“Gold is money. Everything Else Is Credit”

J P Morgan

“If you don’t own gold you don’t know the economics or the history of it”

Ray Dalio

—————————————————————————————

The most profound change in asset allocation has already begun.

Credit is losing ground at a rapid rate as real money reasserts itself.

Gold made a new all time high in January.

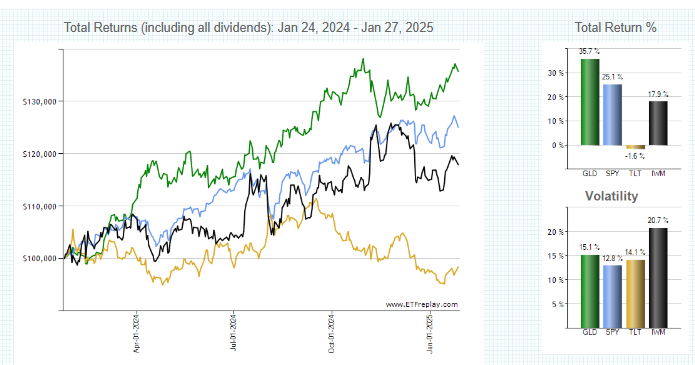

In the last 12 months Gold has outperformed the dollar by 35%! That does not indicate stable low single digit inflation. Furthermore, in US dollar terms gold has also outperformed stocks and bonds. Credit assets are universally underperforming gold already.

Yet US investors have almost no gold in their portfolios. A Capital Rotation Event will be a shock.

Credit/Debt is expanding out of control.

Global Debt Reaches 326% Of GDP

“Emerging markets have reached 245% of GDP in debt, totaling $105 trillion. Poor nations are now spending more on their debt than infrastructure, health care, or education. These nations cannot afford to simply not repay and multilateral development banks have turned into lenders of last resort.

ALL government debt is in serious trouble because they just never fund a damn thing. The solution is to always borrow and there is no plan to ever pay anything back. The behind the curtain reasoning is they are burning money for fuel because they are always reducing the value of prior debt that is never indexed to inflation.”

Martin Armstrong

Will US government spending growth be cut? Not much if anything. Alasdair Macleod explains:

“Trump seems to have grasped the necessity of addressing public spending, hence the establishment of DOGE run by Elon Musk. But instead of cutting government, the intention is to make it more efficient. The initial intention was for DOGE to reduce wasteful spending and eliminate unnecessary regulations. But the executive order establishing it changed it to “modernise federal technology and software to maximise governmental efficiency and productivity”.

Essentially, DOGE is Trump’s attempt to create budget space to allow him to spend instead of Congress. Trump is a spendthrift, as his intention to allocate $500 billion to AI infrastructure and development proves, when China’s DeepSeek does the same job for only $5 million. And even without an economy underperforming expectations, the budget deficit will increase partly due to tax cuts underfunded by trade tariffs, partly due to the inflationary consequences of tariffs driving interest rates higher, and partly because of the recessionary consequences of his tariffs on world trade.”

While the Capital Rotation Event has not yet fully arrived, if you haven’t started preparing, you are already late. The preferred allocations have already been outperforming for the last 3 years!

