Global Bonds Signal Confidence Collapse In Policy.

Bonds Trigger Risks For Banks, Credit And Equity Markets.

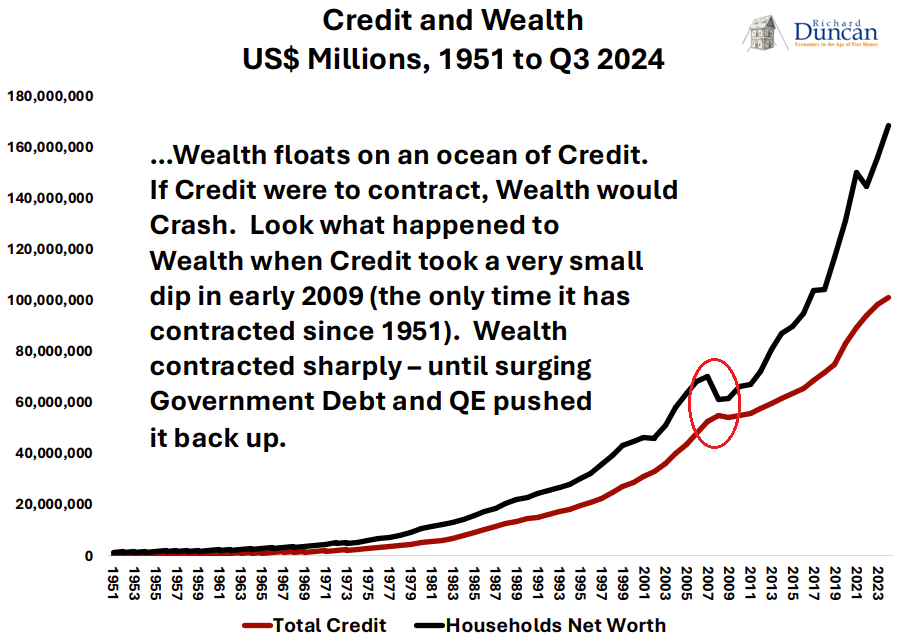

Never before have investors been so committed and leveraged to a 10 year expected nominal return of ZERO ever before.

While confidence in economic and financial policy is collapsing, confidence and valuation in US equities is at an all time high. What if its temporary bad policy temporarily driving the stock market? Then its not so bad and will last forever?

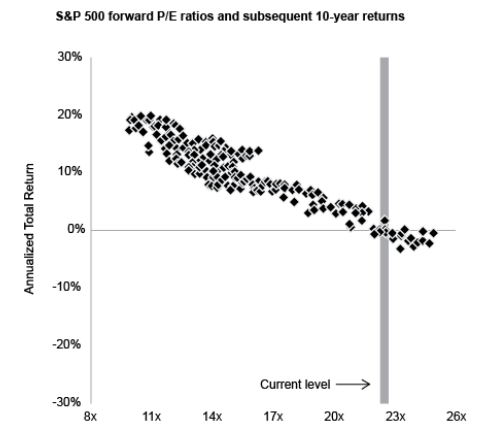

“The graph, from J.P. Morgan Asset Management, has a square for each month from 1988 through late 2014, meaning there are just short of 324 monthly observations (27 years x 12). Each square shows the forward p/e ratio on the S&P 500 at the time and the annualized return over the subsequent ten years.

In that 27-year period, when people bought the S&P at p/e ratios in line with today’s multiple of 22, they always earned ten-year returns between plus 2% and minus 2%.“

———————————

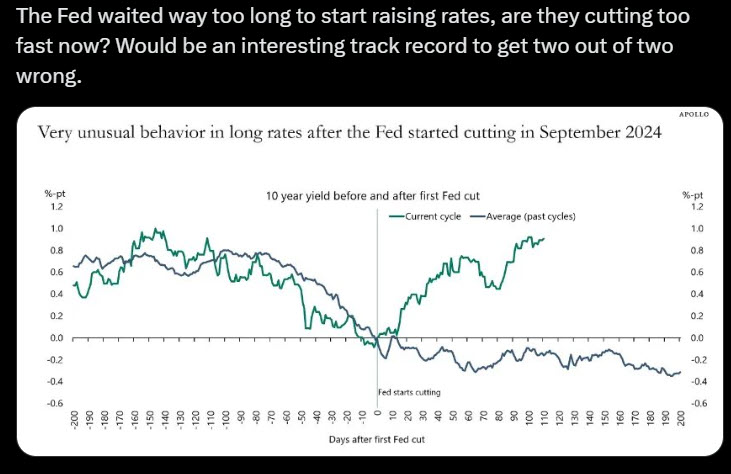

Bonds Lose Faith In Fed Policy.

