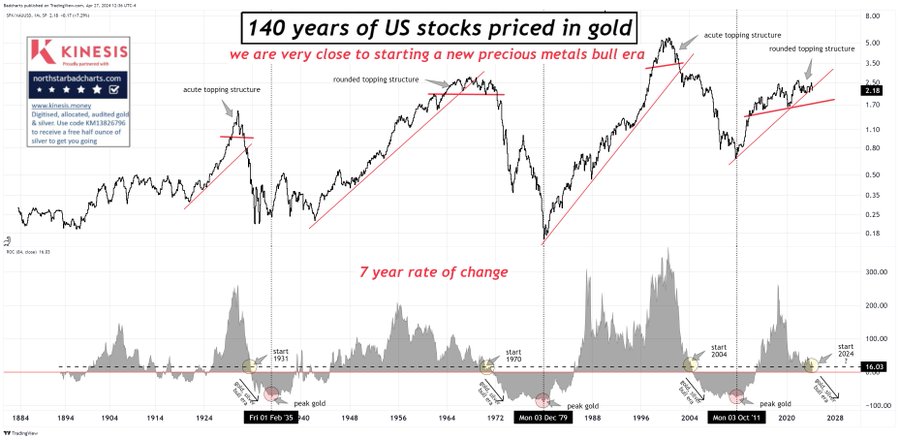

Asset Rotation Alert! Gold Versus Stocks.

US investors have generally failed to understand the appropriate allocation of gold in their own portfolios. This could be a major problem going forward.

Best practices are meant to be shared. That’s why we observe the market and then share our insights on what’s happening, to give you context. We’ve organized every blog into categories, so it’s easier for you to find the answers that matter most to you.

US investors have generally failed to understand the appropriate allocation of gold in their own portfolios. This could be a major problem going forward.

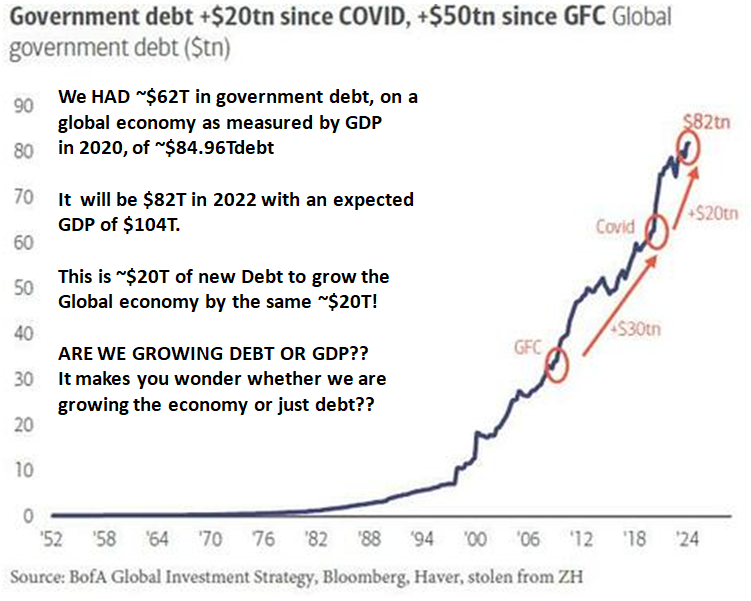

Policy has become a short-term expedient support mechanism, which compounds a long-term sovereign debt crisis. There are also a range of other issues that the Fed would rather not discuss.

While the post 2009 markets have seemed to be benign over all, the debt “stimulus” looks to reached its limits. The outlook for US investors has become more challenging. Prepare

US Federal Debt Growth Has Exceeded GDP Growth For 16 years.

