TIPS: The Benefits Of A Misunderstood Asset Class

The inflation dynamics are considered along with how TIPS have uniquely useful qualities in an allocation.

Best practices are meant to be shared. That’s why we observe the market and then share our insights on what’s happening, to give you context. We’ve organized every blog into categories, so it’s easier for you to find the answers that matter most to you.

The inflation dynamics are considered along with how TIPS have uniquely useful qualities in an allocation.

R-star policy thinking may lie at the heart of both the inflation predicament and also a major allocation opportunity.

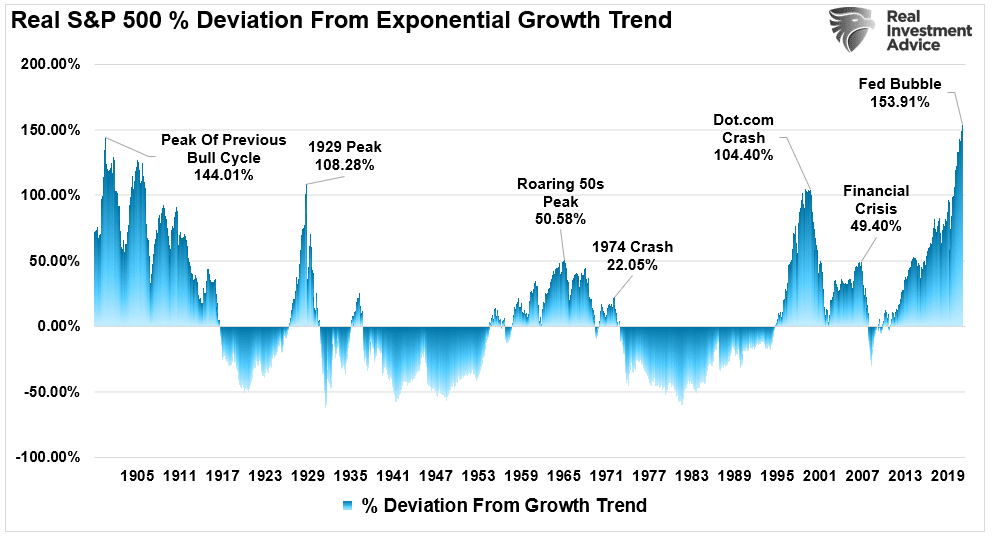

There are several components to the boom and now it looks like tightening financial conditions are coinciding with tightening fiscal conditions. That doesn’t unwind harmlessly because they want it to.

“The real problem for the Fed is that it has completely abandoned any semblance to a systematic policy framework, in apparent preference for a purely discretionary one. By relentlessly depriving

“If you push indexation to its logical extreme, you will get preposterous results” – Charlie Munger Passive equity investing dominated investing styles at the close of

Since the beginning of December this Insight has been talking about the emerging headwinds for the first half of 2022. It is as well to understand scale and depth of

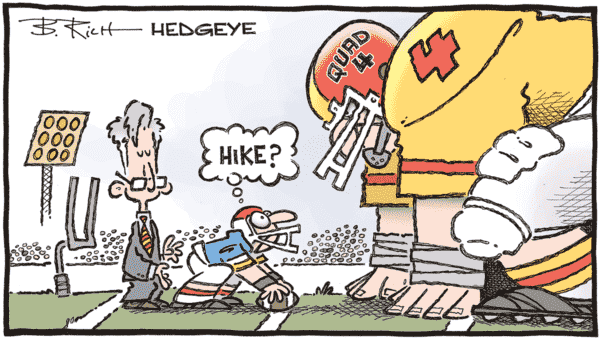

https://twitter.com/TaviCosta/status/1483554635222642689 A clear quad 4 (declining rate of change in both inflation and growth) market signal is gold outperforming equities. Investors should consider the probability of the data

The Most Reckless Fed Ever With A Continuing Contradiction. Serious About Inflation? So Why Does Extreme Easy Policy Continue? Even Fed Chairman Powell states this week, “it’s a

https://twitter.com/dlacalle_IA/status/1405803011419561985/photo/1 How money, credit, and the economy work together is key for long term investment success. The bottom line is that US economic policy has been accelerating in the

https://twitter.com/ISABELNET_SA/status/1475455511675949057 As Warren Buffett says, “Only when the tide goes out, do you discover who’s been swimming naked”. The correlation between stocks and the Fed’s balance sheet over the last

Invest Like The Best reveals the proven strategies of the world’s top investors, showing you how to achieve higher returns with lower risk through disciplined, data-driven decision-making. If you’re ready to break free from conventional, flawed financial advice and take control of your wealth with transparent, repeatable best practices, this book is your roadmap to smarter investing.