Most US investors don’t know the financial game they are in. US investors have clearly failed to understand the basics of financial system distortions, and are paying a huge and unnecessary price in terms of both wealth and risk as a result.

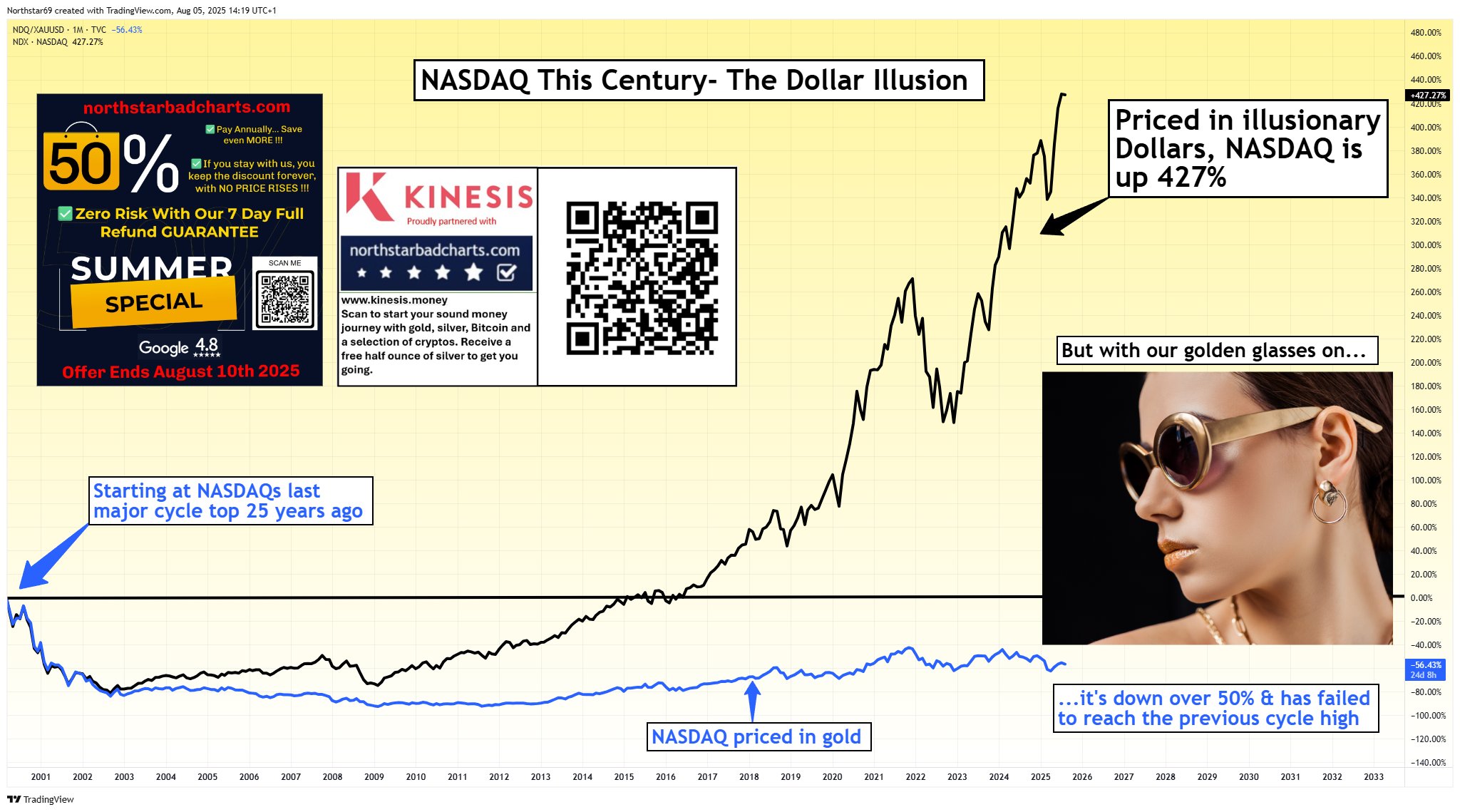

Over the last 25 years the Nasdaq has rallied 427% in USD dollar terms. However, the Nasdaq is down over 50% relative to gold over the same period. The stock market rally is largely a US dollar illusion.

