What Were You thinking In November 2024?

The US economic boom is a Mirage.

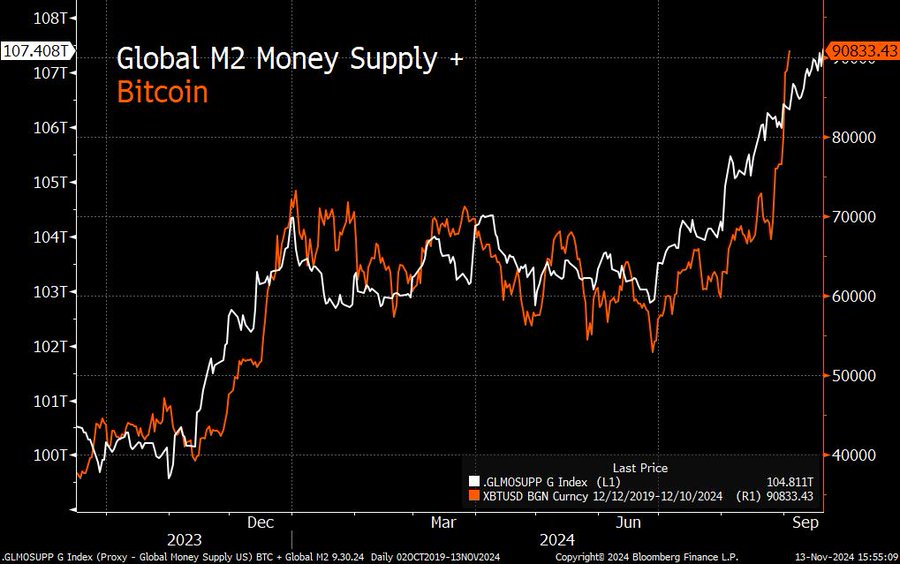

Global Money Supply Goes Vertical.

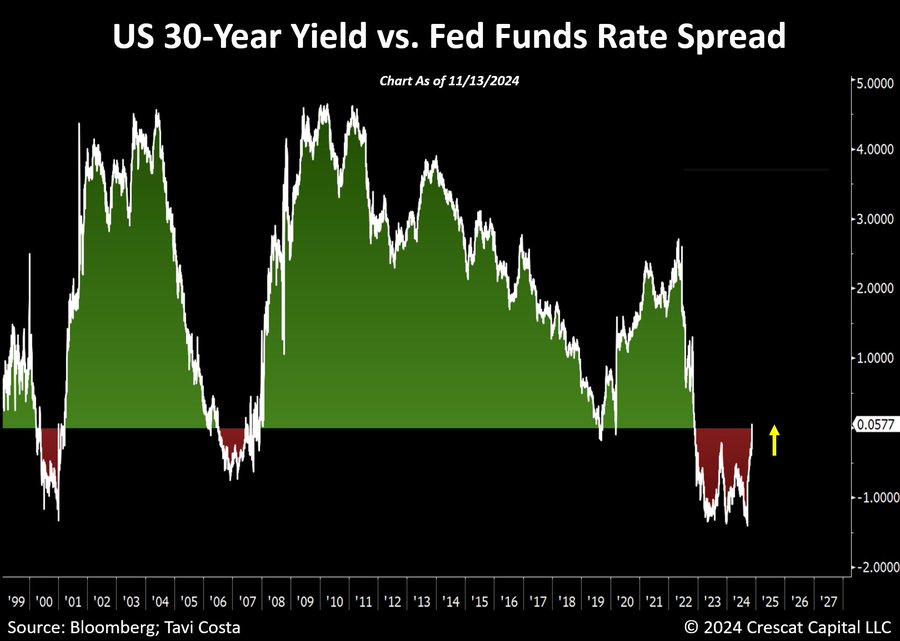

US inflation has started rising again.

