Conventional Asset Management Crisis Will Spread From Bonds As The US Dollar Weakens In 2025.

CLOX Changes The Game For Both Savings Accounts And Asset Management

Conventional Asset Management Crisis Will Spread From Bonds

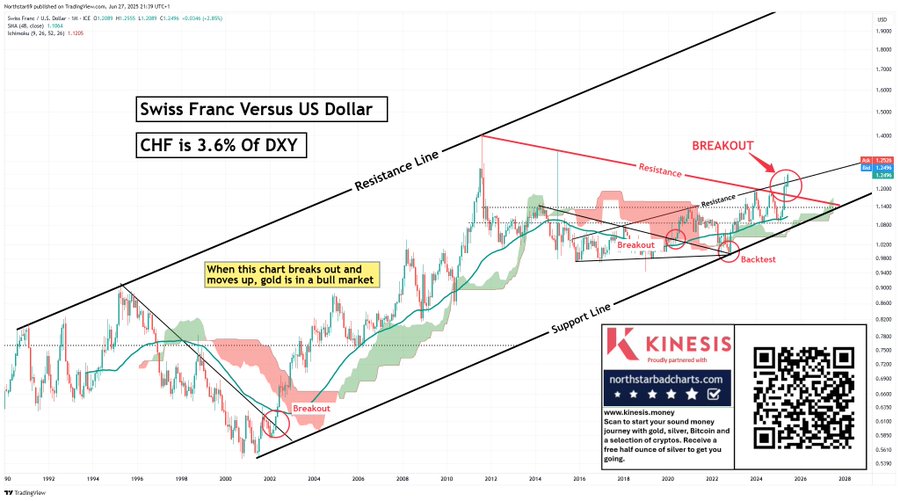

Conventional asset management has completely missed performance benchmarks on both gold and bonds for several years. Now the dollar is breaking down relative to the Swiss Franc the new emerging trends will likely accelerate.

While the S&P 500 continues to makes new highs, it is the US dollar weakness which is the more important development. The long term read from gold and bonds should be considered a warning for equities too in the longer term. US equities now have the worst 12 year return expectations in history, and are already in a long term bear market relative to gold.

Furthermore, new asset instruments are changing the asset management game.

CLOX Changes The Game For Both Savings Accounts And Asset Management, see below.

——————————–

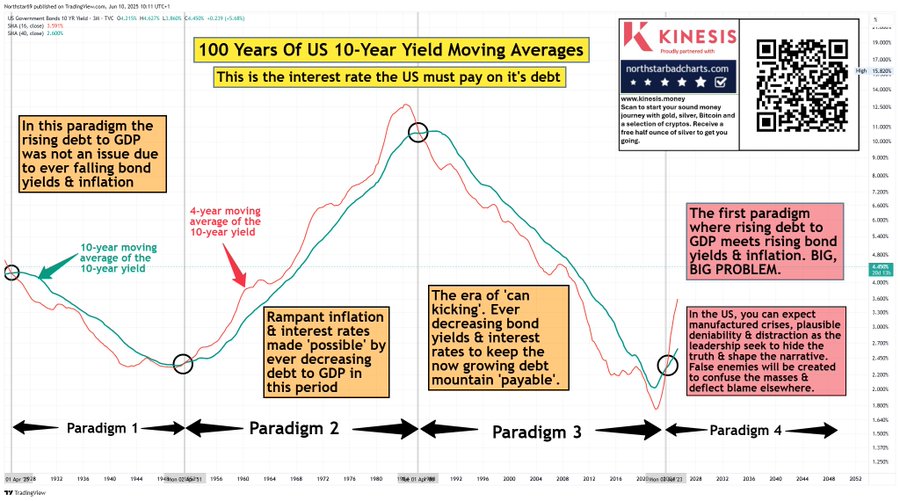

The long term bond chart above shows the major shift in the bond market’s multidecade trend.

Professional Asset managers generally have a poor track record and bonds are no exception.

So you must check the track record before you invest. I am happy to share mine, which may also be clear from my time stamped blogs.

Over the past 10 years, 98% of active managers in Treasury fixed income funds have underperformed their benchmark. For active managers in public investment grade credit, the share is 82%, and for active managers in public high yield, the share is 79%. In fact, the data below from S&P shows that over the past decade, active managers in public fixed income have underperformed their benchmarks across all strategies, see chart in the link above.

Investors continue missing the bond market moves. As shown above the long term moving averages have clearly crossed and generally keep their trend for a couple of decades.

Target dated funds are badly offside on their bond allocation which has little prospect of earning much if any return. Investors need to think carefully about whether bonds will continue to reward the massive allocations that have built up.

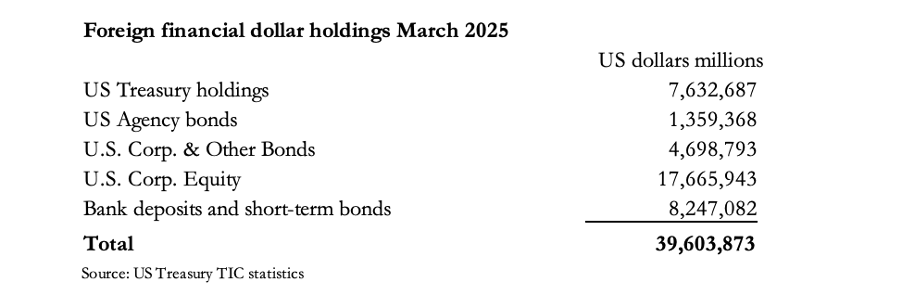

The accumulation of investment in US dollar debt has been remarkable. Their behavior and safety element may well have changed.

The US’s debt pile would not have grown this much if it wasn’t for the enduring belief that US Treasury debt is the most secure form of credit in the post-Bretton Woods currency system. The conviction that it would always be demanded even in a crisis has encouraged US government profligacy. Consequently, foreign ownership of US dollars and dollar-denominated assets has increased to staggering levels. The table below breaks down where this $39.6 trillion is allocated.

Foreigner investment can leave quickly as the outlook for either bonds or the dollar changes.

The challenge for bonds is now considerable and their

behavior in a recession may be different in paradigm 4, shown in the chart.

In view of the debt trap, Americans will find that despite a recession or even a slump, bond yields will have to rise for the debt to be funded. The higher they rise, the worse the debt trap becomes. It is an outlook diametrically opposed to that expected by investors. And when foreigners really do wake up to it and the consequences for the dollar, they are sure to sell down their $17.665 trillion in US equities, along with their other dollar exposures.

This truly is the signal being sent by the gold/dollar exchange rate.

Alasdair Macleod

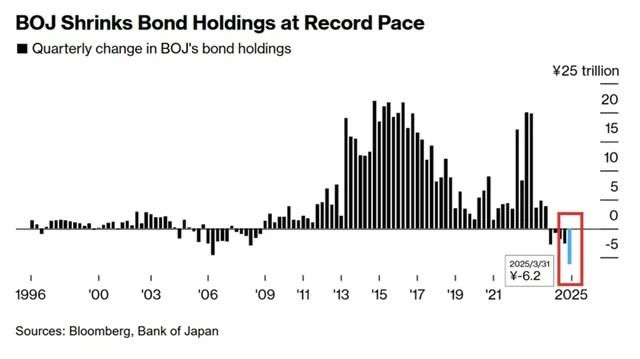

The Bank Of Japan just started selling at scale.

And here’s the deeper concern: if even Japan, the last bastion of infinite balance sheet patience, is stepping away from the bond market… who becomes the buyer of last resort when U.S., European, and emerging market deficits are all surging simultaneously?

The bond yield curve is already signaling recession risks. Long maturity bonds may not get as much relief as in previous slow downs.

If you missed the gold and bond markets you will likely miss the equity market. Most investors still think we are in a “bull market”, just because the S&P500 is at all-time highs. They are missing the obvious developments in gold.

The S&P 500 is already in a bear market relative to gold.

The capital rotation event, where gold outperforms gold over a decade or so, looks to be underway as we have discussed.

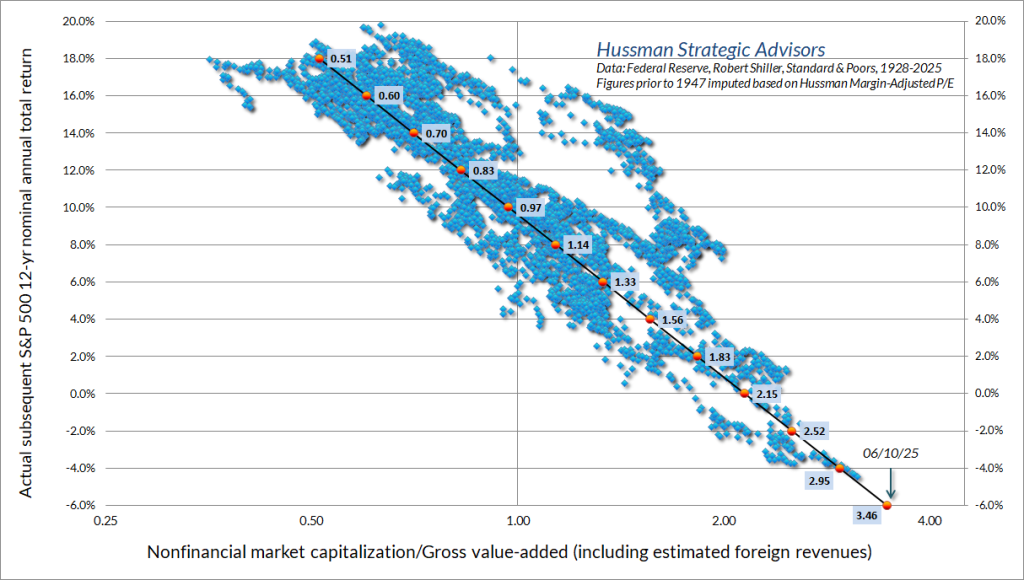

Investors should be aware that historically the stock market has never been this expensive, indicating 12 year returns of around MINUS 6% p.a.

CLOX Changes The Game For Savings Accounts And Asset Management In a bond bear market cash is an allocation.

There is nothing more important in investing than the core low risk interest rate for investing. Adding any risk at all requires considering what extra return you might get relative to low risk investments. It is a key value for all your investing and in particular for your savings accounts.

Collateralized Loan Obligations CLOX has a higher credit rating than Treasuries Bills and ALSO a higher yield!

CLOX is an ETF that gives access to a new contender for investors savings.

CLOs Demystified with Danielle Gilbert, Eldridge Capital Management

There are a range of products along these lines that investors and savers can clearly benefit from. Make sure you get the appropriate trading and Investing advice on the range of low risk high return products. What used to be your bond allocation most likely should be reallocated to gold and high income low risk assets.

In times when the bond market is in a long term downtrend and low risk vehicles with higher credit risk and safety than Treasuries this is an ideal time to review both your savings accounts as well as your investments.

Consider setting up an Ultimate Savings Account.

For more information about how to do this book a call.