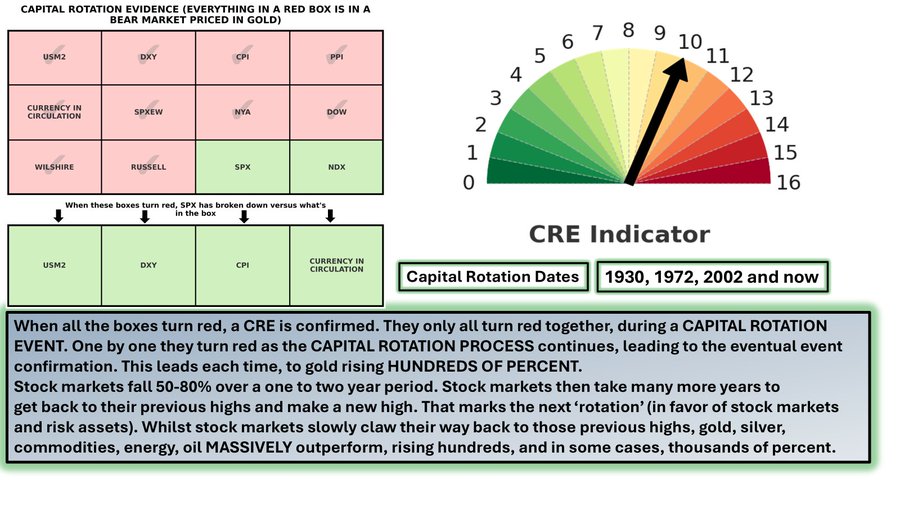

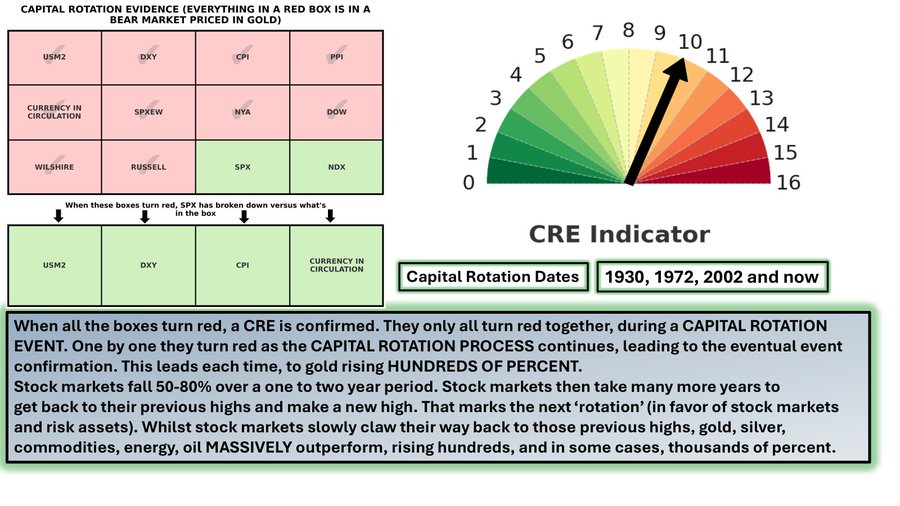

As the table shows, 10 dominos have fallen. The last two would appear to be inevitable, although timing is uncertain.

As we pointed out most of last year most US investors have not adjusted. It seems that the most important element of asset allocation is misunderstood.

Understand the Dollar matrix, and what is credit and money

The post 2008 US economy has been a financial takeover largely driven by debt and balance sheet manipulation. The underlying US economy never fully recovered from the Great Financial Crisis Of 2008. It was never likely to. The policies were mainly designed to perpetuate the financial system, rather than repair and renew the overall economy.

As a consequence, the economy has now fallen into a debt trap while growth has become increasingly weak.

US GDP has doubled in the last 15 years with electrical generation flat!

The confusion about the US economy and markets stems from a fundamental misunderstanding about money and credit. Confidence in credit is now in decline and demand for real money is persistently on the rise.

Credit Crisis in 3, 2….1…….

To understand what is evolving it is crucial to understand the difference between money and credit.

Look At The Markets! They are speaking if you are listening.

For a deep dive, Kevin Wadsworth explains:

A Gold Bull Market VS. A Gold Bull ERA!

Bitcoin has never escaped its high correlation with speculative assets. This would need to break just as speculative assets take a plunge for Bitcoin to be a “safe haven”. That is asking a great deal for crypto currencies.

House prices are already collapsing relative to gold.