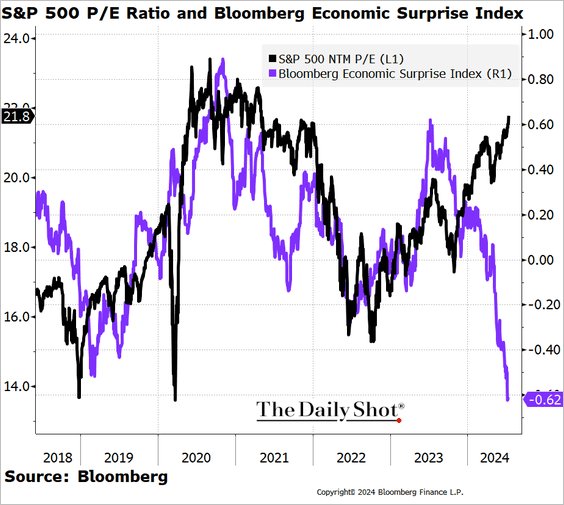

Stock market rises to record valuation even as economic growth weakens.

Earnings grow is broadly flat over the

Now we can understand what Warren Buffett is telling us.

It is hard to believe that policy makers can balance everything out indefinitely.

In my view, key allocations to

Financial planning done well can materially change your life. Yet most people clearly avoid it for a range of reasons. One reason is that conventional financial plans are poorly conceived

In order to address all these components, there are several things you can do, but this does need your attention, good advice may be harder to find than you think,

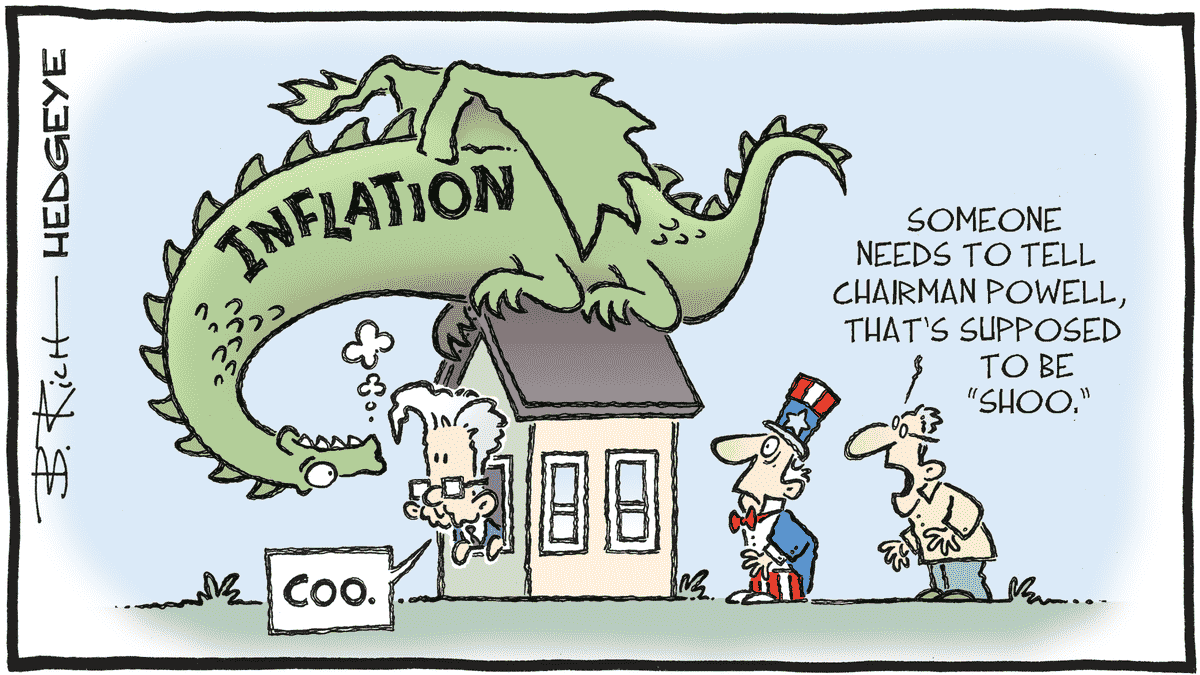

Inflation preparation is not apparent in most western portfolios, as discussed last week. But this issue is much bigger than that. In the 1970s debt levels, relative to GDP, were

