US Investors Are Living In A Truman Show

Leveraged Equity Buyout America (LEBA) rewards the few at the expense of the many through a persistent private sector recession

The Trump Risk: Any new policies that interrupt LEBA could break the illusion and stock markets with it

Open your mind to what is already happening before it gets any worse and it’s too late to do anything about it.

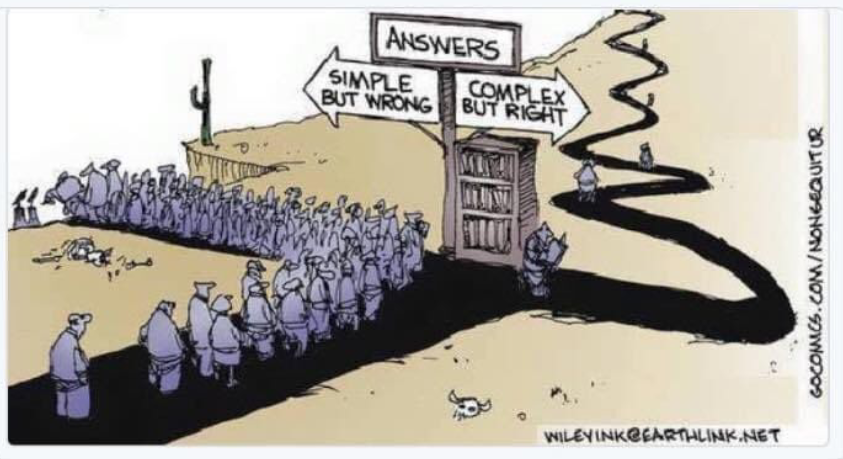

Oversimplistic assumptions are highly dangerous when a complex and leveraged financial system breaks down

Economic Policy Has changed beyond recognition by most investors today.

“Most people make bad decisions because they are so certain that they’re right that they don’t allow themselves to see the better alternatives that exist. Radically open-minded people know that coming up with the right questions and asking other smart people what they think is as important as having all the answers. They understand that you can’t make a great decision without swimming for a while in a state of “not knowing.” That is because what exists within the area of “not knowing” is so much greater and more exciting than anything any one of us knows.“

Ray Dalio

Look again at the data but look at it differently.

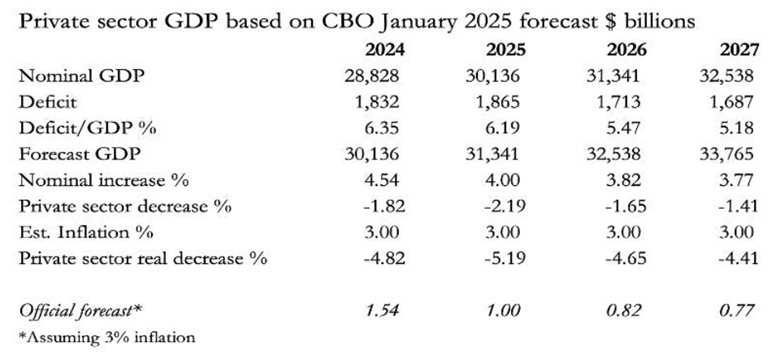

The Growth Illusion is in fact a simple sleight of hand applied to data we all agree on. Deficit spending initially counts as growth in GDP. However, it is not a productive investment and so it soon turns into a profoundly negative persistent debt burden for the economy.

According to the CBO, the increase in nominal GDP in the current fiscal year to end-September 2025 is expected to be 4.54% (Column 1, line 5). At the same time, the budget deficit is 6.35% of GDP. To establish what the private sector contributes to GDP, we must subtract 6.35% (the deficit) from total GDP. Therefore, while the government deficit “grows” the economy by 6.35%, private sector nominal GDP is contracting: 4.54—6.35 = -1.82%.

We must now make an allowance for CPI inflation. We have no idea what the pace of currency debasement will be, but let’s take the current approximate rate of CPI’s annual increase at about 3%. Therefore, in “real” terms, the private sector is contracting by 4.82% (the sum of -1.82% and – 3%) in the current fiscal year on the CBO’s own estimates.