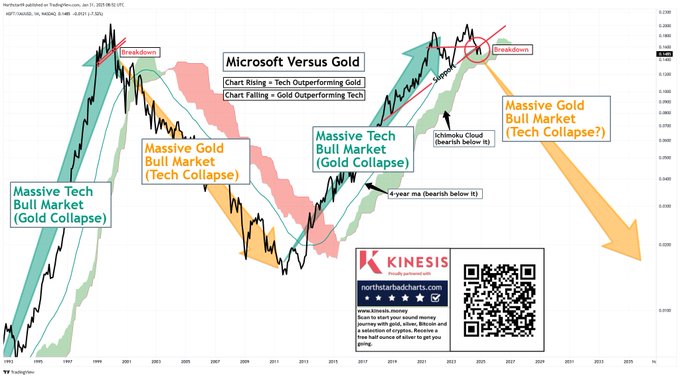

The last two dominos for this to become a Capital Rotation Event are the S&P 500 and Nasdaq indexes breaking down versus gold.

One key stock is MSFT, which could be breaking down.

Summary

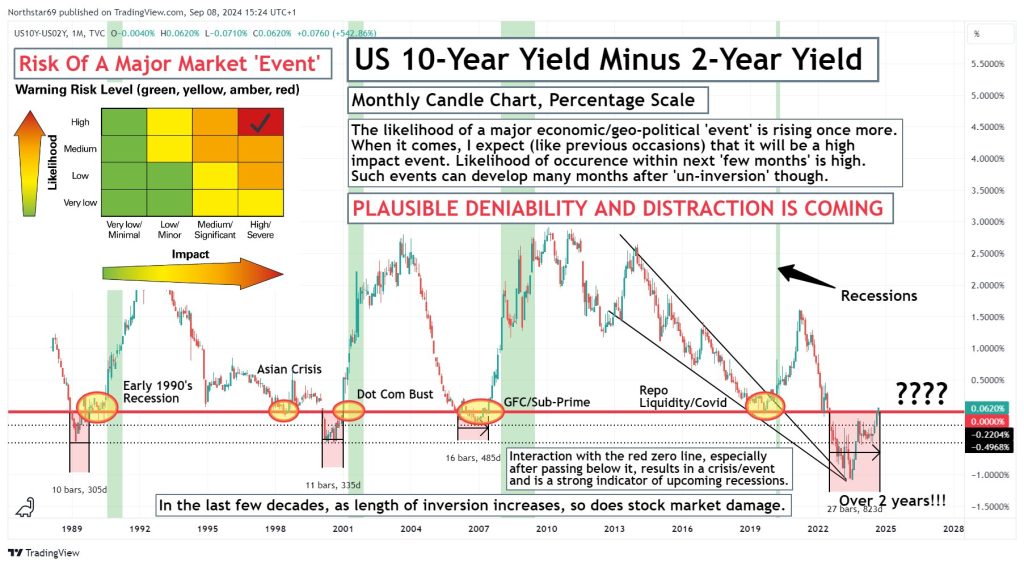

With the Fed facing rising inflation and no immediate signs of recession, the Fed pause in cutting rates was the only credible choice this week. The Fed is hostage to fortune on economic growth, with little room to credibly cut rates if they need to.

If Nasdaq and/or the S&P500 breaks down relative to gold don’t assume they will recover. The Capital Rotation Event suggests the risks are much higher than most believe or understand.

For Nasdaq and the S&P 500 to exceed high growth expectations the economy needs to grow strongly. While the prospect for near term growth over the next quarter is good, it is anyone’s guess whether it will be strong enough and long lasting enough to continue supporting the markets.

The formula for further debt and balance sheet manipulation is becoming increasingly challenged. Yet US investors have record allocations to stocks and limited if any gold.

In the last 25 years, currency values have progressively fallen measured in real money, which despite US Treasury propaganda remains legal money without counterparty risk in everyone’s common law. The log-scale chart below shows the extent of divergence between the value of real money and fiat currencies over just this quarter century:

The yen has lost 93% of its 2000-value, the dollar and euro about 90%, and sterling 92% with the users of these currencies, including savers, unaware of what’s happening to their medium of exchange. And now this collapse is accelerating, with an average loss of over 25% in 2024 alone.

We can talk about bulls and bears in financial markets for ever. But to focus entirely upon the relationship between nose and grindstone blinds us to the true and massive forces driving the relationship between money and credit, condemning the latter towards oblivion.