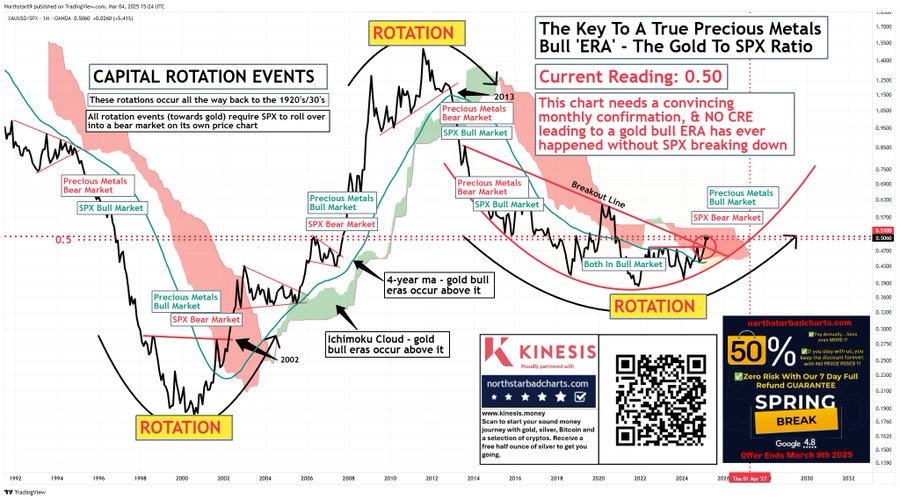

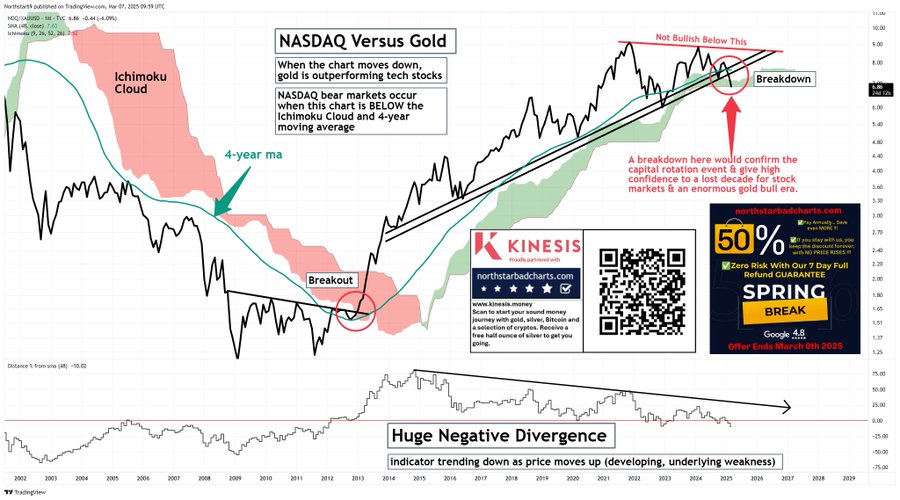

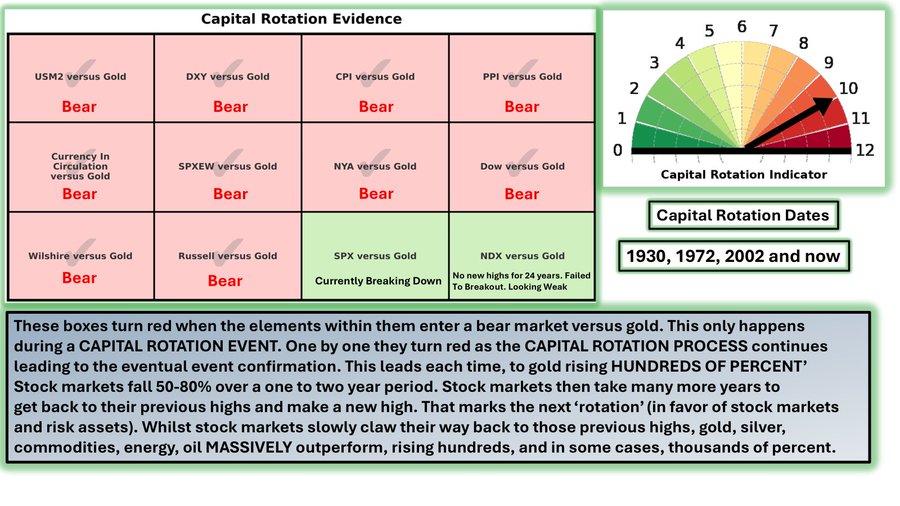

Gold breaks out relative to both the S&P 500 and Nasdaq.

The last two dominoes of the Capital Rotation Event have fallen.

