Policy favors corporations at the cost of everyone else. The bubble will last as long as it can be sustained and endured by the majority that unknowingly pay for it.

“When desire disagrees with judgment, there is a disease of the mind:

and to make a man forget the past, and blind him to the future, is as easy as making him drunk.

The impression of invincibility is disaster itself. The stronger the illusion, the greater the fall.”

Barbara Tuchman, The March of Folly

———————————————————————

“In individuals, insanity is rare; but in groups, parties, nations and epochs, it is the rule.”

Friedrich Nietzsche

———————————————————————-

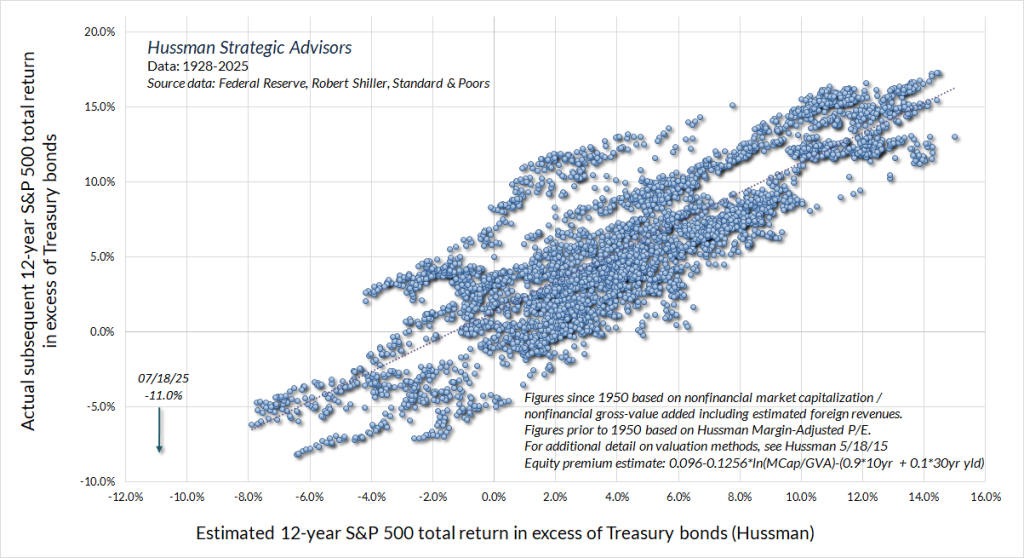

“Investors have conflated elevated profits with technology, innovation, and hand-wavy features of a “new era.” Yet the reality is that record U.S. corporate profits and free cash flows over the past two decades have directly relied on the distortions created by “free money” policies. It’s not a theory. It’s an accounting identity.”

Hussman

———————————————————————-

US Investors have become blind to historical and factual data, and have adopted dogmatic viewpoints which cannot be validated.

Most US investors don’t understand the game they are in and they are using deeply flawed methodologies. That may work while the bubble works, but they will be shocked when it eventually fails. Once more investors understand how they are being exploited and realize how unsustainable policy has become they will realize how much they need to change and what they need to prepare for.

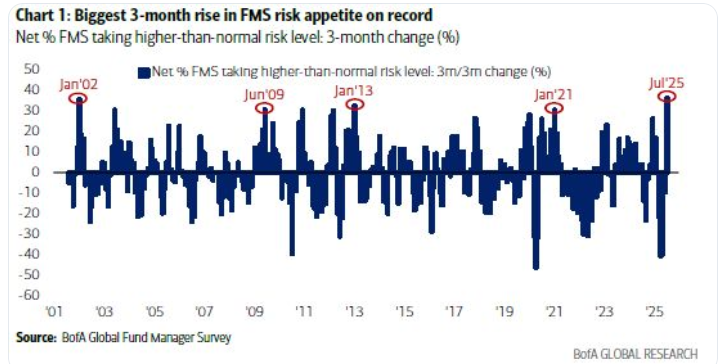

In the meantime they are chasing returns and dreams as never before.

Be grounded in reality. Most investors are completely misunderstanding the investment situation. Massively invested in technology with insufficient allocation to gold.

