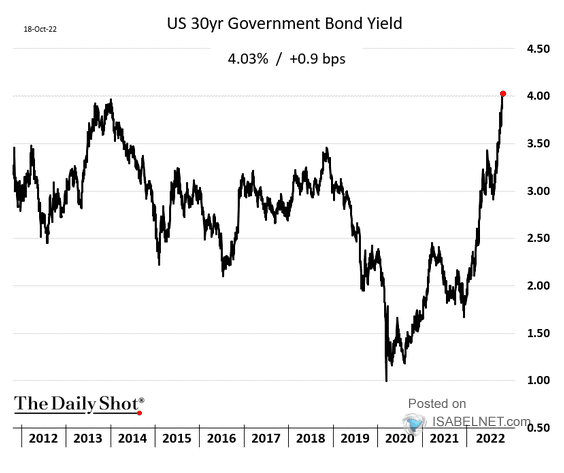

Pricing In Peak Cycle Interest Rates and Inflation. Gold Begins to Outperform Equities.

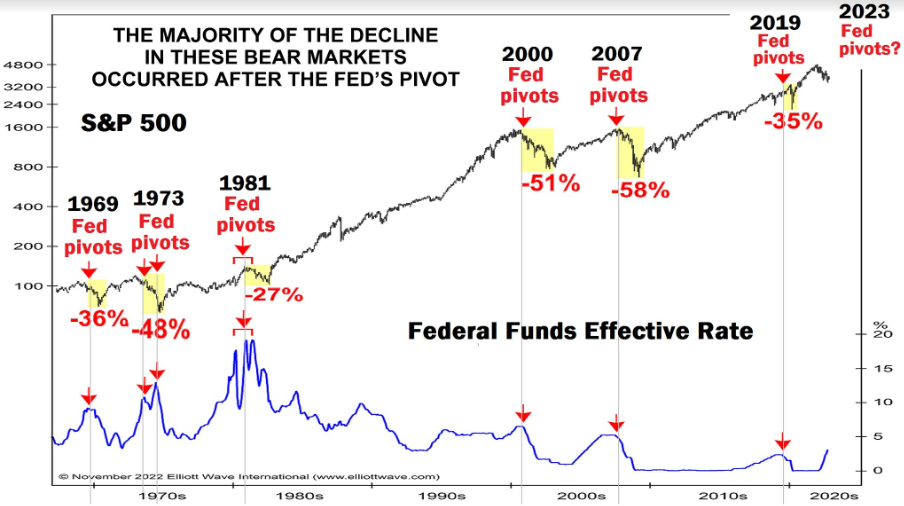

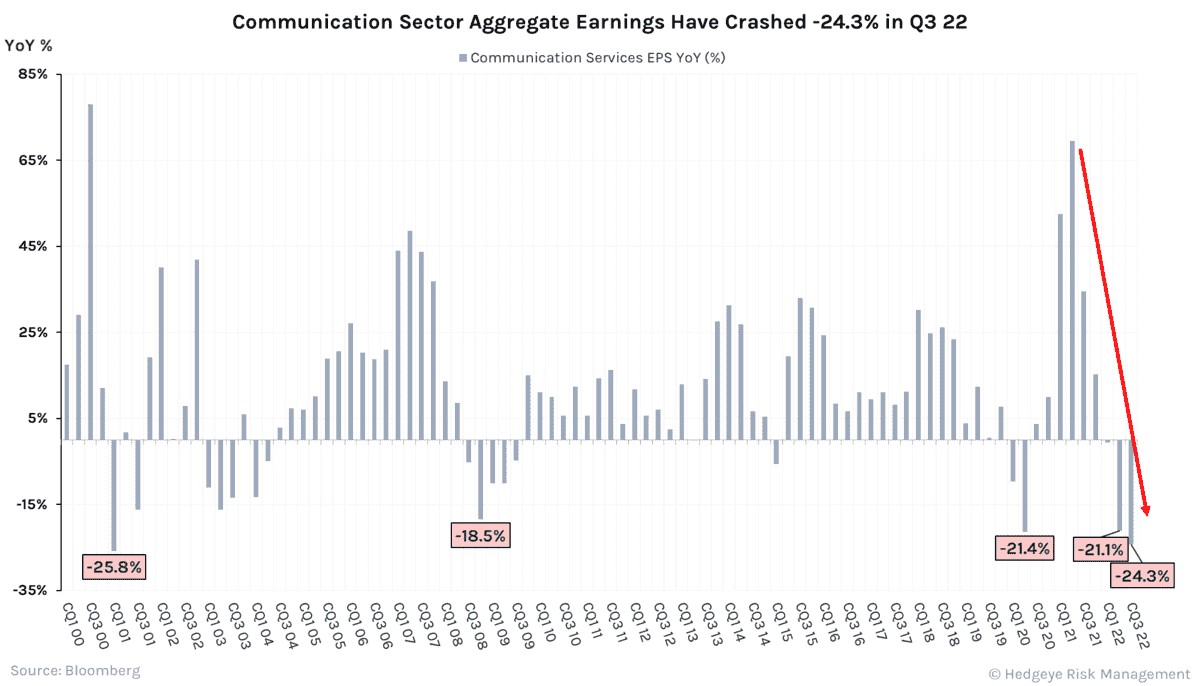

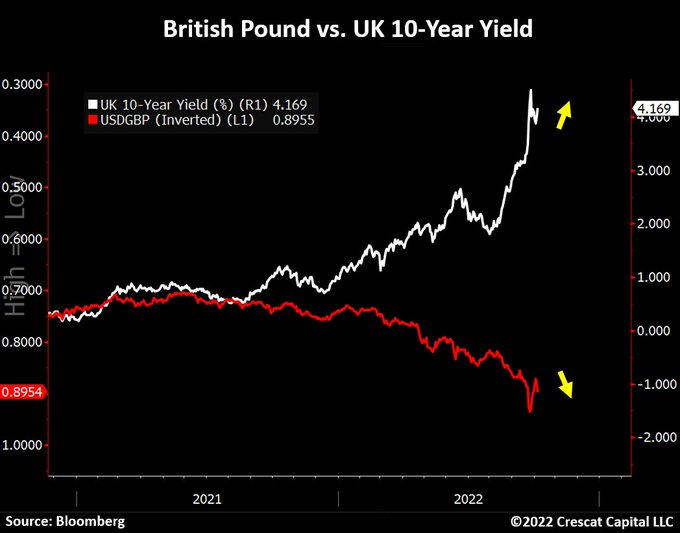

