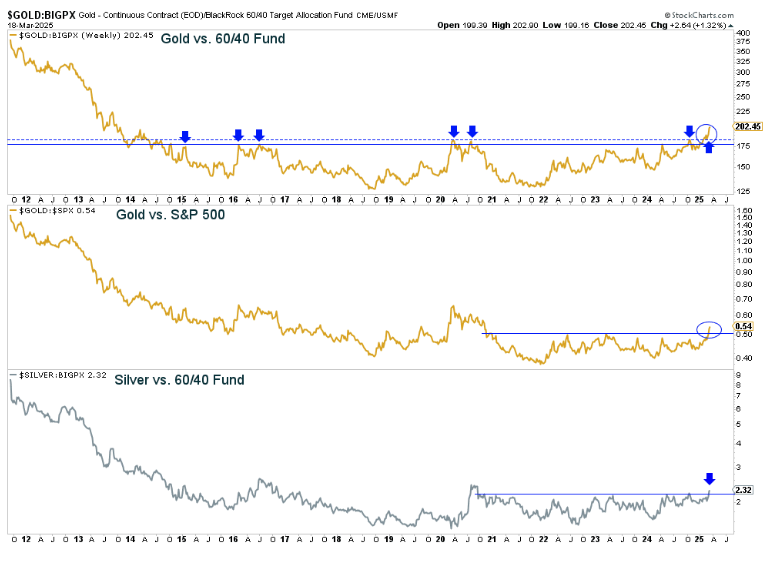

Allocators are ignoring a 3-year trend! And a 10 year Breakout!

Gold is breaking out against all conventional allocations!

Significant breakdown in the S&P 500 versus Gold.

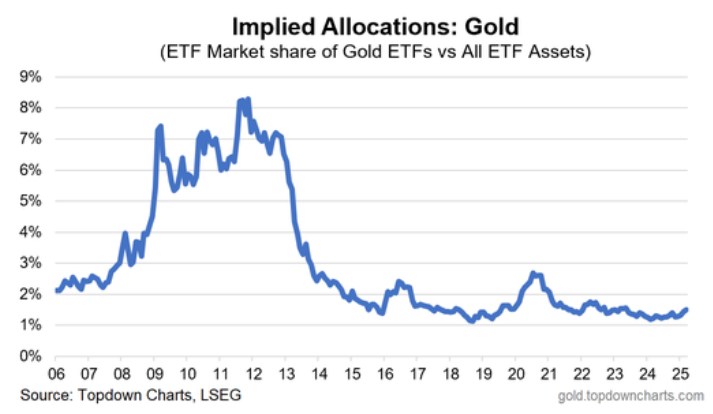

The market reflects a 1% allocation to gold!

Why isn’t this a chronic misallocation to gold?

The Federal Reserve Just Downgraded The Economy Towards Stagflation

Stagflation also favors Gold.

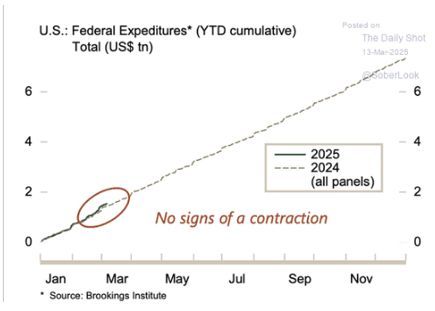

Meanwhile, for all the noise, the real progress on government spending is nowhere to be seen. There are still no signs of a slowdown in total expenditures despite some shifts in composition (away from USAID, toward FEMA, etc)

Trump’s deficit reduction credibility takes a hit

Here we go again. Congressman Massie refuses to support reckless government spending and increased debt. President Trump comes out to criticize Massie and says he should be primaried. Many will remember that we’ve been down this road before with the trillions in healthcare spending (and subsequent inflation). Massie vehemently opposed the Healthcare spending, was criticized by President Trump, and was primaried. Massie was right and won the primary election. It’s not a good look for President Trump to do this again.

Credibility is increasingly on the line for the whole monetary system

In his latest interview, Alasdair Macleod warns that central banks are technically insolvent with negative equity positions, particularly the Bank of Japan which is “40,000 times underwater.” He explains that the bursting credit bubble, combined with protectionist trade policies reminiscent of the 1929-1932 period, could lead to massive financial destruction as the Federal Reserve’s attempts to rescue the system by printing money will only accelerate the dollar’s collapse.

This is a crucial time to understand the full dynamics in play. It is also essential to fully adopt “Best Investor Standards”. Conditions have become so unstable that only excellent risk management can provide both the necessary protection as well as the ability to take advantage of opportunities as they arise.