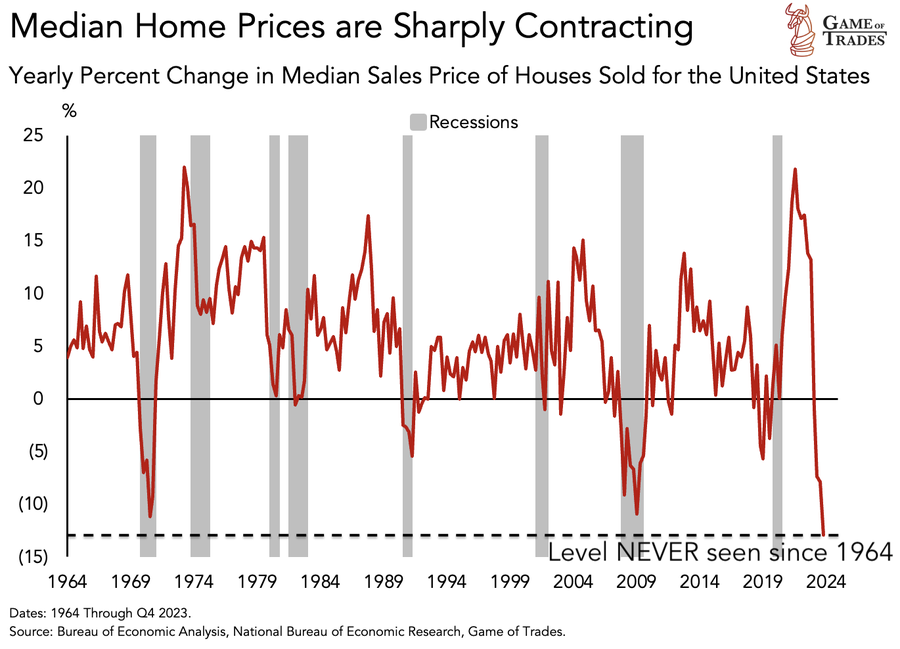

One of the key discoveries is that the math of retirement planning suggests that in many cases downsizing property is very helpful. Federal Reserve policies have been so durably stimulative

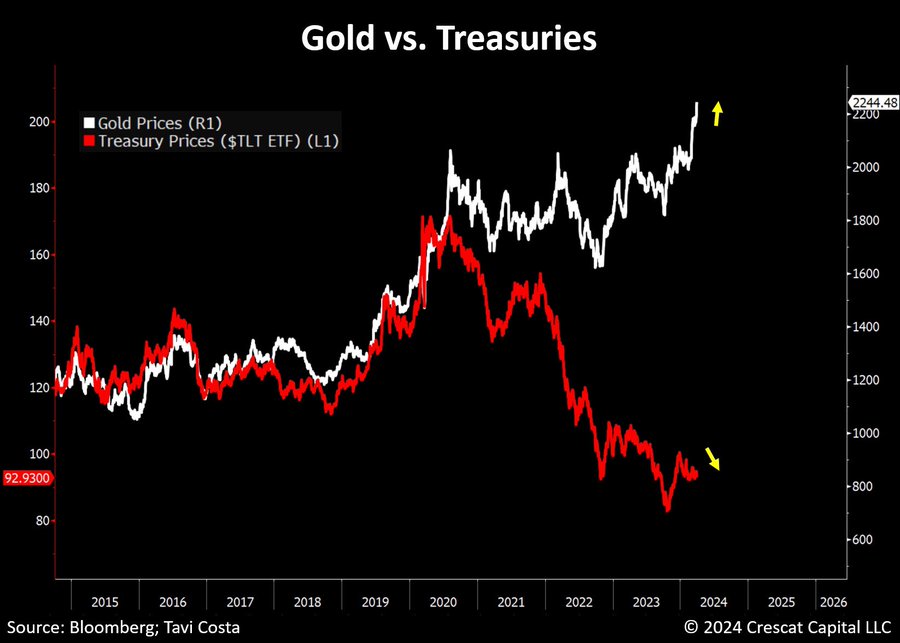

Gold and US Treasuries are already reacting to the possibility of a very different future investment environment, even as asset managers in aggregate are continuing to oppose this possibility even

Invest Like The Best reveals the proven strategies of the world’s top investors, showing you how to achieve higher returns with lower risk through disciplined, data-driven decision-making. If you’re ready to break free from conventional, flawed financial advice and take control of your wealth with transparent, repeatable best practices, this book is your roadmap to smarter investing.