The 90 Year Keynesian Delusion Is Defaulting Into Accelerating Stagflation

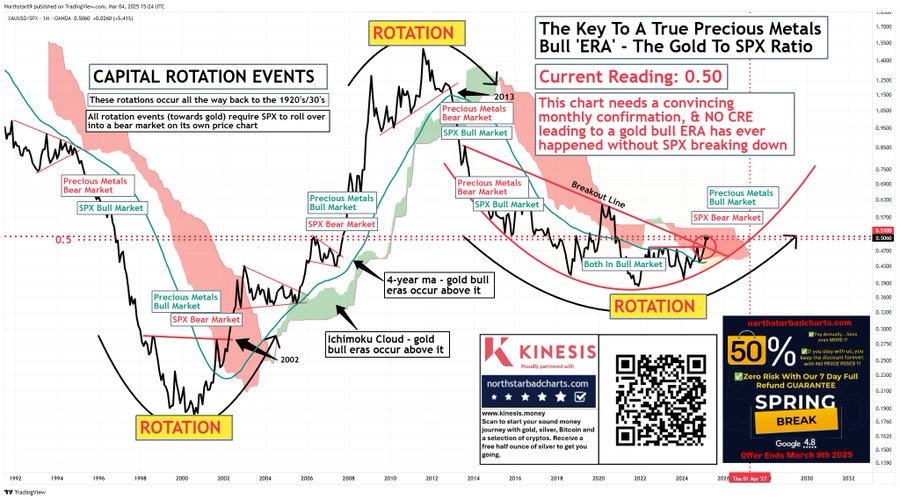

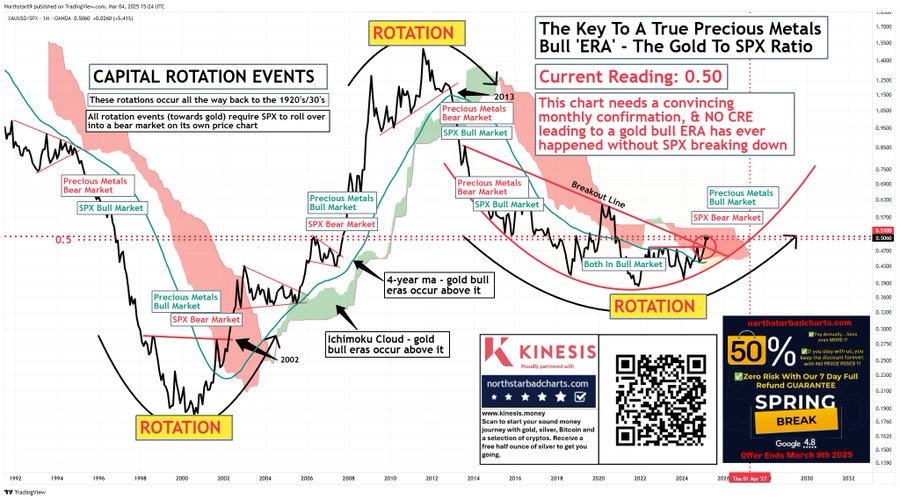

Gold Breaks Out Relative To S&P 500

Global bond yields are breaking higher

“If you don’t own gold, you know neither history nor economics.”

Ray Dalio

“Over the last

Best practices are meant to be shared. That’s why we observe the market and then share our insights on what’s happening, to give you context. We’ve organized every blog into categories, so it’s easier for you to find the answers that matter most to you.

Gold Breaks Out Relative To S&P 500

Global bond yields are breaking higher

“If you don’t own gold, you know neither history nor economics.”

Ray Dalio

“Over the last

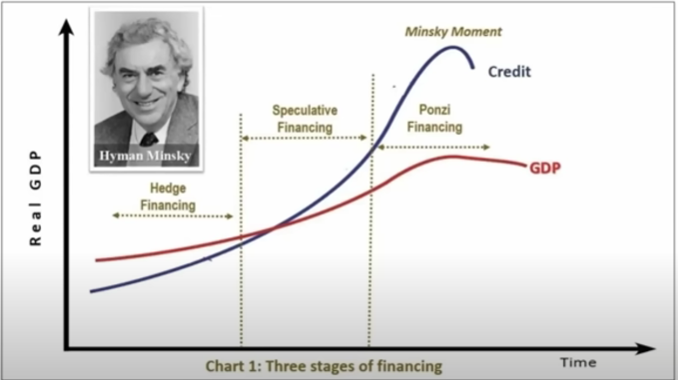

The Growth Illusion

US Investors Are Living In A Truman Show

Leveraged Equity Buyout America (LEBA) rewards the few at the expense of the many through a persistent private sector

