Asset Rotation Alert! Gold Versus Stocks.

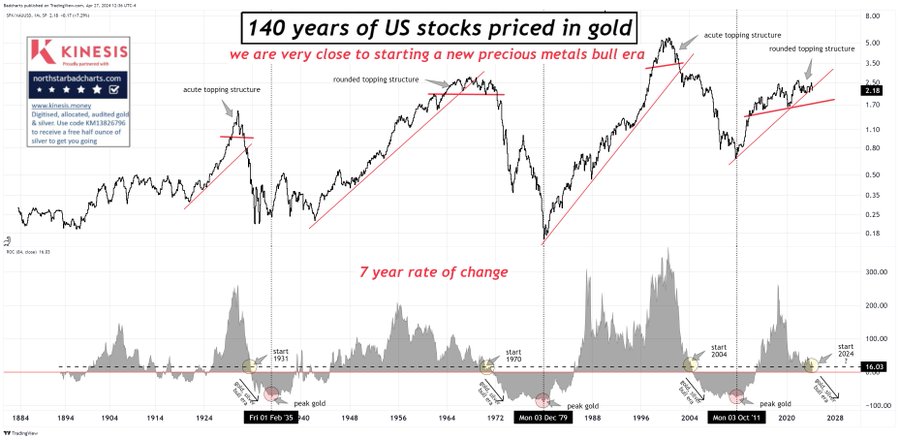

US investors have generally failed to understand the appropriate allocation of gold in their own portfolios. This could be a major problem going forward.

Best practices are meant to be shared. That’s why we observe the market and then share our insights on what’s happening, to give you context. We’ve organized every blog into categories, so it’s easier for you to find the answers that matter most to you.

US investors have generally failed to understand the appropriate allocation of gold in their own portfolios. This could be a major problem going forward.

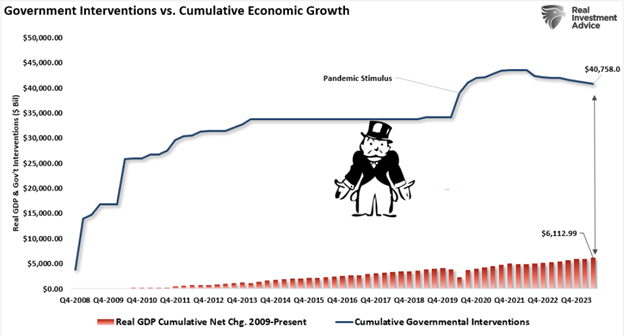

Turn the transition into an opportunity, learn how to avoid taking unmanaged major risks. “The truly unique power of a central bank, after all, is the power to create money,

[et_pb_section fb_built=”1″ _builder_version=”4.23.1″ _module_preset=”default” global_colors_info=”{}”][et_pb_row _builder_version=”4.23.1″ _module_preset=”default” global_colors_info=”{}”][et_pb_column type=”4_4″ _builder_version=”4.23.1″ _module_preset=”default” global_colors_info=”{}”][et_pb_text _builder_version=”4.23.1″ _module_preset=”default” hover_enabled=”0″ sticky_enabled=”0″]“We Need To Be Very Careful With Interest Rate Cuts” Thomas Hoenig, Former Federal Reserve

