Global Imbalances resulting from policy flaws are straining financial markets in unprecedent ways:

- Total non-financial debt-to-GDP in the developed world are at all time records in human history.

- Wealth inequality has never been higher.

- Trade imbalances have never been higher and that also means that capital imbalances have never been higher.

Russell Napier masterfully puts all this in the proper historical context.

Over the last 100 years economic policy has been driven by flawed models.

Keynes was broadly wrong! Increasing the deficit will not boost growth.

It has failed to do so in recent years as the deficit has grown at a rapid rate. At a certain point debt growth has the opposite effect on economic growth. Stimulus does not stimulate!

Keynes trashed Say’s Law to invent macroeconomics – a non-science full of errors, justifying policy intervention which has led to today’s increasingly visible crisis.

The true cost of abandoning Say’s Law

Once again policy makers are doubling down on what obviously doesn’t work. You can’t fix a debt problem with more debt.

The new administration’s “Big Beautiful Bill” is in reality a Great Big Ugly Debt Bomb.

David Stockman, Reagan’s Office of Management and Budget director, explains:

“When it comes to the “Big Beautiful Bill” there is one place, and one place alone, to start the discussion. We are referring, of course, to the built-in baseline of revenues, outlays and deficits under current Federal law and policy.

Needless to say, the latest CBO baseline amounts to a five-alarm dumpster fire. If Congress does nothing about entitlements, tax law or current funding policy for defense and nondefense discretionary programs, the annual Federal deficit will reach nearly $3 trillion and 6.1% of GDP by the end of the 10-year budget window. Accordingly, total public debt will soar from today’s $37 trillion to more than $58 trillion by 2035.”

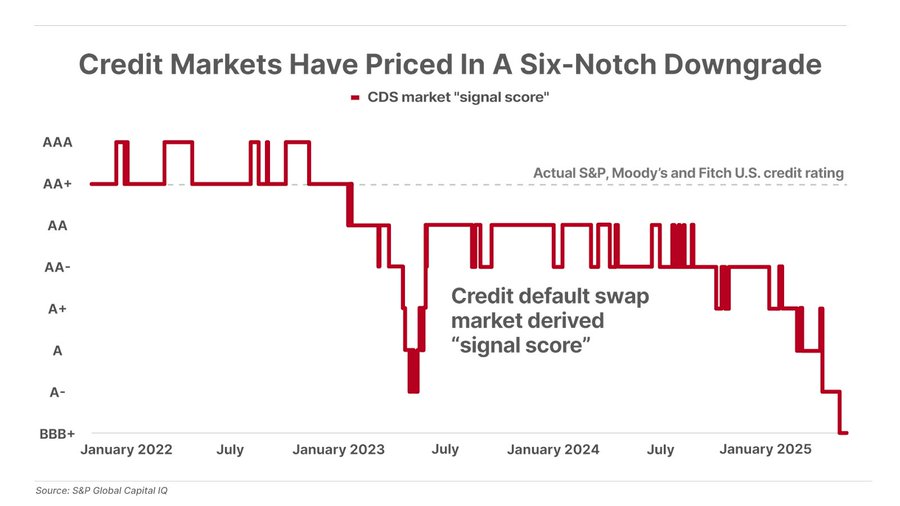

US credit is diving faster than credit ratings.

The bond market’s protection mechanism against default risk, known as credit default swaps (“CDS”), which pay off in the event of a default, is flashing warning signs about U.S. Treasuries. The chart shows CDS prices for U.S. Treasuries anticipating a six-level credit downgrade from their current AA+ rating down to BBB+ – that’s just three notches above a “junk” rating. Uncle Sam is facing a revolt from the bond market.

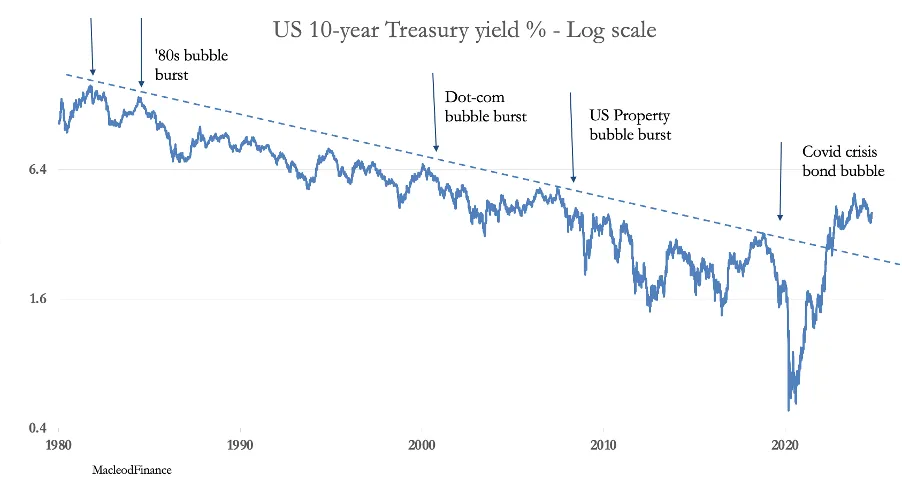

Interest rate markets are breaking

Long term government bonds confirm again they are a risk asset, not for long term investing. Trading only! Yes target dated funds are a bad investment idea the bond allocation has been losing money for over 3 years now.

Bond yields are rising around the world as never before after breaking the 40 year downtrend. Investors have lost long-term confidence in the financial system.

Nowhere more dramatically than in Japan.

