“If you don’t own gold you don’t know either the economics or history of it.”

Ray Dalio

The investment risks are now substantial. See our blogs on the “Capital Rotation Event” which is confirmed as at March 2025 month end. This is the fourth time in 140 years that gold has broken out versus ALL credit assets.

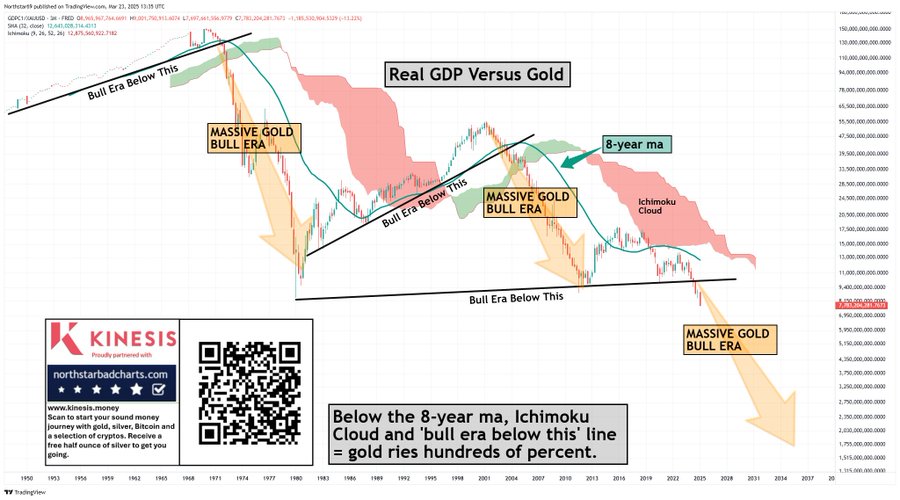

The chart above shows that real GDP is collapsing against gold for the third time since 1970. This time real GDP has remained weak even with excessive government deficit spending. As previously shown, the US appears to be locked into a private sector recession with debt out of control. Policy just continues to double down on an already obvious epic policy failure.

Gold never does anything. So, it does not really ever make sense to say that gold is actively rising in price. When gold outperforms everything else it really means that everything else is going down.

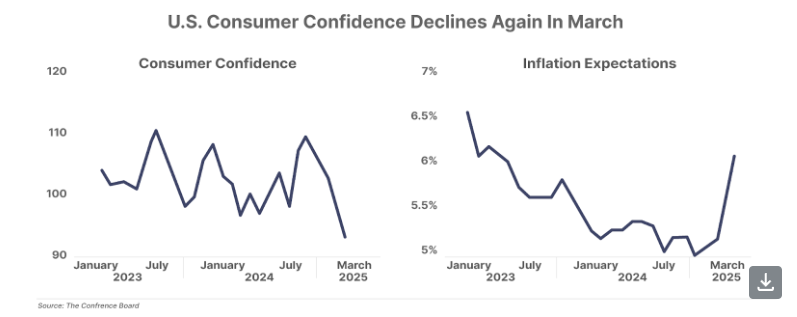

In my Money Show webinar in 2021 I showed that US stocks and bonds had gone off the valuation map, and indicated that stagflation was coming. Consumers are now experiencing acute stagflation.

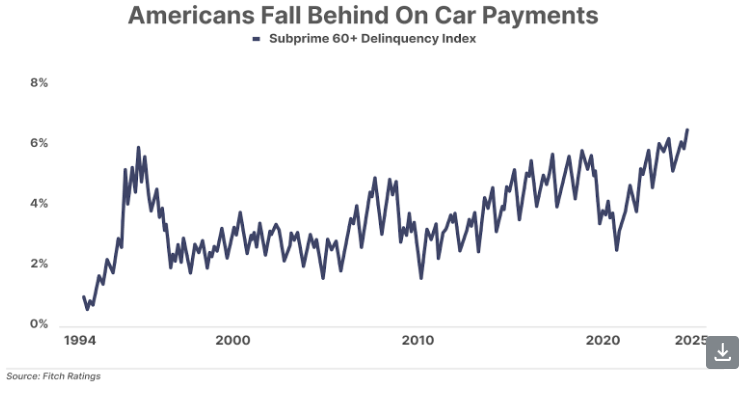

The strains in the private sector show up clearly in all-time record auto loan delinquencies.

