Most investors have too much risk badly allocated

Once you commit to the Calmar Ratio, with good execution your results will start to show:

1. Significantly lower risk

2. Higher long-term returns

This is simply

Best practices are meant to be shared. That’s why we observe the market and then share our insights on what’s happening, to give you context. We’ve organized every blog into categories, so it’s easier for you to find the answers that matter most to you.

Once you commit to the Calmar Ratio, with good execution your results will start to show:

1. Significantly lower risk

2. Higher long-term returns

This is simply

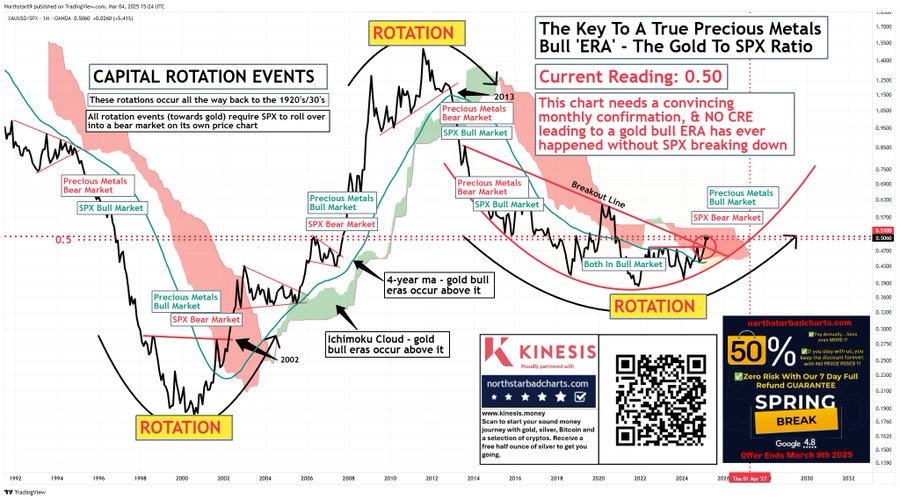

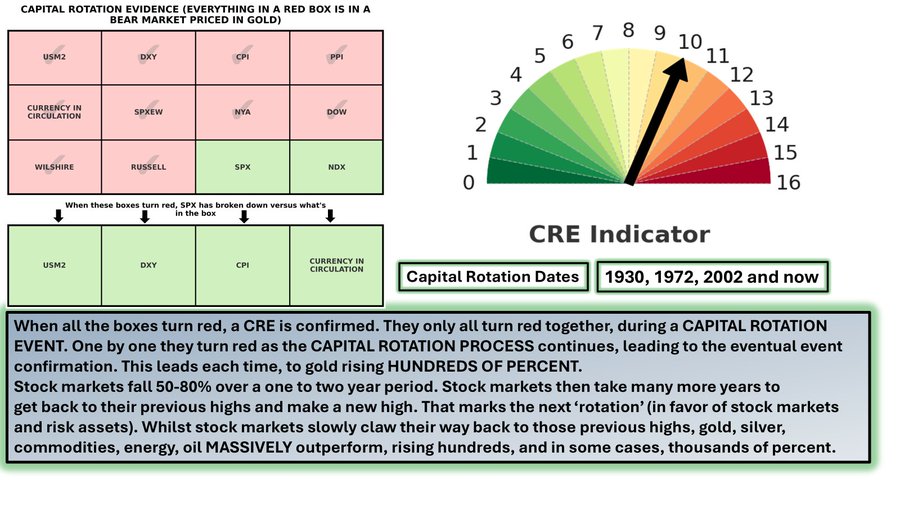

There is no question that investing is at a crucially important stage. Economic policy has failed but policy makers are accelerating dysfunctional policy. Gold has triggered major signal indicating a

This is a crucial time to understand the full dynamics in play. It is also crucial to fully adopt “Best Investor Standards”. Conditions have become so unstable that only excellent

