Next Shoes To Drop. Credit Crunch Then Growth Speed Limit.

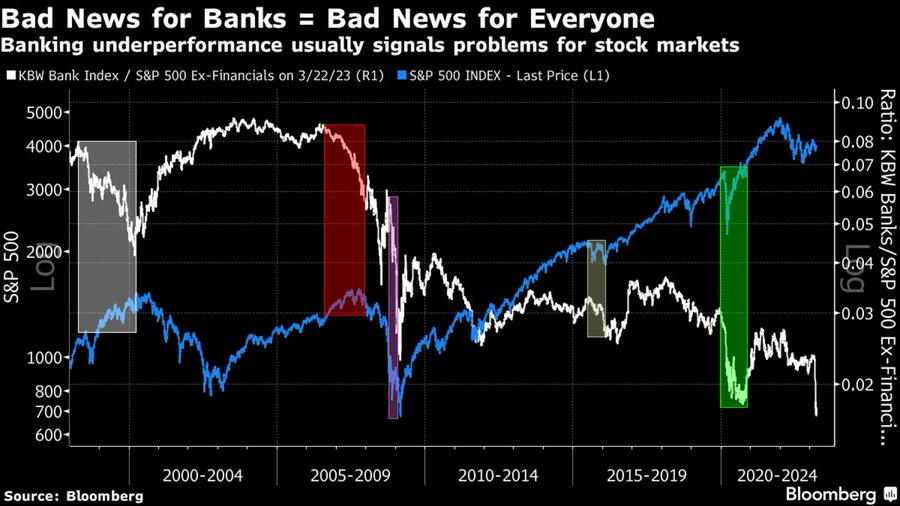

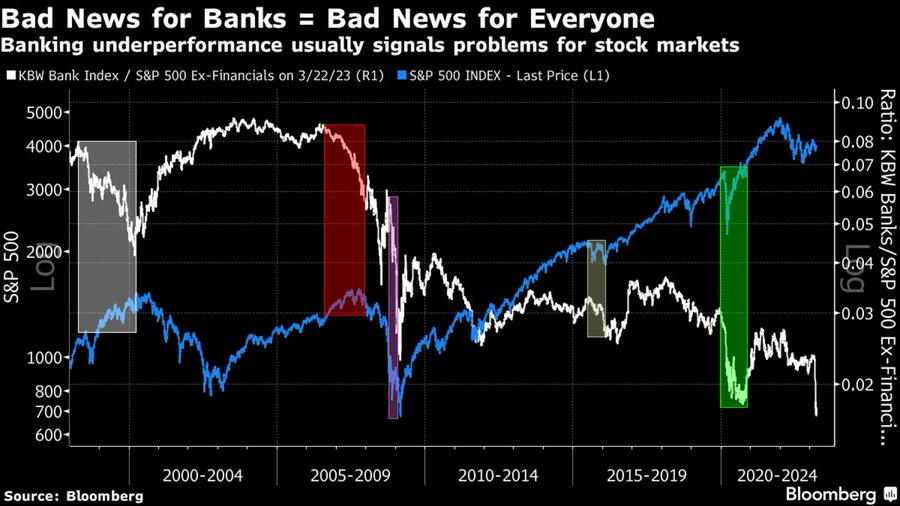

With the regional bank ETF trading at its 52 week lows, it is clear that the banking crisis is far from over, and this is also the view of Jamie

Best practices are meant to be shared. That’s why we observe the market and then share our insights on what’s happening, to give you context. We’ve organized every blog into categories, so it’s easier for you to find the answers that matter most to you.

