Over the last 5 years total commercial bank loans and leases have been essentially unchanged. This means that virtually every incremental dollar of US “GDP growth” has come solely courtesy of Ben Bernanke’s narrow money spigot. Banks do not feel the need to lend as they get deposits from the Fed and can find other uses, but the Fed needs to continue to print as it has become the main (only?) source of “GDP growth”. However, the more they print the less the banks feel the need to lend. So when will the Fed stop printing?

Article 121

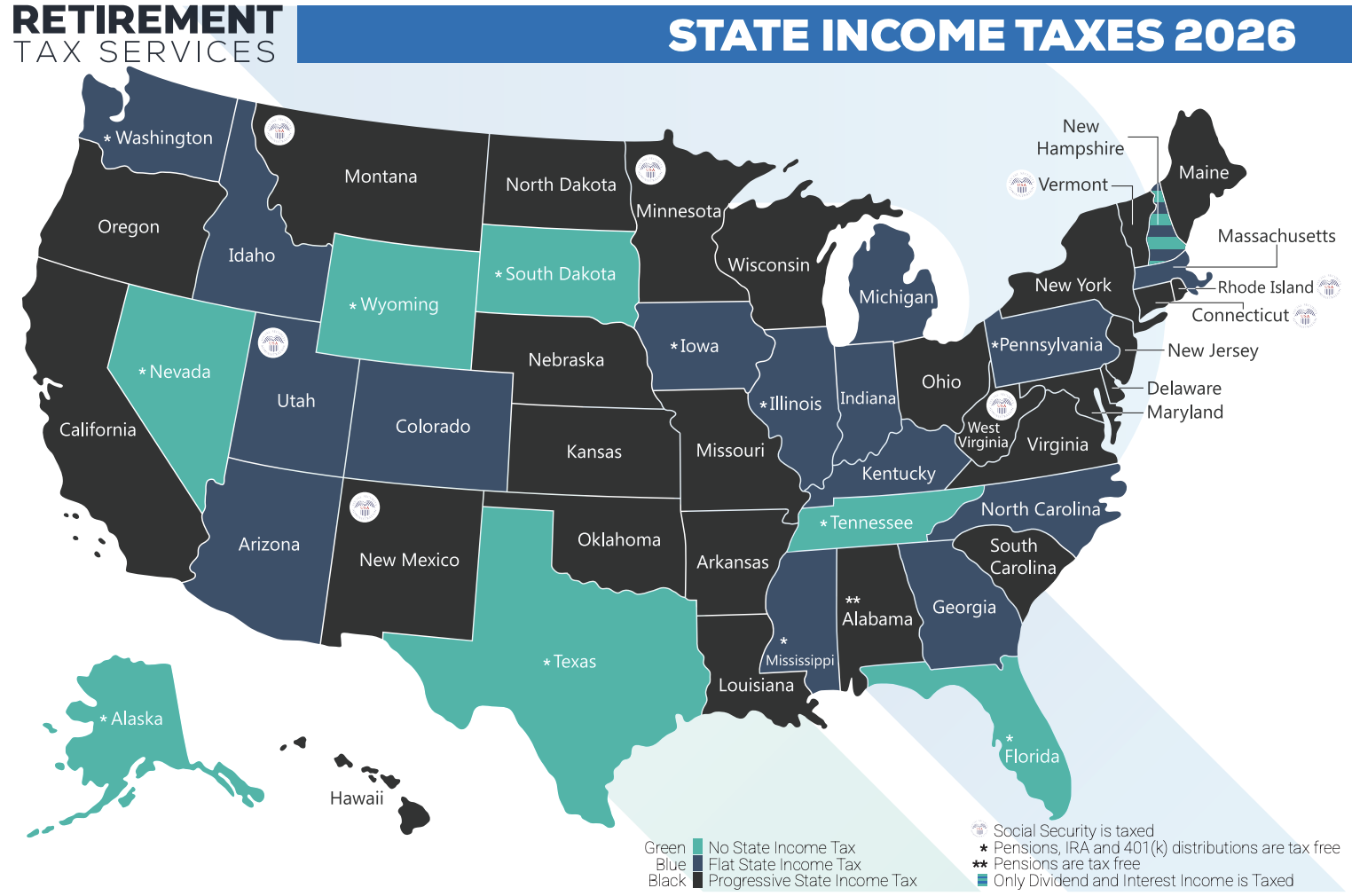

Coordinated Tax Planning Is A Game Changer

Filing a tax return is required. By itself, however, filing rarely produces the best financial outcome. The real leverage comes from planning, especially when that planning is coordinated across the