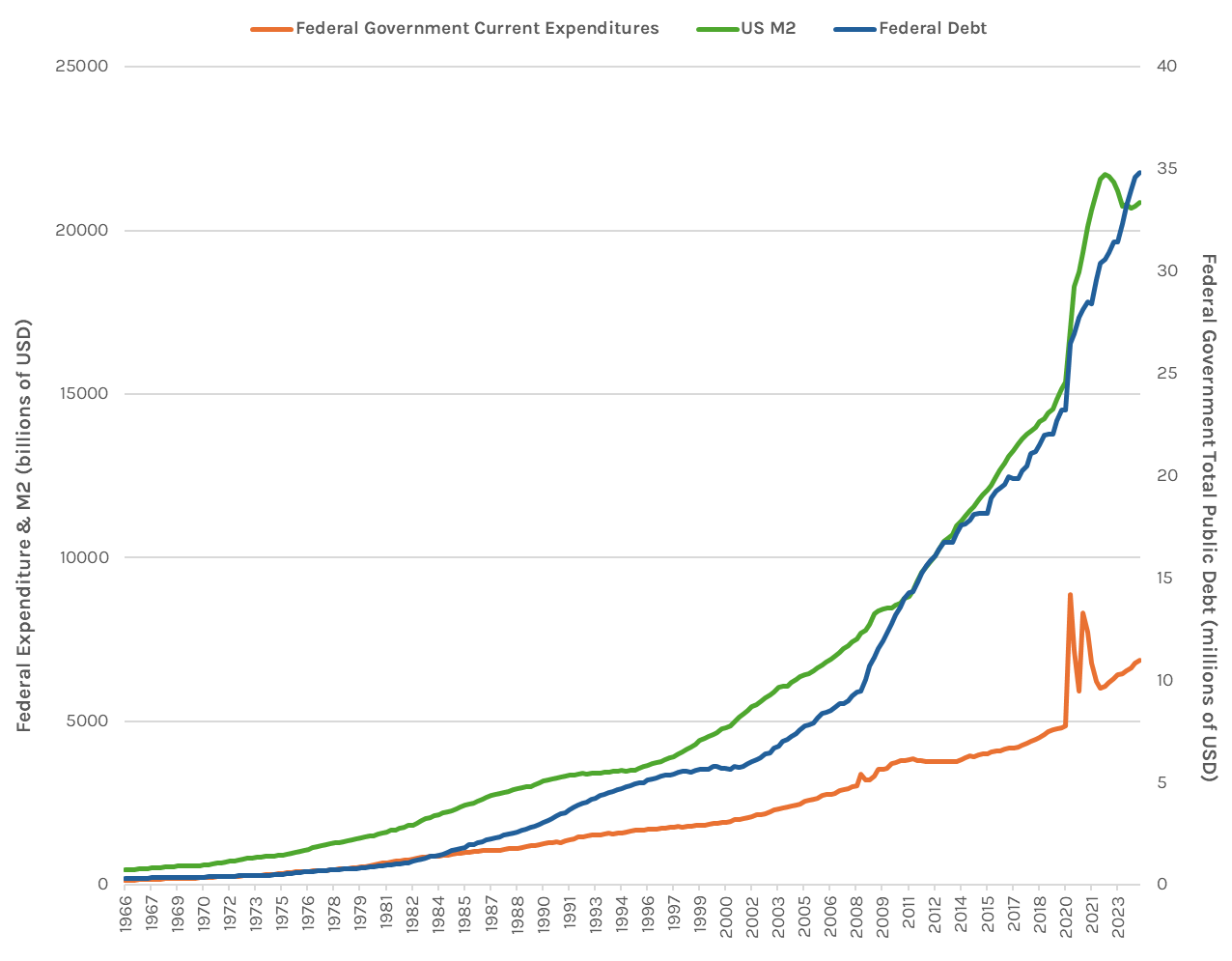

Wealth Preservation Urgent As Epic Policy Failure Accelerates

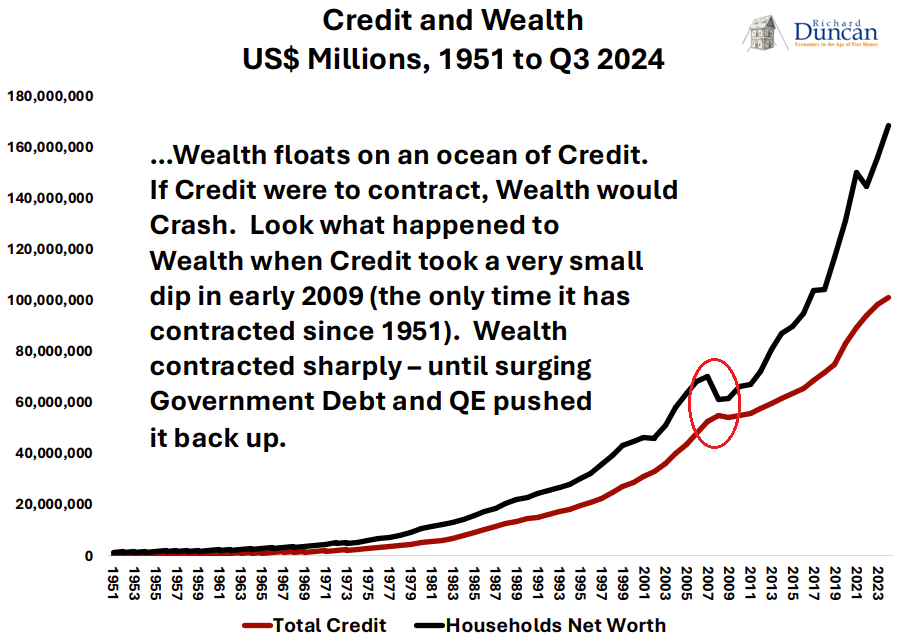

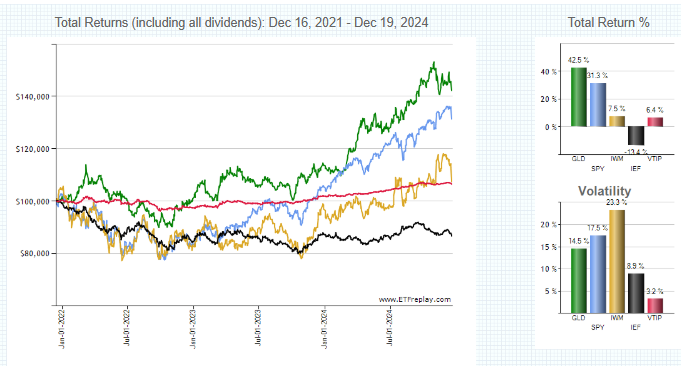

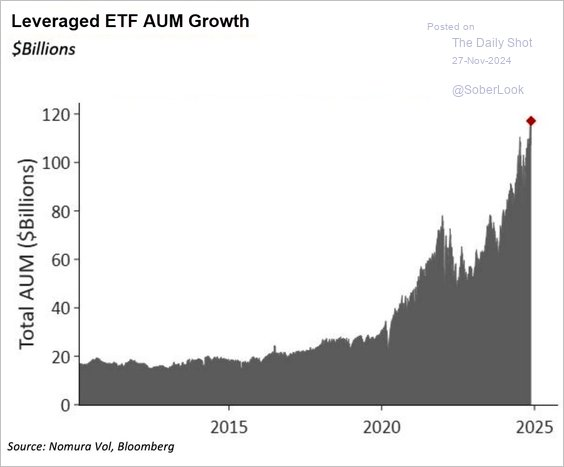