With the regional bank ETF trading at its 52 week lows, it is clear that the banking crisis is far from over, and this is also the view of Jamie

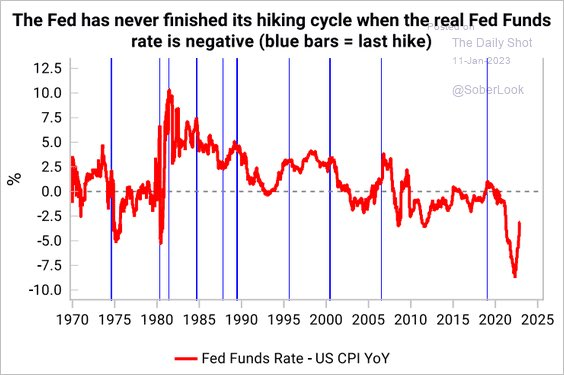

On Wednesday afternoon, March 22, Fed chair Powell and Treasury Secretary Yellen decided to continue business as usual. Powell raised interest rates to contain inflation, perhaps for the last time

The recent divergence between the real yield and the forward P/E is a red flag for US equities. The forward PE Ratio has never been this high compared to real

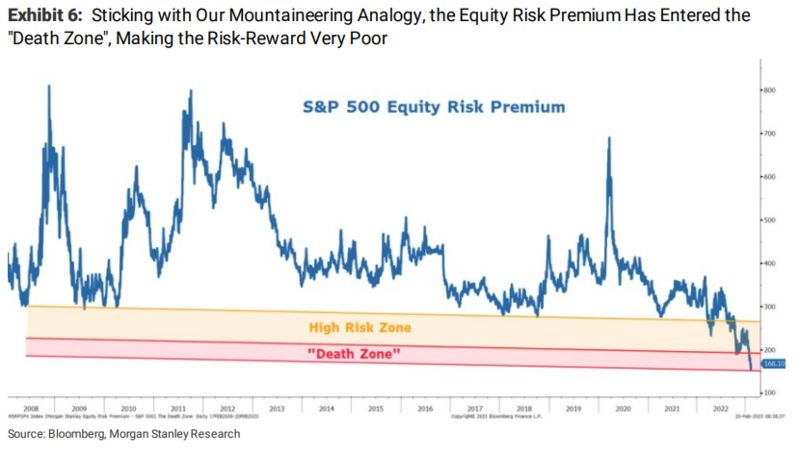

The divergence between bond yields rising and earnings yields falling has driven the S&P 500 Equity Risk Premium to extremes beyond 2008 levels into the clearly defined 110 year “death

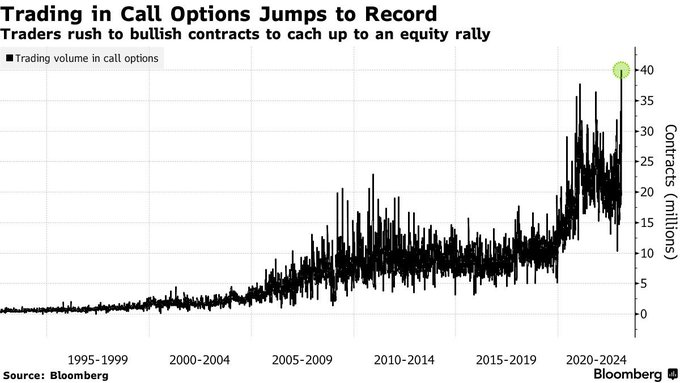

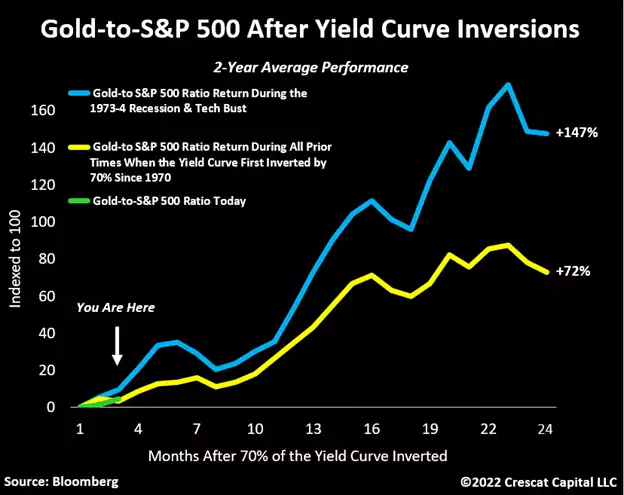

Interest rate markets have since reverted to the Fed script but stocks remain near recent highs. For how long can economic trends and conditions which historically have reliably proved to

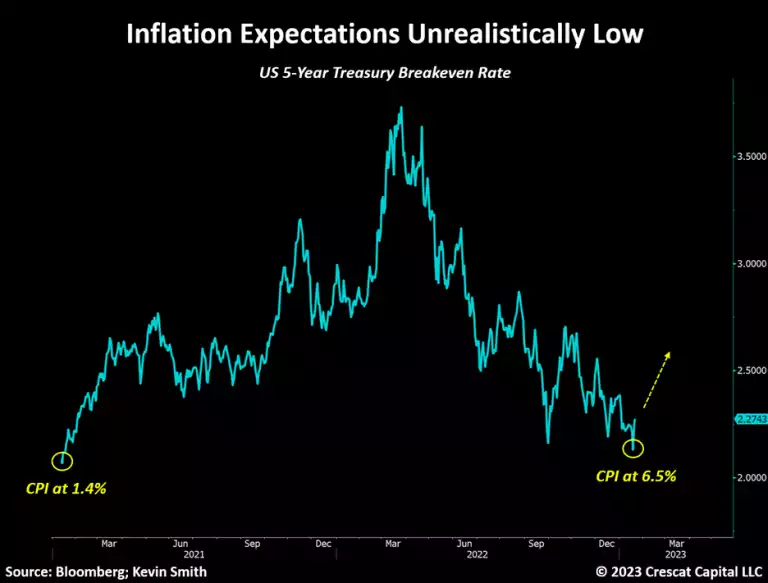

If Central Banks end tightening too soon this raises the risks of higher inflation for longer. There are also some other key additional risks that could get in the way

The current rate cut pivot mania, where immediate rate cuts and higher asset values follow in short order, seems to be out of line with current policy statements and longer

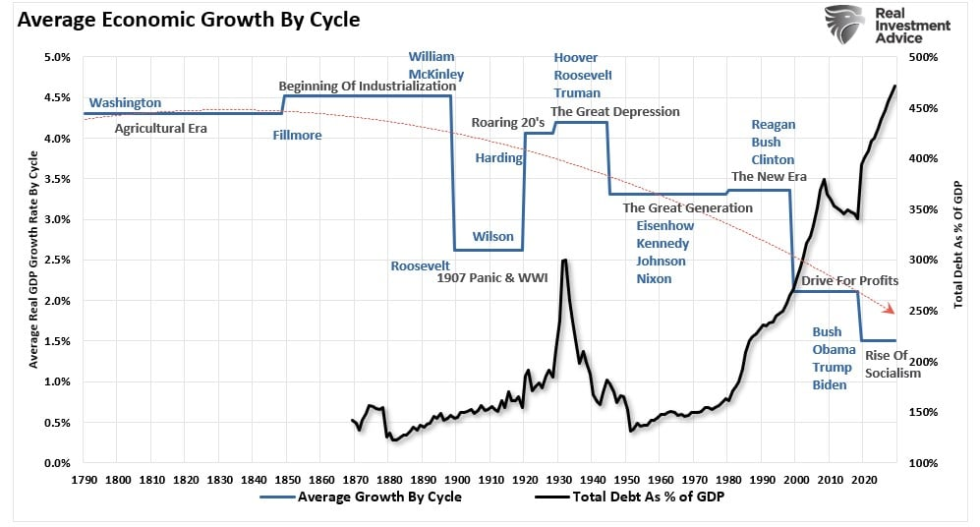

In recent years the Federal Reserve has been alternating between opposite extremes in policy. An expanding debt trap comes with ever more violent cycles. How can investors manage this optimally?

With a recession likely dead ahead, the focus will quickly shift to not only how deep the recession will have to be to get to the inflation target, but also

Invest Like The Best reveals the proven strategies of the world’s top investors, showing you how to achieve higher returns with lower risk through disciplined, data-driven decision-making. If you’re ready to break free from conventional, flawed financial advice and take control of your wealth with transparent, repeatable best practices, this book is your roadmap to smarter investing.