Despite the excessive obsession with technology Nasdaq has underperformed gold in the last 25 years and in the last 3 years. The chart suggests Nasdaq’s underperformance has a long way to go.

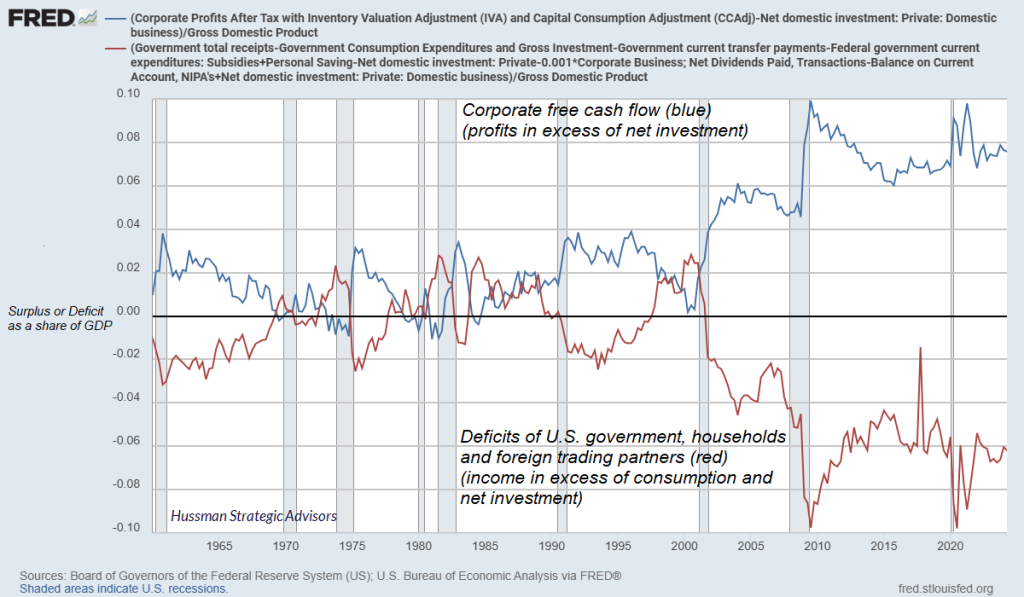

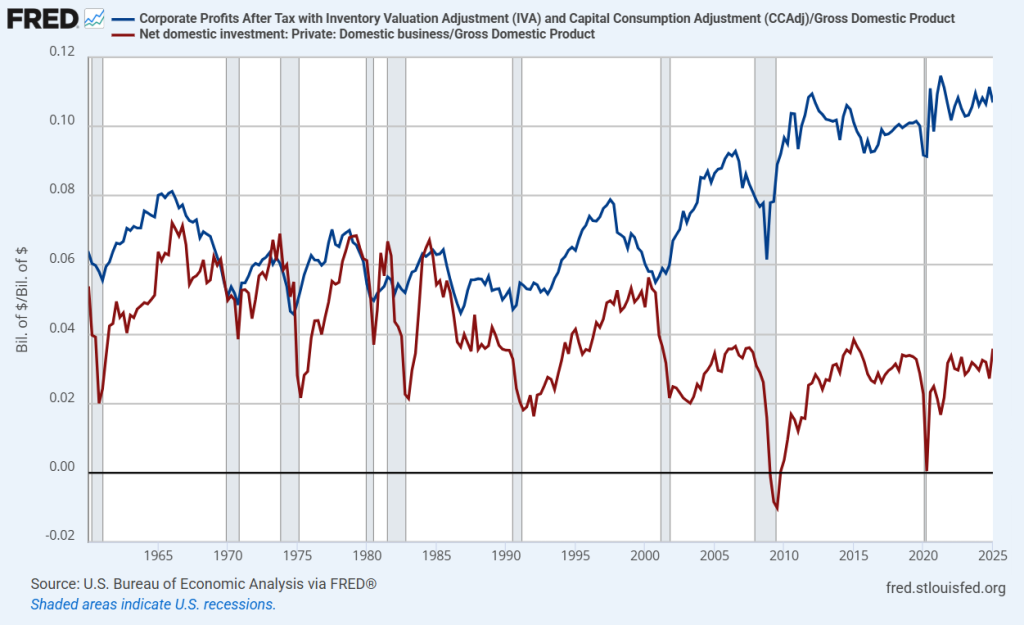

The bubble is a fantasy as can easily be shown. This is not a theory. It’s A Policy Driven Accounting Switch Favoring Corporations At The Cost Of Everyone Else. Corporate free cash flow was boosted in 2000 to favor corporations while the costs relentlessly build within government and households through debt and inflation, while the long term growth of the economy declines. This parasitic behavior is killing the host.

