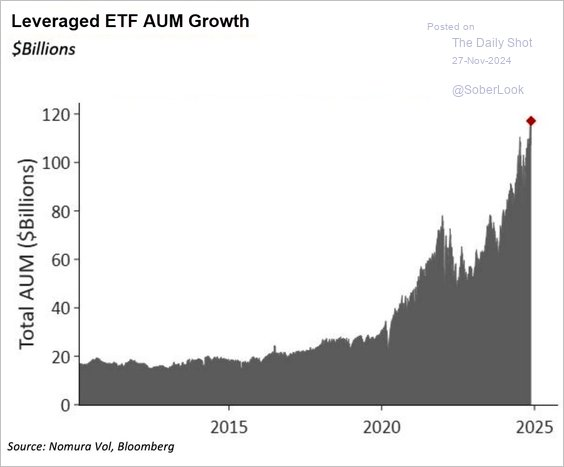

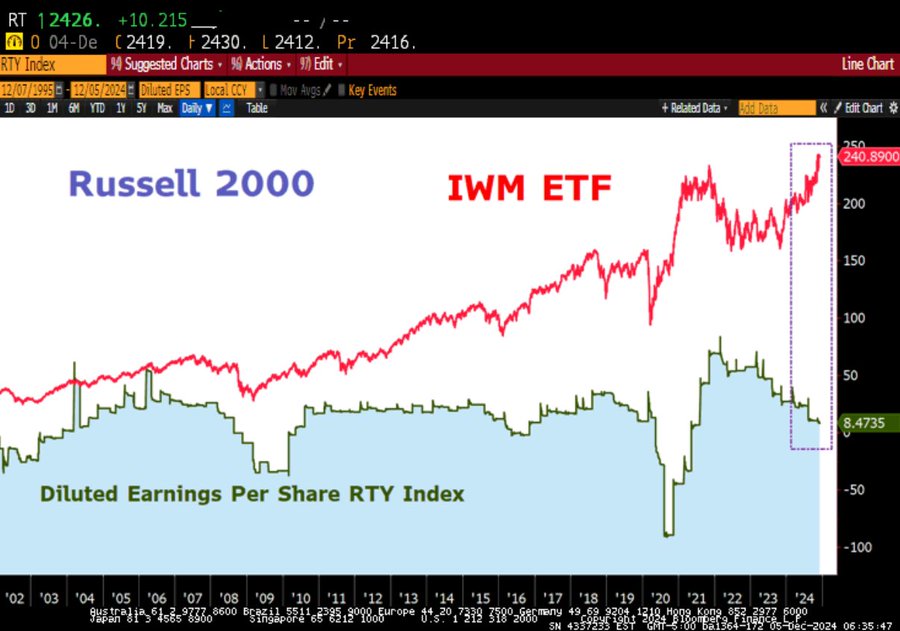

While the amount invested in leveraged Assets Under Management has exploded to new highs. GAAP earnings on the S&P 500 have been unchanged over the last 3 years. Meanwhile, GAAP earnings on the Russell 2000 have collapsed over the last 3 years by more than 80% to the middle of its 20-year range. Here is an explanation of GAAP.

The disassociation between US equity market behavior and earnings is unprecedented. There is no history of significantly declining GAAP earnings with the biggest and most leveraged equity bull market in history. As stated before, the firehose of debt, liquidity, and money supply is most likely responsible for that disconnect. It’s persistence has created the speculative conviction and perception of riskless investing. Investors need to think carefully about what could happen from here.

Do you have an Investment and Financial Plan that can handle this?

Here are the best planning tools to get that sorted out.

Alpha Financial And Retirement Planning

Failing To Plan Is Planning To Fail

If you don’t know where you are or where you are going, then how are you going to get there?

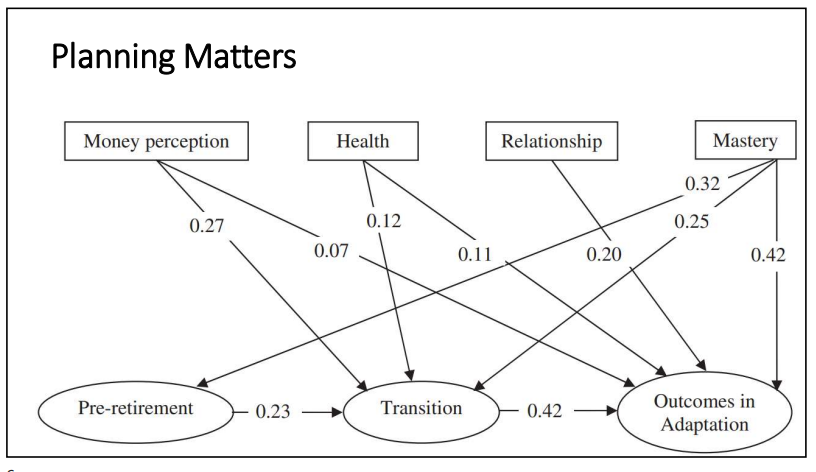

Well-designed Financial and Retirement Planning is a gamechanger for your retirement that can put you in the best position for a happy last chapter of your life no matter what the markets do.

