The “simple” things on a tax return can make all the difference.

Every year, millions of taxpayers file accurate returns on time, and yet they still miss meaningful opportunities. Not because the math was wrong, but because no one fully understood what the return was saying, or how it connected to the rest of their financial life.

Your tax return is not just a compliance document. It is the most complete financial snapshot you produce each year. It reflects your income, assets, decisions, and behaviors, whether you intended it to or not.

To achieve the best possible outcome, both you and your financial advisor need clarity around four things:

- Requirements

- Data

- Checking

- Planning

Without that clarity, even a perfectly prepared return can quietly lock in unnecessary taxes.

Compliance Is the Floor — Understanding Is the Lever

It’s important to be clear about roles.

Your tax preparer’s responsibility is to prepare and file an accurate return based on the information provided. That work is essential, and it requires deep technical expertise.

But Tax Preparation is not the same thing as Tax Planning.

Tax preparation and tax planning are often used interchangeably, but they serve different purposes. Understanding the difference helps explain why a tax return can be accurate and still leave meaningful opportunities on the table.

Tax Preparation focuses on:

- Reporting what already happened during the tax year

- Applying tax rules to past income, deductions, and transactions

- Ensuring accuracy, completeness, and timely filing

- Meeting compliance requirements and avoiding penalties

Tax Planning focuses on:

- Understanding why the tax return looks the way it does

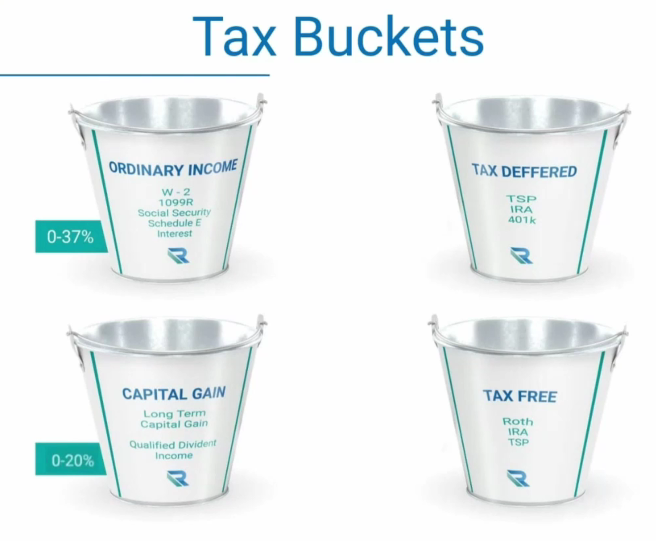

- Evaluating how income is taxed across different tax buckets

- Identifying thresholds, phaseouts, and avoidable tax friction

- Using the current return to inform future financial decisions

Tax preparation ensures your return is filed correctly; tax planning uses the return to reduce taxes over time.

Most taxpayers do not receive meaningful tax planning unless a financial advisor is actively involved. And even then, planning only happens if someone understands the return well enough to interpret it, question it, and connect it to broader financial decisions.

This is why understanding your tax return matters.

You do not need to prepare your own return. But you do need to understand its structure and pressure points well enough to:

- Verify what was reported

- Ask informed questions

- Identify where planning opportunities may exist

Without that understanding, your tax return becomes a historical record instead of a planning tool.

But equipped with the right mindset, a Best Practice Financial Advisor can offer you the context for your taxes.

Your tax return can become your most powerful tool, not just saving you substantial lifetime savings but also compounding your wealth securely through retirement.

The Tax Return as a System of Buckets and Flows

One of the most useful ways to understand a tax return is to stop thinking of it as a collection of forms and start thinking of it as a system.

At its core, the tax system separates your financial life into different tax buckets. Each bucket has its own rules, rates, and consequences.

Some income is taxed immediately.

Some can be tax-deferred.

Some may never be taxed at all, if handled correctly.

Because of this, you may need multiple buckets to properly account for different parts of your finances. The exact number matters less than understanding that not all dollars are treated the same.

Once those buckets exist, every financial move must be recorded and documented:

- Money moving into a bucket

- Money moving out of a bucket

- Money moving within a bucket

This includes transfers, rollovers, conversions, and reallocations, not just income and gains.

Every money move has a tax impact. Some of those impacts are obvious. Others are subtle and only visible when the return is reviewed carefully.

Understanding this structure is what allows the tax return to be used for planning rather than an accidental event with a surprise outcome.

The 37 Questions: A Practical Framework for Reviewing Any 1040

To review a tax return properly, guessing is not enough. Best practice requires a repeatable process.

One of the most effective frameworks for this is a checklist of 37 questions that should be asked on every 1040 tax return. These questions correspond directly to specific lines and schedules on the return and are designed to ensure that nothing important is overlooked.

This framework can be used at every stage of the process:

- During data collection, to ensure completeness

- During review, to verify accuracy

- During analysis, to understand outcomes and implications

The goal is not to replace your tax preparer. It is to ensure that the return is understood well enough to confirm that it reflects your actual financial reality, and also that it has been optimally prepared in a way that supports, rather than undermines, future planning.

Used consistently, this checklist provides something most taxpayers never experience: confidence that their return has been properly reviewed, not just filed.

Allowances, Offsets, and Deductions: Where Behavior Meets Tax Rules

Beyond income and asset reporting, every return must account for allowances, offsets, and deductions. These areas often carry some of the most misunderstood, and misused, opportunities in the tax code.

One of the key decision points is whether to take the standard deduction or to itemize using Schedule A.

Schedule A is used to itemize deductions instead of taking the standard deduction. Whether this makes sense depends on your circumstances and on how well your deductible activity has been documented.

The main categories include:

- Medical and dental expenses, subject to income thresholds

- State and local taxes (SALT), subject to statutory caps

- Mortgage interest on qualified home loans

- Charitable contributions, both cash and non-cash

The ability to benefit from these deductions depends not only on eligibility, but on documentation. Receipts, records, and clear categorization matter.

Understanding Schedule A allows you and your advisor to evaluate whether itemizing makes sense, and to recognize when behavior (such as charitable giving or expense timing) could be structured more effectively in future years.

This is where understanding the return begins to influence decisions, rather than simply record them.

What Best Practice Looks Like in Real Life

In a best-practice environment, roles are clear and coordinated.

Your tax preparer completes the return.

Your financial advisor helps interpret it, answer questions, and connect it to your broader financial strategy.

This level of support is rare, but it is essential for anyone serious about optimizing taxes over time rather than reacting to them annually.

In my own practice, I work alongside a specialist CPA firm that is deeply involved in the technical preparation of returns. I also maintain formal CPA-level training that analyzes every step of the 1040 preparation process. This allows me to serve as a full backup resource: explaining, reviewing, and contextualizing the return in a way that most tax preparers simply do not have time to do.

When this breadth and depth are combined, taxpayers gain something invaluable: visibility.

That visibility is what allows taxes to be optimized not just year-by-year, but across a lifetime. It is also what allows financial decisions—investments, retirement strategies, and estate planning—to be made with informed consent rather than guesswork.

Understanding your tax return is not about doing more work yourself. It is about knowing enough to ensure that the work being done on your behalf is aligned with your best interests.

That understanding is the gateway to everything that follows.

Until you have been properly guided through the whole process, you could be missing out on major wealth creation opportunities.

But with the right visibility and understanding, you are set up to grow your wealth securely through your retirement.