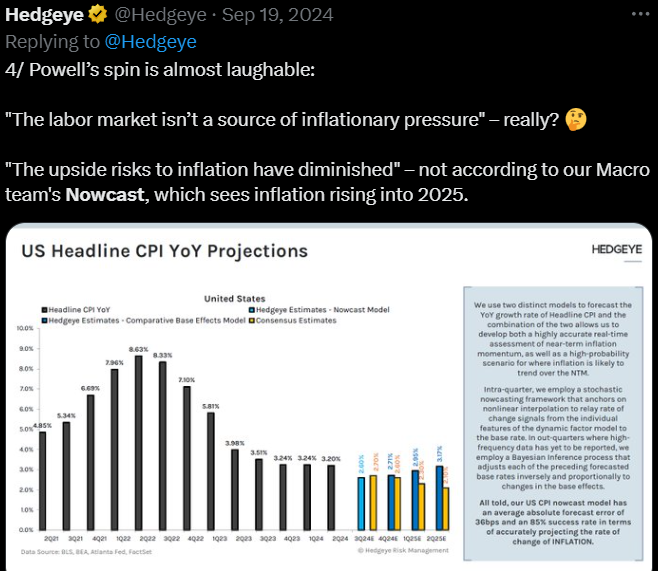

Inflation. The Most Accurate Nowcast rises to 3.5% in 2025. Interest rate relief will be difficult.

Insolvency of Banks and the Federal Reserve Rising again.

Bank Risk Management At The Regulatory Level Has Become Dysfunctional.

Fiscal Policy is already out of control.

Allocations Reach All Time Bullish Peaks

Investors Need to Restore their Risk Management And Financial Sovereignty With The Ultimate Savings Account And Best Practice Financial Management

———————————————-

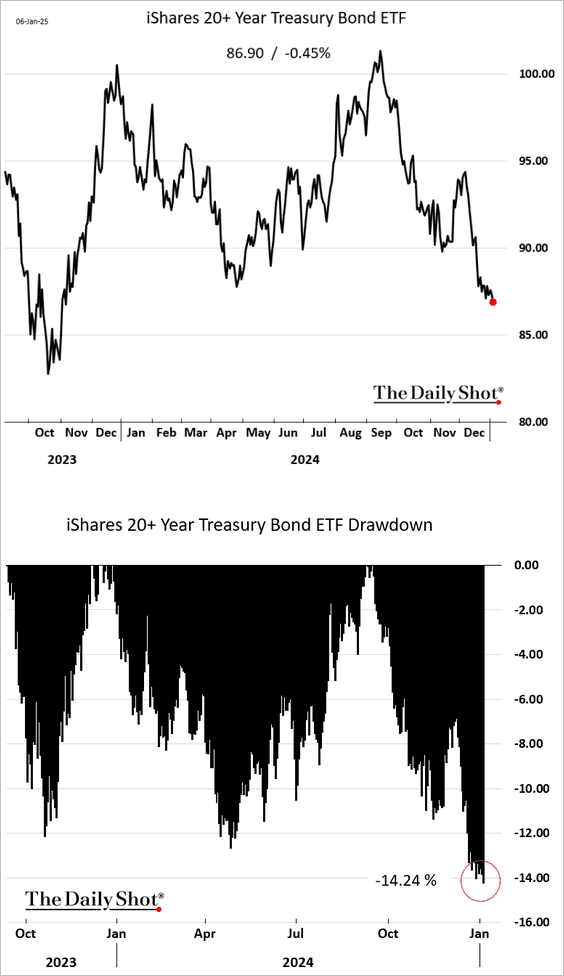

Bonds violently reject Fed policy.

The bond market has lost confidence in policy with a major drawdown since Fed rate cuts started in September.

Inflation. Most Accurate Nowcast rises to 3.5% in 2025. Interest rate relief will be difficult.

As I wrote at the time, the Fed went too soon too fast and now there are inflation concerns on top of a debt trap. The most accurate inflation Nowcaster clearly indicated rising inflation back in September as the Fed executed a panic cut just a month before the election.

Inflation is now expected to rise further to 3.5% in 2025!

How can the Fed cut interest rates any further?

Insolvency of Banks and the Federal Reserve Rising again.

Remember that the Fed and the banking system have massive bond holdings that are held on a loss. So rising bonds yields increase these losses which make them increasingly insolvent. These are big numbers already.

At the minimum bond yields rising does squeeze their balance sheet and so also their risk. That could limit credit at the margin.

Bank Risk Management At The Regulatory Level Has Become Dysfunctional. Powell and Dimon seem to be working together! If Banks With Excessive Risks Fail, Who Pays? You Do! Remember 2008?

This is how bank regulation of risk works these days … prepare to be shocked!

The battle between Dimon and the Fed officially began on July 27, 2023 when the Federal Reserve, FDIC and Office of the Comptroller of the Currency (OCC) – JPMorgan Chase’s bank regulators — released a proposal to require higher capital levels at banks with $100 billion or more in assets. The proposed capital rule is formally known as the Basel III (or Basel Endgame) rule.

