Most families don’t want strangers to make personal decisions for them, but that’s exactly what happens when we put off estate planning.

According to the 2025 Wills and Estate Planning Study provided by Caring.com, 55% of Americans have no trust or will.

This creates a scenario where NOT you, but the state decides:

- Who gets what

- When they get it

- Who speaks for you when you can’t speak for yourself

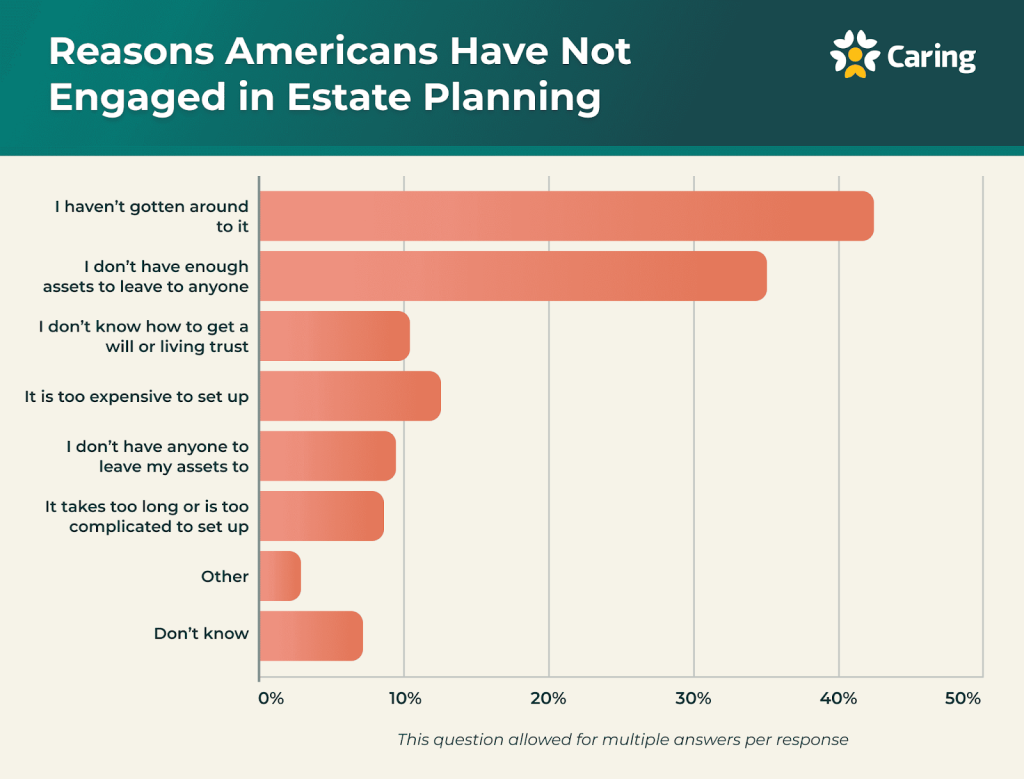

Why do so many people delay? Estate planning often feels uncomfortable, complicated, and expensive.

Life keeps moving: families grow and change, assets shift, and tax rules evolve. Tragically, the people who need it most, the caretaker cohort aged 35 to 54, are the largest group without estate documents.

Without a plan, even simple estates can lead to unnecessary costs, delays, or disputes at the worst possible time.

At 43%, many understand the importance but “haven’t gotten around to it.”

The good news: creating a clear, modern estate plan doesn’t have to be hard or expensive. With the right guidance:

- You can protect the people you love

- You can make your wishes unmistakably clear

- You can gain real peace of mind

- And it often takes less time than you think

Why Estate Planning Matters

Estate planning isn’t just about documents. It’s about protecting the people and priorities that matter most. A well-prepared estate plan answers critical questions before they ever become a crisis:

- Who will care for your children if something happens to you?

- Who will have the authority to make healthcare decisions on your behalf?

- How will your assets be passed smoothly and efficiently to the right people?

- What steps can reduce the taxes, costs, and delays your family might otherwise face?

Without these answers in writing, loved ones are left to guess (or worse, to fight) at a time when clarity and peace are needed most.

Without that groundwork, even simple estates can create stress and conflict.

An estate plan also ensures your wishes are honored, from medical care choices to charitable giving. It brings order to what could otherwise become confusion, protects your family from unnecessary burdens, and provides confidence that your legacy will be carried out the way you intend.

Ultimately, estate planning is less about death and more about life: making thoughtful decisions today so the people you love are protected tomorrow.

Barriers to Action

If estate planning is so important, why do so many people put it off? The reasons are familiar:

- It feels uncomfortable to think about death and “what if” scenarios.

- The process seems complicated and full of legal jargon.

- Traditional planning can take weeks of back-and-forth with attorneys.

- Costs can be unpredictable and often run into the thousands of dollars.

For many families, these barriers create a cycle of procrastination. People know they need a plan, but they delay until “later,” and later often becomes too late.

The good news is that estate planning doesn’t have to be overwhelming anymore. Advances in technology, combined with attorney oversight and clear guidance, have made it possible to create professional-quality estate plans in a simpler, more affordable way.

Easy Win with Estate Guru

That’s why we’ve partnered with Estate Guru to make estate planning both simple and affordable. Their platform combines clear step-by-step guidance with attorney approval, so you can complete your estate plan with confidence.

Here’s what makes this approach different:

- Attorney-approved: Every plan is reviewed to ensure it meets legal standards.

- Guided process: You’re walked through each decision so nothing is overlooked.

- Affordable: Pricing is transparent and competitive, often a fraction of traditional attorney costs.

- Extras included: A financial power of attorney, healthcare power of attorney, and first-year amendments are provided at no extra charge.

You can complete the process in my office or through a secure web meeting, whichever is easier for you.

The Goal: you walk away with a comprehensive estate plan designed to protect your loved ones and give you peace of mind.

Estate Planning ⇒ Wealth Management

An estate plan is most effective when coordinated with ALL your financial services. Wills and trusts don’t exist in a vacuum. They need to align with your retirement goals, tax planning, investments, and insurance coverage.

Too often, people create conflicting documents:

- Beneficiaries aren’t updated

- Tax implications aren’t considered

- There is confusion instead of clarity

By extending my practice to include estate planning, I can help ensure that your documents are not only legally sound, but also aligned with the rest of your wealth management plan.

CBIM coordinates all aspects of your financial services to ensure best practice financial integration.

An estate plan shouldn’t just exist, it should fit. When it does, it becomes a cornerstone of comprehensive wealth management, giving you and your family lasting confidence.

Getting Started? Let’s Talk!

The most important step in estate planning is the first one: getting started.

You don’t have to navigate it alone, and you don’t need to let cost or complexity hold you back.

With the right guidance, you can create a plan that protects your family, honors your wishes, and gives you lasting peace of mind.

I’d love to help you take that first step.

Let’s talk through your current situation, answer your questions, and map out a clear path forward. Whether we meet in person or online, my goal is to make this process simple, approachable, and tailored to your needs.

Don’t leave your most important decisions to chance, or to the state.

I look forward to seeing you soon.

Cheers, Chris.