Fiat currency collapses are historically irreversible and unavoidable events.

For now, buybacks, liquidity, and record deficit spending perpetuate current conditions but only by accelerating the underlying debt trap and perpetuating the private sector recession.

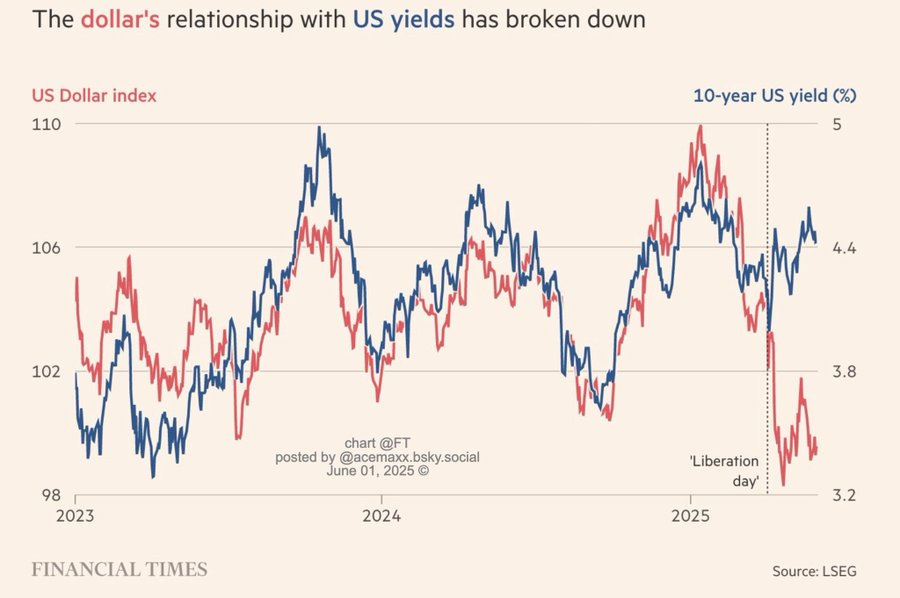

Investors see no change as the US stock market holds up, but gold and government bonds are signaling the accelerating deterioration.

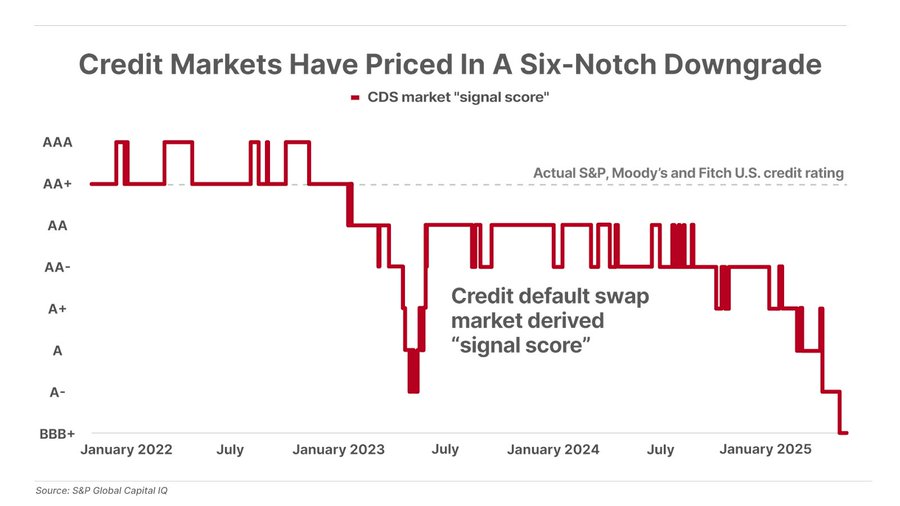

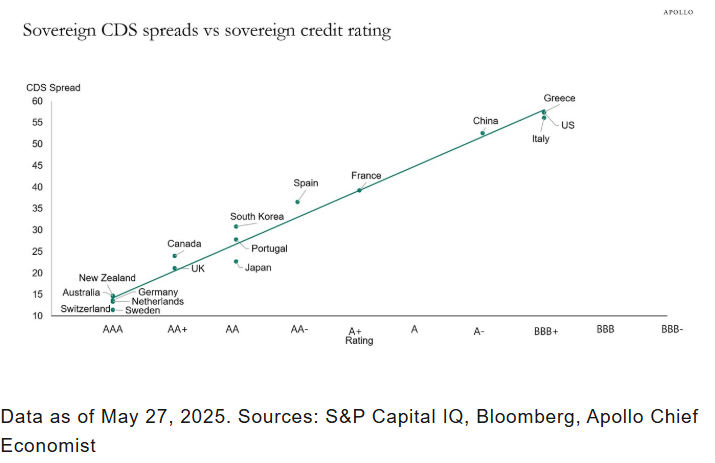

US credit default swaps rank equal with Greece.

Gold is replacing bonds and currency. Standard allocations are broken.