The dynamics, particularly of retirement planning, are complex, but all the best work has already been done to leave you with a straightforward path for lifelong guidance, and with the right first two steps you will be on your way.

Don’t miss the two key steps! Then you won’t be limited to suboptimal choices, completely missed opportunities, and hidden risks in your retirement.

Step 1: Start your retirement planning in your 50s.

Starting early will give you the best options with the biggest financial benefits. The best time to plan for retirement is in your 50s! However, it’s never too late to improve your situation.

Step 2: Only use Maxifi as your software planning tool.

Most, if not all, conventional financial planning is based on flawed methodology that has already failed badly and led to the collapse of Defined Benefit Plans as explained on my website. Yet the same unacceptable approach is still widely used.

Economics’ approach to financial planning was developed over the past century by a Who’s Who of economists plus one extraordinarily brilliant physicist and computer scientist, John von Neumann. The focus of economics-based planning is raising and sustaining your living standard and properly trading off risk and return in guiding your investments. Spending is anchored to what you can afford to spend not to what you’d like to spend.

Conventional financial planning has the opposite anchor. Its first question is “What do you want to spend in retirement?” When you respond, “One trillion dollars a year.”, conventional planning sets your target for you based on a crude retirement-income replacement ratio formula. The formula will invariably set you target far too high. But that’s the point. It gives the planning industry the opening to market its high-yield, but also high-risk and high-fee investment management services to meet “your” target.

Maxifi focuses on your current known net income and net asset. The calculations are reliable and accurate and the whole process flows with the best possible tools for planning. The complexity is addressed but simplified appropriately and your options are easy to understand and test. Maxifi is widely used and is not just great for your planning, it will also change the game in investment planning and also tax planning.

It’s also backed by the best practitioners. Here are two planning experts who reinforce this conclusion.

Liz Weston is the most-read personal finance columnist on the Internet. She uses Maxifi.

Jonathan Parker, is a finance professor at MIT and renowned for his extensive research in policy and economics. He and everyone else at MIT uses Maxifi.

The benefits of Maxifi are multiple:

- Eliminating assumptions as far as possible in a base plan. Then you have a base line for testing what-ifs.

- Focusing on after tax sustainable lifetime spending. That’s what really matters.

- Providing an accurate and reliable basis for a range of investment planning approaches.

- Providing an accurate and reliable basis for optimizing multiple retirement options, from real estate, to social security, to withdrawal rates.

- Providing an accurate and reliable basis for tax planning, Maxifi now includes a powerful tool for optimizing Roth IRA Conversions, which can transform retirement outcomes.

- Excellent support, with regular office hours.

- Constant expert flow of information about economic, financial and retirement topics to stay up to date.

- Center of influence on matters related to the communication and conduct of Social Security, Medicare, and the IRS. Don’t take on retirement without a network of support.

Strengthen Your Investment Planning With your Maxifi Financial Plan

Don’t do this:

Next they show you that you can’t meet “your” target without investing more aggressively. “Let me invest for you. I’ll let you meet your target at least 80 percent of the time.” At this point in the bait and switch, they present a more aggressive investment strategy with an 80 percent or higher probability of success.

The industry’s practices violates any reasonable economics-based fiduciary standard.”

Do This:

Retirement is your biggest lifetime expense and it’s where the rubber meets the road for your finances. You must get this right, and it’s easy to make life-changing errors if you are not careful. There are a range of different approaches that can put you in control with a much more effective investment plan that matches your sustainable lifetime spending.

An accurate and reliable retirement plan, which you now have from Maxifi, should be the key component in creating your retirement investment plan.

Your Maxifi investment plan will clarify all your investment options in the key context of your lifetime sustainable income. You can do some version of “Full Risk Investing” or mix safe investing with “Upside investing” which lets you see the choice you are making compared to standard allocation investing.

If you choose to use “Upside Investing” then you can examine that in detail and select your own preferred mix of risk level and safety.

The True Holy Grail Of Investing combines this kind of approach with “compounding” as described here.

Then you have the necessary control and understanding of your true financial situation at all times, in the full knowledge that you have adopted a valid realiable and accurate approach.

You can understand the investment analysis and the strategy you have adopted and are appropriately ready for the parameters of what you are likely to experience and how it fits with your situation.