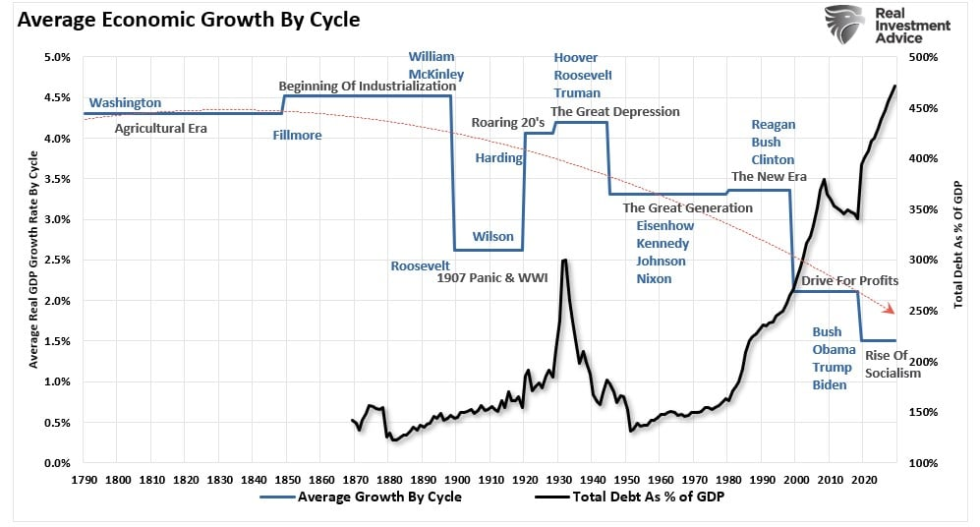

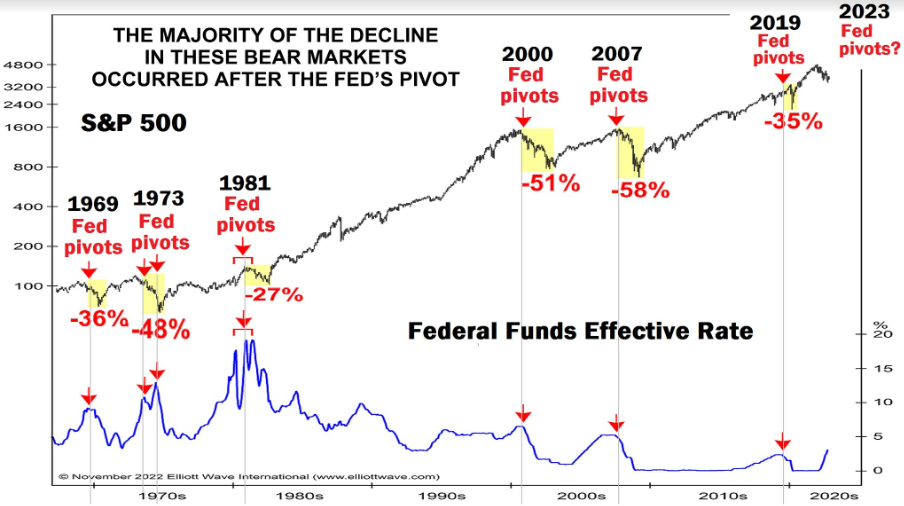

Dominating Debt Dynamics

With a recession likely dead ahead, the focus will quickly shift to not only how deep the recession will have to be to get to the inflation target, but also

Best practices are meant to be shared. That’s why we observe the market and then share our insights on what’s happening, to give you context. We’ve organized every blog into categories, so it’s easier for you to find the answers that matter most to you.

With a recession likely dead ahead, the focus will quickly shift to not only how deep the recession will have to be to get to the inflation target, but also

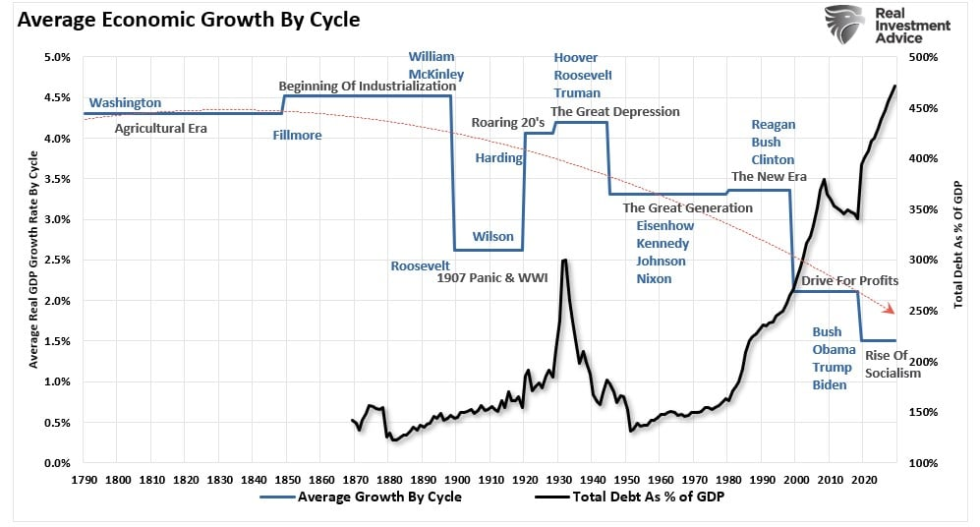

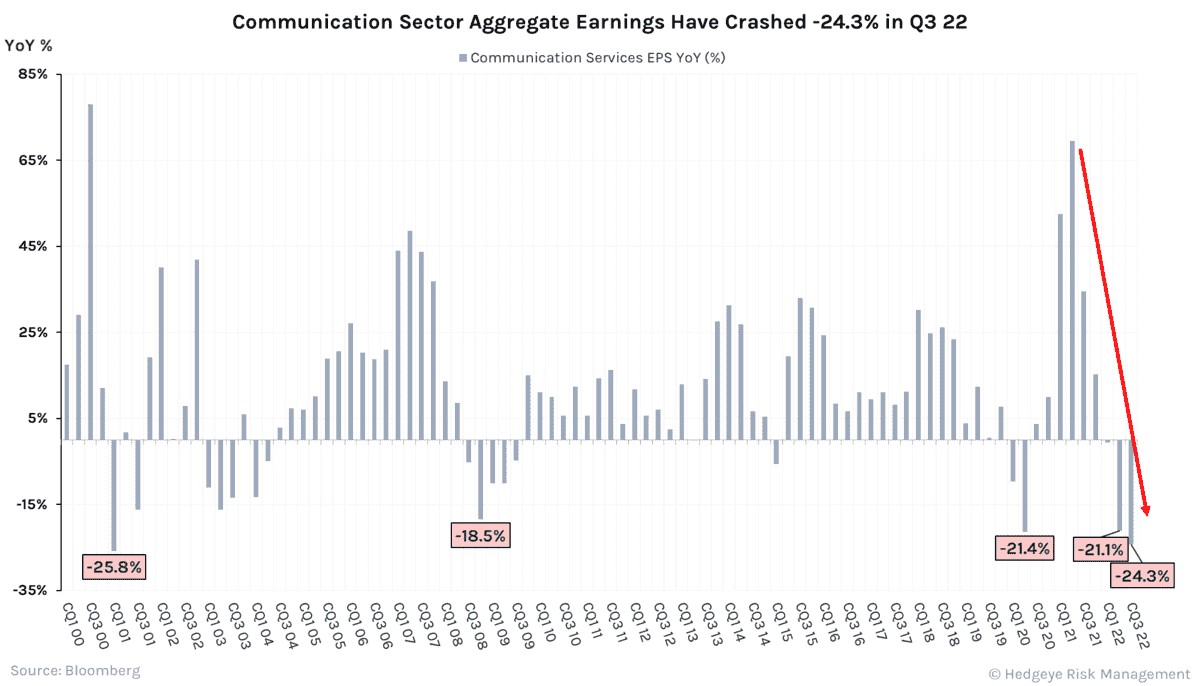

The equity rally since October can be attributed to peak cycle inflation and improving interest rates prospects. These are necessary but insufficent conditions for a durable equity market rally. Corporate

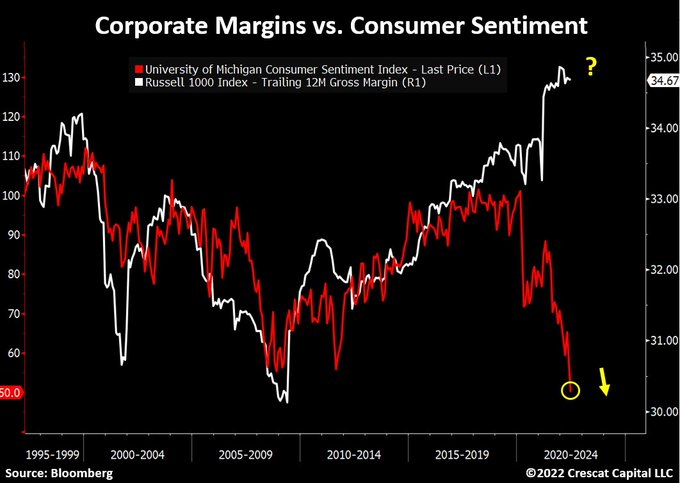

Check you premise and question short term market behavior. The pivot obsession seems to be a temporary market factor. Guessing the timing of the interest rate pivot on each data

