Most financial advisors repeat two popular opinions:

- “More risk means higher returns.”

- “You can’t beat the market. Just buy the index and hold.”

Those two ideas can’t both be true. In reality, neither one is.

Real wealth isn’t built by risk or passivity. It’s built by discipline, a compounding process that lowers drawdowns, smooths volatility, and makes steady growth inevitable.

If you can’t measure how your portfolio compounds, you’re not investing, you’re gambling.

Here are five simple steps to change that.

Step 1 — Understand the Power of Low-Risk Compounding

For decades, investors have been told that higher risk brings higher returns. The data says the opposite.

Across multiple studies of the S&P 500, the stocks with the lowest volatility consistently outperformed the most volatile ones, even during a 27-year bull market.

The reason is simple: every large loss resets progress, but small and steady gains keep building.

Think of it this way:

- A 50% loss requires a 100% gain just to break even.

- A 10% loss needs only 11% to recover.

Over time, avoiding big hits matters far more than chasing big wins. That’s why the most successful investors treat risk control as their growth engine.

Compounding isn’t about swinging for the fences; it’s about staying in the game long enough for math to do its work. The lower your volatility, the stronger your compounding.

This is the low-risk road to high returns.

Step 2 — Measure Your Risk-Adjusted Return

You can’t improve what you don’t measure.

The best investors don’t just track performance. They track how efficiently that performance was earned.

The simplest and most revealing metric is the Calmar Ratio. It measures how much return you’ve achieved against your most painful loss:

Calmar Ratio = Annualized Return / Maximum Drawdown

That’s it. One number tells you exactly what you need to know:

- Above 0.5 is an excellent sign for your portfolio’s long-term growth.

- Below 0.25 means there’s room for improvement.

This ratio exposes the quality of your process. A strong Calmar signals discipline: steady progress with controlled setbacks. A weak one reveals fragility: high drama with little reward.

When you know your Calmar Ratio, you know whether you’re compounding or just hanging on.

Step 3 — Build a Compounding Process

Once you understand how compounding works and how to measure it, the next step is to make it deliberate.

Successful investors don’t just react to markets. They follow a defined process built to protect progress and make results repeatable.

A sound compounding process follows four key priorities:

- Define your maximum drawdown. Decide the largest loss you’re willing to tolerate and design your portfolio to stay within that boundary. Limiting drawdowns is the foundation of steady compounding.

- Minimize risk. Use real diversification, position sizing, and disciplined rebalancing to smooth volatility. Smaller losses are more important than big wins.

- Generate a positive absolute return. Consistency compounds.

- Benchmark intelligently. Compare your portfolio’s risk and return against clear standards so you know whether your process is working as intended.

You can track your Calmar Ratio over any period of time, even daily. It’s your real-time report card for whether your compounding engine is running smoothly.

When your portfolio runs on a process of discipline, uncertainty becomes manageable and compounding becomes inevitable.

Step 4 — Learn from the Simple System that Outperforms Passive Investing

Passive investing tells you to buy the market and hold on.

But when markets fall, passive portfolios fall just as hard. And by now, you understand the cost of massive drawdowns.

There’s a better way.

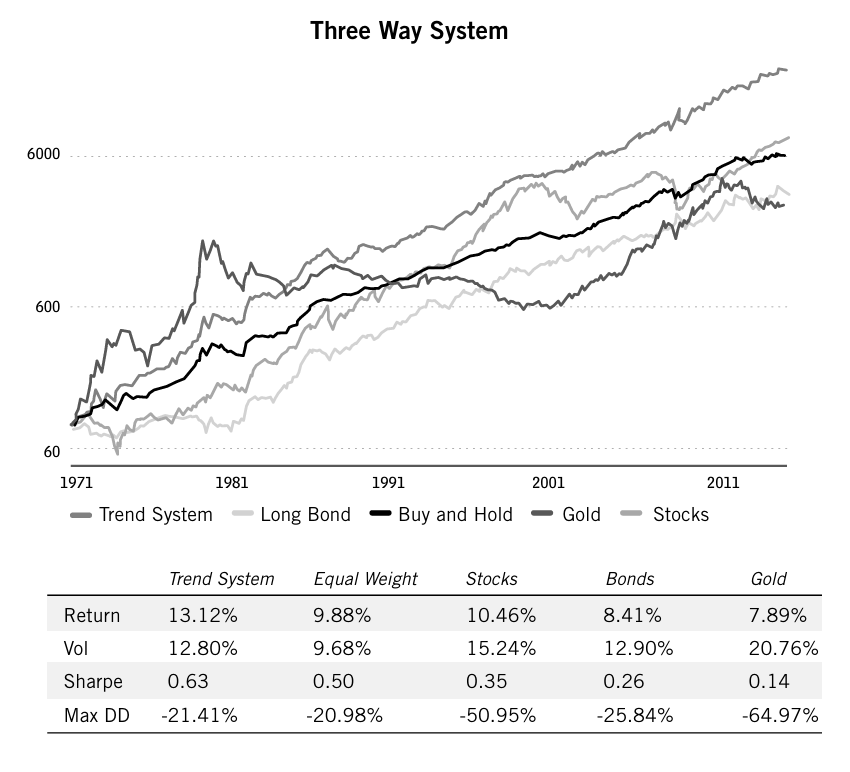

The Three Way System, which I detail in my book, shows that even a simple trend-based approach can outperform passive investing with less risk and smaller drawdowns.

The concept is straightforward. Each month, hold an equal allocation across stocks, bonds, and gold. But only hold the assets showing a clear upward trend. If one turns negative, move that portion to cash.

Over four decades of testing, this simple rotation has delivered:

- Higher returns than a traditional 60/40 portfolio, or any passive allocation strategy

- Lower volatility and dramatically smaller drawdowns

- Consistent compounding through both bull and bear markets

The chart below shows the difference. For a direct comparison, examine the “Trend System” versus “Buy and Hold” over a 40 year period.

You don’t need complex algorithms to outperform the market. You just need discipline.

A process that limits drawdowns and compounds steadily will beat passive investing over time.

If you want to learn more about this system and the math behind it, you will find my book, Invest Like the Best, to be a helpful resource.

Step 5 — Apply Compounding in the Modern Market

Last week’s article, The Market Correction No One’s Ready For, showed how decades of easy credit and intervention have created the conditions for another major shift, what we called a Capital Rotation Event.

That shift is already underway. The question is whether your portfolio is built to endure it.

A compounding system that limits drawdowns, adapts to volatility, and measures its own performance gives investors the discipline to act with confidence instead of fear.

For those who prefer a ready-made solution, the new Hedgeye ETF (HECA) represents an important development. Built on the same principles of drawdown control and real-time compounding, it brings professional-grade process to individual investors.

Together, these tools (from the Three Way System to new ETFs like HECA) mark a quiet revolution in how investors can approach the markets: with structure, accountability, and measurable discipline.

The market will always test conviction.

The difference between losing and lasting isn’t timing or luck; it’s a disciplined process.