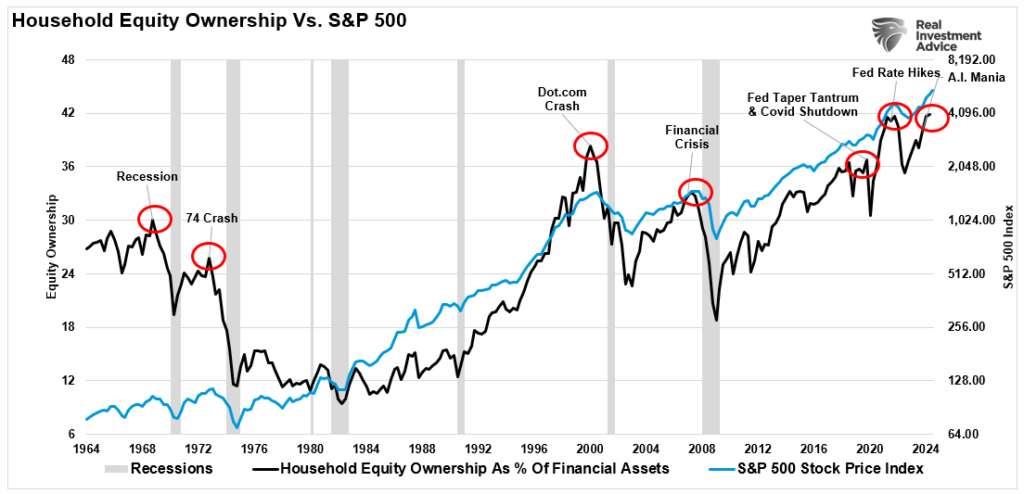

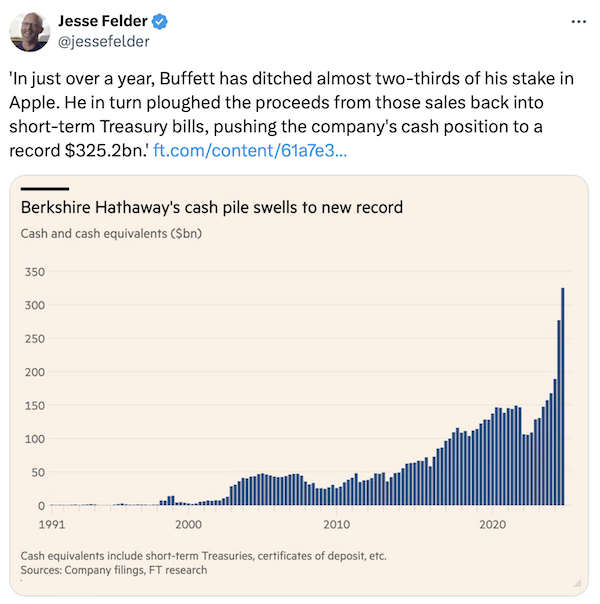

Households have never been more bullishly positioned in equities. Warren Buffet has never had more cash.

The S&P 500 is trying to go vertical at valuations never seen before. Just as junk bond spreads to government bonds have gone to the lowest historical extremes only seen just before the great financial crisis of 2008.

Investors apparently believe this is the best time to allocate to equities! This is a new post WWII all-time high for household Equity Ownership.

The long-term track record of this indicator has been disastrous, but less so recently as money supply and deficit spending has increasingly rescued the S&P 500. This equity strategy may only work in the long term in a hyperinflationary situation. Even then gold and bitcoin might be better allocations.

Meanwhile, Warren Buffet seems to have a diametrically opposite view.

The charts in this blog tell the whole story. Market behavior and prices are reflecting yet another burst of money supply growth. Inflation feels good at first, but the second-round effects are unavoidable. Bitcoin has been the best post election performer as it closely correlates with global money supply growth, which turbo charges speculation.

Money supply is the easiest and fastest response to relentlessly weak private sector growth.

Money supply is magic in the short term but will leave plenty of time for reflection and book writing when authors look back at the unprecedented conditions we are currently experiencing. For now we need to focus our attention on risk management.

As growth fails to respond, a new round of inflation acceleration is already in process.