The problem just gets worse each year, and the dollar keeps falling against gold. Why wouldn’t it?

This creates two further problems. The first is that due to the contraction of private sector activity, tax revenues will fall short of those anticipated, and the likely unemployment resulting from a private sector slump will mean higher welfare costs. This combination will lead to yet higher budget deficits than those anticipated, concealing an even deeper private sector crisis. Furthermore, currency debasement (inflation) will be greater for longer due to the higher budget deficits.

The second major problem is that the debt to GDP ratio will rise not just because of increasing government debt but because “real” statistical GDP will be stagnating or even contracting. Consequently, the debt mountain will be growing at an even faster pace than the economy.

Macroeconomists, central bankers, and politicians everywhere are pursuing the growth illusion, ignorant of the consequences. The same catastrophe is faced by the other major western currencies: euro, yen, and pound.

Just chuck more stimulus in the mix, they say, and it will come right in the end. No it won’t, which is why are all these currencies are declining in value at an accelerating pace measured in gold, as the chart below demonstrates.

Major currencies have fallen 70% in the last 10 years! Does that change your assessment of your net wealth?

Investors should have gotten the joke by now after a 90% devaluation over 25 years. However, they still measure their returns in devaluing currency and ignore the price of gold. Investors think they are doing well in dollar terms but the dollar has been collapsing in gold terms.

Attaching credibility to policy should have already become absurd. Not there yet?

“Give My Regrets to Wall Street: Why the Financial Industrial Complex Does Not Work for You

Wall Street isn’t built to serve the average investor—it’s designed to enrich banks, institutions, and corporate executives at your expense. This session will break down the hidden incentives that drive financial decision-making and show how the system prioritizes profits over real investor success.

By understanding these dynamics, individual investors can make smarter decisions and outmaneuver the financial industrial complex.“

Joel Litman

Regain your own sovereignty. Understand there is a much better way

- Understand the difference between real money, gold, and credit, which is everything else.

- Switch to measuring your wealth in gold, as well as dollars.

- Realize that a portfolio of gold and TIPS has already outperformed a portfolio of bonds and US equities for over 3 years.

- Adopt Best Investor Standards.

There are three main steps to becoming a Best Investor. These three steps are detailed and laid out systematically in my book.

Step 1: Get a check up on how you think and behave as an investor. This is the biggest step for most investors.

Step 2: Make sure you understand the essential math of investing. Then select your Investment Objective and Assessments which must be aligned.

Step 3: Now you are in the best place to select your systematic Investment Strategies, Process, and Execution.

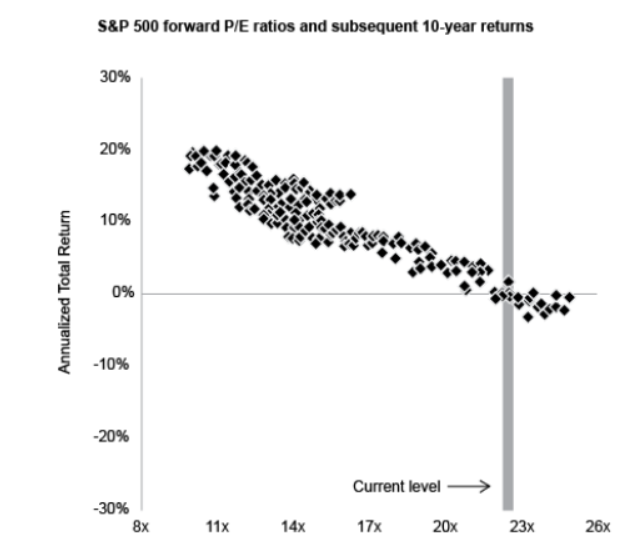

This is how the most successful investors outperform over the long term. They don’t commit themselves to 10 years of expected zero equity returns not counting inflation.

There is a better way!