The US Financial System Became A Leveraged Equity Buyout Supernova

US Equity Passive Investors Are Now Committing To The Biggest Expected Long Term Losses in History.

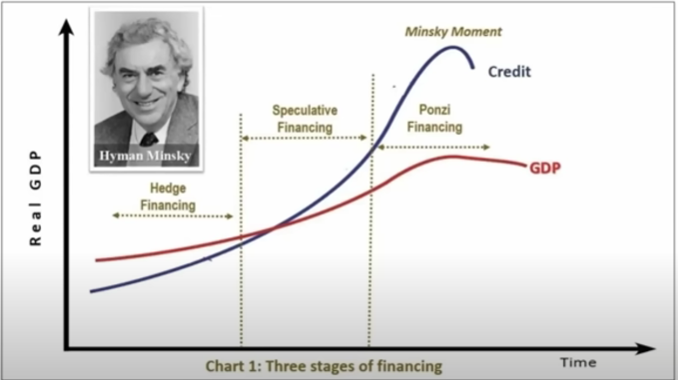

Debt Growth Outperforms GDP Growth Which Outperforms A Chronically Weak Real Economy

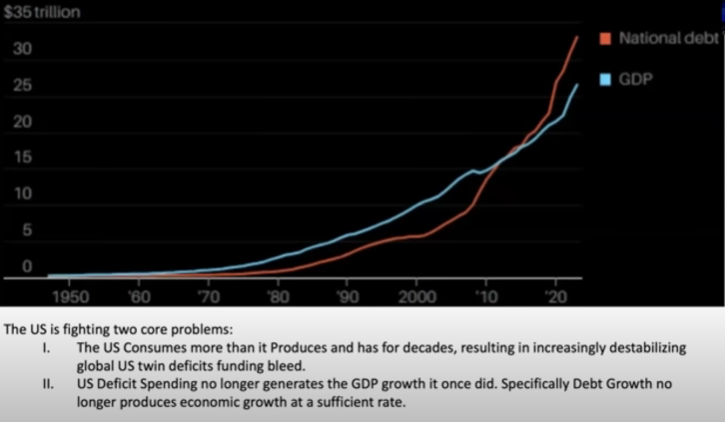

At the Federal debt level, national debt is far outpacing GDP.

Truck tonnage used to have a tight relationship with the S&P500. Now there seems no connection.

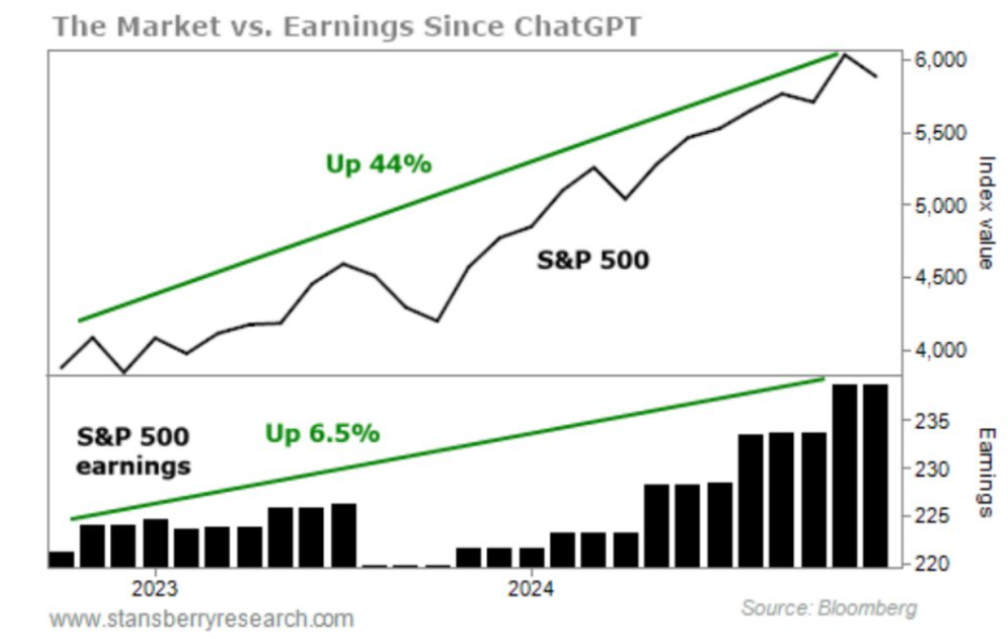

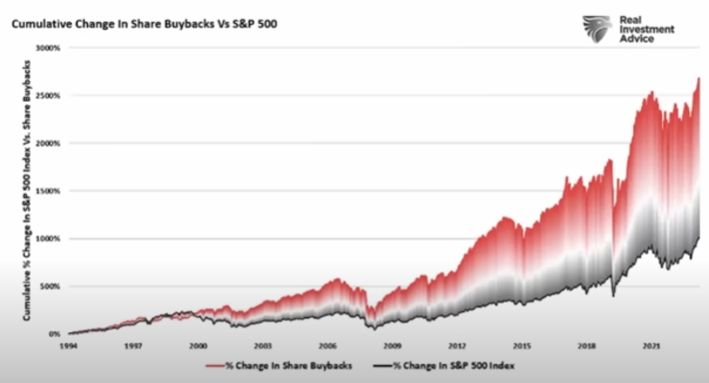

Even earnings that are inflated by buybacks, which reduce the share count, can’t get anywhere near close to market price performance.

