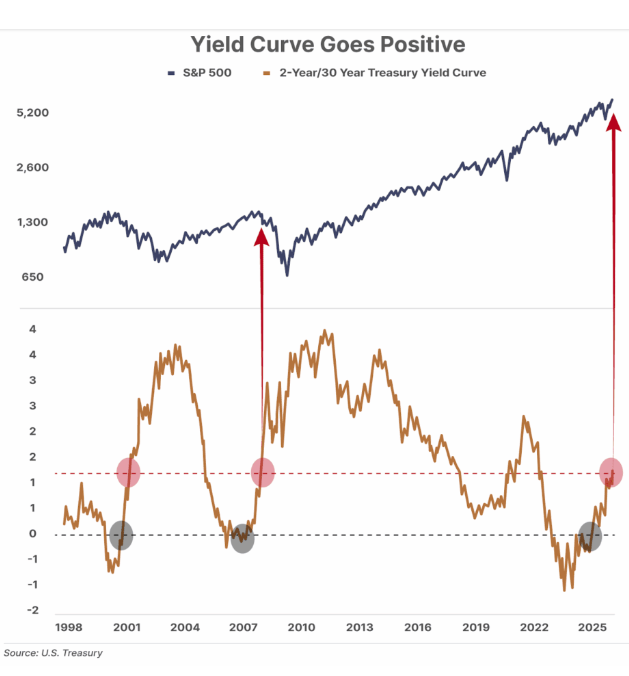

Time is nearly up and the yield curve has often been the trigger for a collapse in US stocks. In prior stock market collapses the shape of the yield curve has been quite similar to where it is now. Investors buy more stocks at any hint of rate cuts, but they are ignoring history here too.

Retirees must be proactive and prepare now. The collapse of Fiat currency is getting close.

Watch these 3 videos to get the advantage over investors and Advisors. This issue is still very poorly and narrowly understood.

Retirees at Risk: Dollar Wars Threaten Your Savings & Pensions — Jack Ma’s Urgent Advice

Why Watch This? Because the money you’ve saved may not be safe if global shocks hit pensions. To gain Jack Ma’s unique perspective on financial survival during currency wars. To learn strategies that protect not just wealth, but dignity in old age. To understand how families worldwide can prepare for a future of instability.

This youtube inspired by Elon Musk also sends a similar message.

This could be an ideal time to shift from US financial assets into real assets.

Alasdair Mcleod provides essential clarity on the foundational flaws in all monetary systems. Without this understanding it is hard to understand optimal allocation. The key differences between money and credit and productive and unproductive credit is widely misunderstood.

The world won’t wait

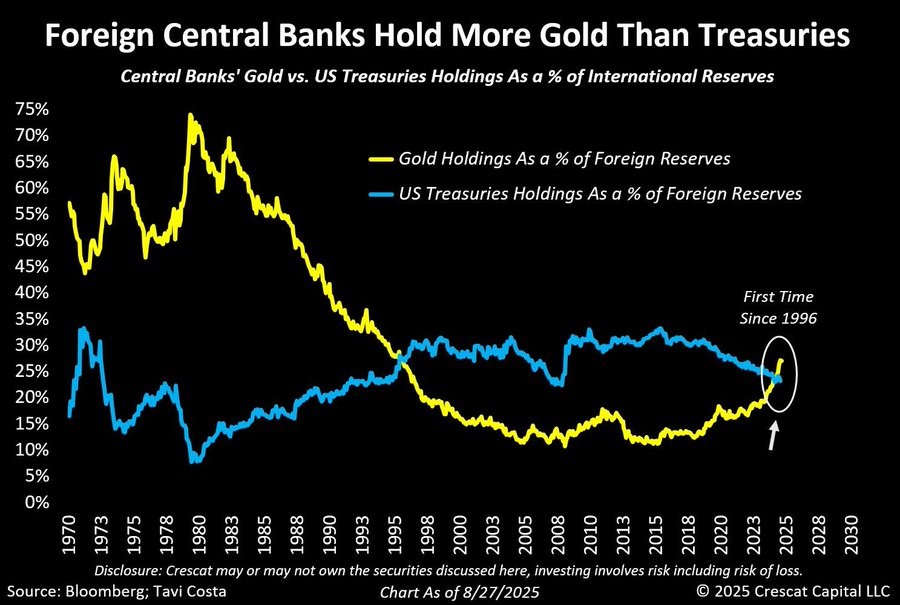

The rest of the world has already started replacing dollar reserves with gold, not least the central banks. Weaponizing the dollar has backfired badly.

Central banks now hold more gold than US Treasuries for the first time since 1996. The unprecedented gold buying spree by central banks is not a coincidence. This chart will soon become widely referenced.

This trend can only accelerate after the recent SCO and BRICS meetings.

Alasdair Macleod reports:

Trading without the dollar

The primary objective of the SCO and BRICS is for member nations to do away with the dollar in trade finance, commodity pricing, and capital investment. It is likely that the SCO’s proposed development bank will have a central role in replacing national debts denominated in dollars with Chinese yuan, allowing them to escape dollar hegemony. It will supplement the BRICS development bank in Shanghai.

National members of the SCO and BRICS amount to over 70% of the world’s population. As these plans mature, the dollar’s reserve status will be replaced by the yuan, leading to a winding down of foreign dollar balances, currently estimated by the US Treasury to total about $40 trillion, about one-third more than the US’s entire GDP.

This estimate doesn’t include offshore dollar balances estimated some time ago by the Bank for International Settlements to be close to a further $90 trillion principally facilitating foreign exchange transactions between other currencies and to a lesser extent the eurodollar market.

It appears that the SCO and BRICS are on the verge of a further leap forward. The following has emerged:

· The establishment of an SCO bank alongside the BRICS bank in Shanghai will assist members to replace capital commitments in dollars with yuan.

· We know that other nations are looking to join BRICS, and the SCO itself will expand as associates and dialog partners move towards full status. The surprise is that while Australia and New Zealand are not officially interested, they have sent unofficial representatives to the Beijing military parade. Fico from Slovakia alerts us that some of the East Europeans are potentially interested.

· Plans to ensure that gold is central to the entire SCO/BRICS payments system as and when it will be necessary are materialising before our eyes.

· The dollar faces an unwinding of its central position to the world economy which is likely to be more rapid that generally expected.

None of this is reflected in foreign exchange markets yet. But as the US debt trap is sprung, it will be an additional factor accelerating the fiat dollar’s demise.

Summary

Once investors realize the degree to which the dollar’s value is at risk, from monetary and fiscal policy, and also that foreigners are continuing to reduce their exposure even after it has already had a 92% devaluation against gold since 2000 it becomes a matter of urgency to measure your wealth in gold rather than dollars.

Investors will soon ask themselves “If you own gold why would you buy dollars?“

Wealth measured in US dollars is increasingly becoming an illusion. What matters to retirees is the durable purchasing power of your wealth which has always been better measured relative to gold. Fiscal and monetary policy together with international preference are likely to accelerate the decline of the dollar relative to gold.

Investors and in particular retirees simply cannot afford to avoid the risk of a material decline in purchasing power and need to urgently address it in their “income” and gold allocation.