Markets Signal A Collapse In Central Bank Inflation Credibility

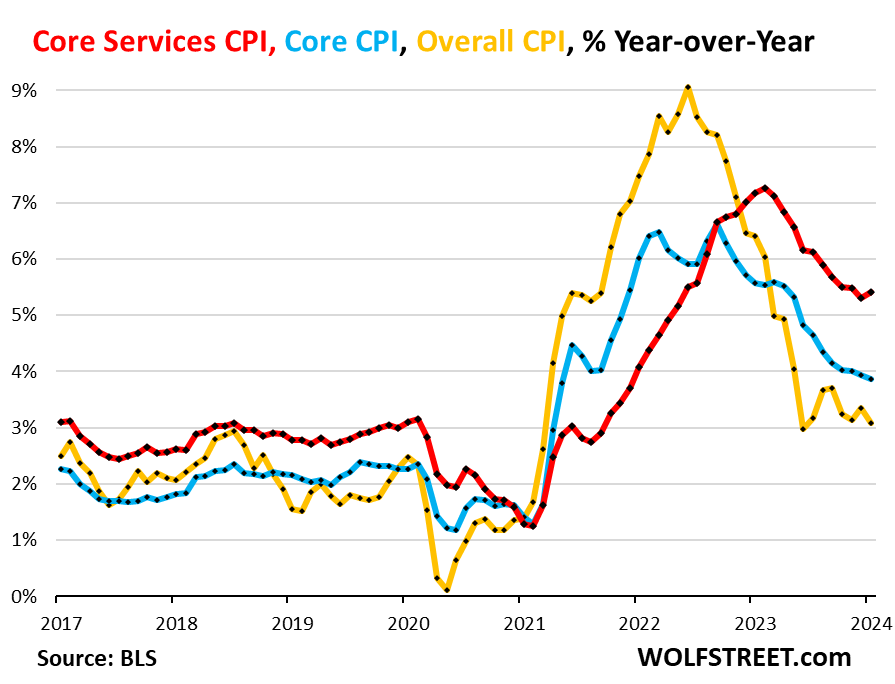

“Despite inflationary pressures pervasive in the economy, we are witnessing what might be described as the most undisciplined monetary and fiscal environment in history.”

Best practices are meant to be shared. That’s why we observe the market and then share our insights on what’s happening, to give you context. We’ve organized every blog into categories, so it’s easier for you to find the answers that matter most to you.

“Despite inflationary pressures pervasive in the economy, we are witnessing what might be described as the most undisciplined monetary and fiscal environment in history.”

Clearly, the benefits, costs and quality of Best Practice Financial Planning are not well understood. Done right, Financial Planning can often uncover significant resources, perhaps up to half your net

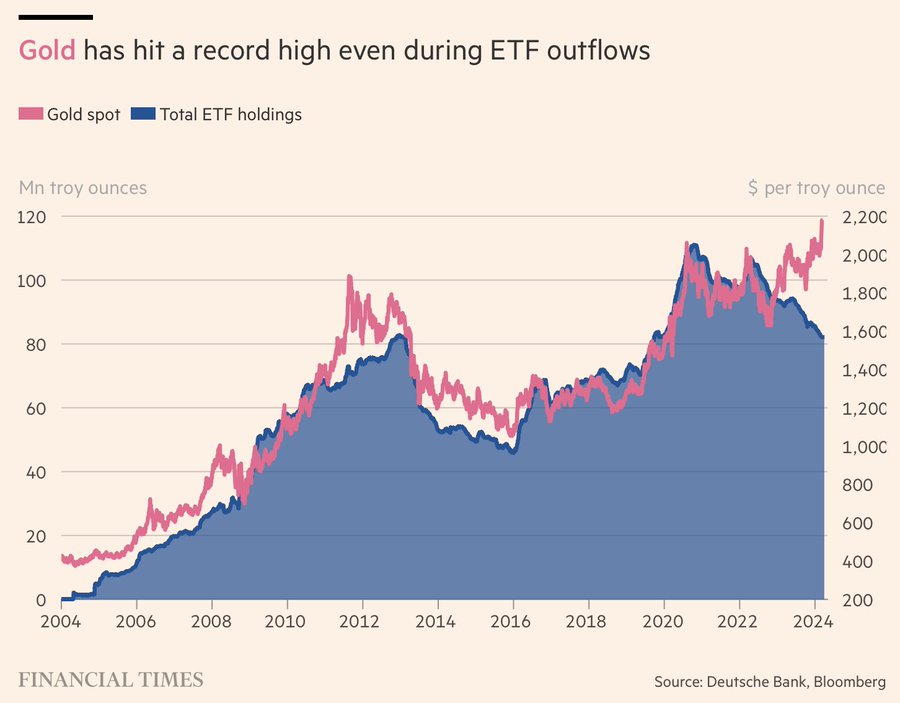

With our Stagflation trajectory firmly in play, has there ever been a better time to own precious metals? Check out the set up. The six cases for gold.

