A sharp blade is not an accident.

It is the result of discipline: steady hands, consistent technique, and the refusal to rely on luck.

Investing should work the same way. But it rarely does.

Most investors are told to take more risk, wait out volatility, and trust that markets will “come back.” That’s like walking into the wilderness with a dull knife and calling it preparation.

The best investors don’t gamble with their future. They sharpen their process.

They manage drawdowns with precision.

They use realtime metrics to measure compounding.

They control risk instead of absorbing it.

They practice the craft.

Marcus Aurelius once wrote, “Tranquility is nothing else but the good ordering of the mind.”

In investing, that tranquility isn’t found by ignoring risk; it’s earned through discipline, structure, and a process strong enough to stay calm when markets are not.

This article reveals what that craft actually is, why the low-risk road produces higher long-term returns, and how investors can build a disciplined edge that survives, and even thrives, in any market environment.

The Market Has Changed — Investors Haven’t

The modern market is not simply more volatile. It is more fragile.

For decades, stability has been manufactured through expanding debt and currency debasement. Each intervention smoothed the last crisis while making the next one larger. Asset prices rose, confidence followed, and investors learned the wrong lesson: that markets are resilient, risk is temporary, and losses will always be repaired.

That belief is now embedded behavior.

What goes largely ignored is the cost of that illusion. Measured against gold, the dollar has lost more than 99% of its value over time. Precious metals have massively outperformed every major asset class across long historical cycles, not because they are speculative, but because paper systems always end the same way. Nominal gains feel comforting, but they increasingly mask real erosion.

Yet most investors still rely on static allocations, tolerate deep drawdowns as “normal,” and assume that time alone will solve structural problems. They mistake prolonged manipulation for proof, and currency expansion for genuine growth. Meanwhile, the foundations supporting those gains continue to weaken.

History is unambiguous. Financial systems built on unpayable debt fail gradually at first, but then suddenly fail dramatically and decisively. Wealth concentrates, volatility spikes, and capital rotates away from what worked before. As we outlined in our previous article, these Capital Rotation Events force an unavoidable choice: adapt in advance, or drown in losses.

Most portfolios are not prepared for that transition.

Markets are now so fragile they are held together by constant intervention. The Fed has just restarted printing money again to add to its balance sheet. The US can no longer finance itself from US savings alone.

This is not a forecast. It is the current environment.

The craft of investing begins by accepting that reality. The only remaining question is whether an investor has built a process designed to survive it.

The Dangerous Myth Still Guiding Traditional Advisors

For decades, investors have been taught a simple equation: higher risk leads to higher returns. It’s repeated so casually—and so often—that it feels like a law of nature rather than an assumption.

But it’s wrong.

This belief encourages investors to tolerate volatility, absorb deep drawdowns, and treat market pain as the unavoidable cost of long-term growth. Advisors repeat it because it simplifies their job. It gives them permission to stay passive, even when clients are suffering unnecessary losses.

The truth is unmistakable: taking more risk does not guarantee better results. In fact, it usually destroys compounding. The bigger the drawdown, the harder the recovery. A portfolio that repeatedly gives back years of progress is not building wealth; it’s leaking it.

Yet the myth survives because it’s convenient. It lets advisors justify inaction. It lets investors believe that discomfort today will somehow produce outperformance tomorrow. And it hides the reality that most portfolios experience unnecessary risk from inadequate skill.

Good investing doesn’t begin with taking more risk. It begins with understanding how dangerous that advice has always been.

The craft of investing requires abandoning the myth entirely. Only then can investors focus on what actually drives long-term results: controlling losses, reducing volatility, and building a process that compounds steadily.

Compounding Is the Real Engine of Wealth

Most investors focus on returns. The best investors focus on how those returns are achieved.

Compounding is not powered by big wins alone. It’s powered by consistency. The math is unforgiving: large losses reset progress, while small, steady gains build on themselves. A portfolio that avoids major drawdowns doesn’t just feel better, it grows faster over time.