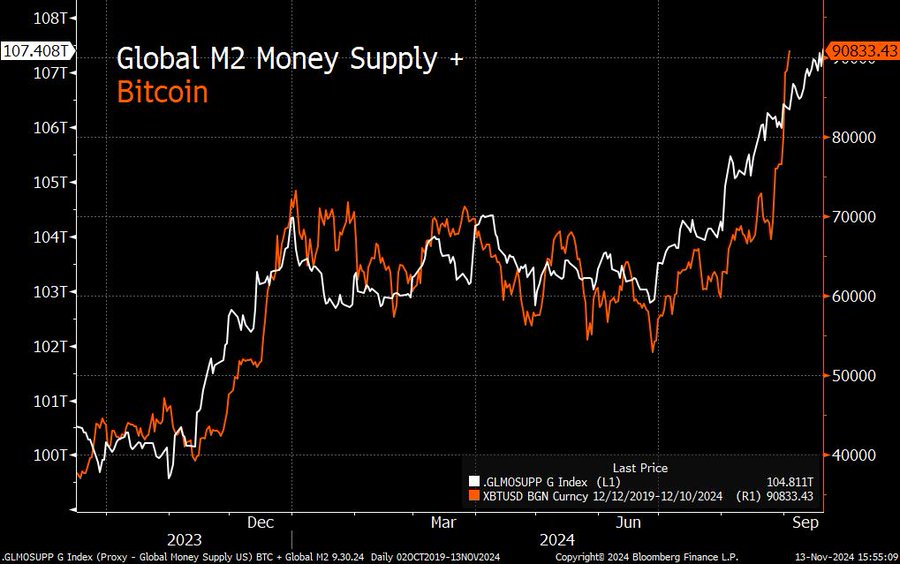

Remarkably investors seem to carry on as if markets are behaving somewhat normally. Worse speculation keeps rising to new all-time records. I hope this blog has demonstrated that investors are