Bank Deposit? Or Treasury Bills?

On Wednesday afternoon, March 22, Fed chair Powell and Treasury Secretary Yellen decided to continue business as usual. Powell raised interest rates to contain inflation, perhaps for the last time

Best practices are meant to be shared. That’s why we observe the market and then share our insights on what’s happening, to give you context. We’ve organized every blog into categories, so it’s easier for you to find the answers that matter most to you.

On Wednesday afternoon, March 22, Fed chair Powell and Treasury Secretary Yellen decided to continue business as usual. Powell raised interest rates to contain inflation, perhaps for the last time

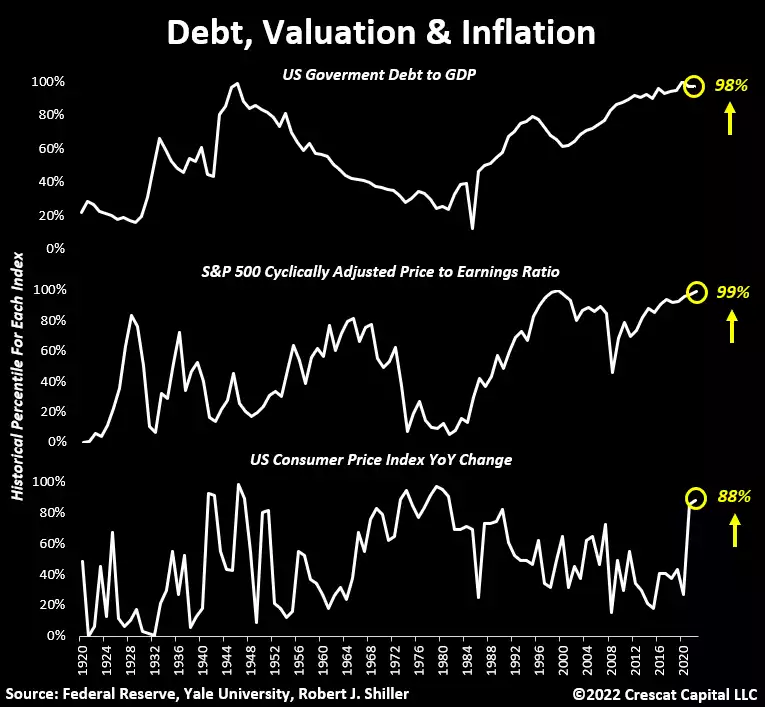

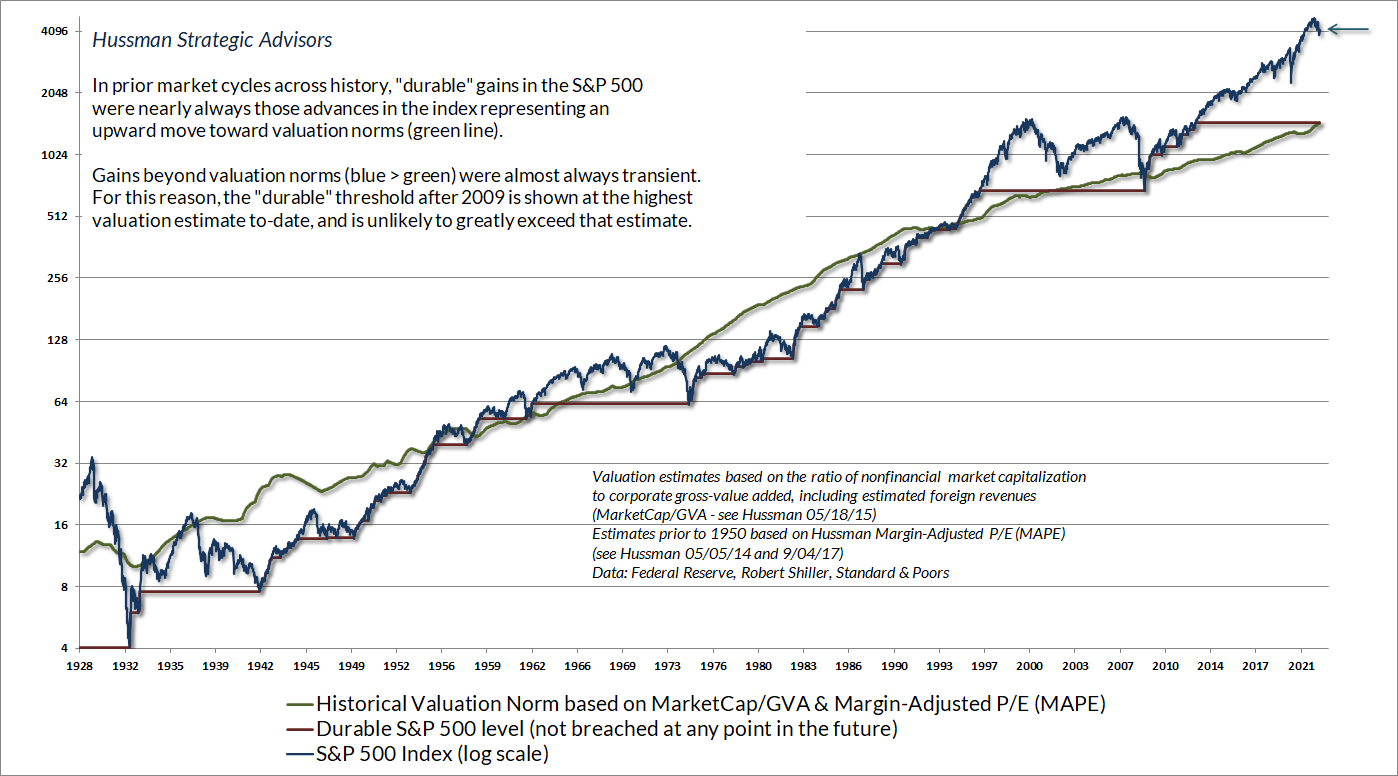

The standard equity and bond allocation has been disastrous in 2022.

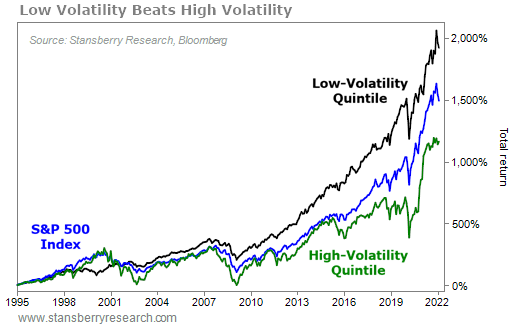

Investors who do not manage risk and drawdowns, have challenging compounding consequences.

