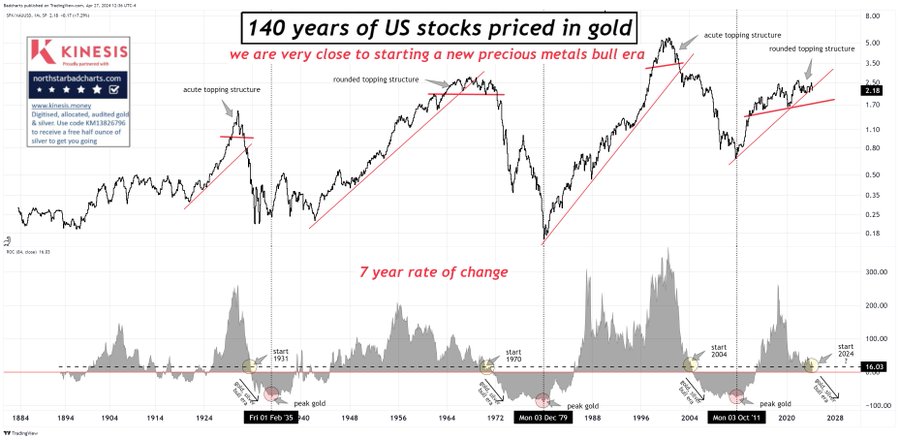

US investors have generally failed to understand the place of gold in their own portfolios. This could be a major error going forward. This event has happened only 3 times in the last 140 years.

“Gold is money. Everything else is credit.”

J P Morgan

“Gold has lasted as legal money, and credit has been separately acknowledged to be deferred payment in money since Rome’s Twelve Tables defined them and their relationship in 449 BC. Since then, there have been many instances of governments denying these facts and promoting their currencies in the place of gold, which have always ended in their collapse.”

Alasdair Macleod

Daniel Lacalle

“Good as Gold: How to Unleash the Power of Sound Money”

Judy Shelton (Book & Video Interview)

—————————————————-

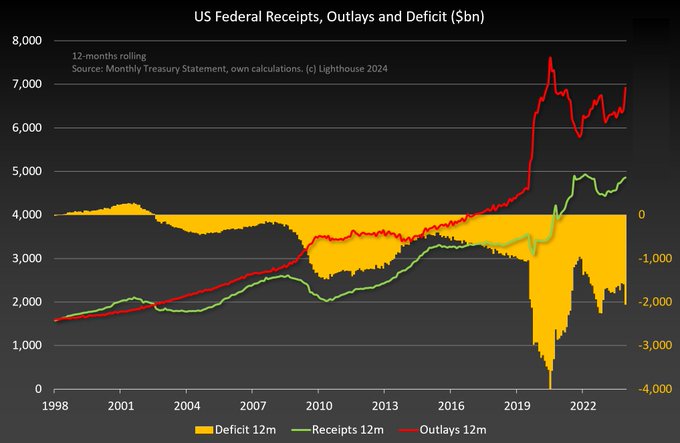

Fiscal and monetary policy recklessness is accelerating.