It

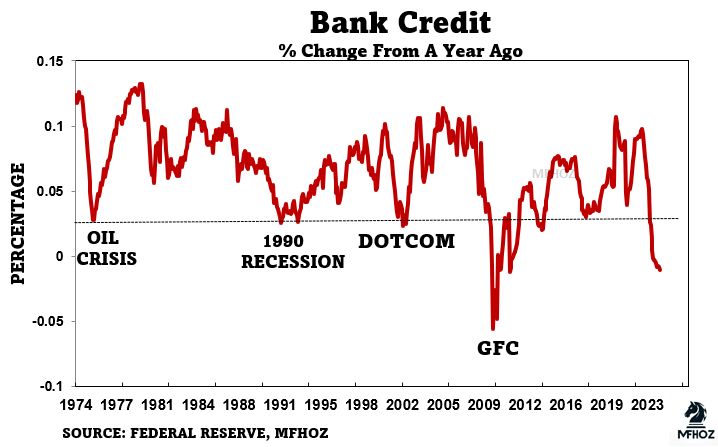

How you invest needs to adjust for the Policy Predicament. Not only has the Fed become part of the problem, but the scale of economic problem keeps getting bigger along

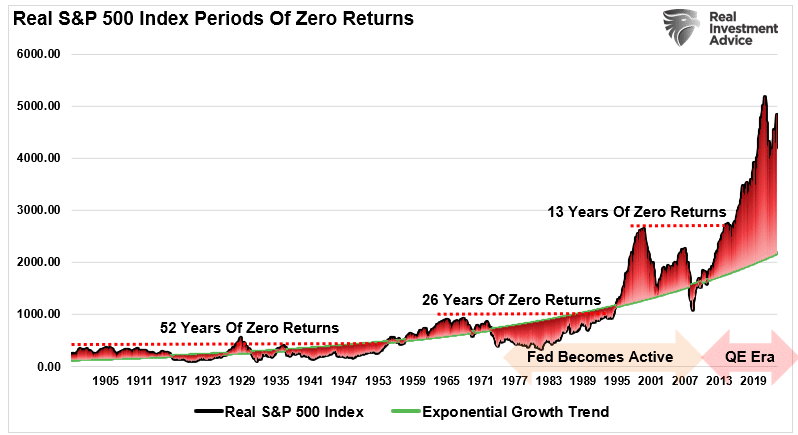

Stagflation is a major risk for equities and it’s easy to miss. Why? Because Keynesian policy on steroids initially produces the opposite short term results as described above. So far

Roth conversions are one of the most important financial decisions you will make. Make sure you do a thorough job and consult an Adviser that understands how to execute best

Inflation does not seem to be likely to sustainably reach the 2% target. At the same time there are new factor in relative value, and a new kind of globalization

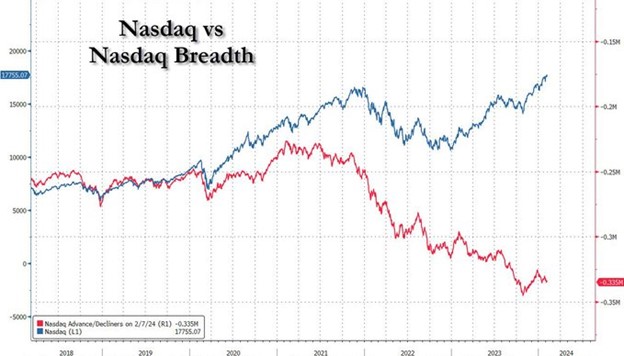

The current rally has created record divergence in performance of stocks. Massive liquidity flows, yet very weak earnings overall.