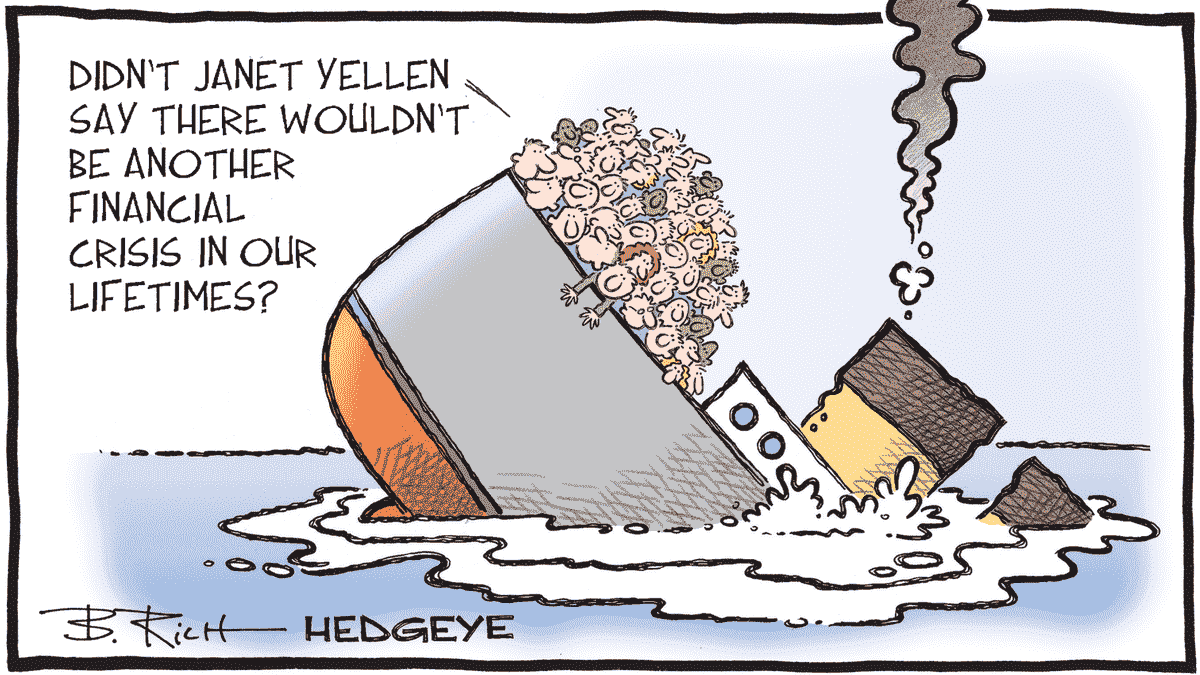

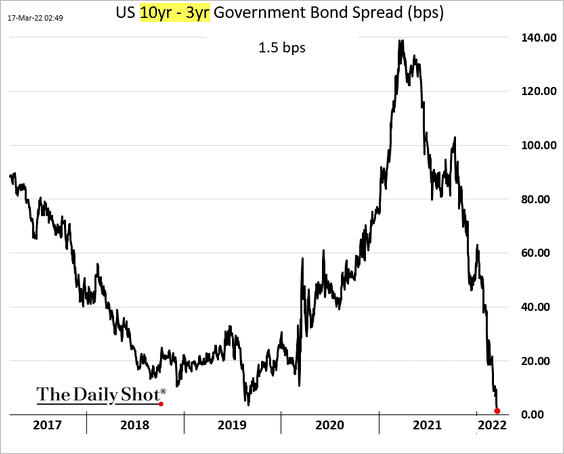

Bond market volatility and the Global Credit Impulse indicate a risk hurricane.

Best Investors always focus on minimizing risk.

“[Ptolemy’s] Earth-centered universe held sway for 1,500 years, showing that

Central Banks and Wall street remain cycle blind.

A major problem but also an opportunity.

Why Wall Street earnings estimates are likely to be wrong at the worst time to

CB Investment Management has partnered with financial tech platform, Pontera, formerly known as FEEX. Pontera specializes in providing full access to all trading and managing of held away accounts (i.e.

Make sure you have a robust full cycle strategy in place. This week the focus is on Paul Tudor Jones, the Best Investor system for outperforming Billionaires, and understanding John

The Fed is on a collision course with market forces, as they are very unlikely to be able to complete the plan they have set out in this forecast. Their

Investors who continue to experience sizeable drawdowns in their account value will have disappointing long term compounded returns. There are many systematic solutions to turn this around.

The inflation dynamics are considered along with how TIPS have uniquely useful qualities in an allocation.

https://twitter.com/TaviCosta/status/1483554635222642689 A clear quad 4 (declining rate of change in both inflation and growth) market signal is gold outperforming equities. Investors should consider the probability of the data

Invest Like The Best reveals the proven strategies of the world’s top investors, showing you how to achieve higher returns with lower risk through disciplined, data-driven decision-making. If you’re ready to break free from conventional, flawed financial advice and take control of your wealth with transparent, repeatable best practices, this book is your roadmap to smarter investing.