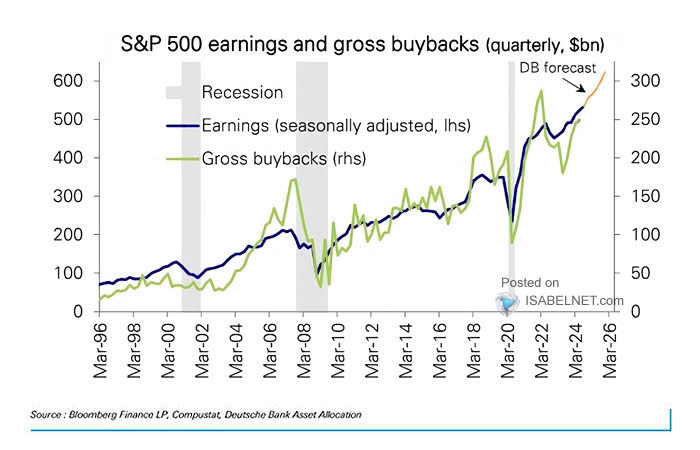

Share buybacks overwhelm other investors at around $1 Trillion a year. The price action of the S&P 500 and buybacks shows just how much earnings depends on buybacks too.

The distortion continues to grow as buybacks continue to grow.

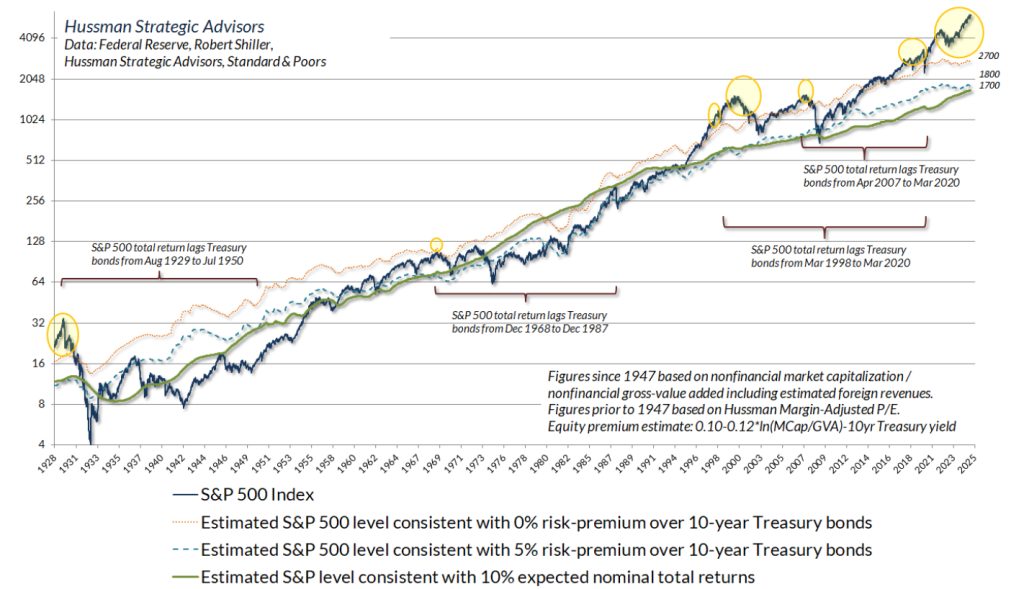

US Equity Passive Investors Are Now Committing Themselves To The Biggest Expected Losses In History.

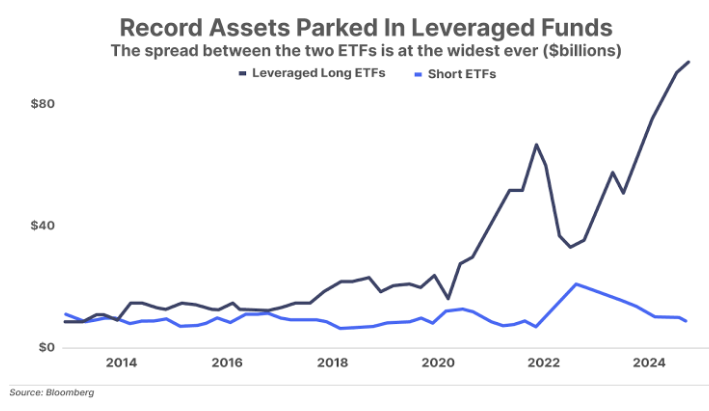

Now the US has record debt, record buybacks, record leverage, record options trading, and record household allocation to equities. Where do we stand on a long term valuation basis? At a record of around 70% above where the long term mean reversion level is.