I hope you have a better understanding of what it means to have a Best Practice Financial Plan and what is often missed to guide you through the several steps

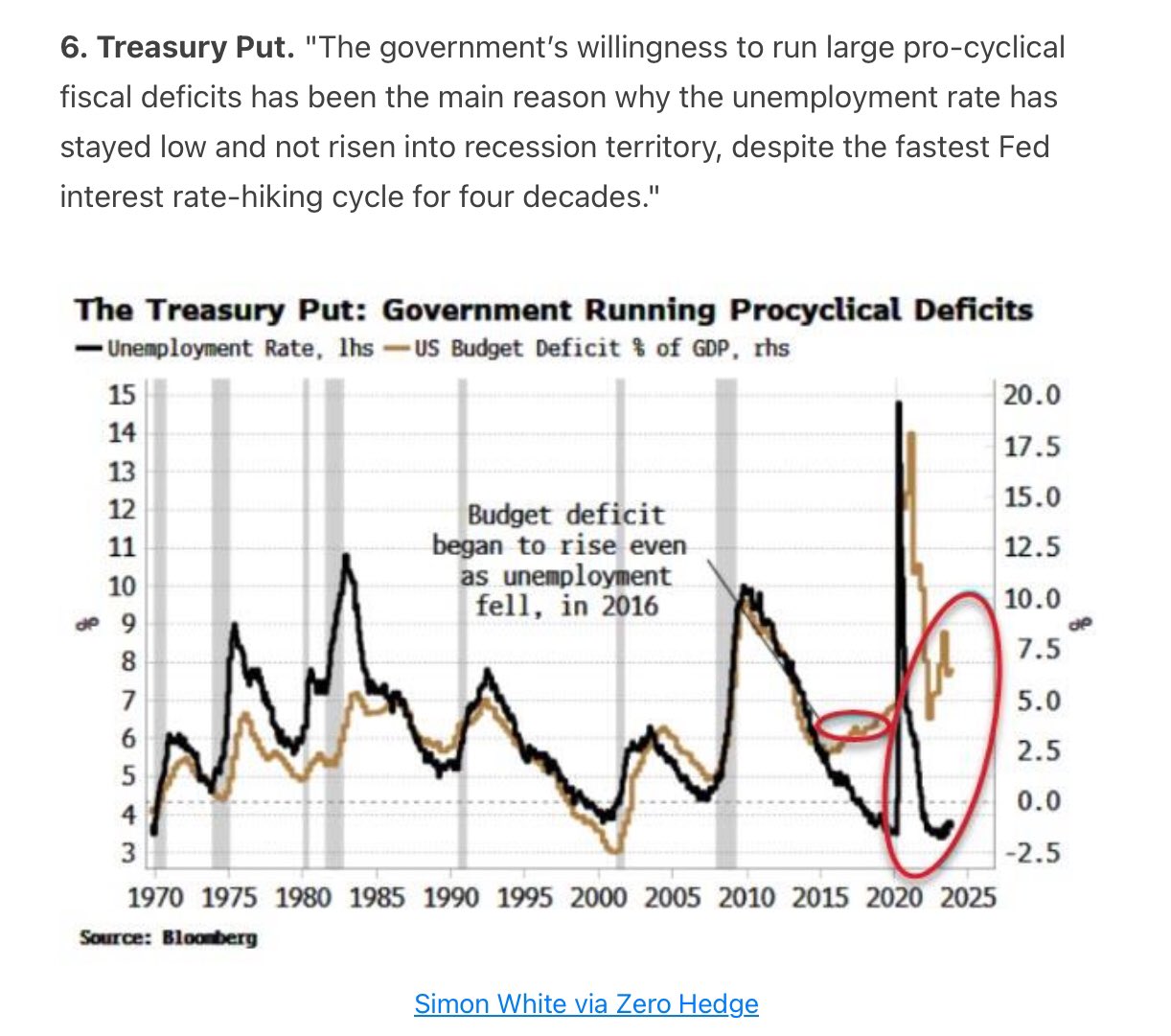

The market’s own measure of future inflation has reversed to the upside following the astonishing fiscal stimulus in the second half of 2023.

Invest Like The Best reveals the proven strategies of the world’s top investors, showing you how to achieve higher returns with lower risk through disciplined, data-driven decision-making. If you’re ready to break free from conventional, flawed financial advice and take control of your wealth with transparent, repeatable best practices, this book is your roadmap to smarter investing.