This is why volatility matters so much. A 50% loss requires a 100% gain just to break even. A 10% loss needs only a modest recovery. Over years and decades, that difference compounds dramatically. The smoother the journey, the stronger the result.

The data confirms this, as we showed in our previous article. Across long market cycles, lower-risk stocks consistently outperform higher-risk stocks, even during extended bull markets. Not because they soar higher, but because they fall less. Less damage means less recovery time, and less recovery time means more compounding.

This is the inversion most investors miss. Risk is not the engine of returns. It is the enemy of compounding.

Wealth is built by staying in the game with progress intact. The craft of investing begins here: protecting the base so growth can accumulate. Once this is understood, everything else—risk management, discipline, process—falls into place.

Risk Management Is the Core Skill to Measure

Once compounding is understood, risk management becomes the central discipline of investing.

Long-term results are not determined by how much upside a portfolio captures, but by how much damage it avoids. Large drawdowns interrupt compounding and force portfolios to spend years recovering instead of growing.

That’s why risk must be measured, not just discussed.

The most direct way to evaluate risk management is to compare return to drawdown. The Calmar Ratio does exactly this by dividing annualized return by maximum drawdown.

One number answers the essential question: How efficiently did this portfolio compound relative to the pain it imposed along the way?

A low Calmar Ratio reveals a fragile process built on exposure rather than control. A higher Calmar Ratio signals disciplined risk management: smaller losses, faster recoveries, and more durable compounding.

Most traditional portfolios score poorly by this measure because they accept full drawdowns as unavoidable. Best practice investing does not. Losses are constrained by design, and success is judged by how smoothly wealth compounds over time.

This is where real risk management becomes visible.

Due Diligence: The Investor’s Superpower

Once risk and compounding can be measured, the advantage shifts decisively to the informed investor.

Best practice investing does not require trust without verification. With the right questions, you can quickly distinguish between disciplined professionals and those relying on hope, habit, or hype.

Proper due diligence eliminates the vast majority of investment managers. Not because they are dishonest, but because they cannot demonstrate best practice with real data.

Here are the requirements that matter.

- First, demand a real track record.

An investment manager should be able to show at least three years of performance from an account they have directly and solely managed. Not model portfolios. Not backtests. Not composites assembled after the fact. If there is no verifiable record, there is nothing to evaluate.

- Second, require alignment.

If an investment approach is genuinely best practice, the manager should use it for themselves in a meaningful way.

When a manager does not invest personally in the same strategy they recommend to clients, there is a contradiction that deserves scrutiny. Either the strategy is not as robust as claimed, or the manager does not trust it with their own capital.

This discrepancy is common—and it is revealing. Alignment is not about motivation or virtue; it is about internal consistency.

- Third, examine compounding efficiency.

Returns alone are not enough. You should be able to see how efficiently those returns were earned. This is where metrics like maximum drawdown and the Calmar Ratio become decisive. If a manager cannot clearly explain how their process protects compounding, the process likely doesn’t.

- Fourth, insist on transparency.

You should be able to see your account data at least as of the previous market close, and ideally in real time. Performance, positions, and exposures should never require interpretation or delayed access and explanations.

Risk that cannot be measured cannot be managed. Performance that cannot be assessed leaves room for storytelling rather than self-analysis. Delayed or opaque reporting is a warning sign.

- Fifth, use a best-practice custodian.

Your assets should be held at a reputable, independent custodian that provides full reporting and control. Best-practice platforms make risk metrics visible and eliminate unnecessary layers between you and your capital. Interactive Brokers has consistently been a top-rated counterparty for several years.

- Sixth, focus on the right metrics.

The essential measures are drawdown, volatility, return relative to risk, and performance versus relevant benchmarks. Above all, the Calmar Ratio provides a clear signal of whether a portfolio is compounding efficiently and has ineffective risk management.