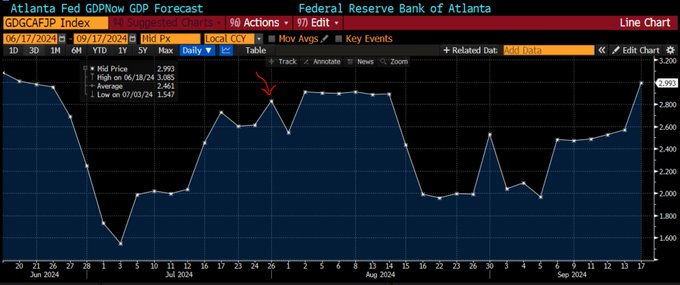

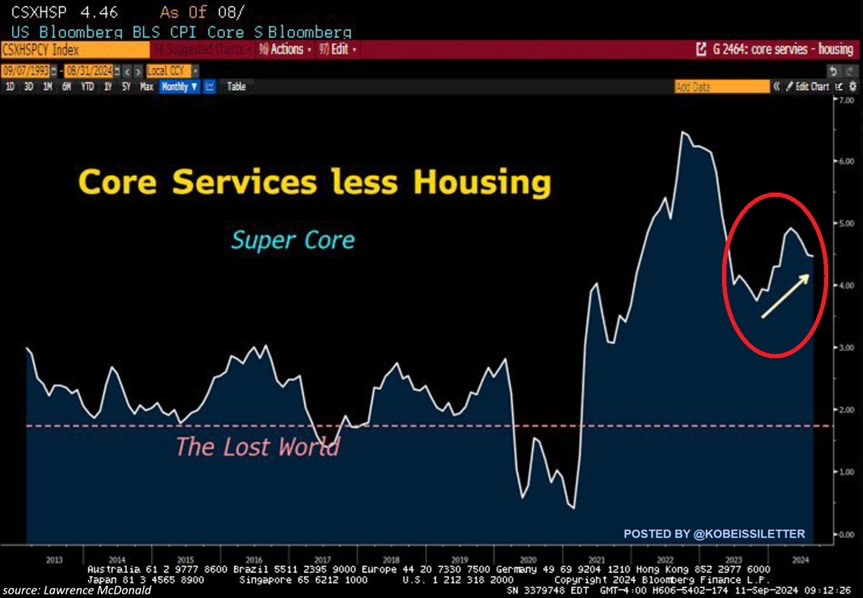

Last weeks interest rate cut is unprecedented interms of economic conditions when initiating an interest rate cutting cycle. The Budget Deficit in August breaks records, and puts the deficit further out of control. This spending offsets a private sector recession, and GDPnow rises to 3%. Meanwhile, supercore CPI is more than double the average prior to 2020, and the Stock market at all time highs!

So …. Let’s panic and cut interest rates!?

At least government interest payments will decline, and inflation will take care of the real cost of the budget deficit. However, that is a paradigm few are prepared for.

This is the recipe for a crack up boom. The US is on track for a similar result to all other attempts to leave a gold standard.

———————————————————————————————————

Policy is trapped and over time will likely have no option but to reinforce the attractiveness of gold

Gold has already been outperforming stocks and with lower risk. Gold’s outperformance will likely accelerate.

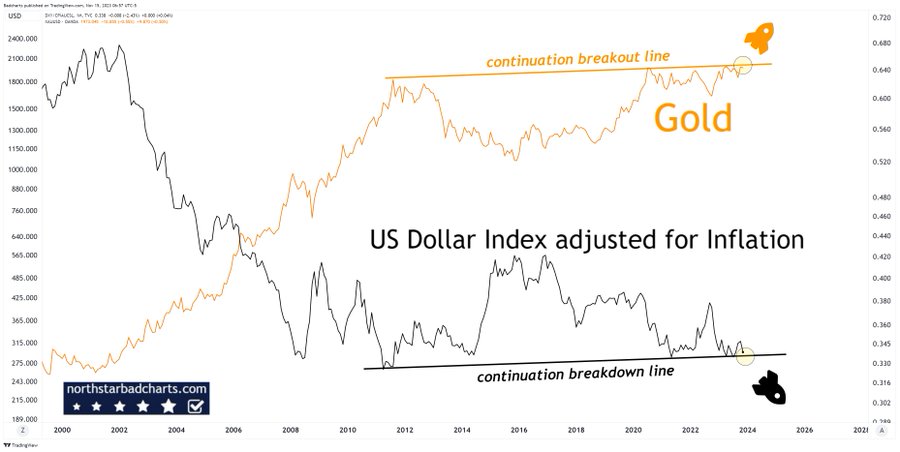

Gold may part ways not only with equities but also with the US dollar

Gold is breaking out relative to the CPI

Silver may also perform exceptionally well.

Central bank purchases have led the rally in gold and will continue. Asset management allocations have been left far behind and will have to catch up.

————————————

Most investors have failed to understand gold as an allocation. Three videos lay it all out.

The scale of the move we could see in gold.

Gold is replacing the dollar as a reserve asset.

Gold’s role as money may need to return to restore financial order.

——————————————————

Deficit in August breaks records, deficit further out of control.

This offsets a private sector recession, GDPnow rises to 3%.

Supercore CPI more than double the average prior to 2020.

Meanwhile, the Fed is going to cut rates for the first time since 2020.. Premature rate cuts may trigger a resurgence of inflation and worsen affordability. However, a lack of cuts could cause unemployment to rise further which is already near 3-year highs. Is the Fed in a lose-lose situation?

The stock market is at all time highs too. As we showed before that has never led to the start of an interest rate cutting cycle.

So …. Let’s panic and cut interest rates anyway.

At least government interest payments will decline, and inflation will take care of the real cost of the deficit?