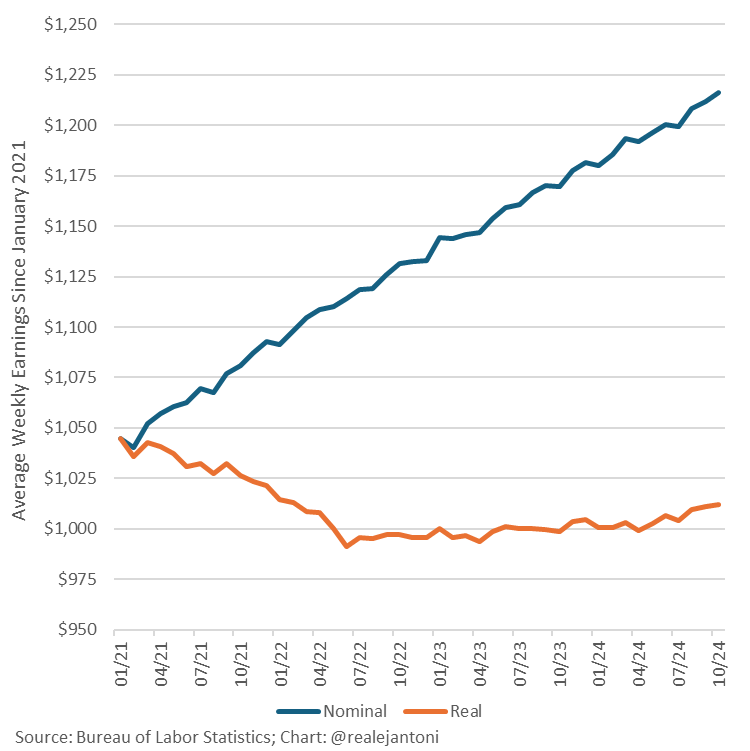

The private sector continues to be in a condition of distress. Wage earnings have failed to keep up with inflation already.

The average weekly paycheck has jumped $171.72 since Jan ’21 but inflation has devoured all that and then more: those paychecks buy $32.38 less per week, despite growing 16.4% – genuinely devastating:

Small business sales remain in distress

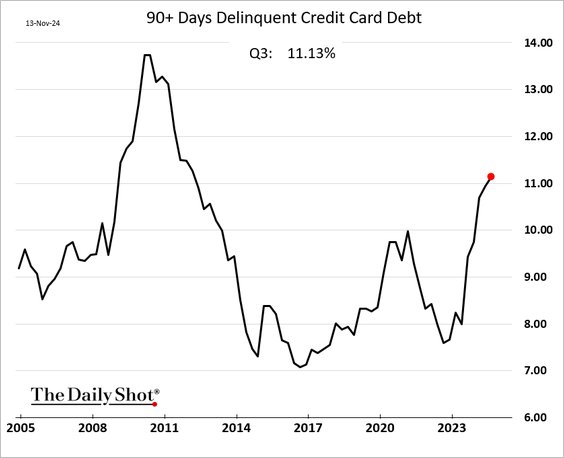

The percentage of US credit card debt that is delinquent reached its highest level in over a decade last quarter.

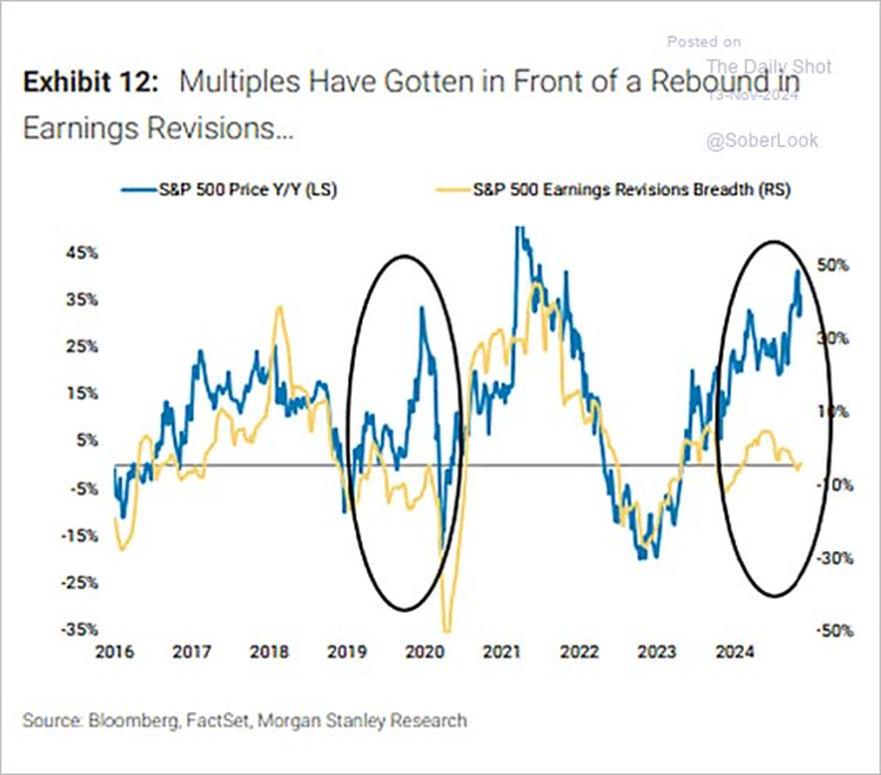

Where are the stock earnings?