Despite this privileged bonanza corporations net domestic investment has declined.

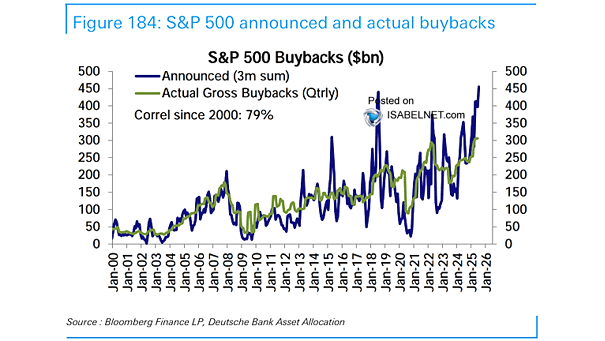

Corporate managers prefer to increase their stock price remuneration through buybacks at the highest valuations in history.

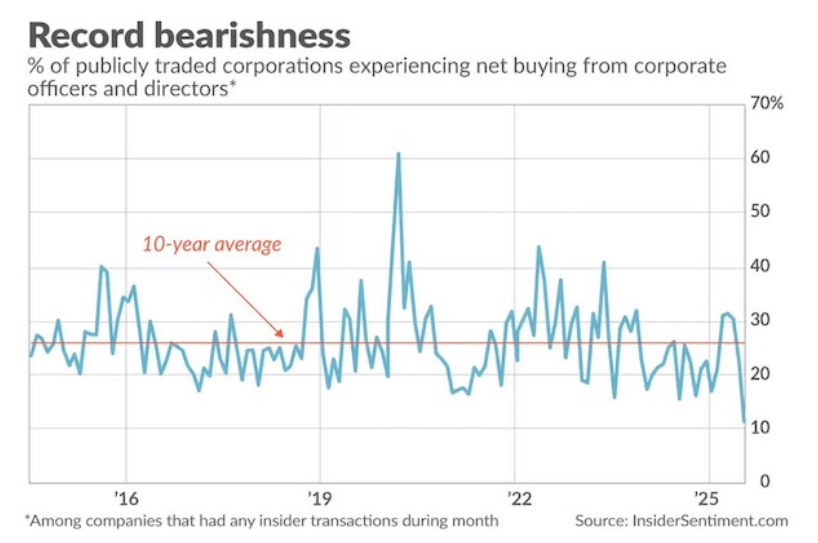

Corporate managers know this is bad capital allocation as insider selling has reached a new extreme. They are selling on their own account while buying for their company’s balance sheet at a record level to keep the illusion and personal wealth growing.

Capitalism has been subverted to favor a new Billionaire class of corporate managers. It will last as long as it can be sustained and endured by the majority that unknowingly pay for it.

