Why Won’t The 2020s Be Worse Than The 1970s?

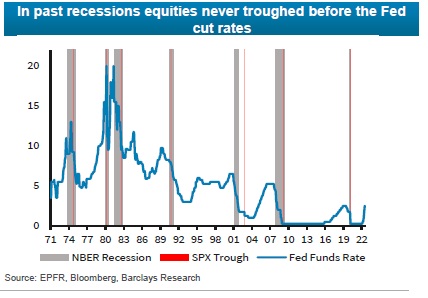

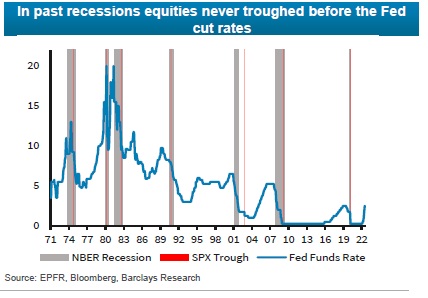

Typically stocks bottom well after the first interest rate cut, which may much longer than investors realize.

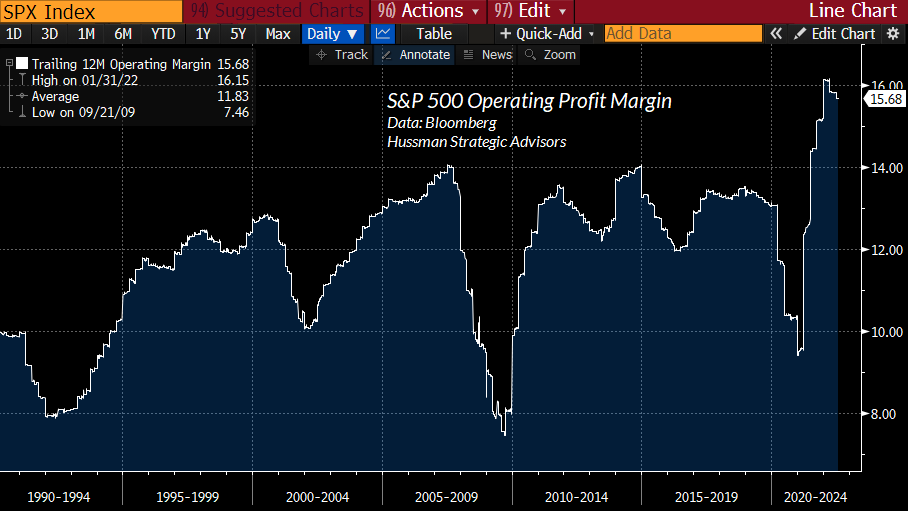

Given the debt levels, it will be much more difficult to reach

Best practices are meant to be shared. That’s why we observe the market and then share our insights on what’s happening, to give you context. We’ve organized every blog into categories, so it’s easier for you to find the answers that matter most to you.

Typically stocks bottom well after the first interest rate cut, which may much longer than investors realize.

Given the debt levels, it will be much more difficult to reach

The standard equity and bond allocation has been disastrous in 2022.

Investors who do not manage risk and drawdowns, have challenging compounding consequences.

Despite the extremes in historically reliable valuation measures, we can be certain of one thing: investors don’t care. They never do at market extremes. If they did, the financial markets