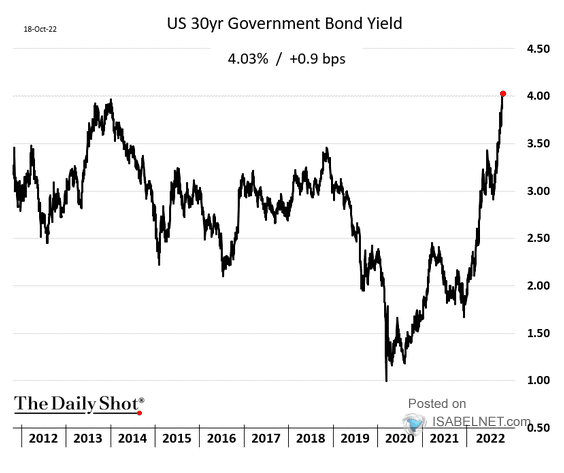

Investors need to be aware that declining rates of change in both inflation and growth is the worst environment for equities, equities are at historic extremes relative the government bonds,

Misinformation and cycle blindness seem to be dominant dangers for market participants. The charts below show there should be no confusion about the downcycle in growth, which is being reinforced

The under 55 US population fell 20m in the last 10 years,

Lower Productivity lowers growth raises inflation,

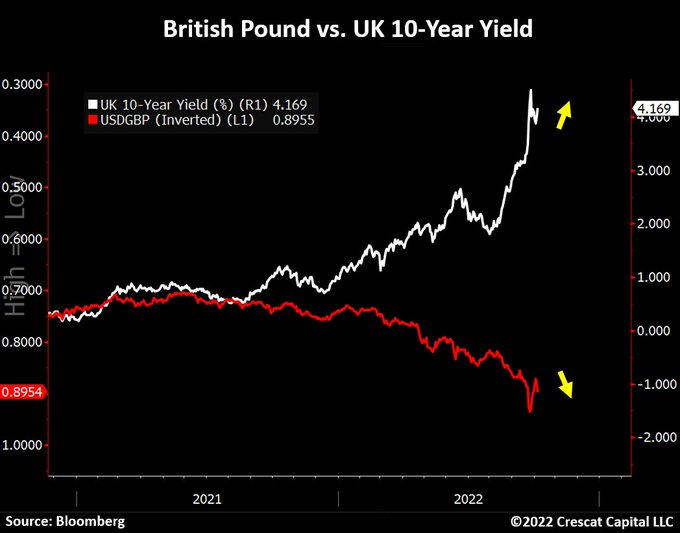

Tension Between Fiscal and Monetary Policy ….. US Treasury role

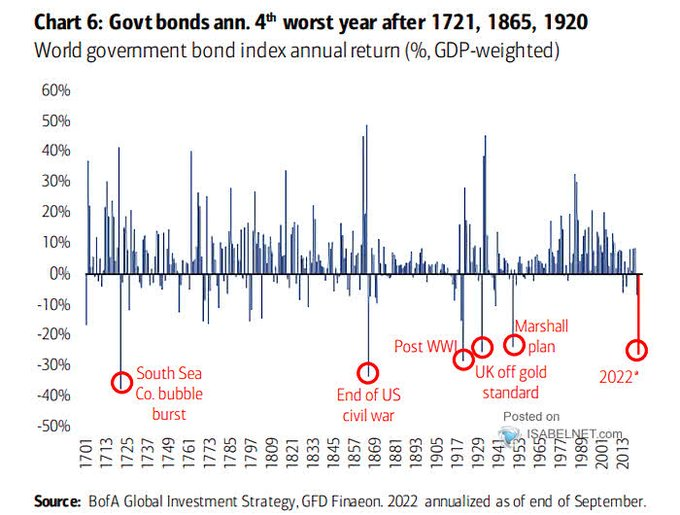

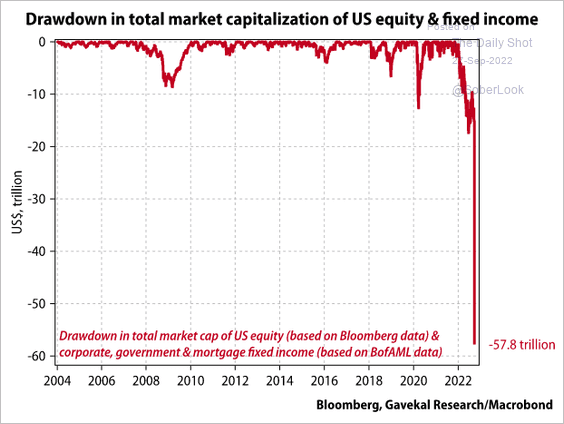

The debt, growth, inflation, asset purchase, interest rate policy is becoming harder and harder to reconcile into an acceptable economic situation and debt is likely to become a growing key

“You might be shocked to learn that “your” money in your bank account is not actually yours. When you place money in a checking, CD, or savings account at the

Government Insolvency is now in play.

Long Term Government Bonds are becoming uninvestable.

How can you ever really enjoy and relax about your current wealth and investment future unless accountability to capital preservation is hard wired into everything you are doing? Capital preservation

Invest Like The Best reveals the proven strategies of the world’s top investors, showing you how to achieve higher returns with lower risk through disciplined, data-driven decision-making. If you’re ready to break free from conventional, flawed financial advice and take control of your wealth with transparent, repeatable best practices, this book is your roadmap to smarter investing.