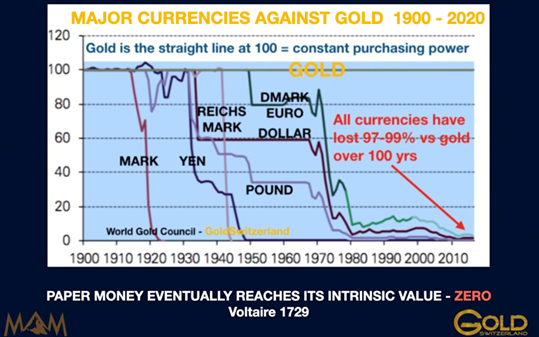

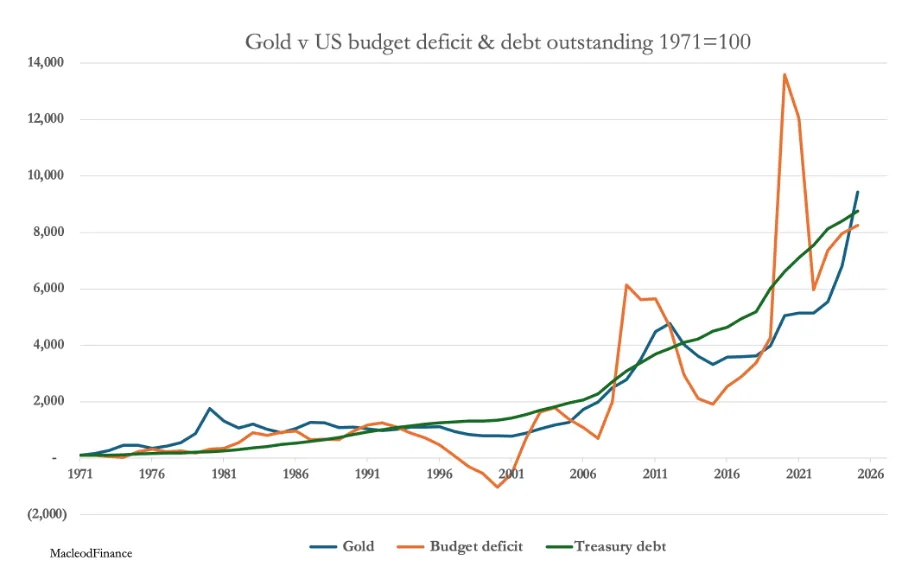

The historical record of fiat money is unblemished by success. The math of our current monetary system is already highly fragile. Can you see a pattern in the chart below?

Fiat money today goes hand in hand with exponential debt creation.

In this 3 minute video Greg Weldon describes how we are beyond the black hole event horizon.

This has enormous implications that many investors don’t seem to understand.

Four economic factors that are misunderstood or are being ignored:

1. While record deficit spending keeps the GDP positive, long term growth has never been weaker.

2. The US economy is in a private sector recession.

3. The policy that is holding up GDP is record deficit spending, NOT the private sector.

4. Bottom Line: Policy is accelerating the policy problem for short term expediency. The private sector is already unable to afford the debt which continues to rise and has a higher interest rate. This is an accelerating debt trap!

Here’s the problem:

“The US tax base, which is proportional to the private sector’s GDP, is already contracting when the distortion of the government budget deficit to GDP at about 6.5% is subtracted from the GDP total. It leaves the tax-paying private sector already shrinking. Therefore, the US government is in a debt trap: a trap of debt increasing faster than the means to fund it.”

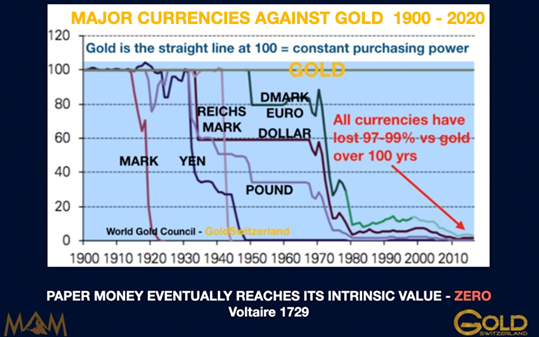

“Liberation Day” broke the correlation between US Treasuries and the US dollar!

Lyn Alden explains why “You can’t stop this train”.

How can you protect yourself?

There is a reason gold has outperformed all other asset classes and with moderate volatility. What is remarkable is how few US investors have a significant allocation to gold.

Gold has more than doubled the value of Treasury bonds (TLT) over the last 3 ½ years! Have you replaced your bonds with some gold?

Notice also that the Russell 2000 is in a 3 ½ year bear market! The equity market is more accurately described as a distorted mixed market. Not a genuine broad bull market.

Bonds are in a 3 ½ year bear market with no end in sight! Yet investment allocations often still favor Treasuries as a safe asset, even though 20 year Treasuries have higher volatility than gold.

While gold has outperformed. All it has done is keep pace with the amount of Treasury Debt. On many measures it is far from overvalued. In a debt trap gold is on course to persistently outperform bonds. It could have a long way to go.

Meanwhile, Credit default swaps indicate a major rerating of US credit is due, far beyond the recent credit rating agency’s downgrades.

US credit now ranks along with Greece.

Summary

Investors have a unique opportunity to shift their allocation to a new financial regime, where the old allocations are inappropriate.

Michael Howell explains …

Debt dominates. Under the sway of excessive debt, the financial system has shifted from raising new capital to predominantly refinancing existing debt, with about 75% of transactions now involving debt rollovers this creates a dependency on collateral (e.g., Treasuries, high-quality bonds) and balance sheet capacity, i.e. Global Liquidity. We believe that the financial system is trapped in a debt-refinancing loop, where collateral shortages and rollover risks (not just credit risk) drive crises, not mispriced risk. Policy makers need to continually expand liquidity. Hence, the attractions of owning hedges against currency debasement, like Bitcoin and gold. Liquidity a cycle and a trend. With term premia rising, 5% yields may persist, and investors must adapt to a world where the Fed’s reaction function is being increasingly reshaped by stagflationary forces…

The signals are clear and everywhere you look, not least from Treasury Bonds changing its 40 year trend from lower yields to now higher yields.

Most investors have failed to understand what is happening. This means that there is still time to adjust. However, do not delay as this is moving quickly and becoming more obvious.

This is an ideal time to change your allocation but also the way you invest. Best Investor standards will also keep you on track in real time in an environment where instability has become inevitable.

If you are unsure how to adjust. Arrange for a good time to chat here: