Reality Check. Highly Managed Global Economy. Where do you fit in?

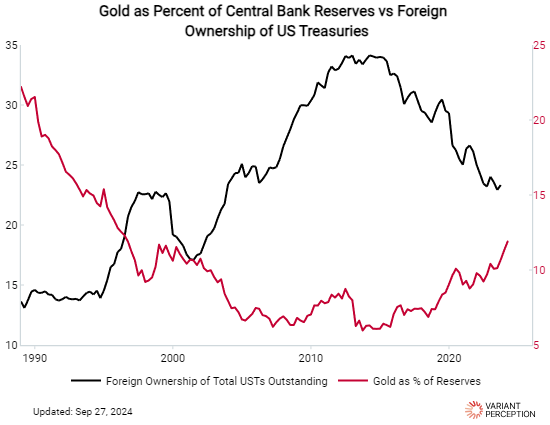

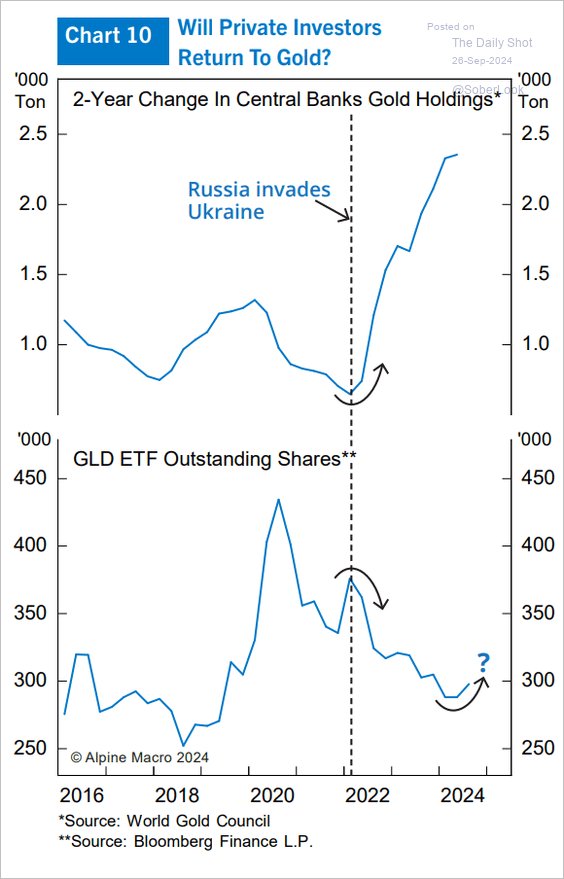

Global central banks are accelerating their downgrade of US dollars and Treasuries relative to gold. Meanwhile, the private sector is reducing their low allocation to gold even as it goes to all-time highs!

Global policy makers are clearly much more troubled by US economic policy than the private sector, which is responding to another burst of liquidity. Policy action in both the US and China is fully set against the risk of deflation and weak growth.

Following the Fed’s emergency interest rate cut, when there was no emergency, the dollar has fallen significantly against the Chinese currency.

The appreciation of the Yuan is very unwelcome to Chinese policy makers so this contributed to China taking significant action this week.

Global central banks keep doubling down on failing policy. The ever more managed economy forces yet another attempt to boost growth with even more debt when there is already too much debt.

Bob Elliott summarizes what I have been saying for some time. US advisors do not seem to understand that more debt on top of too much debt with lower interest rates and extra liquidity just drives gold higher.

Meanwhile, excessive policy flows drive all asset prices higher even as economic values collapse.

It all makes sense when you understand the dysfunction of economic policy and its results.

Policy keeps failing spectacularly in economic data terms

As the stock market makes new highs consumer confidence collapses

Thanks to a plunge in ‘Present Situation’, The Conference Board’s Consumer Confidence index tumbled back near the lows of the last three years.

- Present situation confidence fell to 124.3 vs. 134.6 last month

- Consumer confidence expectations fell to 81.7 vs. 86.3 last month

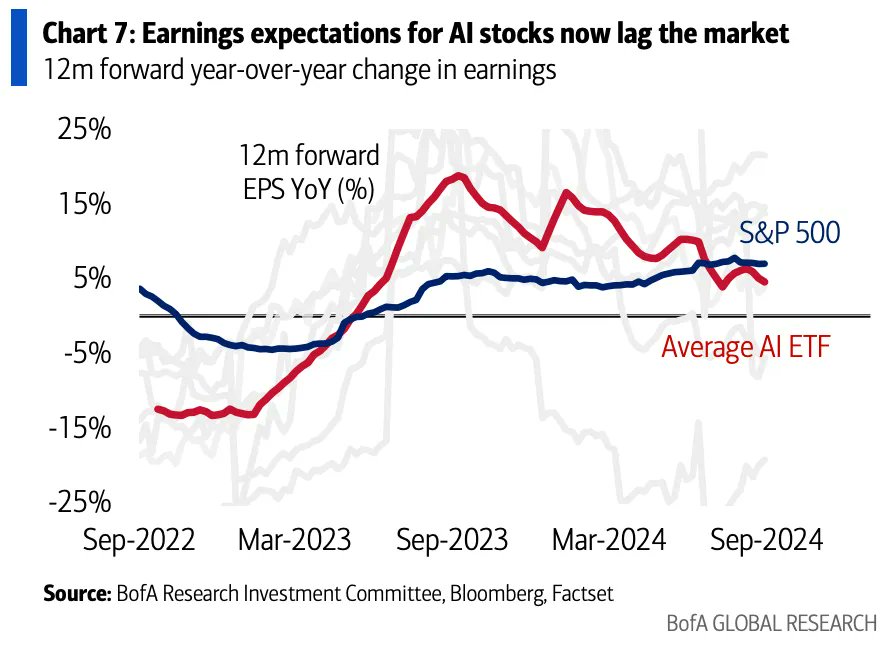

The great hope for growth from AI stocks has finally come to ground, and is even below growth expectation for the broader S&P 500.

This makes investing and trading unprecedented. Market prices respond to financial flows from the excessive stimulus, but the economic data keeps failing. This leads to record divergence between economic value and asset prices.

This dysfunction is unprecedented requiring careful asset management. Lifetime legendary trader Greg Weldon tries to make sense of extraordinary price action of the markets relative to the data. Investors need to understand the dysfunctional relationship between markets and policy and the ever growing long term danger to stock and bond prices, you may be misallocating your portfolio on a grand scale.

Economic Historians have mostly seen it all before and provide remarkably useful information and applicable insight on the current economic predicament.

Don’t miss the brilliant Russell Napier’s lecture on 21 Lessons from financial history. This does a wonderful job of putting the current unusual situation in context and has valuable advice for everyone, not least our current policy makers.

Summary. Where do you fit in?

It is important that it is understood that while asset prices have made many investors feel wealthy. Asset prices in general are higher than ever in history and detached from income and earnings levels, so there is very little security from value. Furthermore, long term growth has been declining for decades and debt is at record highs. This is not a stable or sustainable situation.

Daniel Lacalle: The Economic Risks America & The World Can’t Ignore:

Policy keeps doubling down so we can’t expect anything other than a slow ongoing deterioration.

The private sector is in a recession, but government spending keeps the overall economy out of recession. Wages have not kept up with inflation, so the majority are struggling to keep up with living expenses. Without any benefit from government spending or asset inflation these are challenging conditions.

Investing has become more complicated and challenging as described above, however, there is always opportunity.

The shift to real assets has begun. There is a solution and the prospect of substantial gains despite the flawed policy dogma. Make sure your portfolio is allocated differently from consensus and in real assets and make sure you are managing your account to ensure compounding.