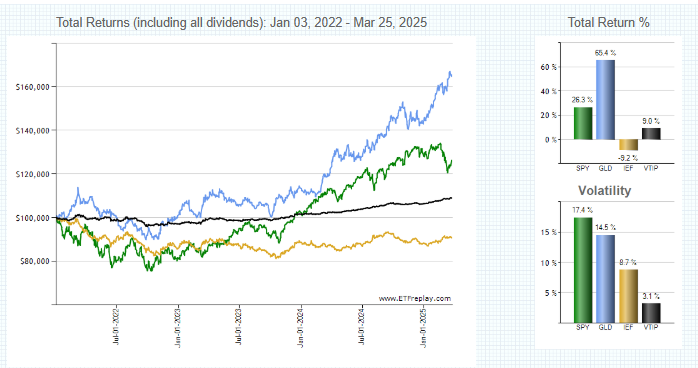

Since 2021 stagflationary assets like gold and TIPS have already massively outperformed the S&P 500 and Treasury Bonds. Furthermore, in both cases gold and TIPS have significantly lower risk, so they have been ideal allocations.

Yet, as I have shown before, more than 3 years later these allocations continue to be ignored and rarely even discussed.

The markets, however, are overwhelmingly clear. Here are the numbers since 1/1/2022.

Sound investing is not widely understood. That is why I wrote my book “Invest Like The Best.”

The optimal long term Investment Objective in simple terms is:

Compound your returns by minimizing losses, then you will have not only security of your capital but also higher long-term returns.

Yes it is that simple, and that means that you can easily assess it in real time! This is not only better investing but it delivers better security, real time verification and transparency.

Now you can measure your performance and the quality of Asset management properly.

“Best Investor Standards” are best measured by a high Calmar Ratio. This is the ratio of the multi-year compound return relative to the highest drawdown. I am happy to compare my client account’s Calmar Ratio since 1/1/2022 against any asset manager.

Passive managers are unlikely to be anywhere close to optimal, as their strategy is to just ride out losses and hope the markets recover. This means they have limited security of capital and the possibility of life changing losses.

Very few Active managers have adopted the rigors of “Best Investor Standards”. High Calmar ratios are very rare.

“Best Investor Standards” check all the boxes for what investors need, and are adopted by ALL the most successful investors of all time.

The investment risks are now enormous an upgrade has become essential for long term success.

Economically we may need to have a crash to finally have a productive conversation about economic policy and get it back on track.

Until we come to terms with the current situation, the “forgot how to grow economy” won’t have a meaningful sustainable recovery. All policy makers are doing now is doubling down on failure, making excuses and avoiding the right questions.

The economy is clearly in systematic trouble and many adjustments will need to be made. Asset bubbles have made investors complacent at the highest valuations in history. Not just in Equities, but also in housing.

House prices are also vulnerable

Trump Just Signed An Executive Order To Pop The Housing Bubble.

Next week we have to face the reality of tariffs. This could lead to many unpredictable outcomes.

Tariff Trouble: Rest of the world has a different take on trade policy

Jeffrey Sachs: Protectionism will backfire on the U.S.

Summary

There is no question that investing is at a crucially important stage. Economic policy has failed but policy makers are accelerating dysfunctional policy. Gold has triggered major signal indicating a transition in all asset allocations is now at hand, and the appropriate allocations have been outperforming already for over three years!

Most investors remain in the dark about these life-changing events, clearly do not have the optimal allocation, and appear to be unaware of the definition or even assessment of optimal sound investing.

If you want a complete upgrade in your financial experience contact Chris Belchamber: