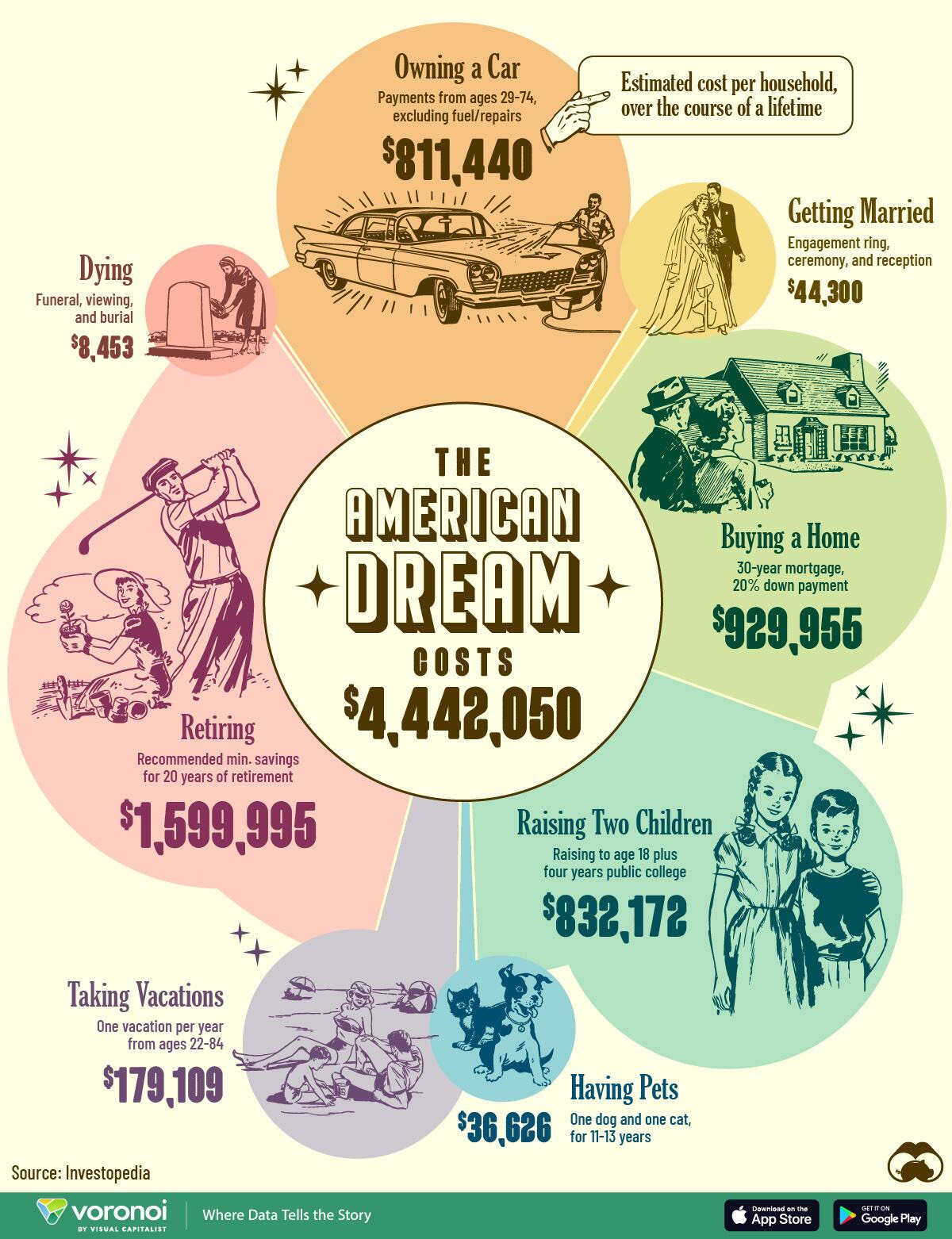

For most retirees “The American Dream” has become unaffordable.

With policy distorting markets and becoming increasingly unstable managing investment risk, while optimizing a retirement and tax plan requires the best software, experience and skill.

“While it is the duty of the citizen to support the state, it is not the duty of the state to support the citizen”

President Grover Cleveland (1885—1889)

Alasdair Macleod

The US dollar has devalued by a third relative to gold in just the last 2 years. Here is the price of the US dollar in Gold terms, the downtrend is accelerating:

THE EXPLODING COST OF LIVING PUTS RETIREMENTS IN JEOPARDY!

There are few Americans who are not acutely aware of rising costs in almost everything we buy, rent or lease. Whether food, gasoline, apartment rent, school supplies, child care, insurance, or medical care – it doesn’t matter what it is, it is going up everywhere.

Retirement comes at the end of the line and it happens to be the biggest cost item of all! This is where the rubber meets the road. As the US workforce ages, the reality of what has happened regarding Retirement support and security has become a frightening reality. Since WWII it was a bedrock of being able to realize the American Dream!

Here are the main issues:

1. Retirement Security is much diminished.

As the chart above shows – retirement is the biggest component of the American Dream and since the late 1990’s Corporations have moved from Defined Benefits Plans to Contributory Plans, then to increasingly stripped-down contributions from employers. Retirees must become self sufficient to ensure they have a successful retirement.

2. Retirement support.

While Social Security and Medicare do offer great support, the long-term future of these retirement programs looks difficult into the 2030s as government debt begins looks unpayable on current trends and the funds backing these programs are clearly insufficient. Some advisors consider it prudent to cut prospective benefits, say 10 years out, to take some account of this. The government may not be able to provide the real value of the benefits, let alone any additional support.

3. Retirement savings are insufficient. Retirement Planning is largely absent or poorly done.

The data below shows how difficult it is for most people to properly address their financial planning. First of all, most people just don’t want to.

Three-in-four undersave for retirement. One-in-four has zero retirement savings. One-in-four doesn’t participate in their company’s 401(k). Three-in-five gamble routinely. Four in five borrow beyond their means. More than half retire very early — at 62, on average. A quarter underestimate their life expectancy. Half face a lower living standard in retirement.

Only 40 percent feel they are saving enough. Of course, saving enough requires financial planning. But two-in-three workers don’t have a financial plan! They are in good company.

In general, financial service companies have done a poor job of delivering useful and actionable financial planning advice. Know why and what you need to look for.

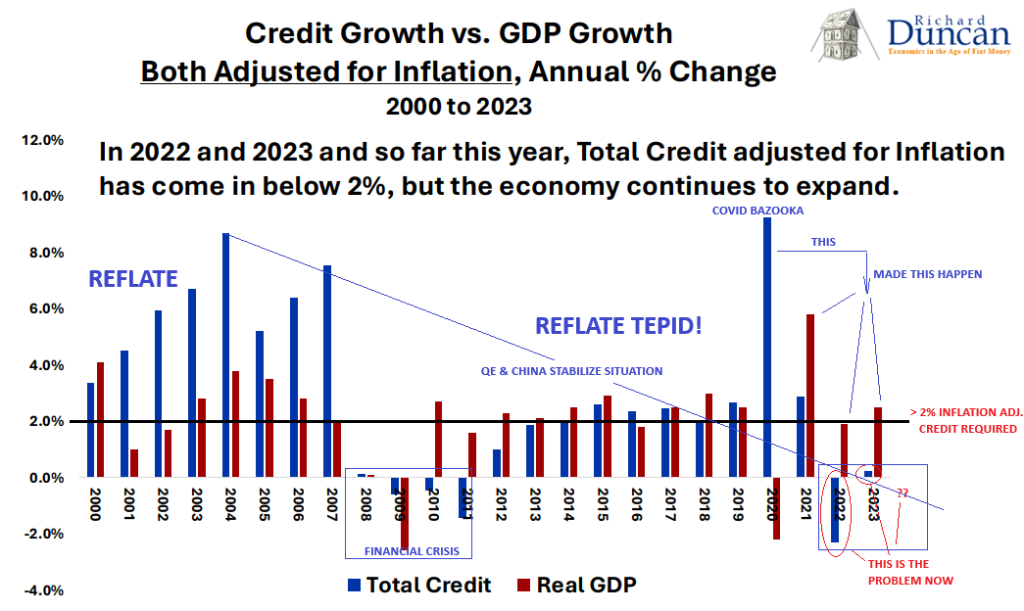

4. Economic policy making has become desperate

Rather than address the issues, the economy has reached the point where any attempt at austerity would now trigger a severe collapse. Yet unsustainable deficit spending is only just keeping credit growth positive.