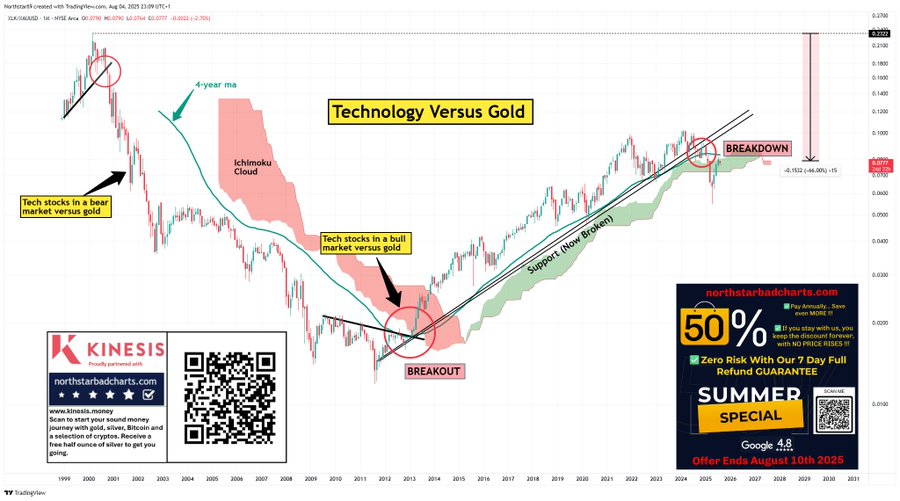

Measured in gold Tech is again in trouble.

Tech – The biggest sector of the S&P 500…down 66% from the highs and breaking down into a new bear market versus gold. Once the market catches on it’s game over.

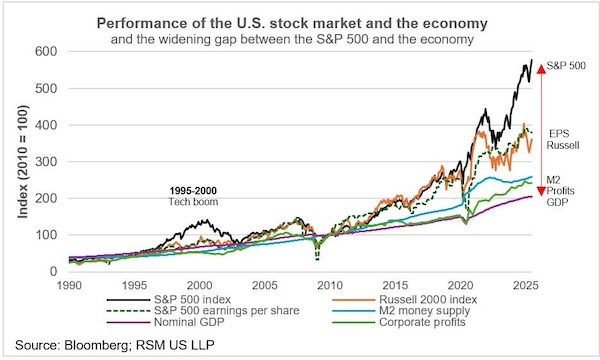

Perpetual spending excesses, central bank liquidity management, buybacks and passive pension flows have materially altered basic relationships between GDP, profits, money supply and asset prices.

The chart below shows the distortions are simply astonishing and policy remains committed making sure they widen further. Just look at the gap between Earnings Per Share and profits created by buybacks.

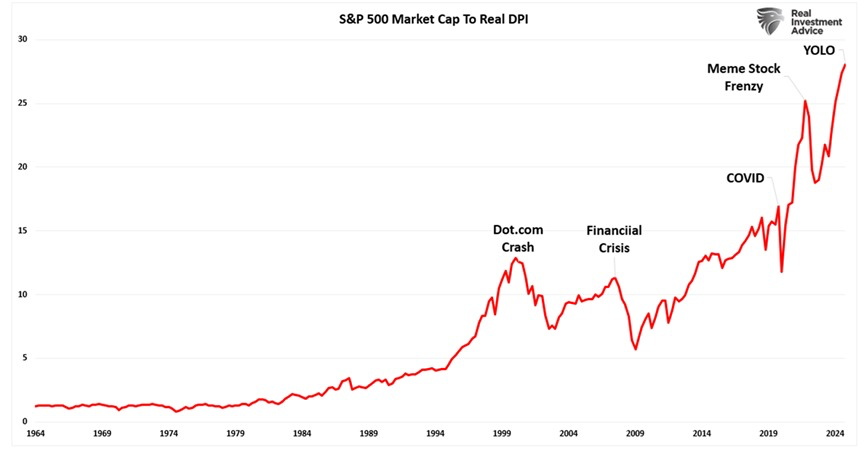

Right now investors think they are getting rich and have never been more highly allocated and leveraged to US stocks.

Instead they have been mislead into the biggest bubble illusion in US history. Any clear examination should make that obvious. The unwind, whenever it comes, will be brutal given the extreme economic distortions.

The S&P 500 has disconnected from real disposable income. It used to be that real disposable income drove the economy which drove the stock market. Economic policy has entirely broken and even reversed this natural causality since the dollar was unhinged from gold in 1970. This is the kind of malpractice that fiat money enables.

This ratio has more than DOUBLED since 2020 and has now surpassed the previous peak of 25x set during the 2021 meme stock frenzy. This comes as the S&P 500 has rallied 116% while real disposable income has increased by just 13% since March 2020. For context, the ratio was just 13x at the 2000 Dot-Com Bubble peak. Stock market gains are outpacing real incomes like never before.