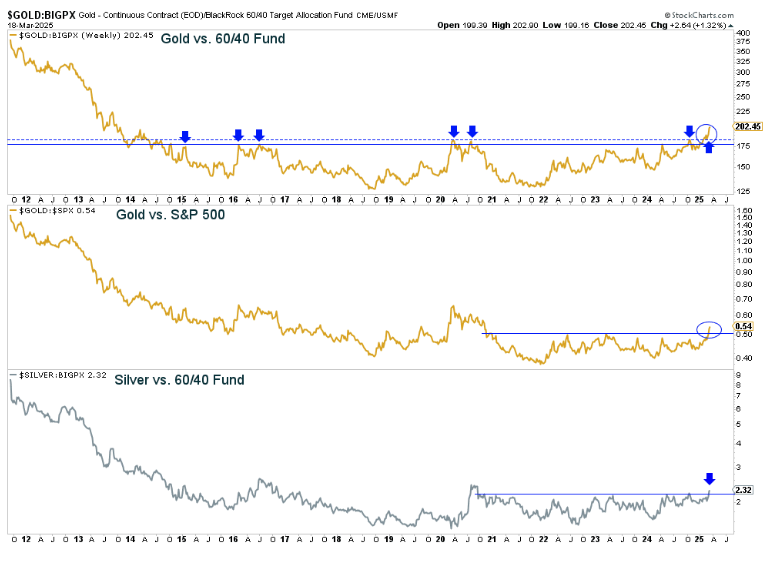

Gold Breaks Out Relative To S&P 500

Global bond yields are breaking higher

“If you don’t own gold, you know neither history nor economics.”

Ray Dalio

“Over the last

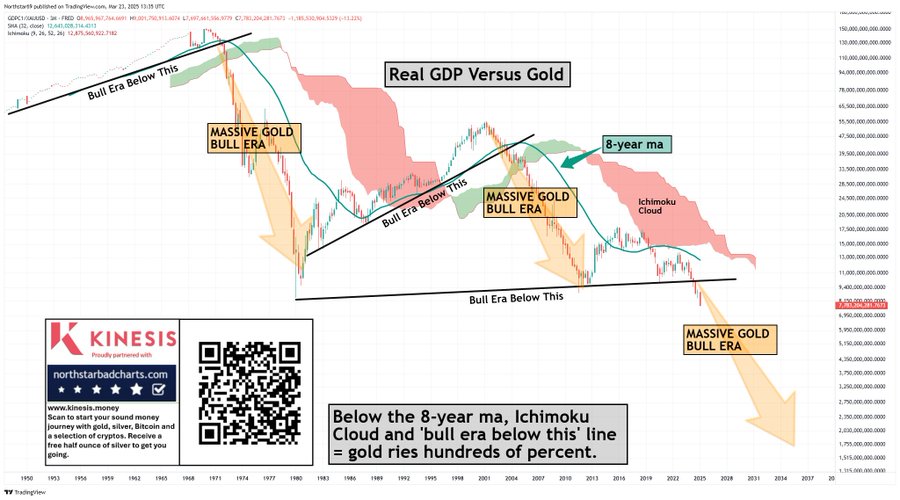

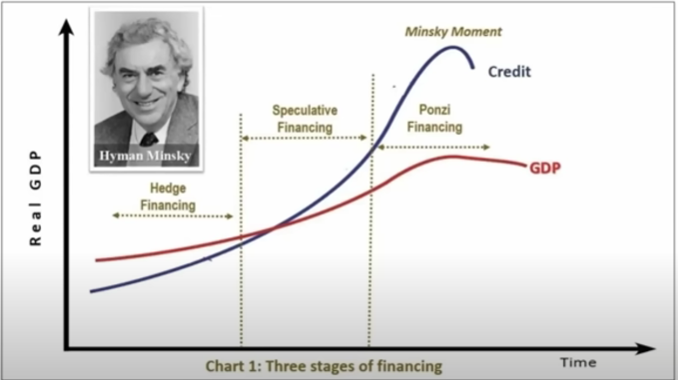

The Growth Illusion

US Investors Are Living In A Truman Show

Leveraged Equity Buyout America (LEBA) rewards the few at the expense of the many through a persistent private sector

