The Craft of Investing

This article reveals what that craft actually is, why the low-risk road produces higher long-term returns, and how investors can build a disciplined edge that survives, and even thrives, in

Best practices are meant to be shared. That’s why we observe the market and then share our insights on what’s happening, to give you context. We’ve organized every blog into categories, so it’s easier for you to find the answers that matter most to you.

This article reveals what that craft actually is, why the low-risk road produces higher long-term returns, and how investors can build a disciplined edge that survives, and even thrives, in

This is the biggest investment event of your lifetime!

The warning signs are no longer subtle. The Everything Bubble—fueled by record valuations, relentless leverage, and decades of policy intervention—is now

Real wealth isn’t built by risk or passivity. It’s built by discipline, a compounding process that lowers drawdowns, smooths volatility, and makes steady growth inevitable.

If you can’t measure how

The story of infinite progress is a powerful one. We want to believe that markets evolve, technology advances, and human ingenuity outsmarts every limitation. It’s comforting, this idea that things

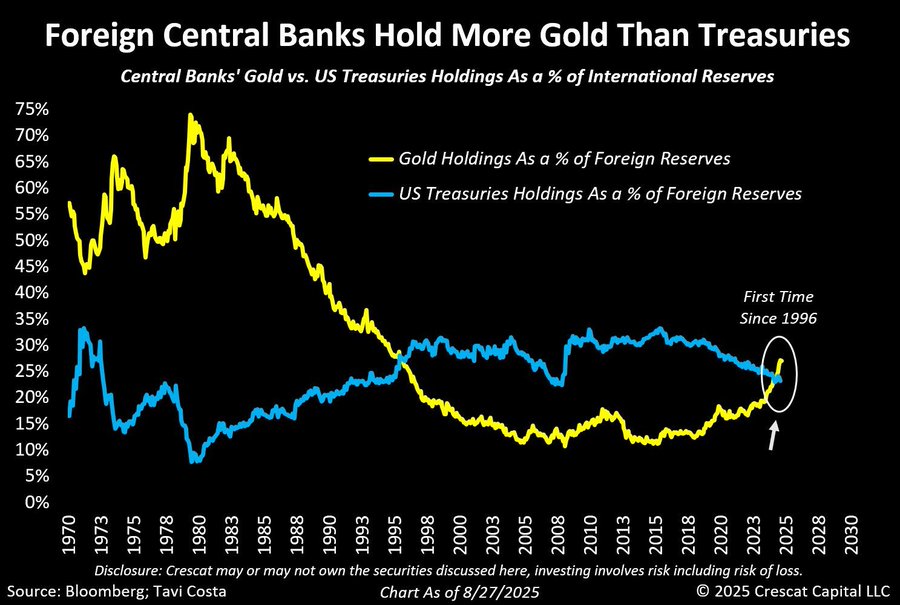

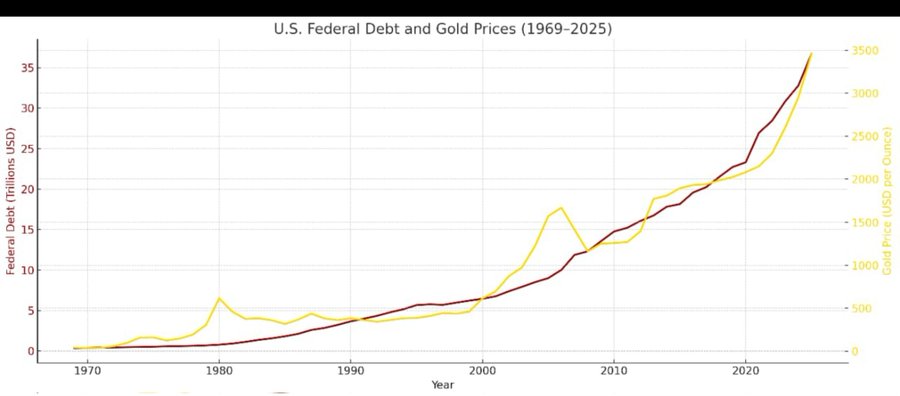

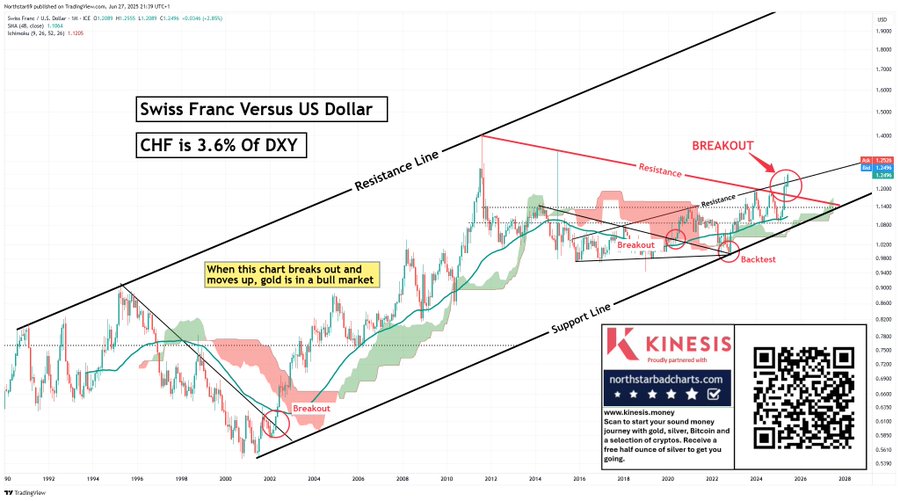

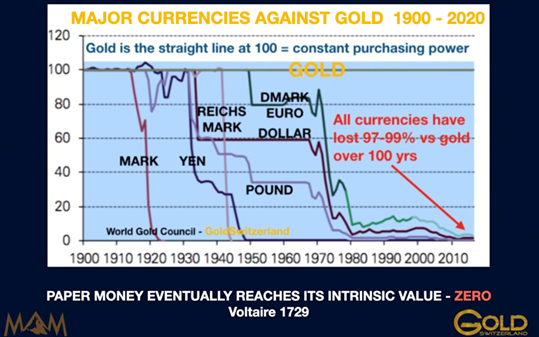

Once investors realized the degree to which the dollar’s value is at risk, from monetary and fiscal policy, and also that foreigners intend to reduce their exposure even after it

The key medium term question for investors is when real assets start to outperform credit and financial assets once more. Gold has already turned.

Dollar financial assets and credit are

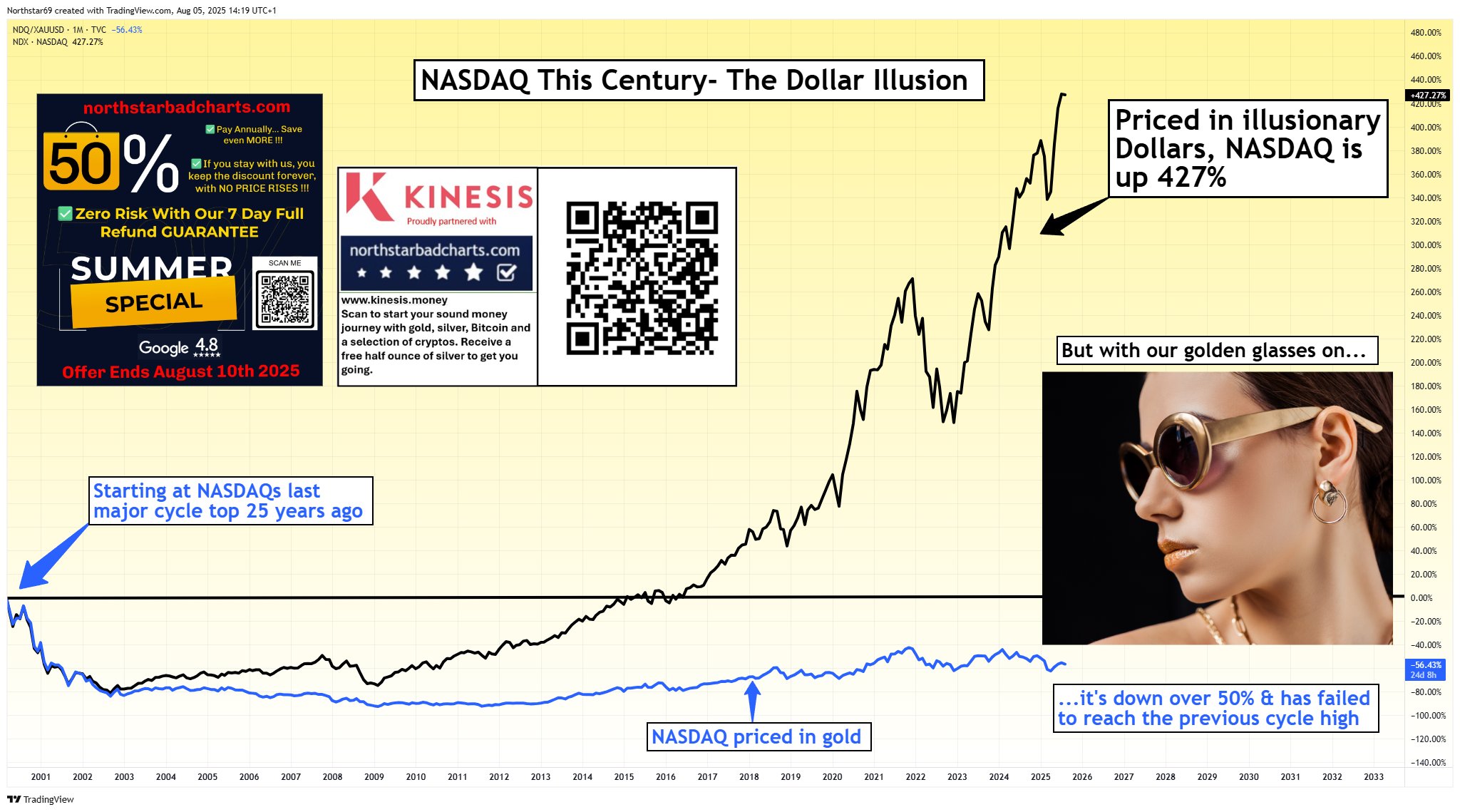

Most US investors don’t know the financial game they are in. US investors have clearly failed to understand the basics of financial system distortions, and are paying a huge and

Most US investors don’t understand the game they are in and they are using deeply flawed methodologies. That may work while the bubble works, but they will be shocked when

If you are paying attention you should realize that conventional asset management has completely missed performance benchmarks on both gold and bonds for several years. Now the dollar is breaking

“The US tax base, which is proportional to the private sector’s GDP, is already contracting when the distortion of the government budget deficit to GDP at about 6.5% is subtracted

Invest Like The Best reveals the proven strategies of the world’s top investors, showing you how to achieve higher returns with lower risk through disciplined, data-driven decision-making. If you’re ready to break free from conventional, flawed financial advice and take control of your wealth with transparent, repeatable best practices, this book is your roadmap to smarter investing.