Japan’s bond market is imploding: Japan’s 30Y Government Bond Yield has officially surged to its highest level in history, at 3.15%. For decades, Japan was known for low long-term interest rates. Now, they are dealing with high inflation, shifting policy outlook, and a whopping 260% Debt-to-GDP ratio. On top of this, Japan holds $1.1 TRILLION worth of US debt, making it the largest foreign holder of US debt. Yesterday, Japan’s Prime Minister Ishiba called the situation “worse than Greece.” What will Japan do here?

The financial system is on borrowed time as

cross asset correlations break down.

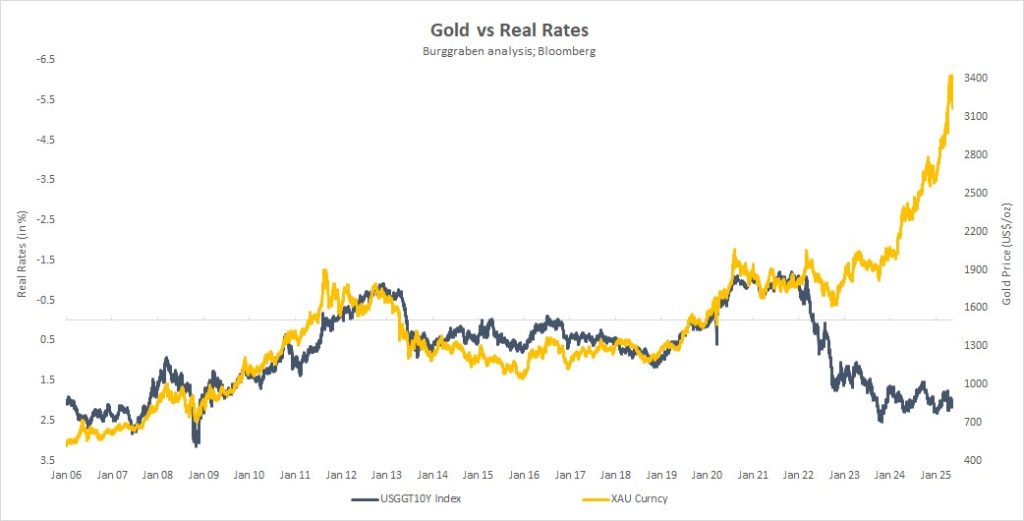

Gold has already shattered its tight correlation with real yields in the US.

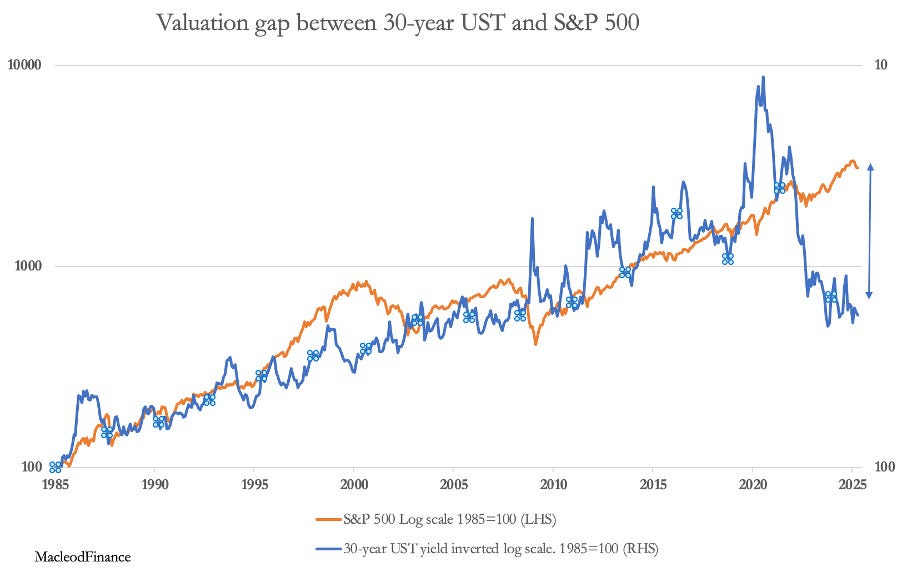

Bonds may now challenge the equity market

Rebased to 1985, this chart inverts the US long bond yield to show its close negative correlation with the S&P. By doing so, we can see when relationships between the two become distorted in the knowledge that eventually the relationship returns to trend.

The S&P is more overvalued than it has ever been relative to the long bond than at any time in the last 40-years, and is quite possibly the most overvalued in history.

Behind it all are the same factors that collapsed Wall Street in 1929 — the end of the late-1920s credit bubble coupled with the Smoot Howley Tariff Act of 1930.

Ringing any bells yet?

Summary

Remarkably investors seem to carry on as if markets are behaving somewhat normally. Worse speculation keeps rising to new all-time records. I hope this blog has demonstrated that investors are not paying attention and don’t seem to have studied any history.

Ray Dalio, one of the most successful investors of all time, explains in simple terms the long term cycle which describes the whole process that we are now in.

I have shown that core market relationships have already broken down and that the equity to bond relationship is at a record extreme with bonds continuing to trend to higher yields globally. Policy makers are losing control.

Investors need to prepare by fully adopting “Best Investor Standards” as soon as possible. The bond market will place banks and central banks in an increasingly insolvent condition and challenge equity market valuations.

You cannot secure or compound your wealth if you allow major drawdowns in major asset allocations. The vast majority of investors are simply unaware and unprepared for what has already begun to happen.

If you need help getting started, set up a chat for at most 30 minutes.