Most investors have too much risk badly allocated

“Best Investor standards” systematically reallocates to a higher “Calmar Ratio” which focuses on lower risk yet higher long term returns

“In western financial circles it is commonly believed that America and her mighty dollar continues to rule the world. It is coming as a shock to investors’ subconscious awareness that this might no longer be true. It’s subconscious because booming gold, the declining dollar, and rising bond yields are poorly understood by fund managers incapable of escaping from a collective groupthink driven by an anointed elite. They are the victims of an intellectual entrenchment.”

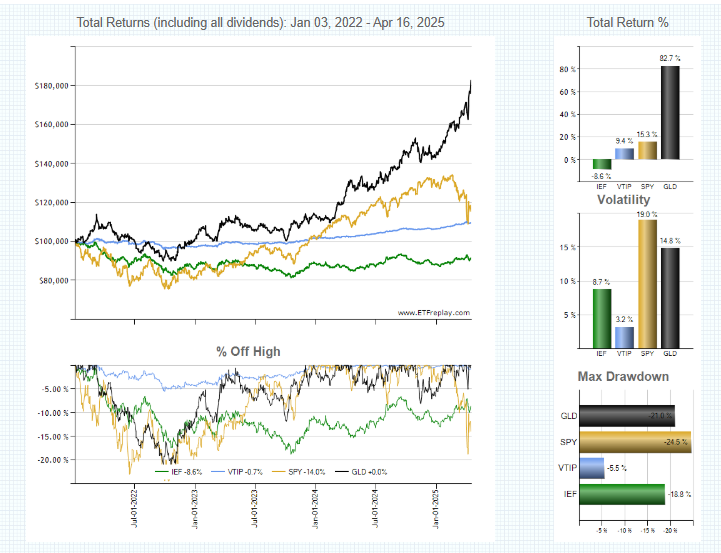

I have been advocating gold and TIPS as key allocations, relative to stocks and bonds since my Las Vegas Webinar in 2021. This is because policy is relentlessly driving a long term stagflation environment. This view is time stamped across my blogs:

Dec 2024 – https://cb-investment-management.com/us-investors-are-badly-misallocated/

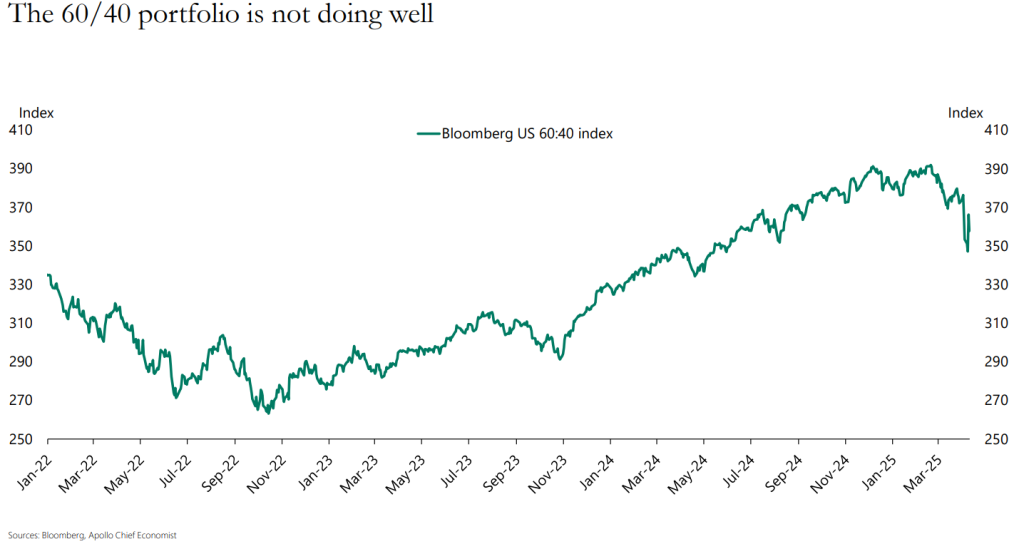

The outperformance of gold and TIPS has continued through to the present, for more than three years now. The S&P 500 has massively underperformed gold and barely outperformed VTIP. Bonds have remained in a bear market. The S&P 500 and bonds 60/40 portfolio are high risk losers compared to TIPS and gold.