Credit Growth is Slowing Sharply

The main driver of economic growth in the post-gold standard era has been credit expansion. However, the growth of total credit has weakened significantly. In Q2 2024, credit grew by just under $4 trillion compared to over $8 trillion at the peak of the pandemic stimulus. Historically, such weak credit growth has led to recessions.

Government Debt is Propping Up the Economy

The bulk of this credit growth has been fueled by rapidly increasing government debt. Without this increase, total credit growth—and economic growth—would be much weaker, potentially triggering a severe recession.

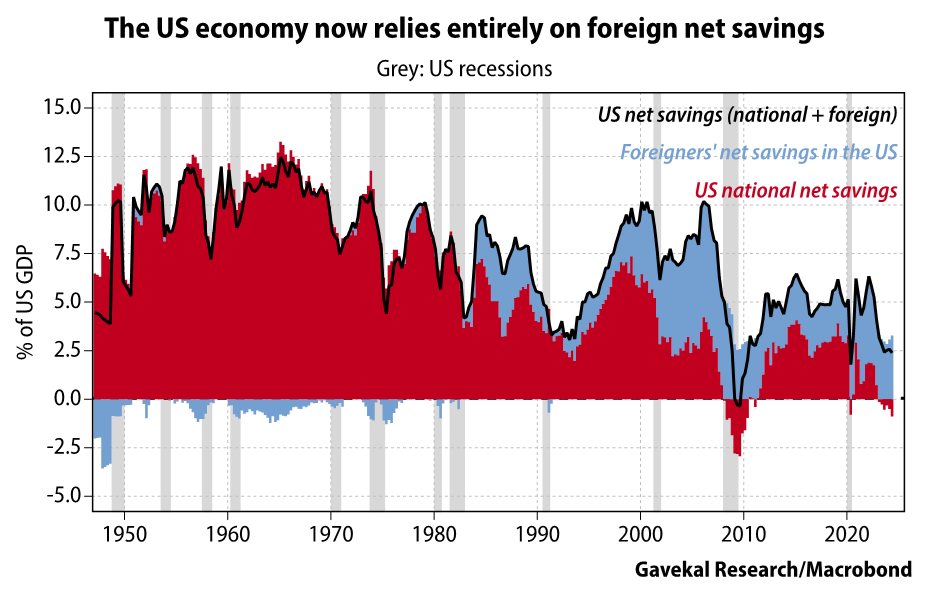

5. The US is now fully credit dependent. On a net basis the US has negative savings. Even foreigners are reducing their US dollar savings.

6.The US is ever more dependent on credit as it now has Negative Net Savings with a deep-seated debt and growth dynamic problem and no off ramp.