The S&P 500 has completely detached from earnings revisions.

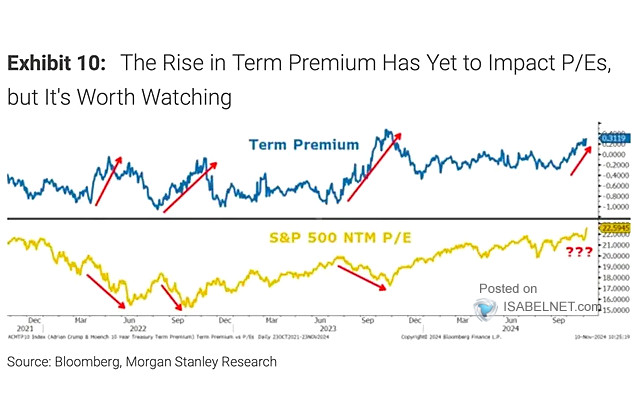

This time equities have not only ignored the bond market’s recent fall. It has even gone in the opposite direction!

More simply from an income point of view… The S&P 500 risk premium (forward earnings yield minus the 10-year Treasury yield) has turned negative for the first time since 2002, indicating frothy valuations in the US stock market.

How will Trumponomics work out?

Olivier Blanchard does a good job of laying out a policy path and the challenges and consequences.

Trying to think through the implications of Trumponomics: deportations, tariffs and lower taxes. Main conclusions. It will not work out as he hopes. But it will also not be the catastrophe some predict. The main issue may be inflationary pressure, setting up a fight with the Fed.

To oversimplify. I believe that MMT will continue, but the path will be different. Even so it will be difficult to avoid a similar broad outcome. Most likely Trumponomics will simply be a new path to stagflation.

Investors always need to proactively look forward in their assessments about allocation. When you realize how distorted the markets have become and calculate expected returns having a maximum allocation to equities is a remarkable statement. It is clearly not shared by Warren Buffett or any of the Best Investors I follow.

Here are some interest thoughts on the unprecedented situation we find ourselves in. Two of the best brains in finance try to put the next four years in context.

Where Will Stocks Go Under Trump? Watch Passive Capital Flows | Mike Green

What kind of economy is President-elect Trump inheriting? And what impact on it are his policies likely to have? And what does this mean for investors? Where do the opportunities, as well as the risks, lie? To discuss, we’re fortunate to be joined again by Michael Green, portfolio manager & chief strategist at Simplify Asset Management.

Mike has strong opinions on the above questions, though his convictions are strongest that passive capital flows (aka, the “giant mindless robot”) will play a HUGE role in determining the future of financial assets over the coming years.

Mike’s Macro Outlook

8:44 What Kind Of Economy Is Trump Inheriting?

16:20 Will Trump’s Disruptive Policies Create Pain?

31:35 Why Passive Capital Flows Are So Critical

54:00 Mike’s Investing Ideas

Will Trump Save the Economy and Drain the Swamp? | Jim Rickards

00:00 Understanding Socialism and Fascism

00:49 Introduction to the James Altucher Show

01:04 Discussing Recession Possibilities

01:16 Historical Recessions and Economic Policies

03:03 Trump’s Economic Policies and Predictions

05:13 The Role of Interest Rates in Economic Growth

06:48 Defining Depressions and Economic Growth

10:23 The Great Depression and Monetary Policy

20:04 Modern Banking and Financial Crises

32:04 Unexpected Term Sheet and Deal

32:13 The Panic of 1907: A Historical Model

33:26 Pierpont Morgan’s Financial Triage

36:16 The Origin of the Federal Reserve

36:47 Fascism and Government Control

39:45 COVID-19: Lockdowns and Vaccines

44:05 Fascism in Modern America

49:38 Trump’s Challenge: Draining the Swamp