Interest Rates Collide With Growth

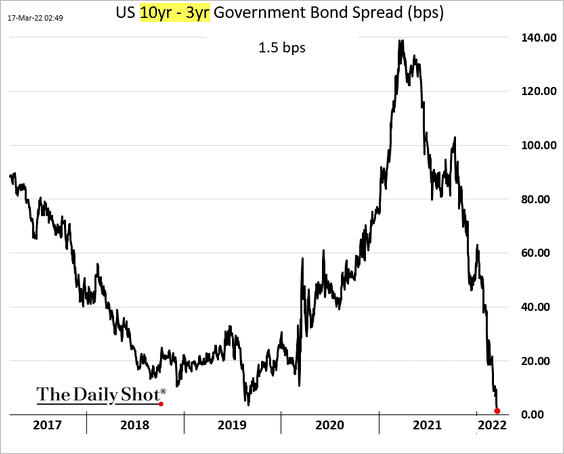

Investors can benefit from a clear understanding of the dynamics between growth, inflation and the yield curve, and how it signals changes in allocation.

Best practices are meant to be shared. That’s why we observe the market and then share our insights on what’s happening, to give you context. We’ve organized every blog into categories, so it’s easier for you to find the answers that matter most to you.

Investors can benefit from a clear understanding of the dynamics between growth, inflation and the yield curve, and how it signals changes in allocation.

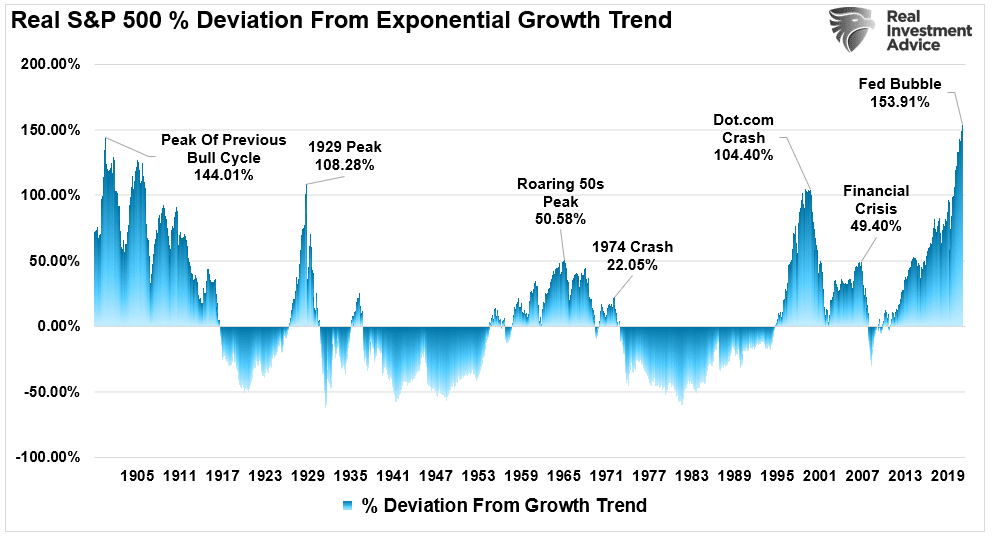

The Fed is on a collision course with market forces, as they are very unlikely to be able to complete the plan they have set out in this forecast. Their

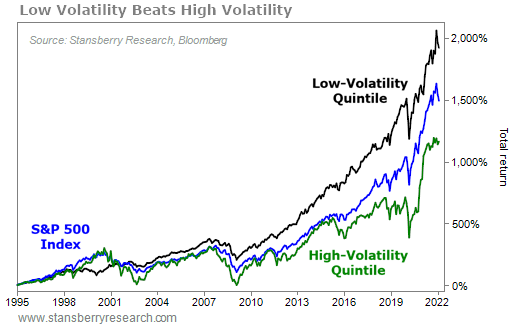

Investors who continue to experience sizeable drawdowns in their account value will have disappointing long term compounded returns. There are many systematic solutions to turn this around.

The inflation dynamics are considered along with how TIPS have uniquely useful qualities in an allocation.

There are several components to the boom and now it looks like tightening financial conditions are coinciding with tightening fiscal conditions. That doesn’t unwind harmlessly because they want it to.

“The real problem for the Fed is that it has completely abandoned any semblance to a systematic policy framework, in apparent preference for a purely discretionary one. By relentlessly depriving

“If you push indexation to its logical extreme, you will get preposterous results” – Charlie Munger Passive equity investing dominated investing styles at the close of

Since the beginning of December this Insight has been talking about the emerging headwinds for the first half of 2022. It is as well to understand scale and depth of

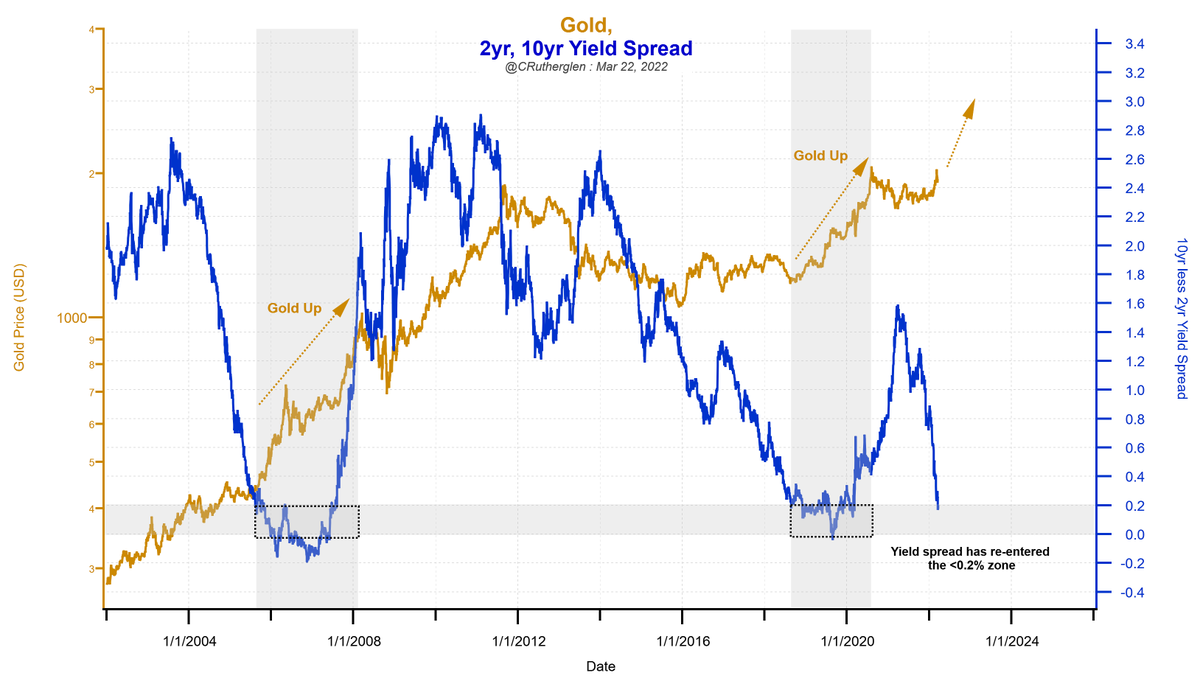

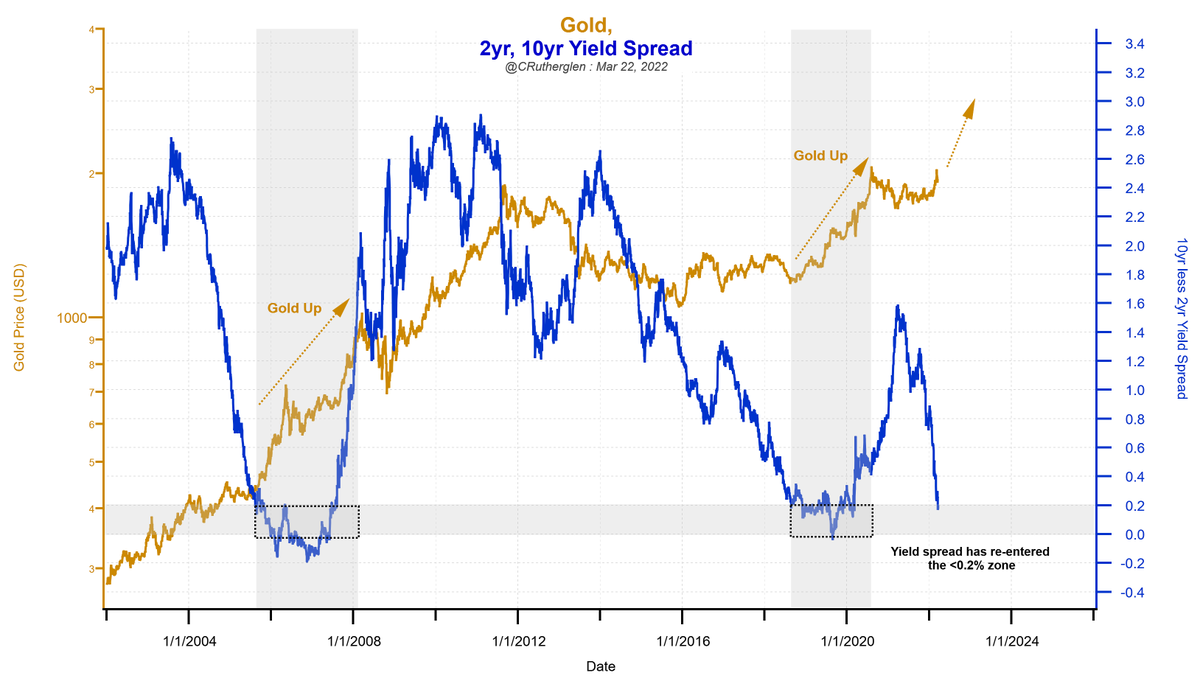

https://twitter.com/TaviCosta/status/1483554635222642689 A clear quad 4 (declining rate of change in both inflation and growth) market signal is gold outperforming equities. Investors should consider the probability of the data

The Most Reckless Fed Ever With A Continuing Contradiction. Serious About Inflation? So Why Does Extreme Easy Policy Continue? Even Fed Chairman Powell states this week, “it’s a

Invest Like The Best reveals the proven strategies of the world’s top investors, showing you how to achieve higher returns with lower risk through disciplined, data-driven decision-making. If you’re ready to break free from conventional, flawed financial advice and take control of your wealth with transparent, repeatable best practices, this book is your roadmap to smarter investing.