“Over half of FDIC insured banks are now insolvent when properly valued on a mark-to-mark basis.“

Larry Kotlikoff

“Banking stands revealed as a part of the state masquerading as part of the private sector. At the least, it needs to be far more robust. Ideally, it would be radically transformed.”

Martin Wolf

“Too-big-to-fail institutions have not disappeared. Big banks are bigger, small banks are fewer, and the financial system is less stable.”

Jeb Hensarling

“Too Small To Not Fail”

Danielle DiMartino Booth

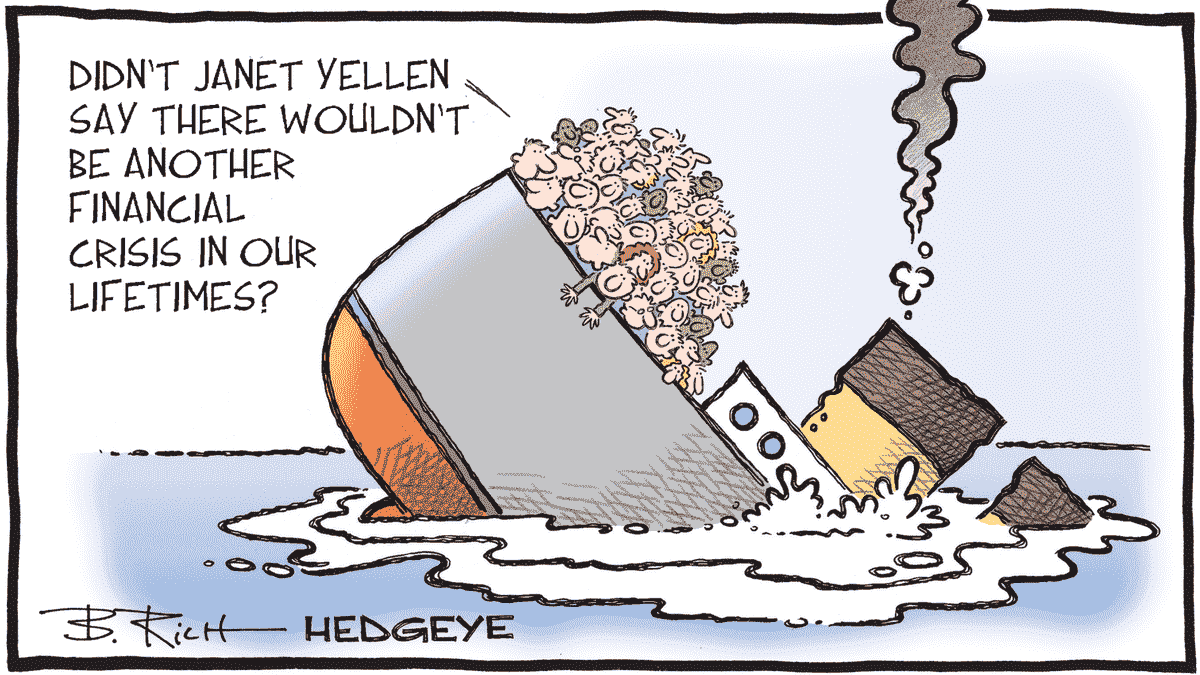

On Wednesday afternoon, March 22, Fed chair Powell and Treasury Secretary Yellen decided to continue business as usual. Powell raised interest rates to contain inflation, perhaps for the last time in this cycle, while Yellen announced she is not considering blanket bank deposit insurance. Is the banking crisis over? Or have they run out of options and new ideas?

A seachange in the economic environment has emerged with an explosion in the budget deficit and the rise in the cost of interest on debt, resulting from inflation.

A Sovereign Debt Crisis Is Emerging

Sovereign credit risk has blown out to new highs.

Banks Have Suddenly Been Hit By A Whole Range Of Problems

So it is no surprise that instability is the result, and bond market volatility (move) has risen to the highest levels since 2008.

This has created havoc to the ever growing bank balance sheets and their awkward time and maturity mismatches.

That is serious enough but it is just the start of their problems. Small banks have already been consistently dieing over the last twenty years.

Cost and Competition For Deposits

It will be increasingly challenging for smaller banks to compete profitably for their core capital which is deposits. Treasury bill yields have risen significantly, so have become highly competitive. This means that to get deposits they need to pay more interest which is a further hit to earnings. Small bank are at an additional disadvantage if they are considered higher risk.

Small banks have also been paying higher rates for reserves (borrowed from bigger banks awash with deposits).

Did banks follow Powell hand-over-foot into Treasuries and mortgage-backed securities? We know they did. They had little choice. You can clearly see on the charts the spike in the trajectory of these holdings after the pandemic flash recession.

Another problem that will hit this year is that Commercial Real Estate loans are in trouble and may soon need a resolution. The small banks have the lion share of the exposure.

If that was not enough, delinquency is just now breaking out to multi decade highs in a range of other debt. This data is from before the current crisis.

Overall, American consumers are not feeling upbeat about their financial situation. This looks like the beginning of the downside of a credit cycle. That is not good for banks!

Understand The Scale Of The Problem

The issues are not just limited to the small banks. The big banks have a different profile, but another problem. Note that Credit Suisse was one of the world’s biggest banks.

“The five banks labeled “too big to fail” have $188 trillion in derivatives. The brutal fact is that 5 US banks have risk exposure that is twice the size of the GDP of the entire world. It is incomprehensible that 5 US banks have sufficient capital to back derivative bets that are twice the size of world GDP.”

Llewellyn Rockwell

Depositors need to understand that they are a part of a bank’s capital structure. What security does a depositor really have?

“FDIC insurance covers about $9.8 trillion of deposits, but the institution has assets of only $126 billion. That’s about one cent on the dollar. I’ll be surprised if the FDIC doesn’t go bust and need to be recapitalized by the government. That money—many billions—will likely be created out of thin air by selling Treasury debt to the Fed.” Doug Casey

Then There Is Another $9 Trillion Of Uninsured Deposits

Bank Deposit? Or Treasury Bills?

The main benefit of banking is the usefulness of the income and expense payments system. That is what banking used to be. Now technology has improved deposit mobility, interest rate competition has increased, and deposits have become part of a much wider and leveraged asset structure.

The risk and return equation has changed significantly. Beyond the capital needed to manage payments why would you prefer bank deposits to higher yielding Treasury Bills?

Last October I also pointed out that a good brokerage account not only had more flexibility and options, but was also was safer than a bank account. Interactive brokers offers attractive interest on cash balances.

Also, the stock price is substantially outperforming banks.

“Best Investor” Standards Safeguard Optimal Investing

In order to optimize opportunities safely, investors need to be set up with the most productive framework possible. Why not adopt the methodology of the most successful investors of all time? They all ended up embracing their own version of “Capital Preservation and Compounding”. You can find out why here.

The great additional advantage of “Capital Preservation and Compounding” is its clear definition. Just 5 metrics which can be illustrated in the Risk/Return Performance grid tell you in seconds how well you are doing.

Raise your accountability, transparency, understanding and control of your investing in real time by having access to this information.

Transform Your Investment Experience

The room for policy manoeuvre, and the stability of the current system should not be taken for granted. Volatility has increased and is likely to continue to stay high. The outlook has rarely been this uncertain. Investment management needs “Best Investor” metrics and techniques as never before.

Market and economic events are moving fast at this stage. If you need a quick review of the issues that you may need to know about for your own circumstances, schedule a FREE consultation today.

Please note these important disclaimers: Educational use Only. The market update published by CB Investment Management, LLC (“CB Investment”) is intended to be educational in nature and is not intended to be a recommendation for any specific investment product, strategy, plan feature or other purposes. Accordingly, it should not be construed by any consumer and/or prospective client as solicitation to effect, or attempt to effect transactions in securities, or the rendering of personalized investment advice for compensation.Advertising and Marketing. Communications such as this are not impartial and are provided in connection with advertising and marketing. This material is not suggesting a specific course of action or any action at all. Prior to making any investment or financial decisions, an investor should seek individualized advice from a personal financial, insurance, legal or tax professional that takes into account all of the particular facts and circumstances of an investor’s own situation. No person associated with CB Investment is a licensed attorney or tax professional and the information contained herein should not be considered tax or legal advice. Links to Third Party Content. This Market Update contains links to articles or other information maintained by unrelated third parties. You acknowledge and agree to the following: All such information is provided solely for convenience purposes only because we believe that it may provide useful content and all users thereof should be guided accordingly. We disclaim any responsibility for the link’s performance or interaction with your computer, its security and privacy policies and practices, and any consequences that may result from visiting it. We do not control the content published by the third-party; we do not guarantee any claims made on it, nor do we endorse its sponsor or any of the content, policies, activities, products or services offered by any advertiser on the site. CB Investment assumes no liability for any inaccuracies, errors or omissions in or from any data or other information provided by the third party and inclusion or reference by CB Investment to any third party link should not be construed by any consumer and/or prospective client as a solicitation to effect, or attempt to effect transactions in securities, or the rendering of personalized investment advice for compensation, over the Internet.

Important Information regarding Registration Investment advice is offered through CB Investment Management, LLC (“CB Investment”), 8231 Crestwood Heights Drive, Mclean VA 22102 an investment adviser registered with the states of Virginia and Maryland. Registration with the states of Virginia and Maryland should not be construed to imply that the SEC has approved or endorsed qualifications or the services offered, or that its personnel possess a particular level of skill, expertise or training. Important information and disclosures related to CB Investment are available at https://old-site.chris-belchamber.com.