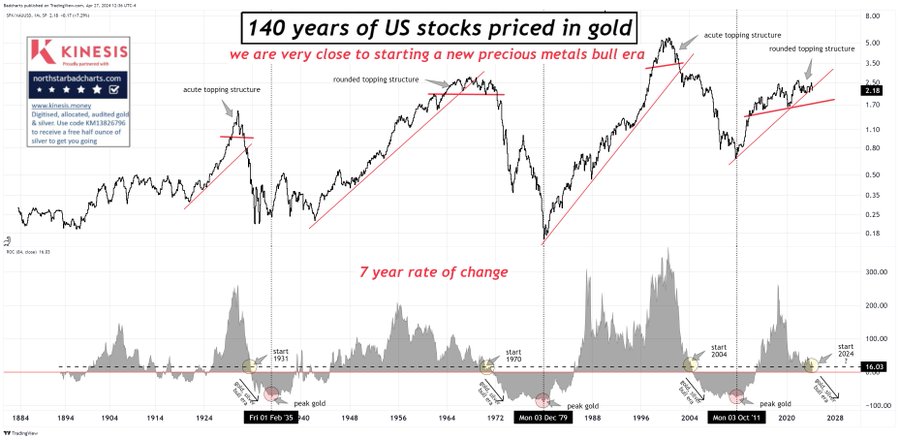

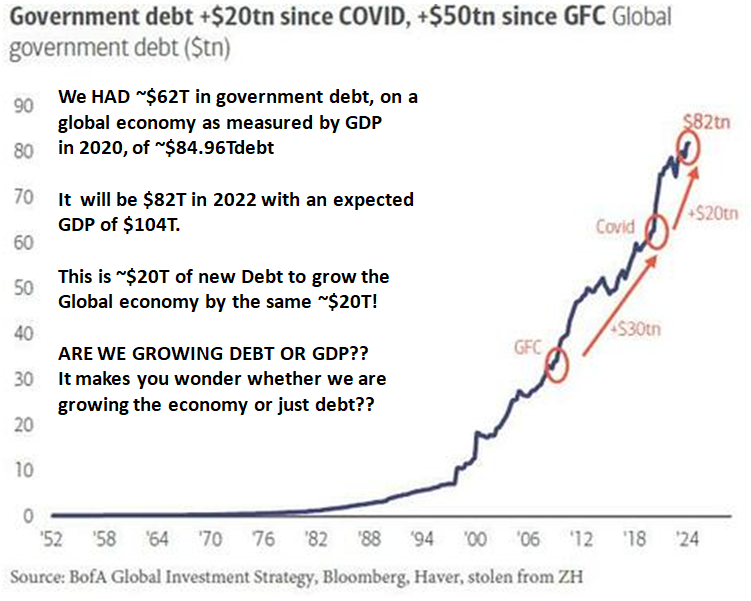

Policy has become a short-term expedient support mechanism, which compounds a long-term sovereign debt crisis. There are also a range of other issues that the Fed would rather not discuss.