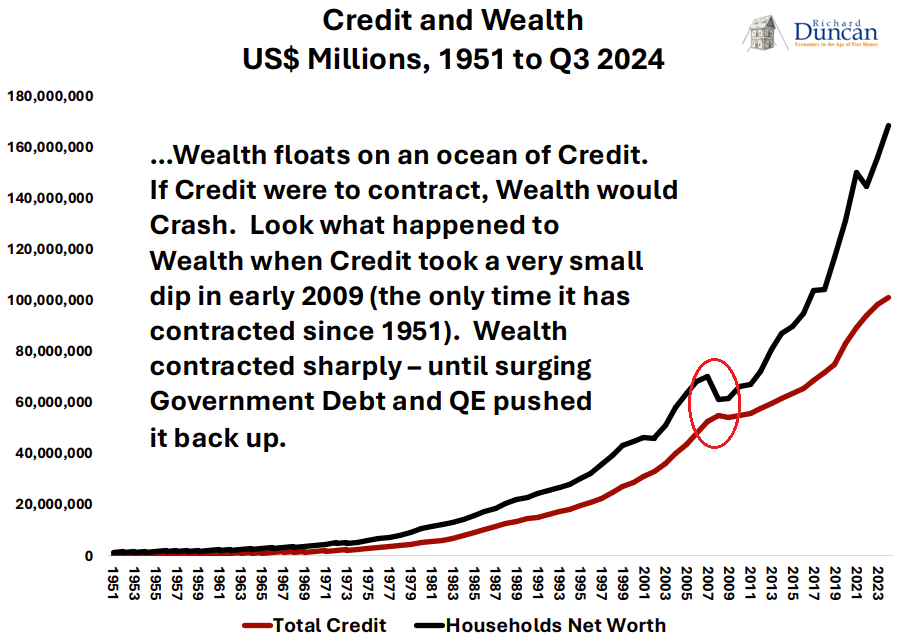

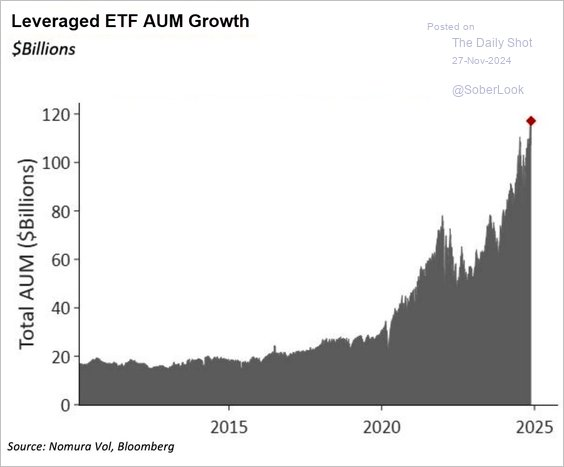

Financial values reflect excessive debt and leverage induced by reckless policy. Debt for equity finance is everywhere you look. Persistent and relentless policy support for the stock market has created

Global Bonds Signal Confidence Collapse In Policy. Bonds Trigger Risks For Banks, Credit And Equity Markets. Never before have investors been so committed and leveraged to a 10 year expected

Probably the biggest expense item of your lifetime is taxes. While tax returns are a requirement, by far the most important part of dealing with your taxes is tax planning

The disassociation between US equity market behavior and earnings is unprecedented. There is no history of declining GAAP earnings with the biggest and most leveraged equity bull market in history.

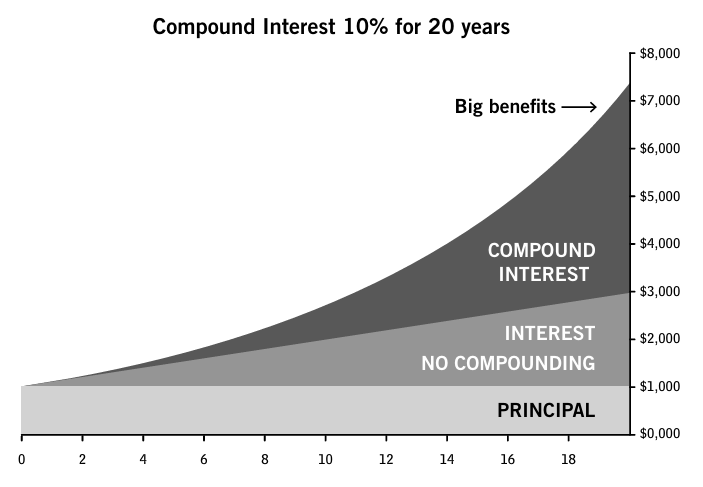

Surprisingly, few investors understand how to optimally assess their performance or align their investment practice and objectives appropriately to the most optimal investment approach, which is compounding.

Whether your

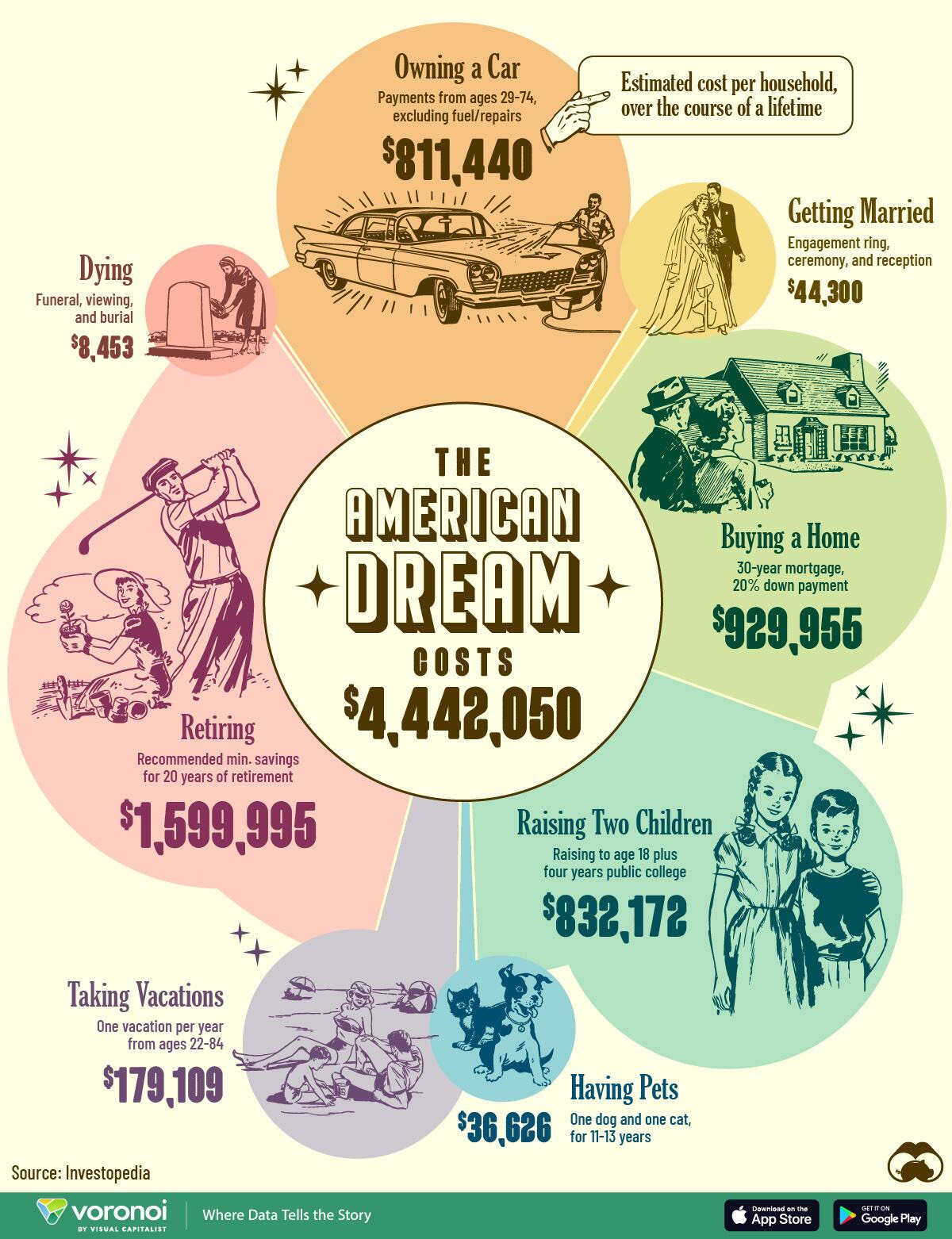

For most retirees “The American Dream” has become unaffordable.

With policy distorting markets and becoming increasingly unstable managing investment risk, while optimizing a retirement and tax plan requires the

Launching CCB Tax Pros has evolved by extending my service from Investment Management, to Financial Planning, to becoming an IRMAA certified planner, to the next logical extension which is tax returns and

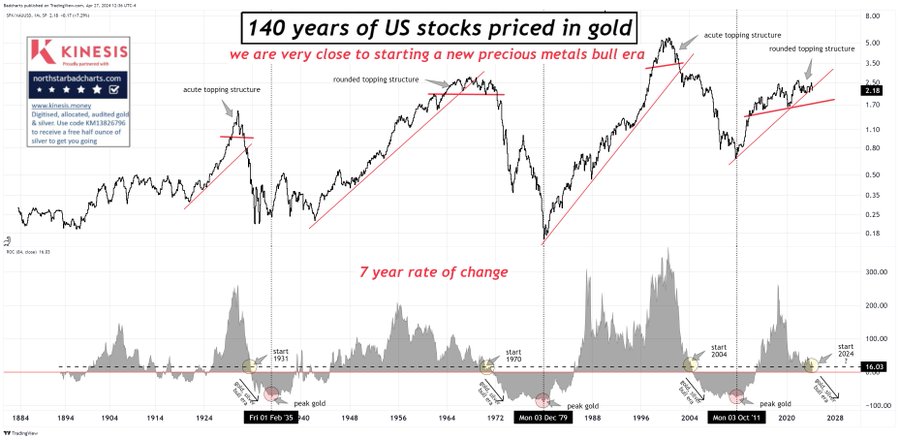

US investors have generally failed to understand the appropriate allocation of gold in their own portfolios. This could be a major problem going forward.

Invest Like The Best reveals the proven strategies of the world’s top investors, showing you how to achieve higher returns with lower risk through disciplined, data-driven decision-making. If you’re ready to break free from conventional, flawed financial advice and take control of your wealth with transparent, repeatable best practices, this book is your roadmap to smarter investing.