Treat the obvious financial crisis as an opportunity and a call to action.

Nothing stops this train is the new refrain when it comes to the budget.

Maxifi, the ultimate financial planning software, has been updated for the new budget plan. How much tax will you be paying on inflation?

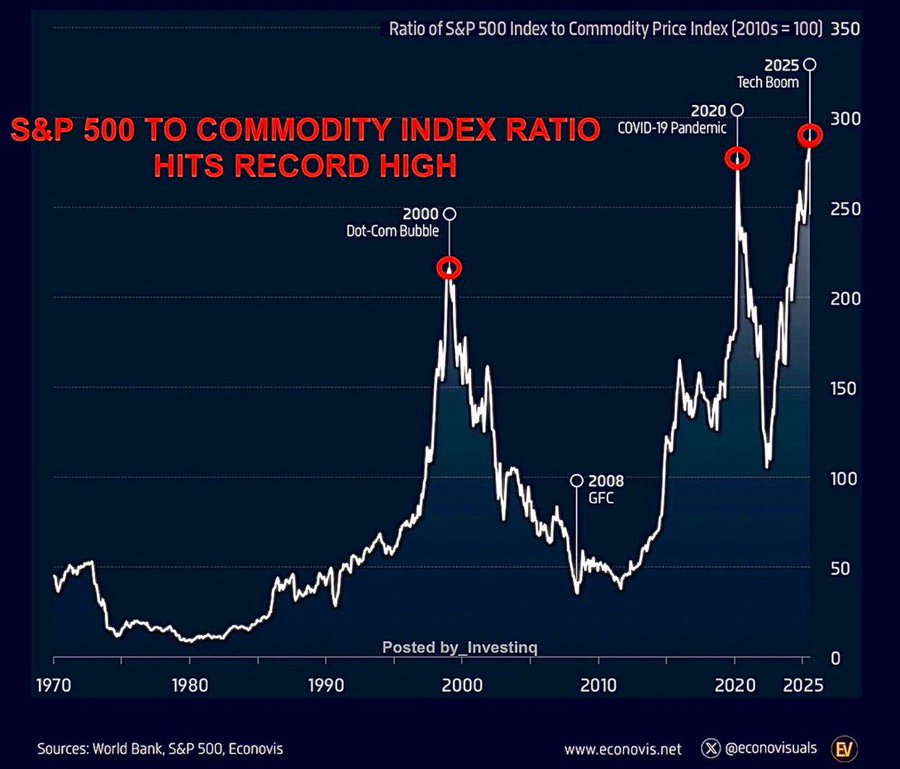

Dollar financial assets and credit are reaching limits never seen before especially against real assets. Don’t miss the turn.