AI has now become perhaps the biggest investment gamble of all time

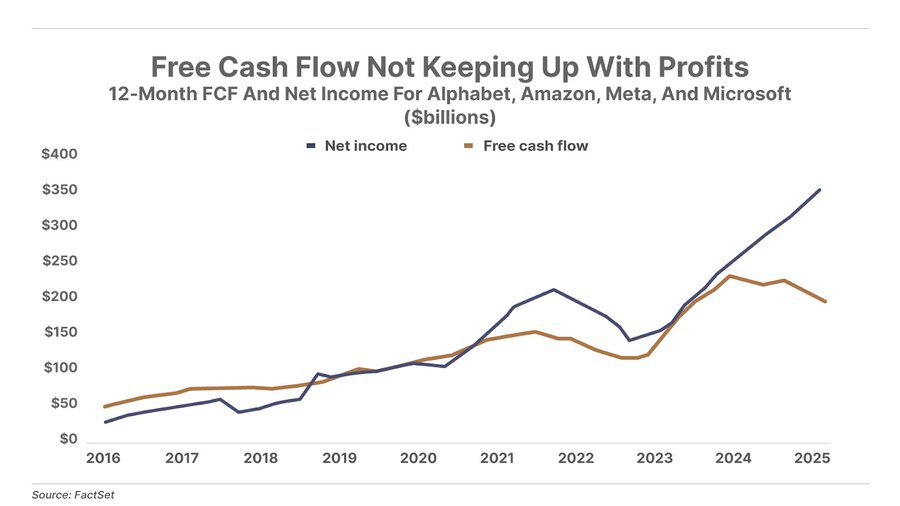

Up until the AI boom kicked off with the launch of ChatGPT in late 2022, big tech’s free cash flow generally tracked their earnings growth. But since 2023, these companies have been sinking earnings into capex for data centers and other AI infrastructure. As a result, free cash flows are falling even as reported earnings are rising. This sets up a key risk for tech stocks and the overall market if the AI capex boom doesn’t eventually lead to free cash flow growth.

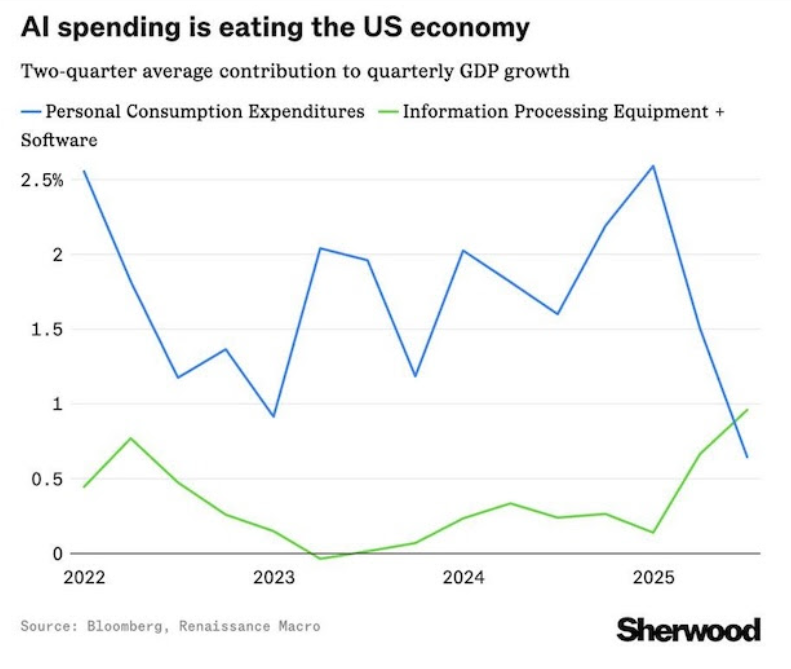

AI is eating the US economy. Together with excessive deficit spending this is where US “growth” is coming from. Leveraged spending not natural organic prosperous growth.