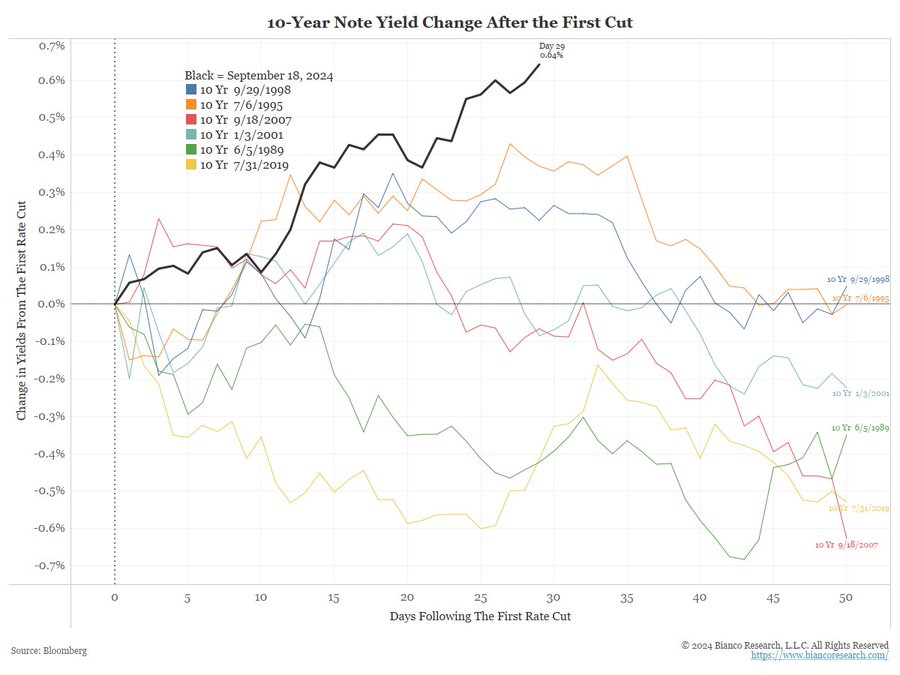

7. The bond market signals the Fed made a big mistake when it cut rates by 50 bp in September.

As we have been indicating for some time, it is becoming increasingly clear that policy is becoming increasingly inflationary. The bond market signals the Fed made a big mistake when it cut rates by 50 bp in September. Of course the chart above of the US dollar also tells you clearly how successful the Fed has been in “preserving the value” of the US dollar!

8. Valuation is a poor timing tool but long-term investors should not ignore it as a warning sign. Future returns from the stock market look challenging on multiple measurements. For example:

The Wealth to Income Ratio is Alarmingly High

The ratio of wealth to disposable income is now at 785%, far exceeding historical peaks that preceded previous market crashes, such as the 2000 dot-com bubble and the 2008 financial crisis. Should any significant shock occur, we could see a sharp decline in asset prices and a subsequent recession, or a long period of poor passive returns.

Even Wall Street, which always has disproportionate buy recommendations, is struggling with this inevitable valuation conclusion.

Goldman Sachs, David Kostin and his research team point out, while only the gullible will extrapolate current returns forever, ‘past performance’ does actually infer future performance expectations… and that may mean disappointment ahead for many:

“Investors should be prepared for equity returns during the next decade that are toward the lower end of their typical performance distribution,” the team wrote in a note dated Oct. 18.

- Goldman’s 3% annualized 10-year return forecast for the S&P 500 is well below the consensus average of 6% and Kostin concludes with a warning: “investors should be prepared for equity returns during the next decade that are towards the lower end of their typical performance distribution relative to bonds and inflation.”

- “Our 3% annualized equity return forecast combined with a current ten-year US Treasury yield of 4% and ten-year breakeven inflation of 2.2% suggests the S&P 500 has roughly a 72% probability of trailing bonds and a 33% likelihood of lagging inflation through 2034.”

Retirement investors will have to navigate treacherous waters, plan and execute well to get through the coming investment challenges. I will expand on this issue in a coming blog.