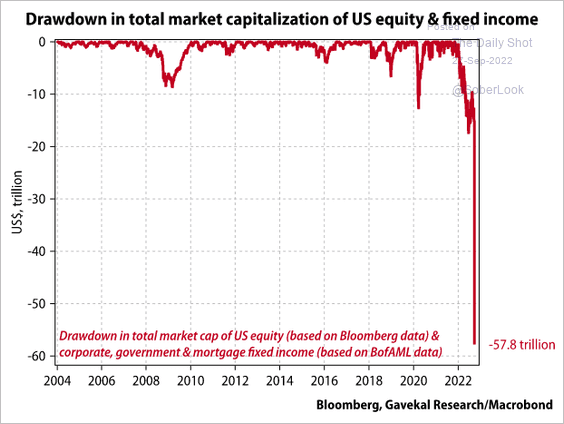

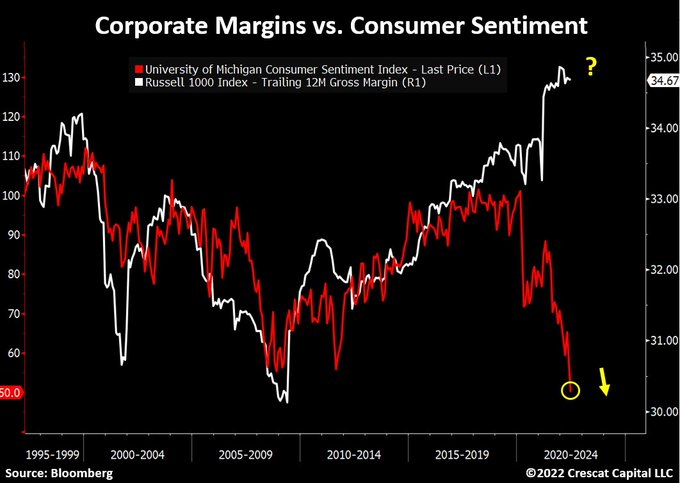

The equity rally since October can be attributed to peak cycle inflation and improving interest rates prospects. These are necessary but insufficent conditions for a durable equity market rally. Corporate