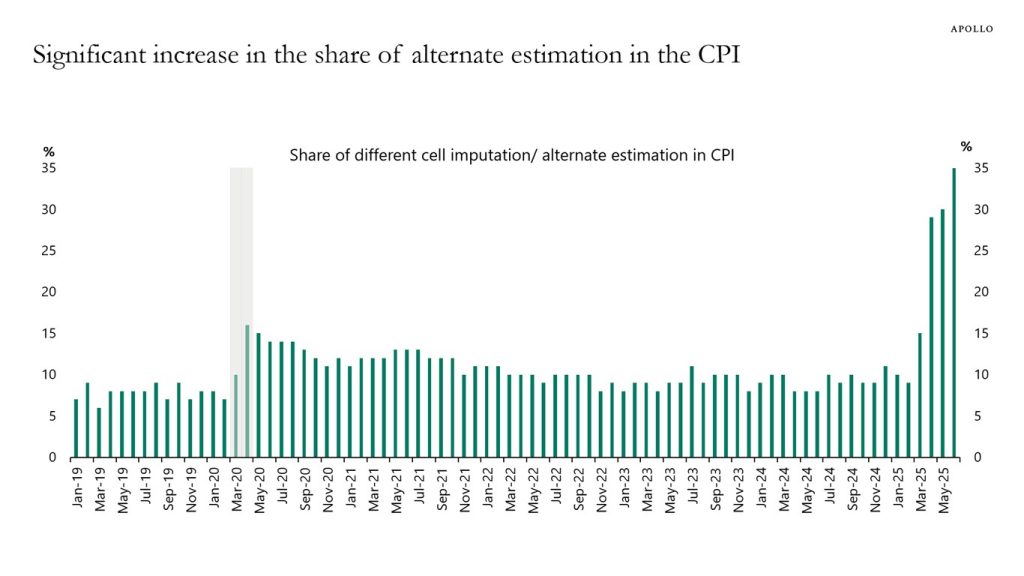

The quality of data and economic statistics is deteriorating. Not only has data got to meet with the approval of White House messaging but data collection is increasingly based on guesswork.

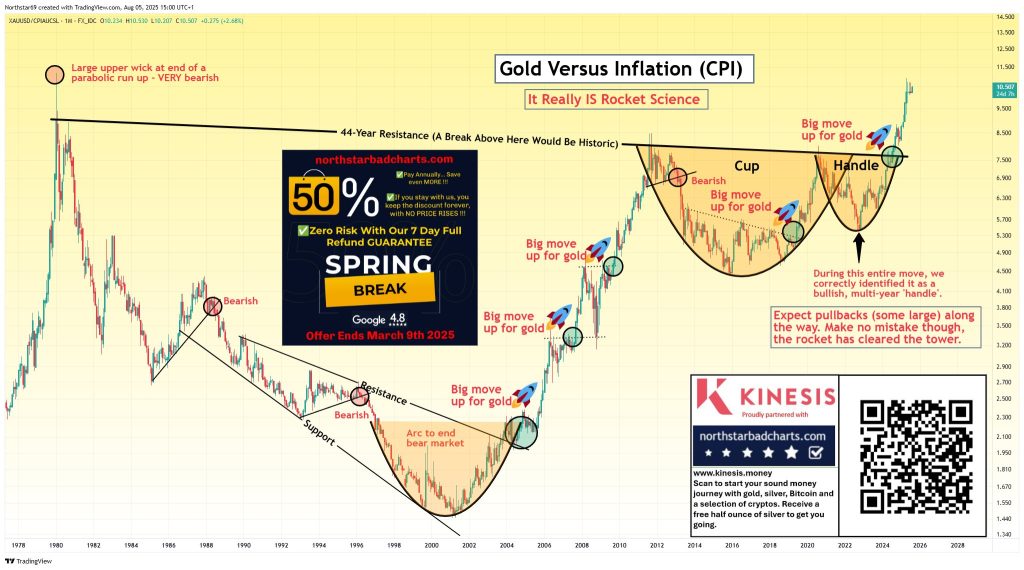

Investors think they know what inflation is because we have the CPI. Look at the relationship between gold and inflation below. Gold is saying something different.