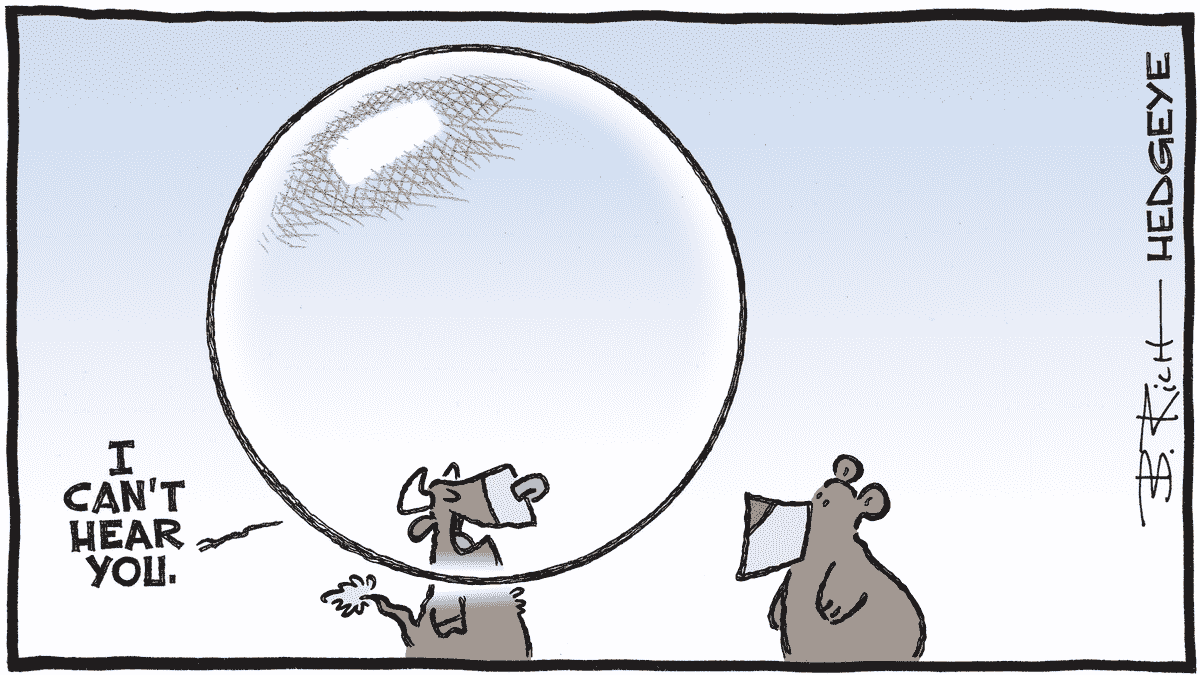

While the post 2009 markets have seemed to be benign over all, the debt “stimulus” looks to reached its limits. The outlook for US investors has become more challenging. Prepare

If you have been reading this blog, I hope you were prepared for the return of market volatility. This is an accident waiting to happen and it is just getting

Washington just digs a deeper fiscal hole. Let’s be clear. Excessive deficits are your future taxes, or inflation, or both. Policy Chaos: How U.S. Treasury Is Fighting The Fed |

US Federal Debt Growth Has Exceeded GDP Growth For 16 years.

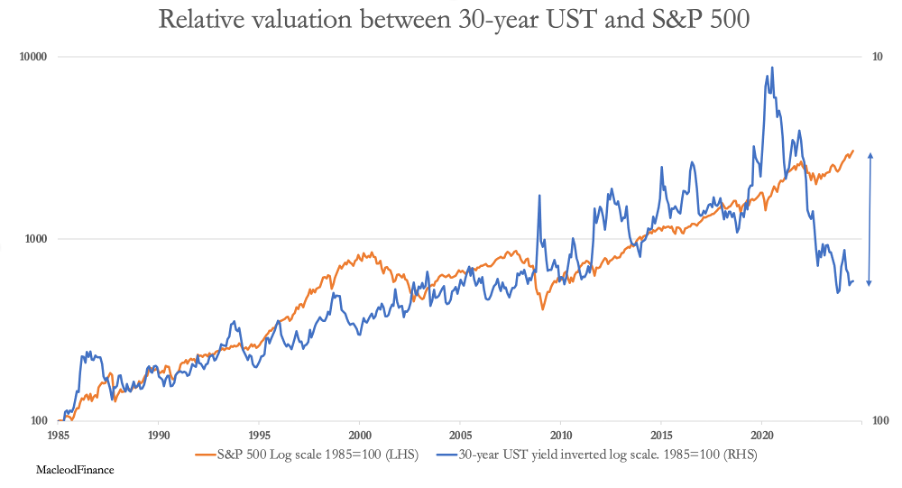

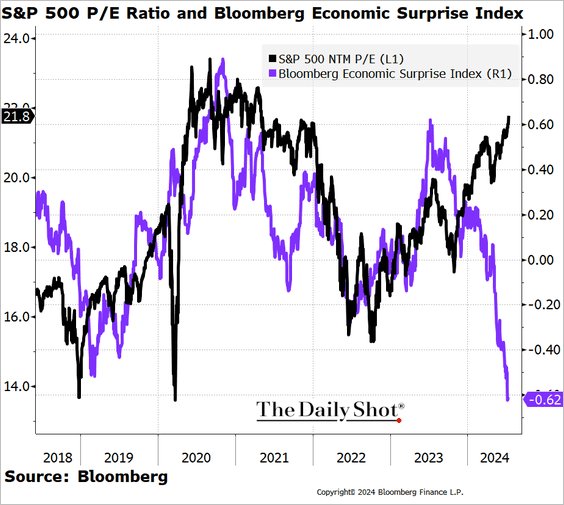

Stock market rises to record valuation even as economic growth weakens.

Earnings grow is broadly flat over the

Now we can understand what Warren Buffett is telling us.

It is hard to believe that policy makers can balance everything out indefinitely.

In my view, key allocations to

Invest Like The Best reveals the proven strategies of the world’s top investors, showing you how to achieve higher returns with lower risk through disciplined, data-driven decision-making. If you’re ready to break free from conventional, flawed financial advice and take control of your wealth with transparent, repeatable best practices, this book is your roadmap to smarter investing.