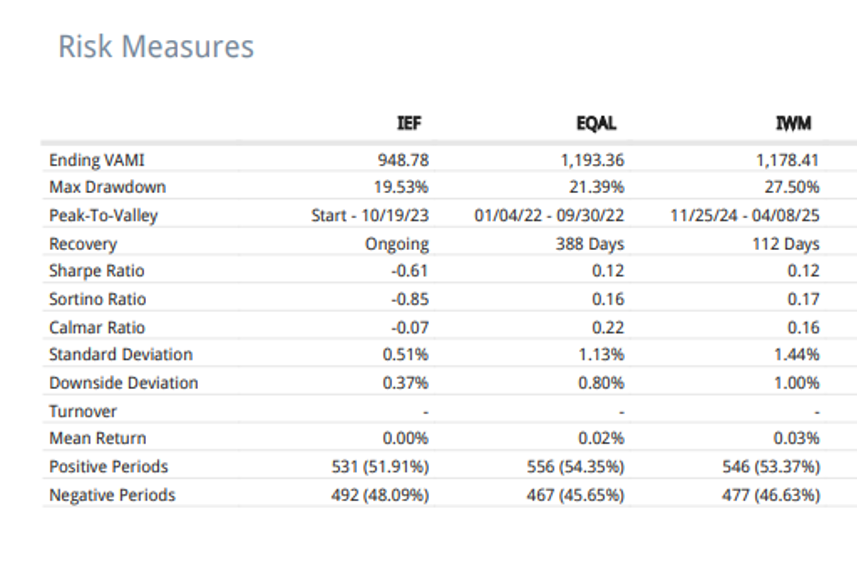

Putting all of this together, here’s an example of how I apply Due Diligence. The chart below shows all this data over the 4 years since the beginning of 2022:

- The drawdowns and time to recover the prior peak. Although IEF (8 year Treasury Bonds) are still in drawdown as they have still not recovered.

- Returns as accumulated value.

- Three measures of Return relative to risk, with the Calmar Ratio being the best long term measure.

- Average risk level in the form of average daily return.

There is other information too. These tables can have your portfolio included for comparison. I am not allowed to show my performance in a public message but am happy to show all my data in a compliant one to one basis.

Together, these requirements form a simple filter. Apply them consistently, and most managers will disqualify themselves without further discussion.

Due diligence is not about becoming an expert. It’s about knowing what excellence looks like, and refusing to accept anything less.

Options Trading: A Game Changer For Superior Performance And Risk Management

When restricted to buying options only, options can transform investing in six important ways:

- They allow explicit hedging. Buying put options can protect portfolios against downside risk without requiring wholesale changes to underlying positions.

- Risk is predefined. The maximum possible loss is known in advance and limited to the cost paid. There are no open-ended losses.

- Outcomes are asymmetric. When the underlying view is correct, gains can exceed losses by a wide margin. When it’s wrong, losses remain contained.

- Investors can choose price and timing. Options allow precise expression of both conviction and time horizon, adding structure to uncertainty.

- They manage market discontinuities. Overnight news, gaps, and sudden shocks are uniquely dangerous to traditional portfolios. Options come with built-in risk control for exactly these scenarios.

- They can accelerate compounding when used selectively. Profits from asymmetric opportunities can be reinvested to increase capital while preserving overall discipline. This accelerates your compounding rate through active risk management and asymmetric risk.

Options are not a substitute for a sound investment process. They are what become possible after the process is sound.

The Low-Risk Road to High Returns

Investing is not about prediction. It’s about clear risk assessment and management.

When risk is measured, drawdowns are controlled, and compounding is protected, outcomes improve naturally. Due diligence becomes straightforward. Tools like options become useful rather than dangerous. And tranquility, earned through structure, replaces anxiety.

This is the craft of investing.

If you’d like to see how these principles apply to your own portfolio, I’m happy to walk through them with you. A short conversation is often enough to clarify whether your process is truly built for long-term compounding or needs some assistance.

When you’re ready, let’s talk!