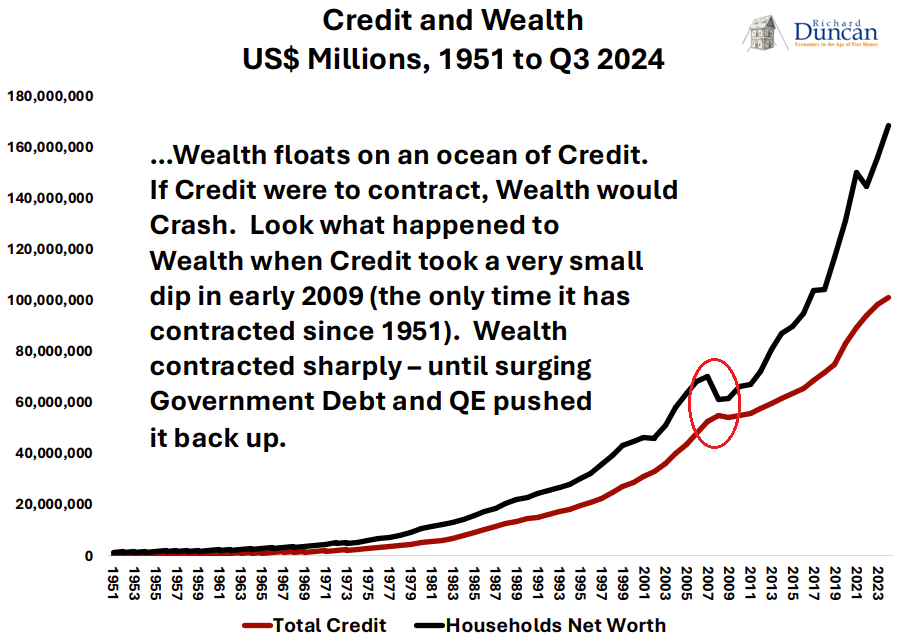

Financial values reflect excessive debt and leverage induced by reckless policy. Debt for equity finance is everywhere you look. Persistent and relentless policy support for the stock market has created

The most profound change in asset allocation has already begun.

Credit is losing ground at a rapid rate as real money reasserts itself.

Global Bonds Signal Confidence Collapse In Policy. Bonds Trigger Risks For Banks, Credit And Equity Markets. Never before have investors been so committed and leveraged to a 10 year expected

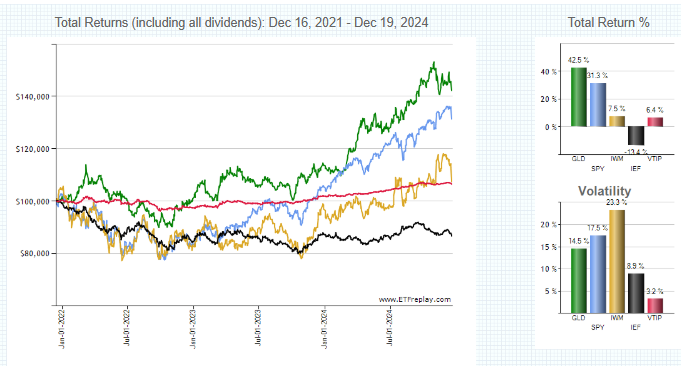

Stagflation Allocations have already outperformed Conventional Stock and Bond allocations over the last 3 years.

Gold has outperformed both the S&P 500 and the Russell 2000. TIPS have substantially outperformed

Invest Like The Best reveals the proven strategies of the world’s top investors, showing you how to achieve higher returns with lower risk through disciplined, data-driven decision-making. If you’re ready to break free from conventional, flawed financial advice and take control of your wealth with transparent, repeatable best practices, this book is your roadmap to smarter investing.