Allocation Resets. New Era Globalization And Long Term Inflation Risks.

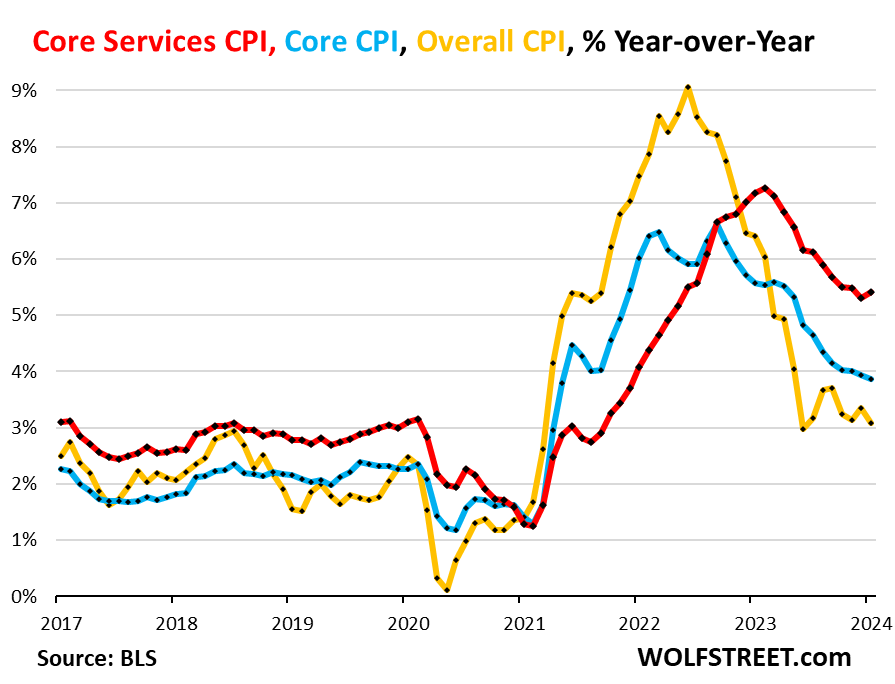

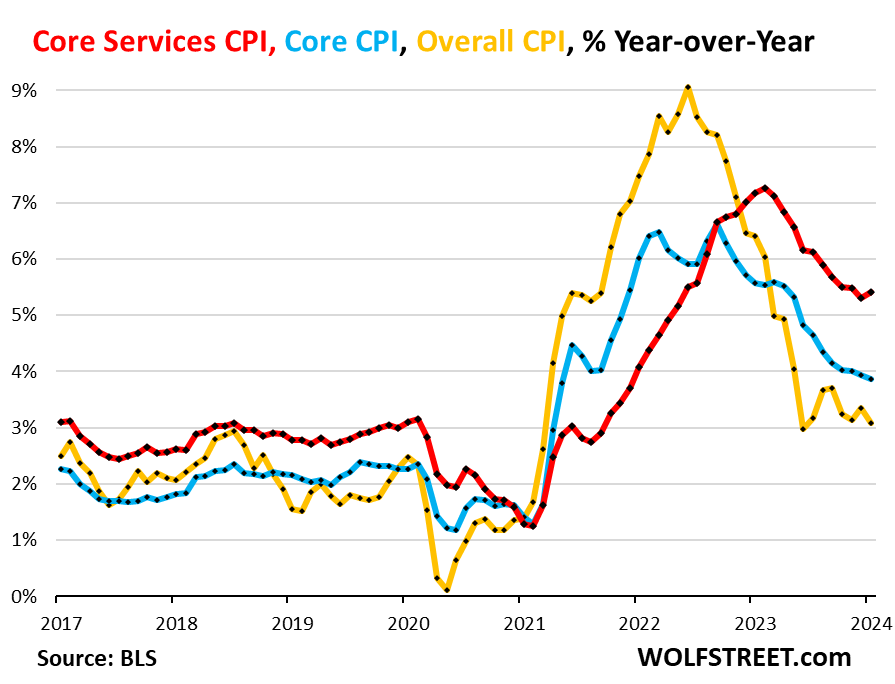

Inflation does not seem to be likely to sustainably reach the 2% target. At the same time there are new factor in relative value, and a new kind of globalization

Best practices are meant to be shared. That’s why we observe the market and then share our insights on what’s happening, to give you context. We’ve organized every blog into categories, so it’s easier for you to find the answers that matter most to you.

Inflation does not seem to be likely to sustainably reach the 2% target. At the same time there are new factor in relative value, and a new kind of globalization

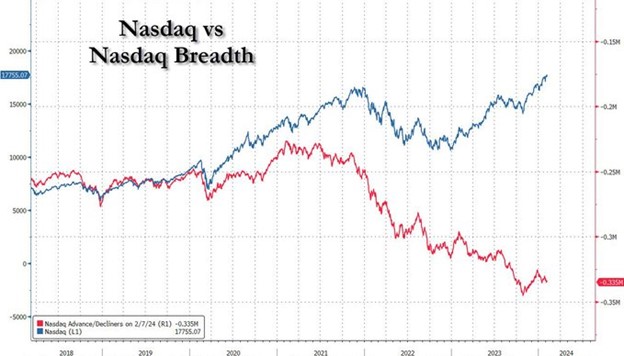

The current rally has created record divergence in performance of stocks. Massive liquidity flows, yet very weak earnings overall.

1. Growth Investor? Or Liquidity Speculator? The chart above was produced by one of the world’s biggest hedge funds, Bridgewater. It shows that Growth as an investment factor in equities

1. Inflation is still trending higher. Inventory to sales reflects supply to demand. The everything shortage and price hikes mechanism is in full flow. This should be characterized as trending

Weekly Investment Insight 08302021 Focus Five 1. “Narrow money supply is going off the scales. Yet at Jackson Hole it was never mentioned, except in a footnote. Equally incredible

The 5 most impactful comments. 1. The US has the easiest financial conditions ever and is far behind the rest of the world in starting to reverse policy. https://twitter.com/LizAnnSonders/status/1431209487810060290 In

1. Are you a Dunning-Kruger? How good do you think you are? 2. Central Banks cannot really taper with this slowdown. 3. The Dollar’s Debt Trap. 4. When the

1. The folly of ruling out a collapse. The valuation metric that most closely inversely correlates with poor future long term returns is unequivocal. 2. “Scramble for survival” for the next

Invest Like The Best reveals the proven strategies of the world’s top investors, showing you how to achieve higher returns with lower risk through disciplined, data-driven decision-making. If you’re ready to break free from conventional, flawed financial advice and take control of your wealth with transparent, repeatable best practices, this book is your roadmap to smarter investing.