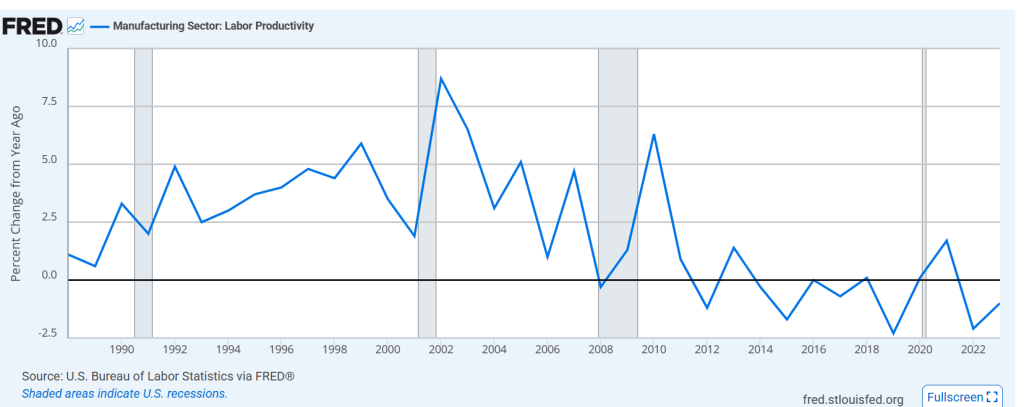

US productivity has collapsed since 2000. This reflects the weakness of investment and exposes the fantasy of technology productivity.

Have you clearly defined the investment objective and strategy choice you are making?

Be conscious of the choice you are making:

- Do you want to be prepared and thrive for durable wealth?

- Do you want to assume the biggest ever bubble, as clearly defined by history and math, will continue forever without any requirement for putting proactive, preparation and process in place in case history repeats?

Why the evidence of the end of the bubble has grown dramatically. The warning signs could not be clearer.

Gold and Equities

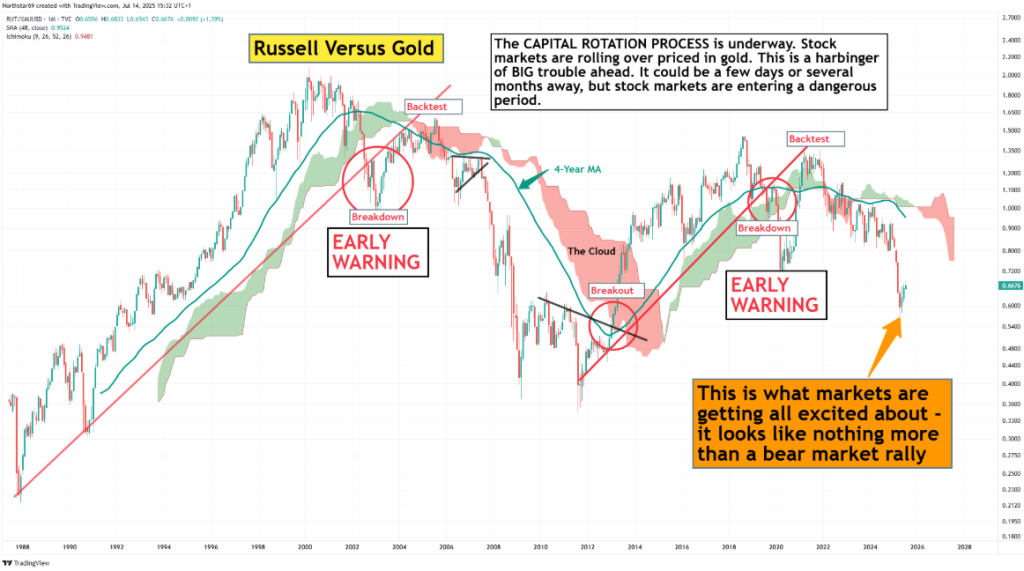

The capital rotation has already begun. Gold is outperforming everything including equities. The Russell 2000 is far less influenced by the massive deficit spending and capital flows and so reflects equities more clearly.

The Russell 2000 peaked in 2000 relative to gold in line with the switch in economic cash flows

A genuine equity bull markets does not look like the Russell versus gold.