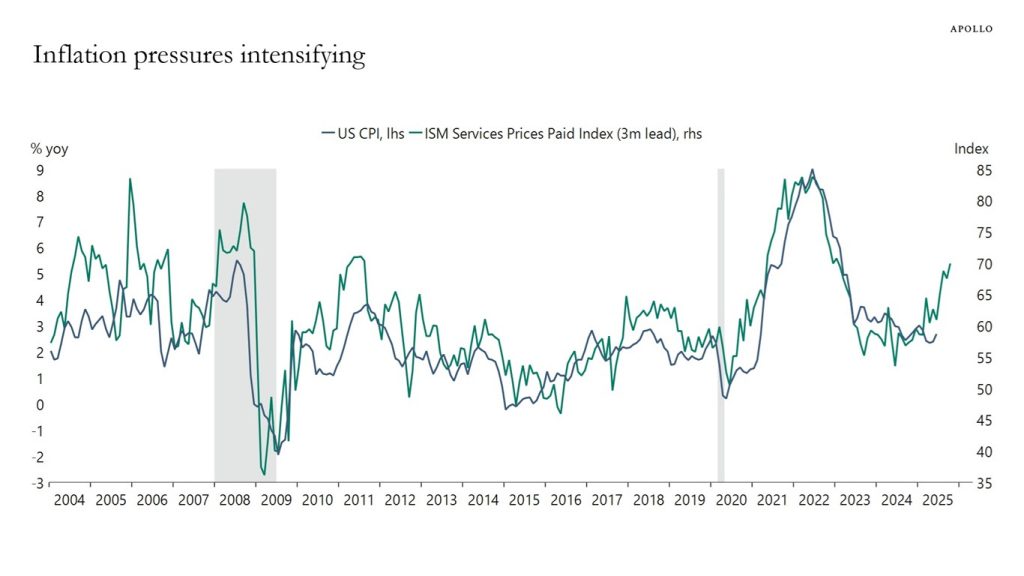

Stagflation is intensifying

Meanwhile, it is clear that real inflation is now likely to shoot higher in the near term.

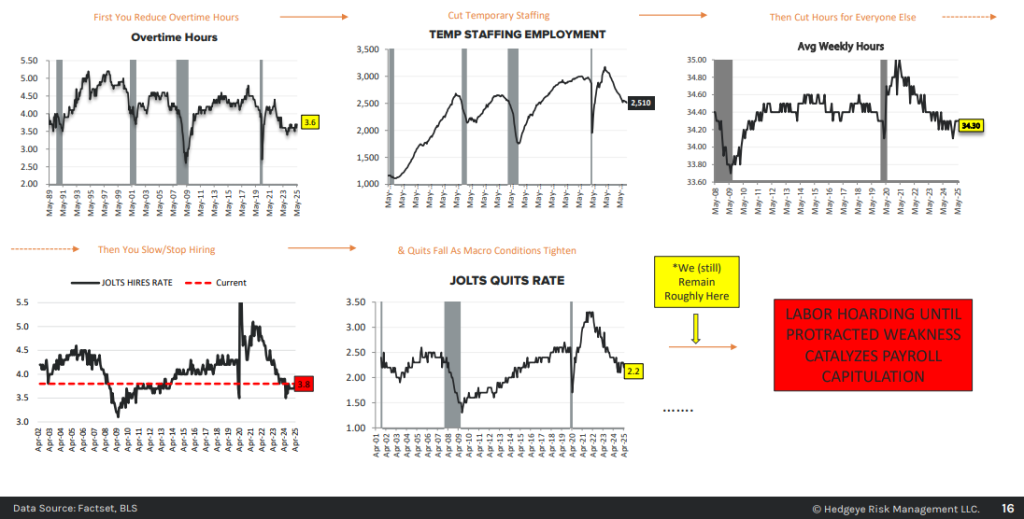

Even as the labor market continues to weaken.

Leveraged spending shows up as growth as counted by GDP, but how sustainable or generative do you believe it is particularly as inflation starts rising again. Is there a better inflation hedge than gold?

Summary

A gold strategy is key to your long-term wealth strategy. It is an incomparable asset for long-term inflation hedging. The chart above shows it is massively outperforming the CPI and so TIPS as well.

The CPI is a less than perfect measure which makes TIPS a useful investment vehicle but dependent on the quality and accuracy of the CPI data as an inflation measure.

The US dollar will remain a key global currency for a very long time but its primacy as a reserve asset is already in decline relative to gold just by reference to the holdings of global central banks.

Confidence in the Federal Reserve is clearly in rapid decline as it has been above its inflation target for several years, and has become technically insolvent.

Simply, there is no fiat currency that has kept its value over the long term relative to gold. At this stage of decline and loss of confidence in the US Dollar makes it illusionary to value your account or wealth in terms of the US dollar.

Investors seem to believe the Nasdaq is in a massive rally. This idea has become increasingly absurd as the dollar losses have accelerated relative to gold.

Over the last 25 years the Nasdaq has rallied 427% against the US Dollar. However, the Nasdaq is down over 50% relative to gold over the same period.

US investors feel compelled to invest in the Nasdaq’s bubble in US terms when they could be far more wealthy in the much lower risk allocation of gold.

US investors have clearly failed to understand the basics of financial system distortions, and are paying a huge and unnecessary price in terms of both wealth and risk as a result.