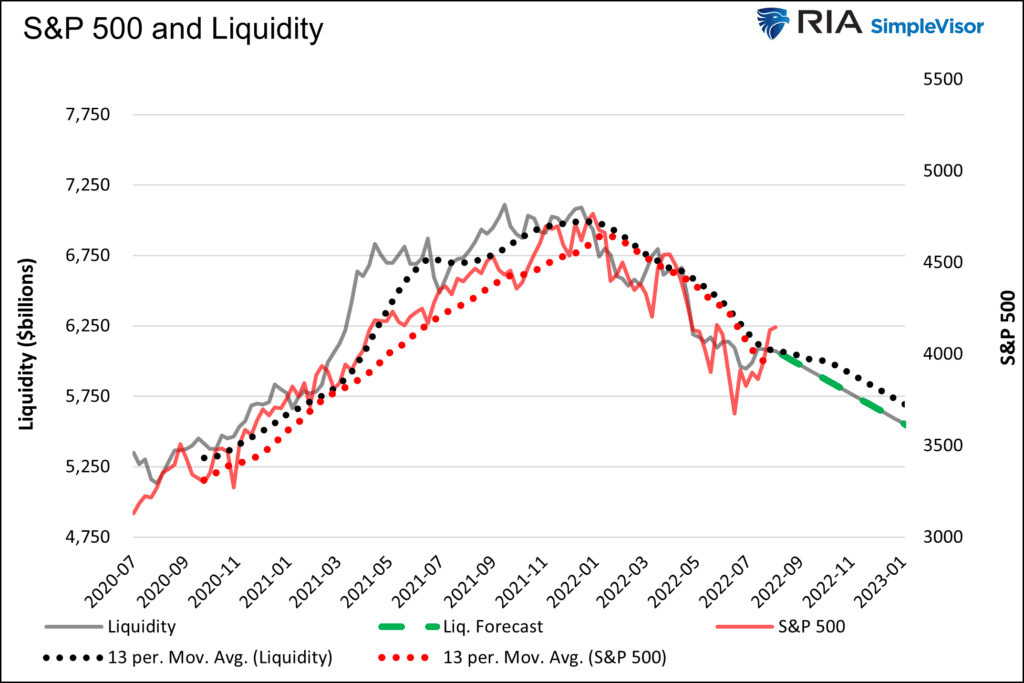

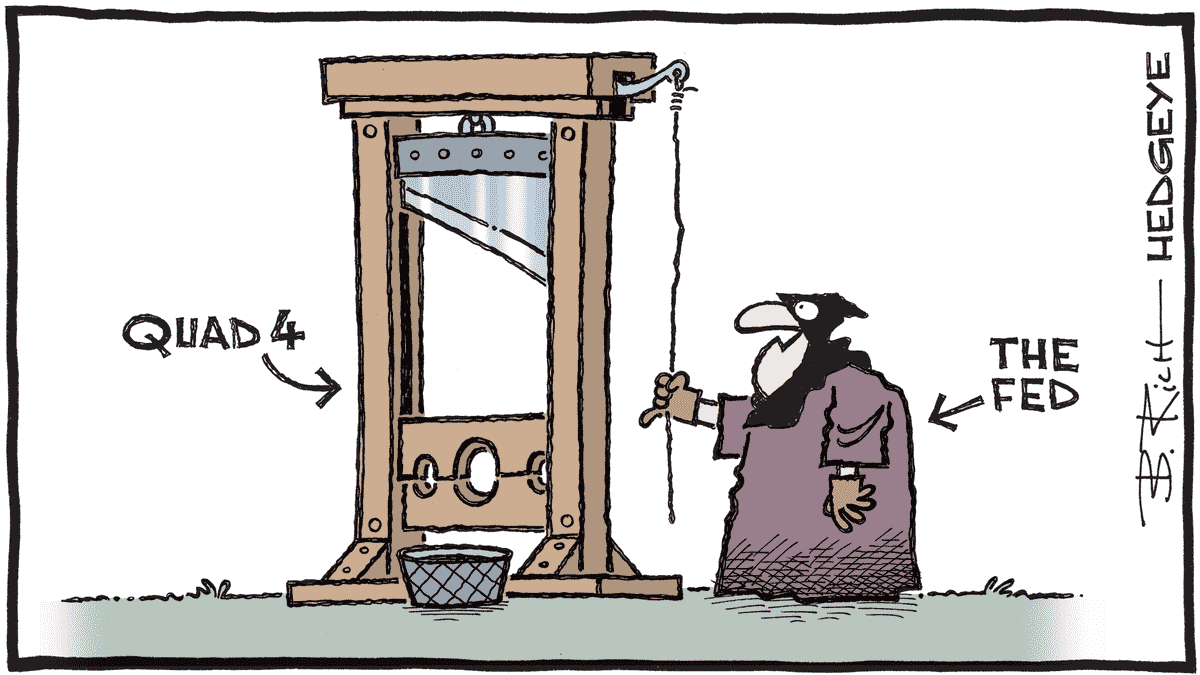

The Fed may benefit from adding QT and liquidity management to its interest rate tool, but this will likely be a direct hit on the stock market….

A healthy market and economy can’t continue for long without access to ample credit. The Bank stocks have been underperforming for well over 3 years. Far longer than they did

What has become clear over the last month is that while central banks have been raising rates to contain inflation, the growth outlook has continued to deteriorate. Of key importance

This is a challenging overall negative atmosphere, but there will always be rewarding proactive cyclical opportunities to grow wealth. A Best Investor approach with careful risk management techniques provides the

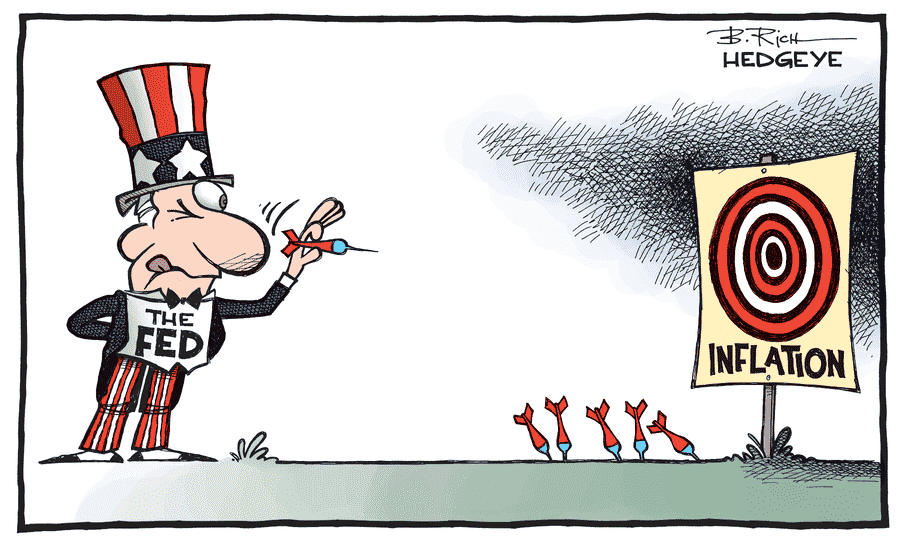

Although the Fed admits they have little understanding about inflation they believe they are now fully on it.

At the same time as they are tightening aggressively to contain

“The way you create deflation is you create an asset bubble. If I was ‘Darth Vader’ of the financial world and decided I’m going to do this nasty thing and

Invest Like The Best reveals the proven strategies of the world’s top investors, showing you how to achieve higher returns with lower risk through disciplined, data-driven decision-making. If you’re ready to break free from conventional, flawed financial advice and take control of your wealth with transparent, repeatable best practices, this book is your roadmap to smarter investing.