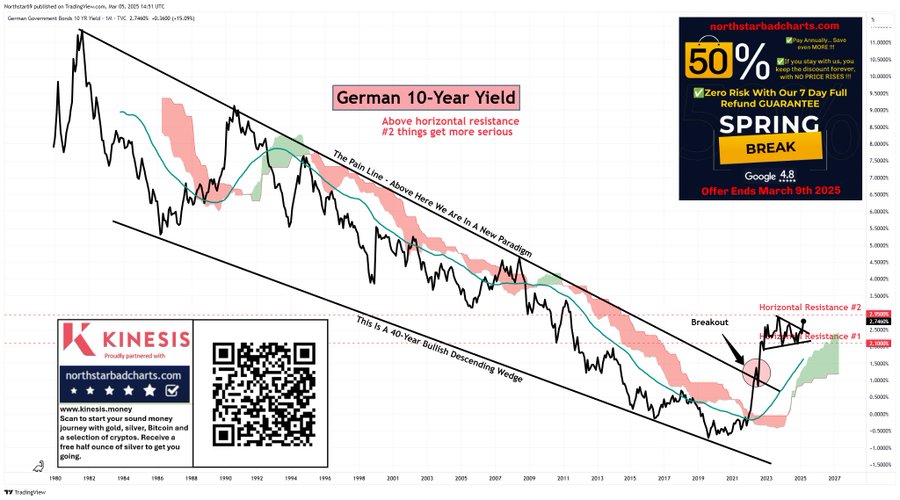

Global bond yields are breaking higher.

“If you don’t own gold, you know neither history nor economics,”

Ray Dalio

“Over the last ninety years there has been a growing belief held by macroeconomists and investment strategists that interest rates and bond yields are under the control of central bank monetary policies.

It has its origins in the Keynesian-inspired role of governments using deficit spending and interest rates to stimulate economic activity when the private sector suffers a downturn. However, this is one of the fundamental errors of macroeconomic beliefs as we are about to find out.“

Alasdair Macleod

———————————————–

US Budget Deficit talks are already failing

This highly informative conversation describes the enormous difficulty of getting meaningful constraint on the US budget Deficit, with insight from participants who are in the room.

This a global problem as Keysian policies are at an advanced stage across the world. Even with a weak global economy government bond yields are breaking higher everywhere.

Aside from the US, this is also the case In Germany.

And in Japan.

No government seems able to contain government spending. Debt reduction conflicts with the playbook of increasing government support when the economy is weak and also many other demands.

However, if deficit spending is not addressed the economy will become even more dysfunctional with ever higher debt and weaker growth.

At the same time interest rate policy becomes increasingly ineffective. Higher interest rates now significantly boost interest payments, now over $1 Trillion, on ever larger government debt.

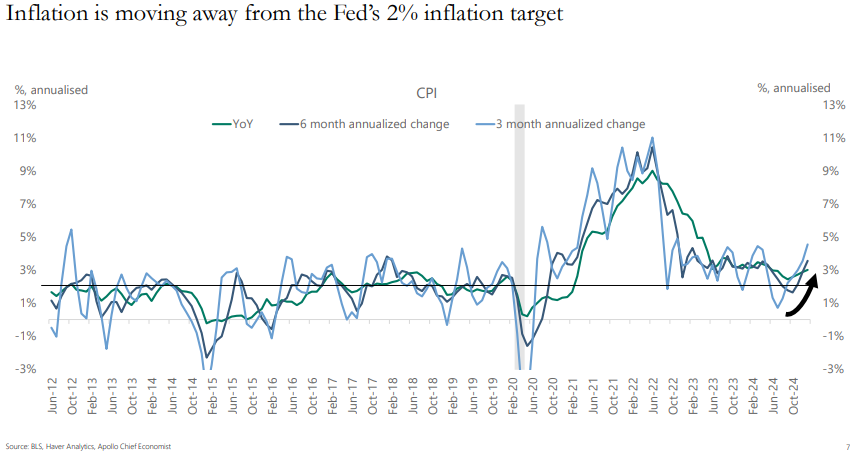

Ultimately, the most likely solution then becomes inflation to reduce the real value of the excessive debt. If so then who wants to buy bonds?

Long term government bonds don’t see long term credibility, and are sending a clear message.