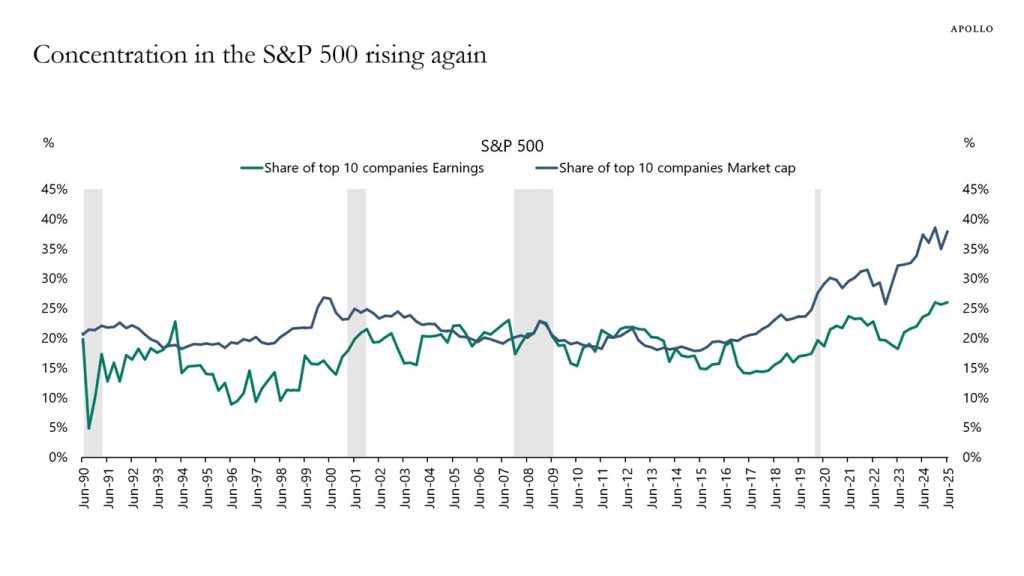

The earnings distortion in tech earnings has been further exaggerated by the market’s structural biases discussed below in terms of performance.

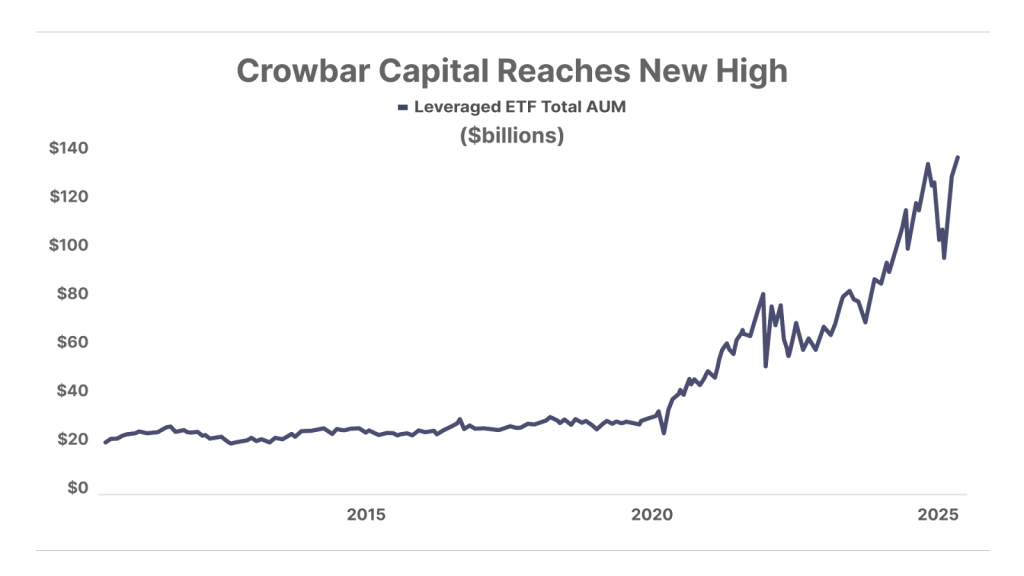

With such overwhelming short term support factors, speculators have accumulated the strongest leveraged positions, which have even surpassed the “earnings” outperformance to new leveraged extremes ever seen.

All time leverage highs in ETFs.

We are also now at the worst expected long term returns in history for the S&P 500.

Corporate managers are taking their profits just as most investors are making their biggest ever allocation to equities, not realizing that all they had to do was buy gold and make more money with far less risk over the last 25 years!

Bonds

The government bond markets are in a 10 year confirmed bear market against gold and governments across the world are doing nothing to address their deficits even with world debt to GDP at all time historic extremes. Indeed defence spending has broken out to the upside, while few governments show any prospect of deficit reduction far into the future.

No wonder that central banks became committed to increasing their reserves in gold some years ago relative to fiat currency and bonds. They themselves realize the enormous growing risks to holding bonds.

