Tax Returns, Tax Planning, And Continuous Optimization.

Probably the biggest expense item of your lifetime is taxes.

While tax returns are a requirement, by far the most important part of dealing with your taxes is tax planning and continuous optimization.

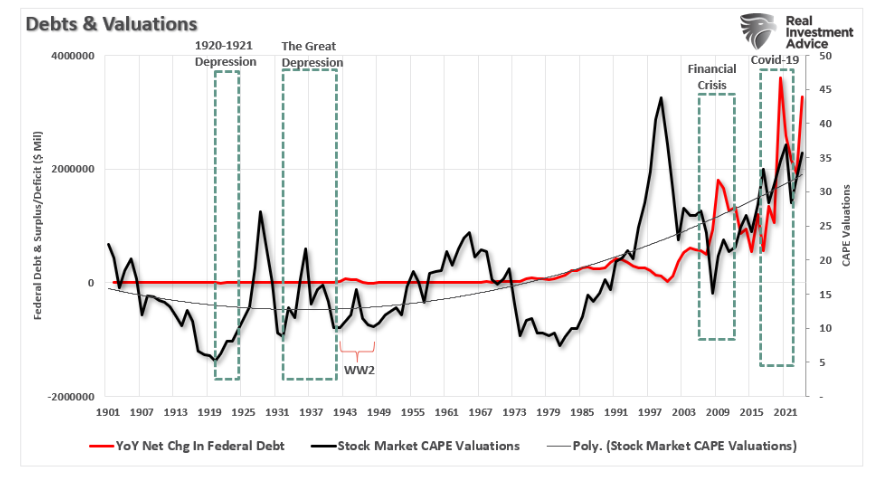

Taxes are likely to rise substantially over the coming decade. Unfunded retirement benefits will become a significant growing burden, and as the chart below shows, Federal deficit spending has already accelerated significantly over the last 20 years. Put these two problems together and it’s obvious that taxes and how to address them is going to be crucial to your financial wellbeing.

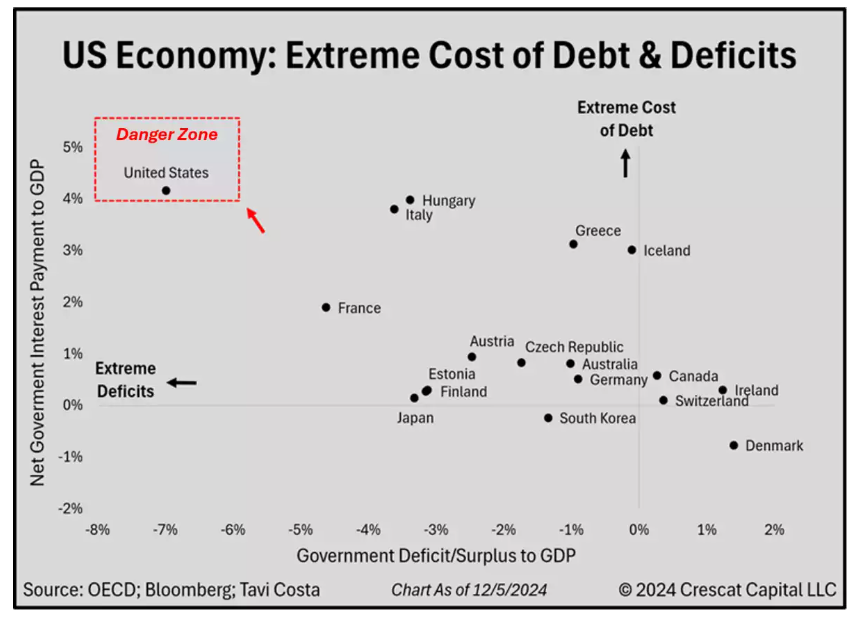

As highlighted persistently by the IMF, the US is a standout globally in terms of how aggressively it is expanding deficit spending and the high cost of doing so. You are who is going to pay this bill as it becomes due.

The US now has Extreme Deficits and the highest interest rate costs across the globe.

The burden of taxes will likely rise through both direct taxes and inflation.

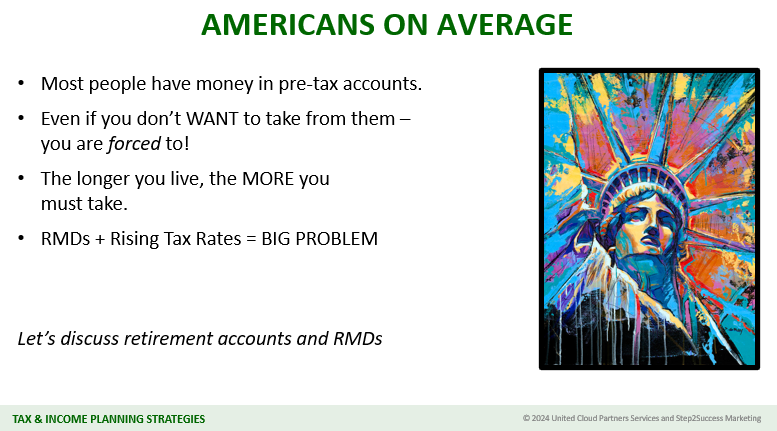

In particular understanding retirement taxes is crucial and not broadly understood.

Deferred pension plans have taxes that will become due in your 70s. Without tax planning you will be poorly prepared for the predictable consequences to your spending power in your later years. A credible tax plan is essential.

Alpha Comprehensive Tax Service

Tax Returns, Tax Planning, And Continuous Optimization.

Your tax return is just the first part of what you need to do to address your taxes. To maximize lifetime wealth, you need to get smart about your taxes, now and into the future.

Tax Planning and continuous optimization is the goal. Be proactive and reduce your biggest lifetime expenditure. Great tools are now available to enable you to do this, as demonstrated in this and other articles.

Understand Tax planning VS Tax Preparation

The most important Tax planning check you must do is your income tax through your retirement.

Your taxes likely will accelerate through your retirement. How will that impact your net income? You must be prepared. The best opportunity for tax savings starts in your 50s!

While it may seem attractive to defer your tax-free investment returns for as long as possible, your Required Minimum Distributions (RMDs) can force significant increases in taxes in your 70s. The scale of the increase in income taxes, and Medicare costs through IRMAA, can devastate your retirement income at a time of your life when you are not able to be flexible.

If you act in time in your 50s and 60s, and with clarity from the best Financial and retirement planning tool, Maxifi, there are many options you can take to optimize your net income through retirement, but you must be proactive. In your retirement, taxes can be make or break if you have substantial tax deferred accounts. .

One of the most popular methodologies is to start paying your taxes early on your tax deferred plan by converting your tax deferred plan into a Roth IRA, which is free of tax for life.

Ordinarily, this is too complicated to optimize but Maxifi has just produced an exceptional Roth IRA Conversion tool. This is demonstrated in the video below.

Summary

Comprehensive Best Practice Wealth Management requires Best Practice in a range of areas. The core of wealth management requires excellence in investing, planning, and taxes. Taxes are a vital component of this. This article is the third part of a full process for lifetime wellbeing in finance. Consider these three articles together:

Alpha Financial And Retirement Planning,

and this article Alpha Comprehensive Tax Service.

Each area needs attention for Best Practice, and only if it is properly coordinated can you achieve the best possible outcomes across Comprehensive Wealth Management. Each area fits together to produce the ideal total long-term financial results.