Financial values reflect excessive debt and leverage induced by reckless policy. Debt for equity finance is everywhere you look. Persistent and relentless policy support for the stock market has created a new culture of investment confidence, despite weak underlying fundamentals, which are not improving.

The Treasury issues excessive short-term debt to boost deficit spending and takes no action to address the IMFs constant warnings about the scale of the budget deficit.

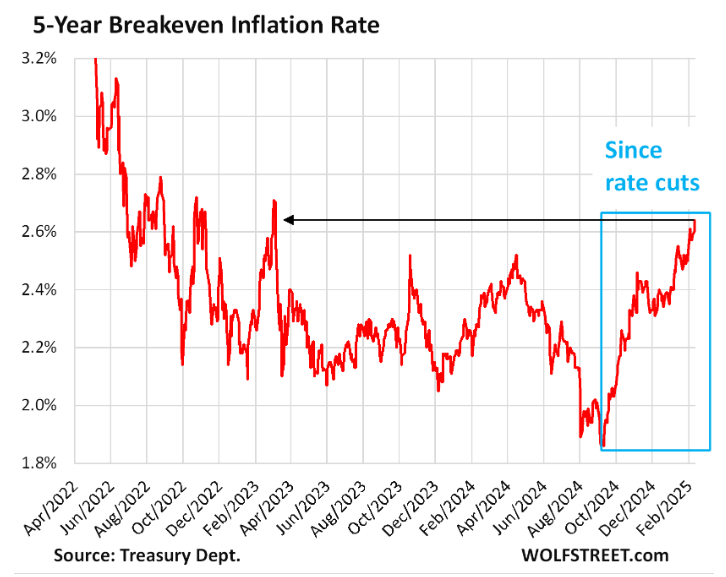

The Federal Reserve not only keeps interest rates too low and stimulates inflation but also inflates asset prices with QE and excessively loose financial conditions. It furthermore mismanages its own balance sheet to the point of insolvency and has become an additional burden on the taxpayer. The Federal Reserve has also lost the bond market’s confidence in inflation policy.

Inflation expectations rose 80bp when the Federal Reserve started cutting interest rates last year with a “panic” 50bp in September, just over a month before the US election.

This conversation goes in depth on the current situation.

The Fourth Turning Is Here & Stocks Are About To Get Clobbered | Gordon Long

The world economy faces a very weak industrial production backdrop.

The Global Capacity Glut

Factories across the world are growing increasingly idle. Global industrial capacity utilization (CAPU) has fallen significantly, and a rising unemployment rate has followed suit, signaling that the available factors of production globally are progressively more redundant. The reason this is relevant is that since 1990, this thirty-four year correlation is consistent with the U.S. experience where data has been available for seven decades. As such, CAPU appears to be the dominant supply-side variable in determining inflation in the United States, China, Japan, U.K. and the EU.

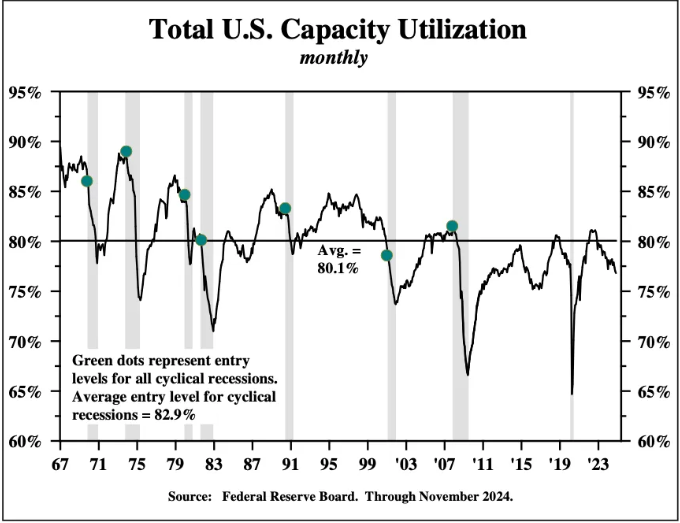

CAPU – At Recessionary Levels

In the United States, CAPU has plummeted to levels lower than at the start of all of the cyclical recessions since 1967:

Summary

The new administration is making changes at a rapid rate. However, economic development is still obsessively focused on the financial system which has become brilliant at solutions for keeping some stock prices high and rising, even while the broader economy as a whole continues to show weak growth at best.

To be effective policy will have to focus on the real economy and go against the financial system’s own short term best interests to reach a durable restoration of economic stability. It is unlikely that the real economy needs more debt and leverage at this stage.

In the meantime, it is crucial that Investors understand the risks embedded in the current market predicament. Then prepare and adopt strategies that can first protect their wealth effectively and then possibly also benefit from the volatility that will inevitably occur.

A compounding strategy outperforms other strategies over time because risk management is embedded in the methodology.

This is a challenging time to invest. The financial system focus remains the stock market upside which may continue in the near term. At the same time the increasing fragility and disconnect continues to grow.

Make sure you are prepared for whatever happens when you need to be and understand the message of the price behavior of gold versus credit. The S&P 500 has underperformed gold for over 3 years, and the US dollar is collapsing against gold.