———–

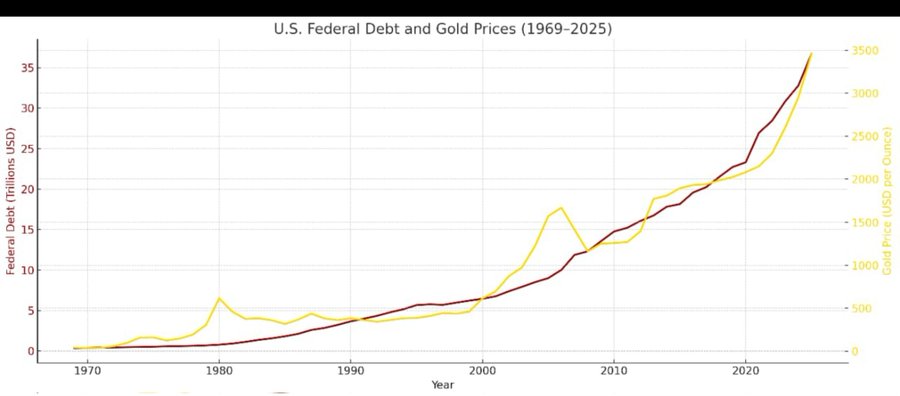

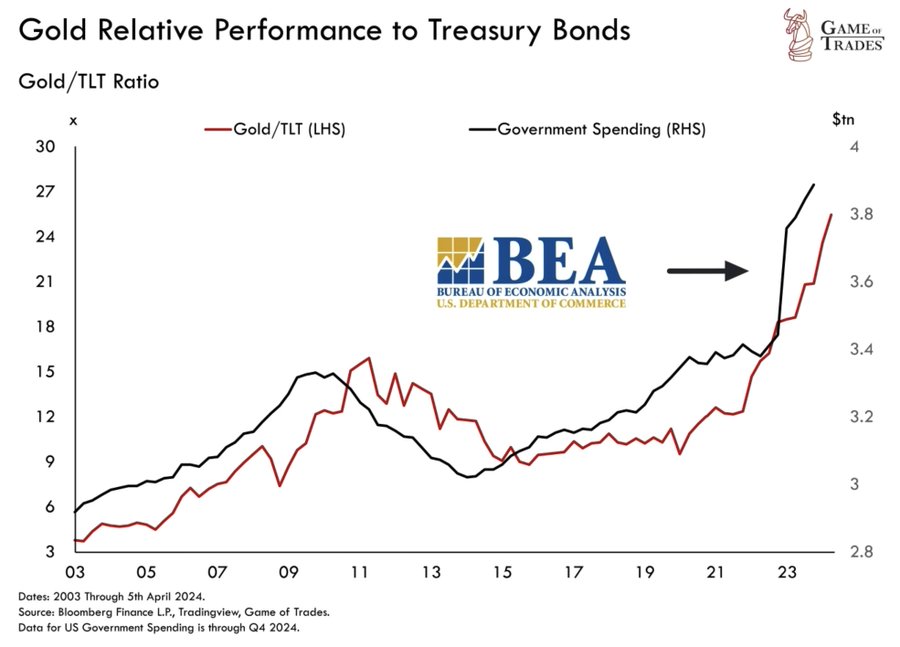

US Federal Debt & Gold are both up around 9300% since 1971. A 97% correlation.

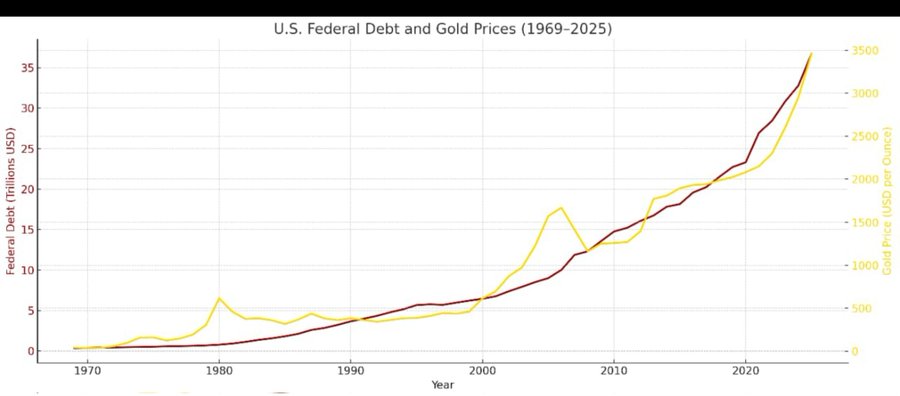

But gold isn’t really going up. Gold doesn’t do anything. It just reflects the collapse of the US dollar, down 92% since 2000 and now accelerating.

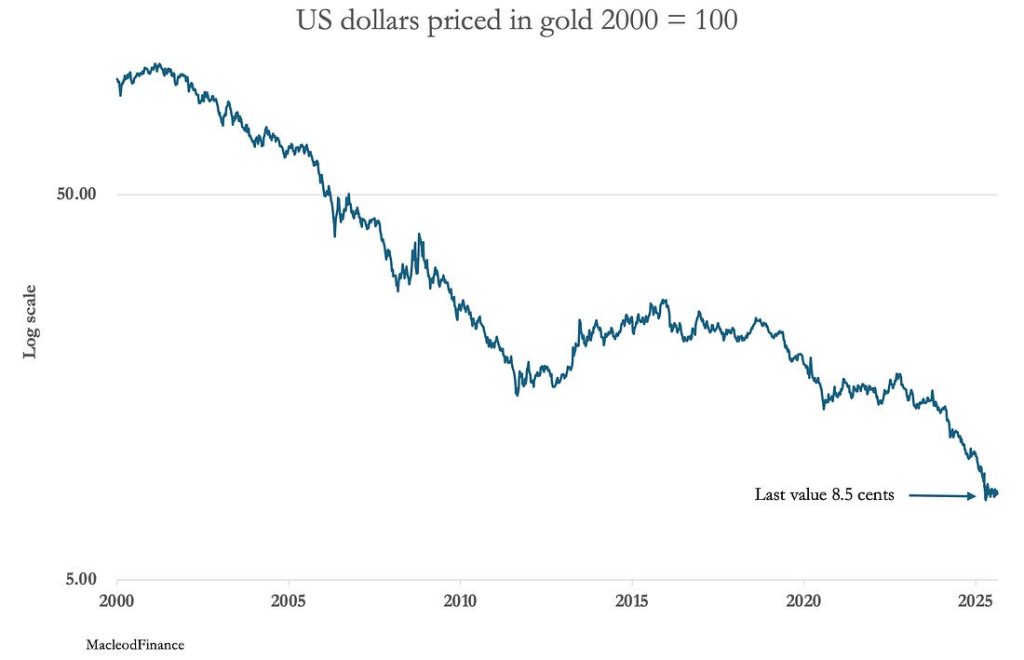

That was the best chance for addressing the deficit for the next 4 year election cycle. Gold and Treasuries have responded predictably.

Since March 2020, gold has outperformed Treasury bonds by 170% amid surging government spending with government expenditures rising from $3.4 trillion to nearly $4 trillion in just 2 years

Not just fiscal policy is out of control, monetary policy is too

To make matters worse the Federal Reserve has lost any remaining inflation credibility with Powell’s Jackson Hole speech giving the green light on interest rate cuts.

Someone needs to tell the FOMC that the “commitment” to a 2% inflation mandate lacks any credibility when inflation has been above it for 52 months and the Fed signals rate cuts as inflation rises and the economy is at near full employment.

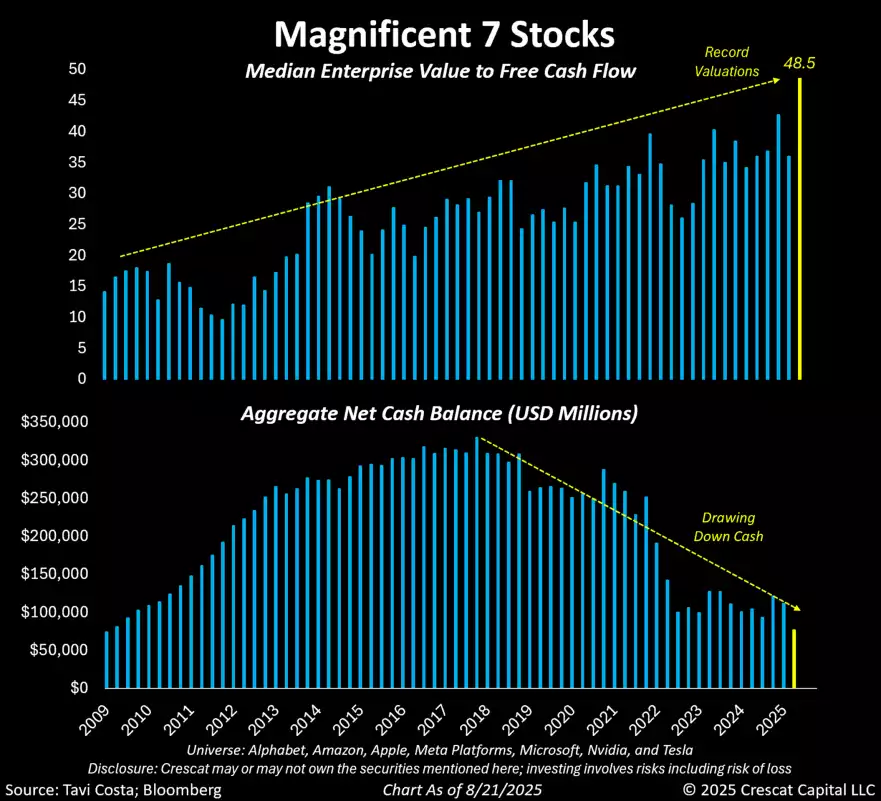

Even so investors seem to ignore gold in favor of stocks even as we break to record stock valuations on dwindling cash balances and gold has been outperforming the S&P 500 for 4 years!

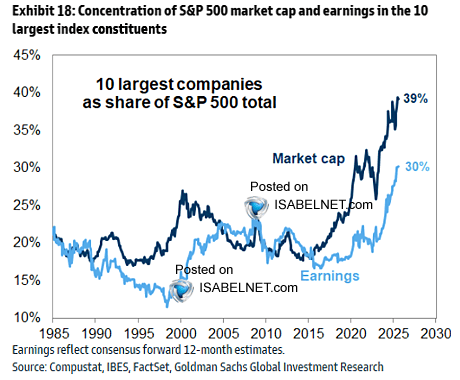

The S&P 500 becomes ever more absurd as a reasonable benchmark.

The S&P 500’s heavy weighting toward its top ten stocks, which exceeds their earnings share, exposes the index to greater risks from volatility, limited diversification, and sector imbalances

The pressing question is how long current valuations can be sustained as balance sheets deteriorate. The median Magnificent 7 stock is already trading near 50 times annual free cash flow, the highest multiple in history, even as cash balances deteriorate to the worst levels in 15 years.

The key medium term question for investors is when real assets start to outperform credit and financial assets once more. Gold has already turned.

Dollar financial assets and credit are reaching limits never seen before especially against real assets. Don’t miss the turn.

Will you be paying tax on inflation when it breaks out? The only way you can be sure is to have a credible financial and tax plan.

MaxiFi Is Fully Updated to the New Tax Law Get The New conclusions in the link below.

The elder generation experiences a mild improvement, however, it is anyone’s guess what will happen more than 5 years out. The younger generation faces an impossible burden.

Summary

Start realizing that gold is returning as the cornerstone of finance, so measure your wealth in gold. Look again at the charts above if you don’t understand why.

This is an opportunity and a call to action. It is clearly vital to make good decisions.

Get an accurate and assumption free investment and financial plan. It has never been more crucial.

Set up a call with Chris to get started.