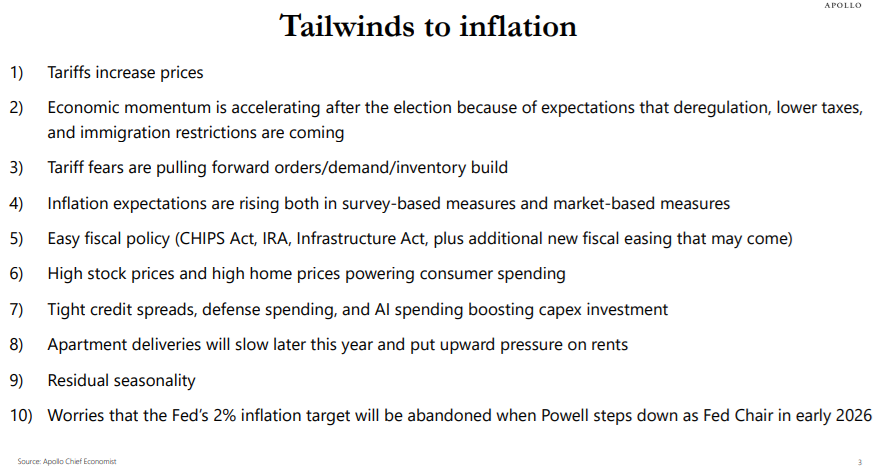

Inflation is turning up.

Tailwinds for inflation are rising

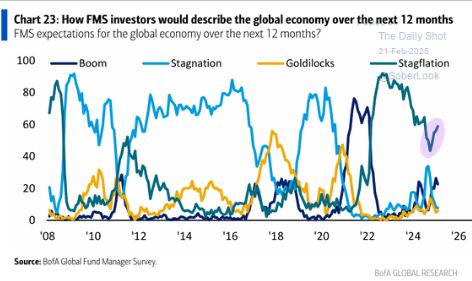

Stagflation is the expected modal outcome, but this is not priced in to US equities.

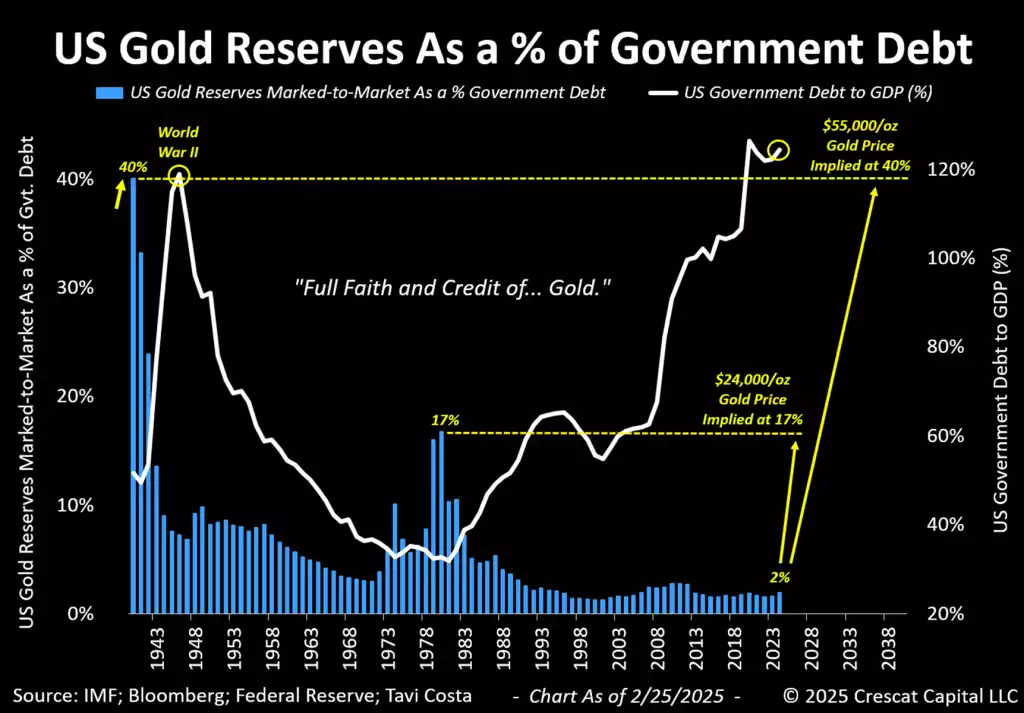

US Gold reserves as a percentage of government debt near all-time lows. Reveal the scope for an astonishing gold bull market.

The Capital Rotation Event measures the evolution of gold bull markets and continues to confirm an almost complete set up.

Policy makers can’t promote gold but it seems that for a range of reasons they may need it to go higher.

GOLD to $3,600? Liquidity Crisis Sparks Big Move!

US Investors with a high passive allocation to US equities and very little gold need an urgent portfolio review.

The CRE is a life changing financial event, which is both technically and fundamentally setting up. Nothing is certain, but this path is clear and significant and deserves a meaningful probability in your portfolio allocation.

Check out the last 3 times it was triggered over the last 140 years as described in September 2024.