Log chart of “long gold, short LT UST futures” since global Central Banks stopped growing holdings of USTs in favor of gold in 3q14. 12% CAGR for 10 yrs on low volatility. Very few western bond investors have had this trade on, and very few have it on today.

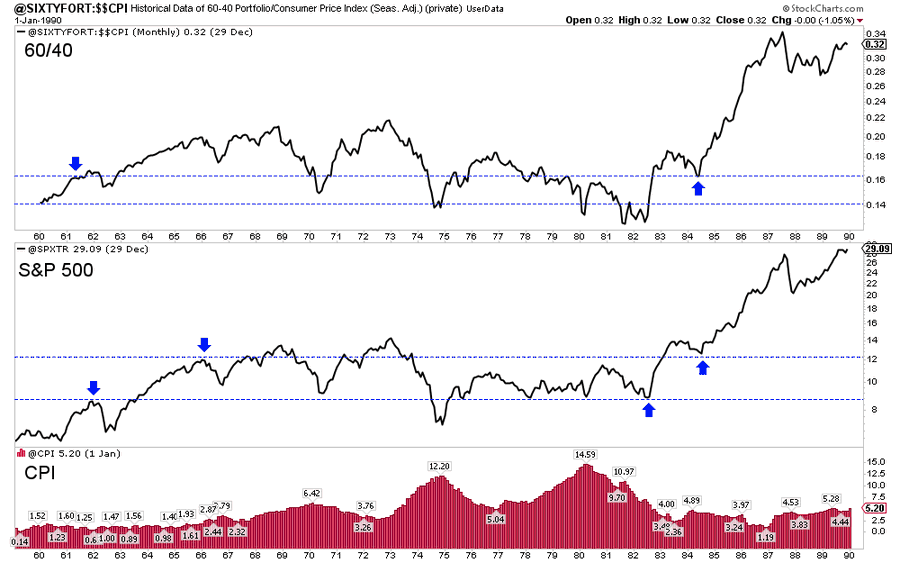

No matter the emerging performance facts conventional allocators seem to have forgotten that 60/40 portfolios had a zero real return for 23 years. How could 60/40 be a good standard long term allocation for anyone?

The total real return of a 60/40 Portfolio from 1961 to 1984 was 0!

Private Credit

“Private credit isn’t inherently bad. In many cases, it helps where banks won’t. And it provides crucial financing to small and midsize firms. But questionable ratings and minimal oversight aren’t the solution.

Egan-Jones’ rapid rise and recent stumbles underscore the risk of unchecked private credit. As defaults climb and scrutiny grows, the entire sector is facing a reckoning.

Unless the ratings backbone becomes more credible and transparent, the private credit powder keg could explode.”

Joel Litman, Forensic accountant.

July 16, 2025

Most Investors are facing a very poor long term return, unless they adopt Best Investor methodologies.

It happens every time we have a bubble.

It is natural behavior to want to see high performance returns even in the short term. This is what happens in the first half of a bubble. The more reckless the investor the more spectacular the returns in this period. However, by the end of the bubble cycle many investors are ruined, and very few have a good full cycle performance.

The problem is simple to describe but apparently very difficult for the great majority of investors to adopt.

As most investors prioritize return as their assessment tool, they are using a statistic that makes no distinction between:

- Risk

- Skill

- Luck

Return alone is a terrible long term investing assessment metric, both theoretically and in practice as described in great detail in my book.

So adopting return represents a complete failure of preparation for investing in a productive process for long term investment success.

Return relates to history, so it is reactive and it also takes no account of forward looking expected returns and proactive and productive investing processes.

Invest Like The Best

While I am not saying that return should be ignored, I am saying that it is not the primary assessment of the most successful investors of all time and for good reason. Over the long term return based investors have their highest allocations at long term highs and their lowest allocations at long term lows. At best they underperform as a result.

Long term compounding is the preferred assessment tool and it is crucially different from prioritizing short term return.

Here is a deeper dive into this issue:

If you want a different outcome from investors who prioritize short term returns, and now have terrible long term allocations, and get on track for “The Low Risk Road to High returns” set up a call here: