Alpha Financial And Retirement Planning

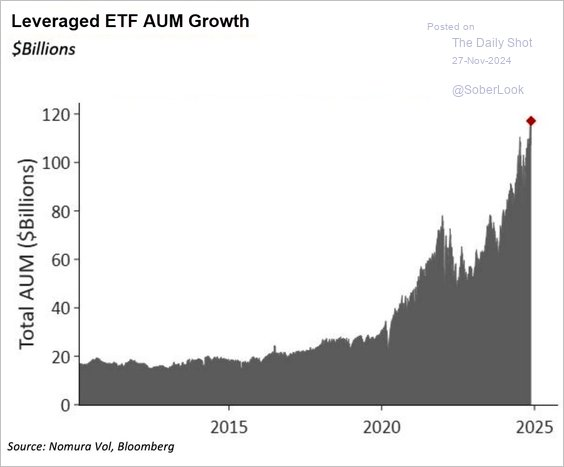

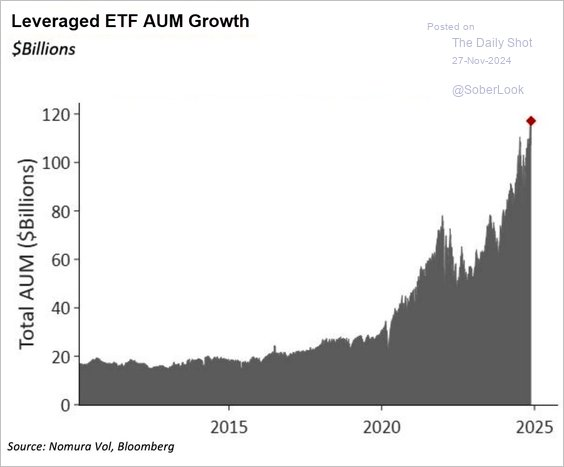

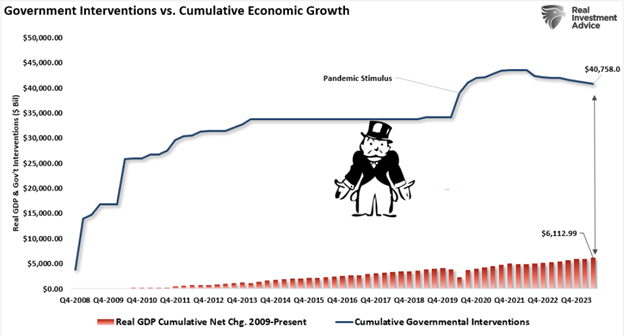

The disassociation between US equity market behavior and earnings is unprecedented. There is no history of declining GAAP earnings with the biggest and most leveraged equity bull market in history.

Best practices are meant to be shared. That’s why we observe the market and then share our insights on what’s happening, to give you context. We’ve organized every blog into categories, so it’s easier for you to find the answers that matter most to you.

The disassociation between US equity market behavior and earnings is unprecedented. There is no history of declining GAAP earnings with the biggest and most leveraged equity bull market in history.

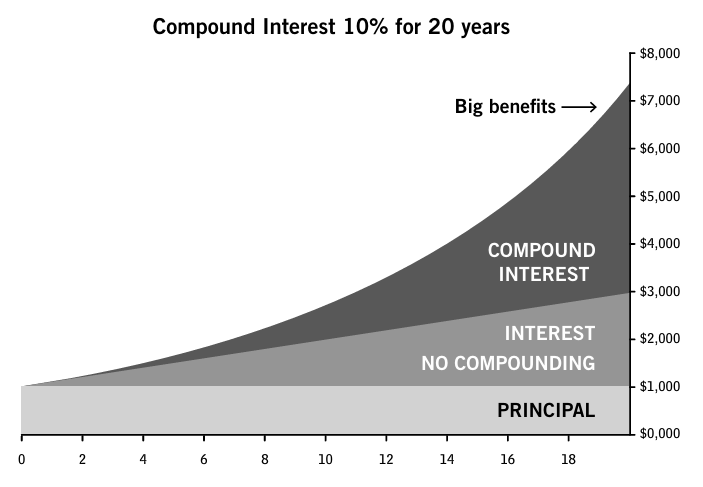

Surprisingly, few investors understand how to optimally assess their performance or align their investment practice and objectives appropriately to the most optimal investment approach, which is compounding.

Whether your

The S&P 500 is trying to go vertical at valuations never seen before. Just as junk bond spreads to government bonds have gone to the lowest historical extremes only seen

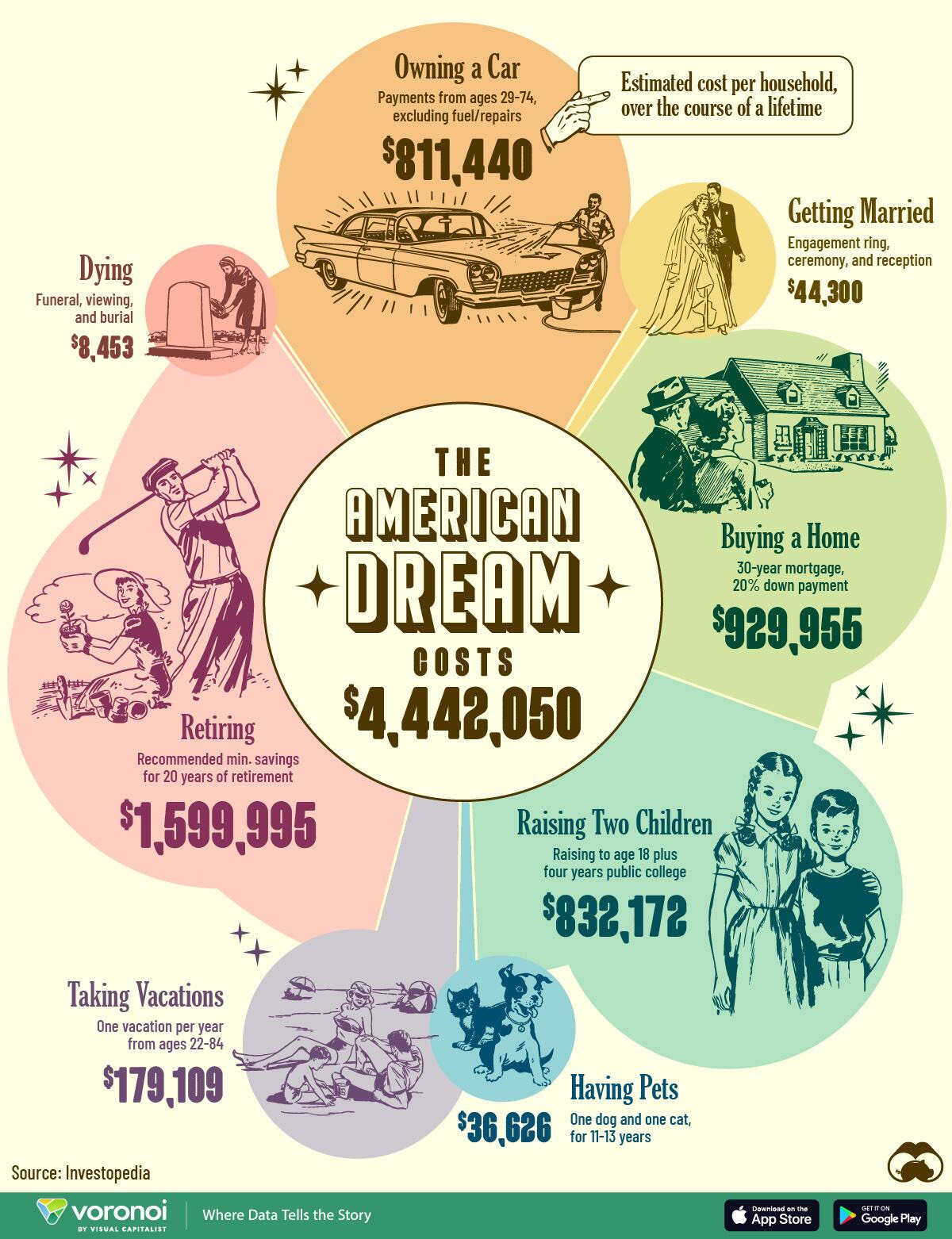

For most retirees “The American Dream” has become unaffordable.

With policy distorting markets and becoming increasingly unstable managing investment risk, while optimizing a retirement and tax plan requires the

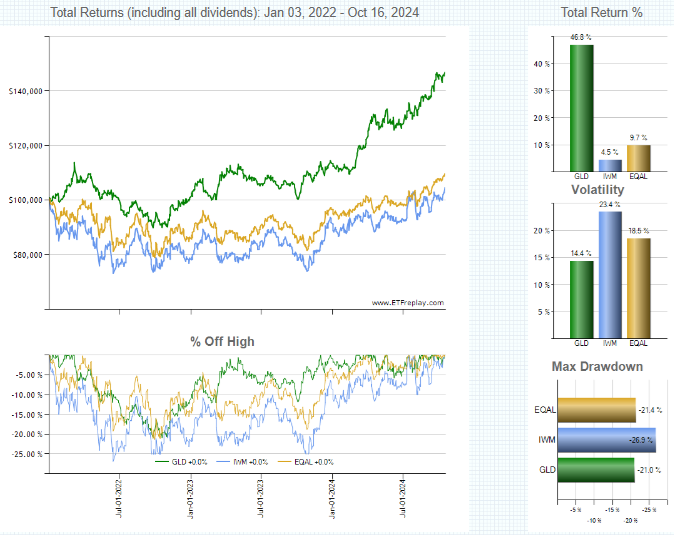

The Chart above shows that the equal weighted top 1000 US companies has an almost identical performance as the Russell 2000, the next 2000 biggest US companies. On average these

Launching CCB Tax Pros has evolved by extending my service from Investment Management, to Financial Planning, to becoming an IRMAA certified planner, to the next logical extension which is tax returns and

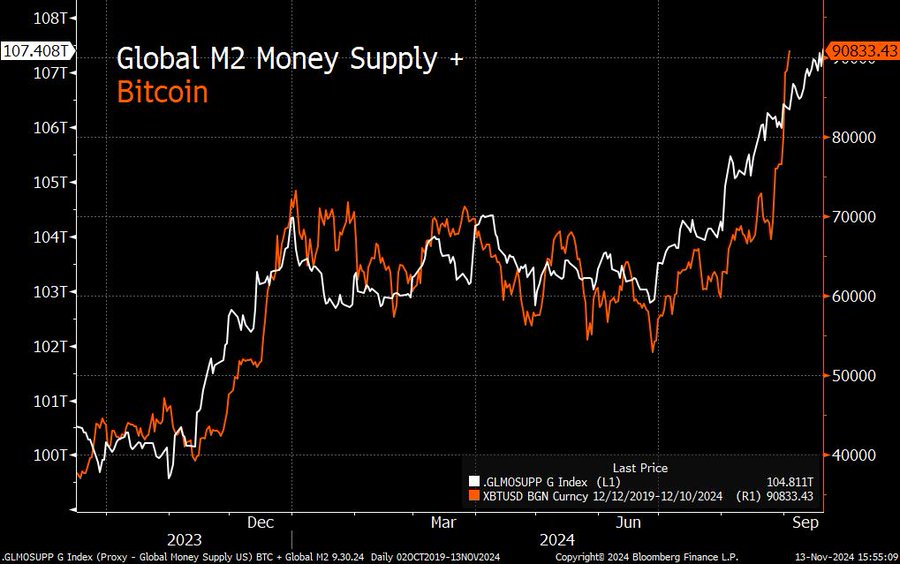

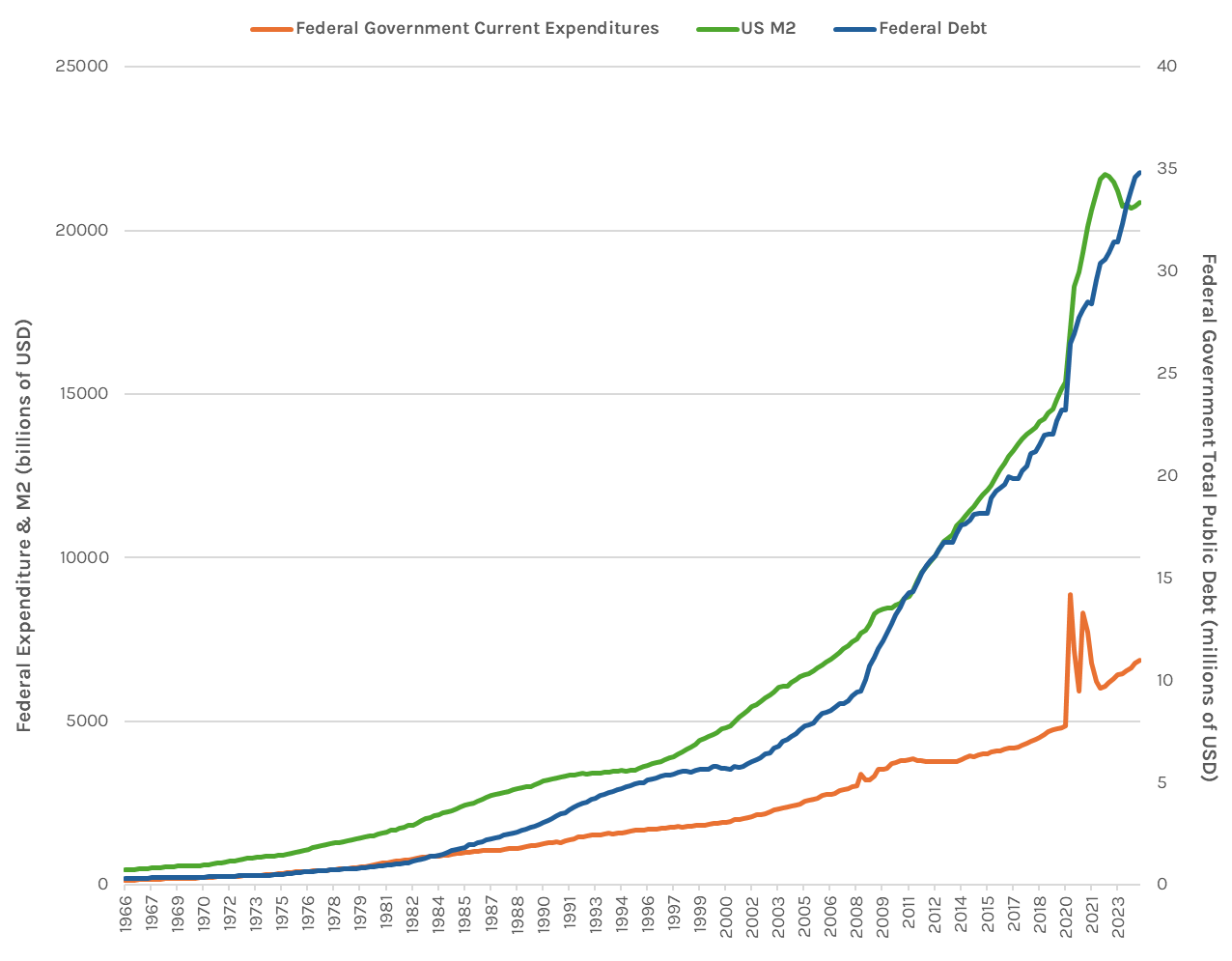

The debt bubble is driven by the those that benefit and will be bailed out or escape the consequences. It is down to you to protect yourself from this complicated

It is important that it is understood that while asset prices have made many investors feel wealthy. Asset prices in general are higher than ever in history and detached from

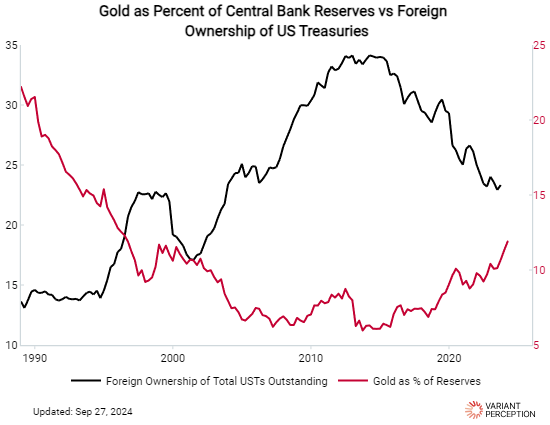

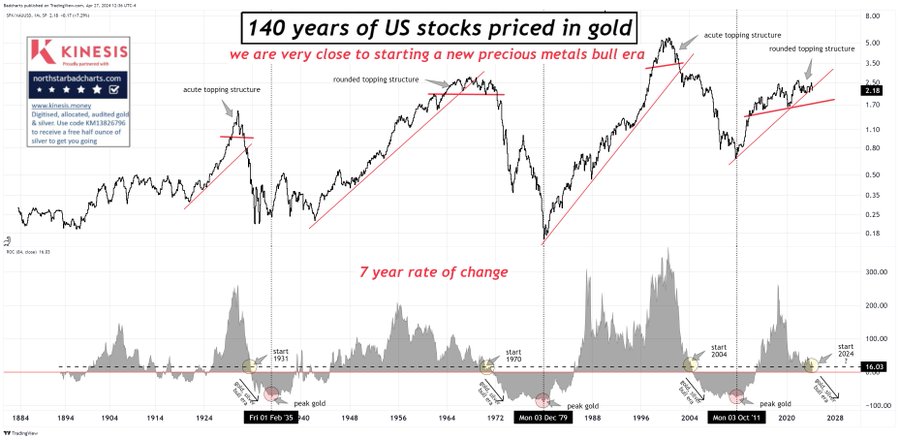

US investors have generally failed to understand the appropriate allocation of gold in their own portfolios. This could be a major problem going forward.

Turn the transition into an opportunity, learn how to avoid taking unmanaged major risks. “The truly unique power of a central bank, after all, is the power to create money,

Invest Like The Best reveals the proven strategies of the world’s top investors, showing you how to achieve higher returns with lower risk through disciplined, data-driven decision-making. If you’re ready to break free from conventional, flawed financial advice and take control of your wealth with transparent, repeatable best practices, this book is your roadmap to smarter investing.