This is the recipe for a crack up boom and higher long term inflation.

————————————

Gold has already been outperforming stocks over the last 3 years and with lower risk. Gold’s outperformance will likely accelerate.

Gold is breaking out relative to the CPI

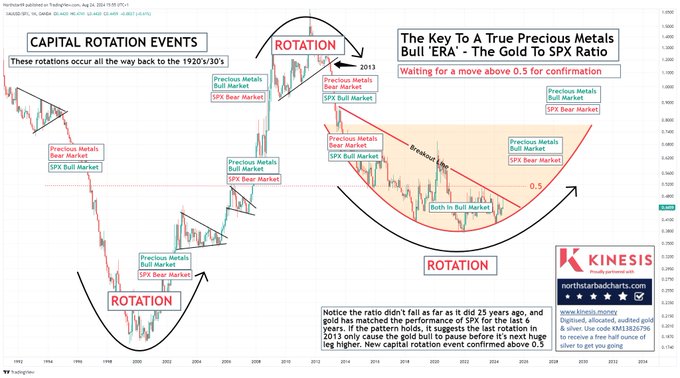

Gold versus the S&P 500 has the potential to explode higher.

Gold may part ways not only with equities but also with the US dollar

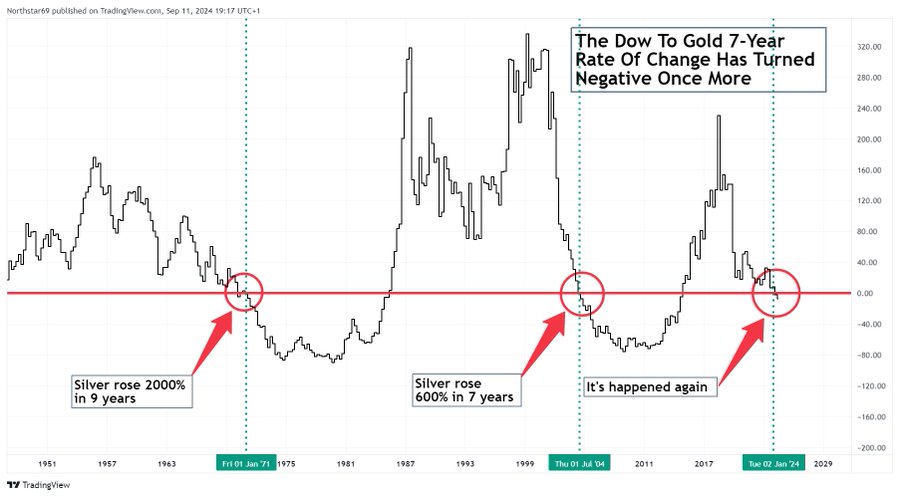

Silver may also perform exceptionally well. This indicator says a multi-year surge of hundreds of percent is likely.

Central bank purchases have led the rally in gold and will continue. As shown before US Asset management and also household allocations have been left far behind and will have to catch up.

Three videos will explain this.

The scale of the move we could see in gold.

Gold is replacing the dollar as a reserve asset.

Gold’s role as money may need to return to restore financial order.

Real Conversations | Judy Shelton 1-on-1 with Keith McCullough

From the echoes of financial crises to the recent spikes in pandemic prices and the persistent cycles of inflation, the economic landscape remains tumultuous. Yet, amid the murky discourse of economics dominated by questionable pundits and politicians, Judy Shelton stands out with clear, courageous insights that provide real and actionable solutions.

A Senior Fellow at the Independent Institute and former Chairman of the National Endowment for Democracy, Shelton brings to the table a profound understanding of monetary policies and their far-reaching implications.

Her latest book Good as Gold: How to Unleash the Power of Sound Money offers more than just analysis; it provides a blueprint for a prosperous economic future. Shelton challenges the status quo, particularly criticizing the inflationary policies that disproportionately benefit the elite while disadvantaging the middle and lower classes. Her bold stance is that this can—and must—change. In our upcoming webcast, Shelton will discuss her vision for the US Dollar—a vision that sees it perform “as good as gold… or even better.” She argues for a new international monetary order, advocating for a use of gold that transcends traditional and historical constraints, offering a step-by-step guide on how gold can act as a universal measure of value, enhancing financial stability and fostering global economic growth.

Summary

Last week’s blog detailed the inevitable changes that will have to come from unsustainable policy spiraling out of control. The most likely solution will come through some kind of remonetization of gold.