Most likely this is just the beginning of a long term trend yet most investors don’t see it even as their underperformance becomes increasingly obvious. The new Tariff policy will accentuate stagflation at least in 2025.

US Investors don’t seem to notice the collapse in their unit of account the US dollar relative to gold.

“Since only 2016, by this measure it has lost 70% of its purchasing power for foreign holders. This is a far cry from the government’s own inflation statistics, slavishly followed by investors, economists, the media, and politicians alike. And because investors like to record their asset values in dollars or their own currencies, they are oblivious to this debasement. And consumers observe merely that prices are rising, not their currency declining which they would do well to understand.

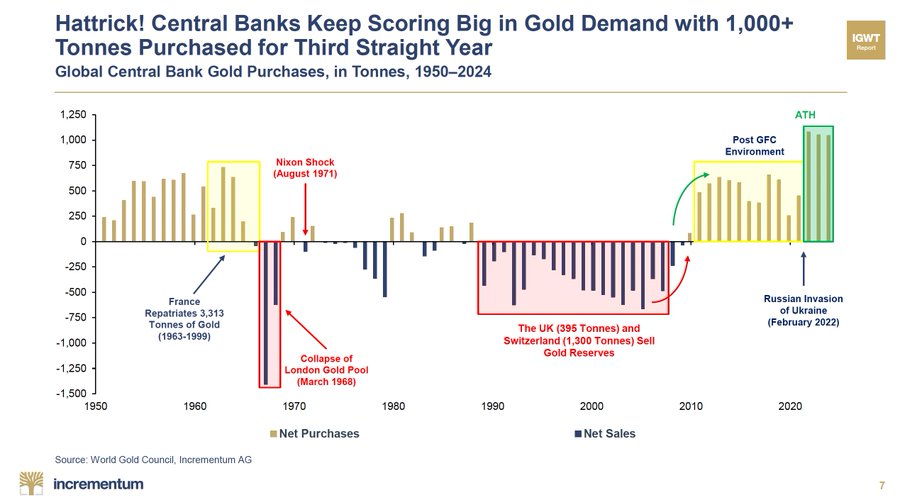

International Investors are switching dollar bonds for gold at a record rate. Central Banks have purchased over 1000 tonnes per year for 3 years straight. This is historically unprecedented.

The central banks themselves are clearly downgrading US Treasury Bonds in favor of gold with an intensity never seen before.

The Tariffs seem to be accelerating the process.

The World Is Dumping U.S. Assets | Julian Brigden

Time To commit To Best Investor Standards

How do you win at investing no matter what?

Do you know the definition of what good investing really is?

Without a definition you don’t have a clear objective or assessment.

Without an Objective and Assessment you can’t allocate optimally, because you don’t know what that is.

Isn’t it about time you committed yourself to “Best Investor Standards”?

First, what is good investing?

Compounding.

I have already described why read here.

What single metric best defines “Best Investor Standards“?

The Calmar Ratio.

What really defines reliably good compounding is the long-term compounding rate relative to the worst drawdown that you had over the assessment period. The most essential ingredient of reliably good investing is a minimal drawdown. So, the best measure of “Best Investing Standards is the Calmar Ratio. It comes right out of our Compounding metric priorities.

Calmar Ratio = (Long term compounding rate) / (Worst drawdown over assessment period)

Once you commit to the Calmar Ratio, with good execution your results will start to show:

- Significantly lower risk

- Higher long-term returns

This is simply a mathematical consequence that all the most successful long-term investors understand. This is completely antithetical to conventional financial wisdom.

You can do this yourself. Or you can arrange a call to see the results I am happy to show you in a fully compliant one on one setting.