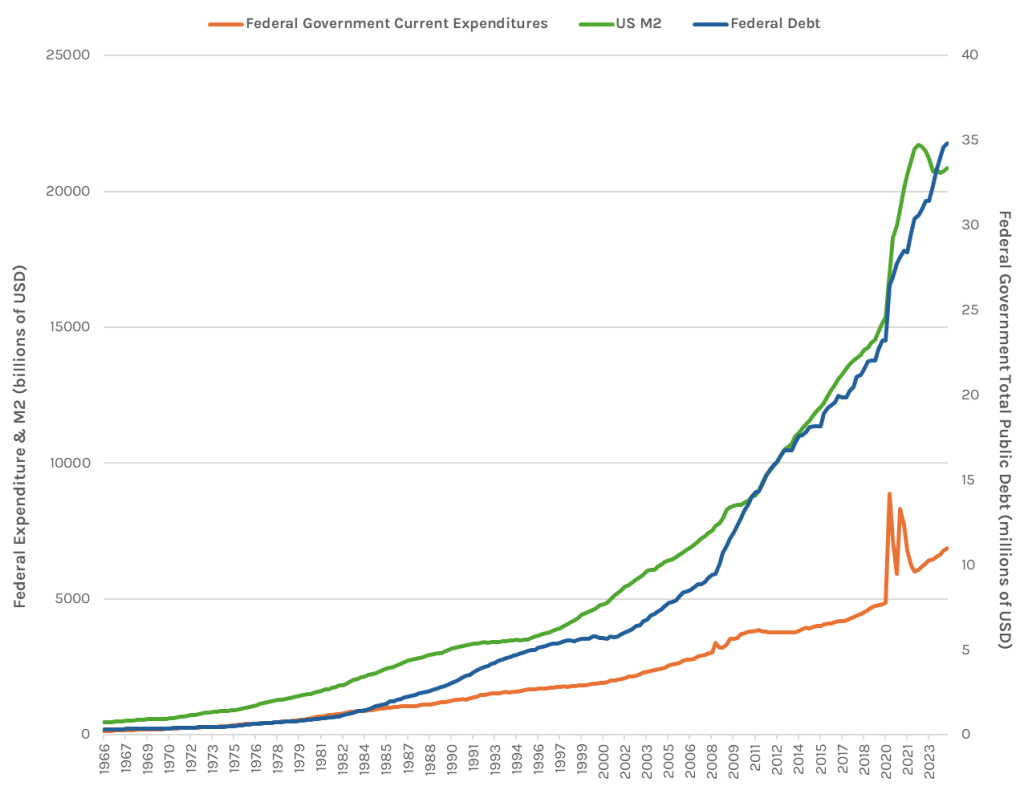

9. Economic policy has gone off the rails and investors will be confronted by an inflationary period. Debt enabled by excessive money supply far in excess of growth in the economy is inflationary.

10. Markets have become distorted as never before and disconnected with economic value.

Professor Plum would like you to explain the chart below.

- S&P GAAP earnings are still below where they were 3 years ago

- The S&P is more than 20% higher than it was at the peak 3 years ago.

- Total debt has risen broadly in line with personal income, but with excessive government borrowing, and chronically weak private sector borrowing. Why is private sector borrowing so weak and the stock market so strong, other than the interpretation in this blog?

- Starting from the same place in 2013, the S&P has grown to double the increase in personal income today.

Summary

Your retirement is the biggest spending item by far in your lifetime. Do you have a genuinely credible plan? To what extent are you completely different from the vast majority of retirees who are very badly prepared?

Don’t you owe it to yourself to make your retirement work? You can get help but it won’t work unless you are motivated to face up to the retirement crisis.

As I wrote before:

The Retirement Crisis Requires Your Proactive Engagement.

Excessive debt and money supply have extended the equity bubble in time and price terms and has made the underlying economy even more vulnerable and distorted. Retirement investors, in particular, cannot recover from any major drawdown without a change in lifestyle.

It is crucial that retirement investors have a clear retirement, tax, and investment plan.

Retirement planning is complicated and needs a combination of factors to be optimized and there is really only one software package that is widely recommended by the top universities.

Tax planning is rarely provided even by financial planners and CPAs.

Retirement investing needs special care. Security of capital is even more essential. Fortunately, there is a methodology that increases long term returns through low-risk methodologies. Very few investors understand this approach that is widely used by all the most successful investors. I wrote the book on this and I can demonstrate my results.

Could it be that the fire hose of government debt and money supply over the last decade has massively distorted asset prices and investor behavior beyond previously accepted norms? Can policy really continue without inflation, or a debt restructuring? How will you manage your investments through that? What experience and skills will you need?

Make Your Life Better! Fully Address The Issues Because They Get Harder The Longer You Don’t Deal With Them!

Are You Motivated To Get Your Retirement Plan As Good As It Can Be?