Bonds take on the 30 year Yield downtrend

The Government-Induced Liquidity Crisis

Global Divergences

Market shifts are confirming – Japan, Germany, Copper

Yet sentiment remains very positive

US growth 2nd derivative is now falling

The risks are very real and allocations need to reflect that

—————————— —————————–

Bonds Take on the 30 year Yield downtrend

The chart above shows the recent shift to higher government 10 year bond yields, which recently broke up through the 30 year downtrend. It also shows how US equities have historically had a significant problem with this trend line going back decades.

For several weeks my cycle dynamics bond model has been in cash. This is very unusual, as almost always there is an asset sector that can pick up some kind of uptrend. Not now. The bond model seems stuck in cash. So bonds remain a significant challenge for the equity market.

The Government-Induced Liquidity Crisis

The Government-Induced Liquidity Crisis

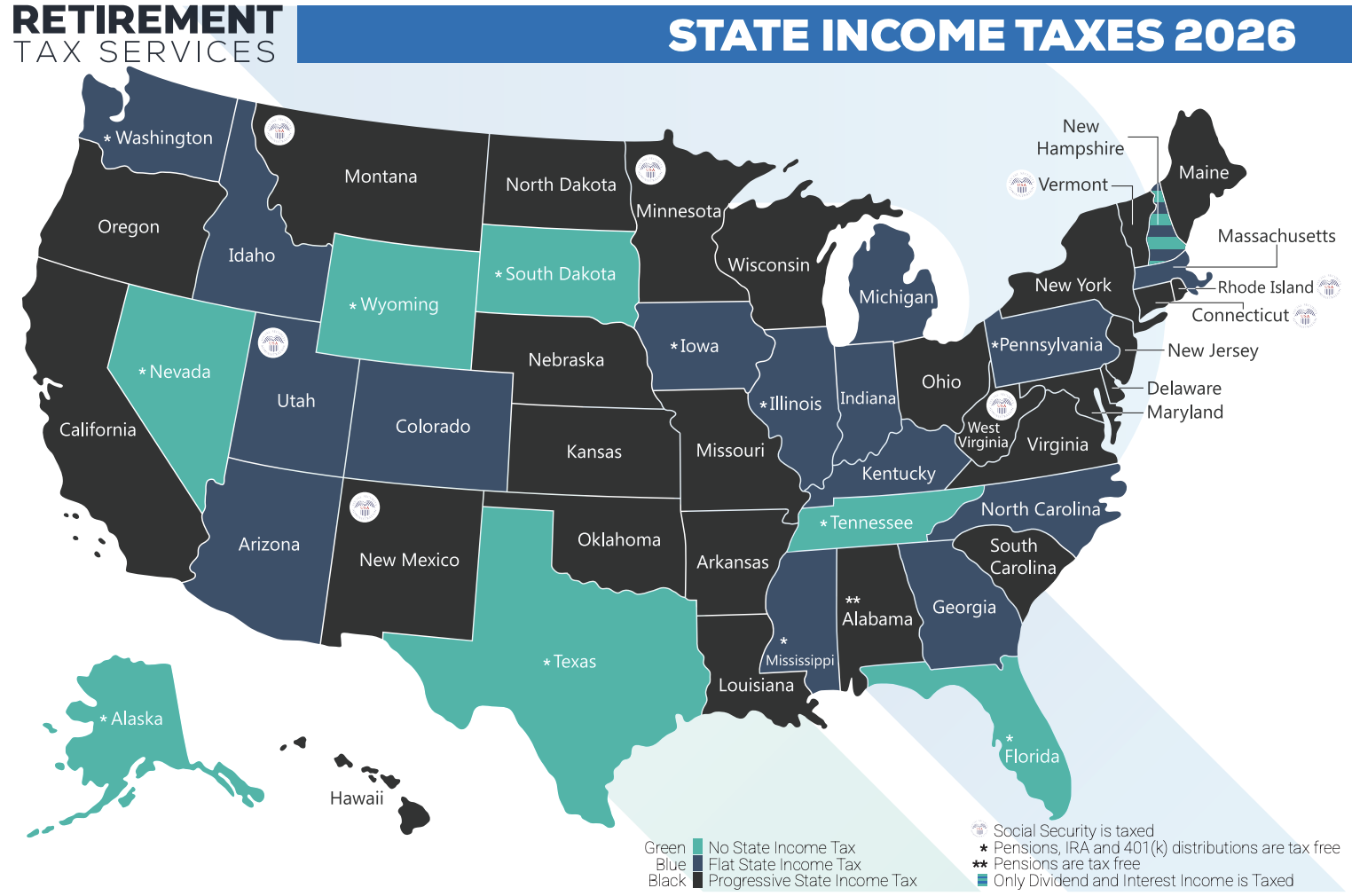

One of the most powerful influences on asset prices is policy induced liquidity. A very little discussed element of the tax reform bill is the huge drain it now creates for capital markets. The Treasury bond market is already having to handle record sizes in government bond auctions. Richard Duncan explains:

“Liquidity determines whether asset prices move up or down. The Liquidity Gauge illustrates whether liquidity in the financial markets is abundant or scarce. This video updates the Liquidity Gauge to incorporate Quantitative Tightening and trillion-dollar a year budget deficits.

Adding together estimates for the Budget Deficit, Quantitative Tightening and Capital Inflows gives us the figure for the Liquidity Gauge. It is shockingly bad. The Liquidity Gauge will swing from negative $56 billion last year to negative $904 billion this year, which will be the worst on record, by far. Then it gets worse: negative $1,165 billion in 2019 and negative $1,237 billion in 2020. That amounts to a cumulative Liquidity Drain of $3.3 trillion over the next three years.

Only at the beginning of this month did the financial markets wake up to the fact that the US government is going to have to begin borrowing extraordinarily large amounts of money this year. And that was before Congress passed a large spending stimulus package on February 9th.”

Global Divergences

While the recent US economic data remains good, a big shift is taking place globally. The GIP model shows that the synchronized growth of the world has ended. Around half of the S&P 500 earnings is international. Notably the Eurozone and China have taken a downshift. Hard to ignore.

Market shifts are confirming – Japan, Germany, Copper

sentiment remains very positive

Both open interest on SPY call options, and the AAII Bullindex are near record highs.