The three federal bank regulators provided a very generous public comment period of 120 days on the proposal. The large banks had to only begin transitioning to the new rules on July 1, 2025, with full compliance not due for a ridiculously long five years – on July 1, 2028.

Whatever Scalia was doing behind the scenes appears to have worked out well for Dimon. We know that federal banking regulators had originally planned to increase JPMorgan Chase’s capital requirement by 25 percent because Dimon stated that fact in his April letter to shareholders, writing that if the capital rules proposed by the FDIC, Office of the Comptroller of the Currency and the Federal Reserve are implemented, they “would increase our firm’s required capital by 25%.”

But instead of 25 percent, when the Fed released its new capital requirements for the megabanks on August 28, the Fed raised JPMorgan Chase’s capital requirement by just 7.89 percent from the 2023 level, taking it from a total capital requirement of 11.4 in 2023 to just 12.3 in 2024. Had the 25 percent increase been imposed, JPMorgan Chase’s capital requirement would have totaled 14.25.

The U.S. Treasury’s Office of Financial Research, which was created under the Dodd-Frank financial reform legislation of 2010 to provide federal regulators with up-to-date research on threats to financial stability, has created a “Bank Systemic Risk Monitor” that provides an overall score to show the systemic risk a particular bank represents to U.S. financial stability. JPMorgan Chase’s score for last year was 857, which is 23 percent higher than the next riskiest bank on the list, Citigroup, which has a systemic risk score of 697. (Citigroup is the bank that blew itself up in the financial crash of 2008 and received over $2.5 trillion in secret revolving loans from the Fed from December 2007 through July of 2010 according to the eventual audit released by the Government Accountability Office.)

Equally noteworthy, JPMorgan Chase’s score is twice that of Deutsche Bank USA (DB USA), which has a systemic risk score of 422. And yet, when the Fed released its capital increases on August 28, it raised Deutsche Bank USA’s capital requirement from 13.8 in 2023 to 18.4 currently – an increase of a whopping 33 percent versus an increase of 7.89 percent for JPMorgan Chase.

So if Dimon got everything he wanted with the help of Scalia, why is the Bank Policy Institute, of which Dimon serves as Chairman, moving ahead with a lawsuit against the Fed?

According to Senator Elizabeth Warren at a Senate Banking hearing on March 7 with Fed Chairman Jerome Powell, it was Powell that led the efforts inside the Fed to weaken the capital rule after getting pressure from the megabanks. Warren told Powell this:

“You are the leader of the Fed and when the heat was on last year, you talked a lot about getting tougher on the banks. But now the giant banks are unhappy about that and you’ve gone weak-kneed on this. The American people need a leader at the Fed who has the courage to stand up to these banks and protect our financial system.”

Dimon’s and Scalia’s strategy may be to send a permanent message to the other federal banking regulators and any future Fed Chair that you might find your agency hauled into federal court by a Big Law firm if you don’t do the bidding of the Wall Street megabanks. Scalia is one of the lawyers representing multiple plaintiffs in the newly filed lawsuit.

What is particularly outrageous about all this is that a similar bank front group called the Clearing House Association had the audacity to battle in court – all the way to the U.S. Supreme Court (which declined to hear the case) — to prevent the Fed from releasing the names of the megabanks and the trillions of dollars in emergency revolving loans these banks had received from the Fed for two and a half years following the banks blowing up Wall Street and the U.S. economy from 2008 to 2010. The megabanks were “owners” of the Clearing House Association according to its legal filing and it brazenly demanded secrecy from the courts on this unprecedented money spigot from the Fed to the banks. It failed in that effort.

Now these same banks want us to believe that their mission in filing this lawsuit is to force “transparency” from the Fed to enhance the public interest.

The new court filing by the Bank Policy Institute states that “The Clearing House Association [is] one of the Bank Policy Institute’s predecessors….

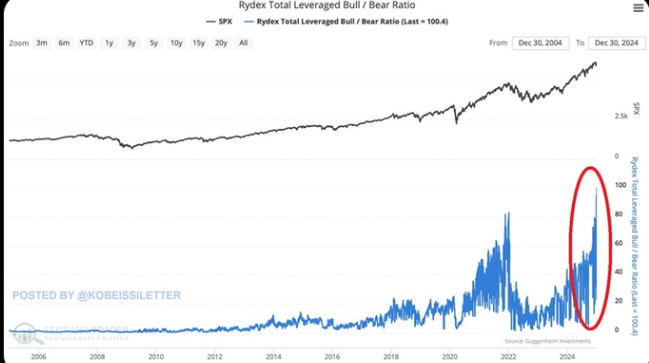

Allocations Reach All Time Bullish Peaks

You could be forgiven for thinking that given this environment that market participants would become a little more reserved. However, for the last 15 years the Fed and deficit spending has persistently supported the market. New investors think this is normal and will continue forever!

When the market gets this one sided it is hard to imagine who is left to buy! Also who can buy when the leveraged investors have to sell.

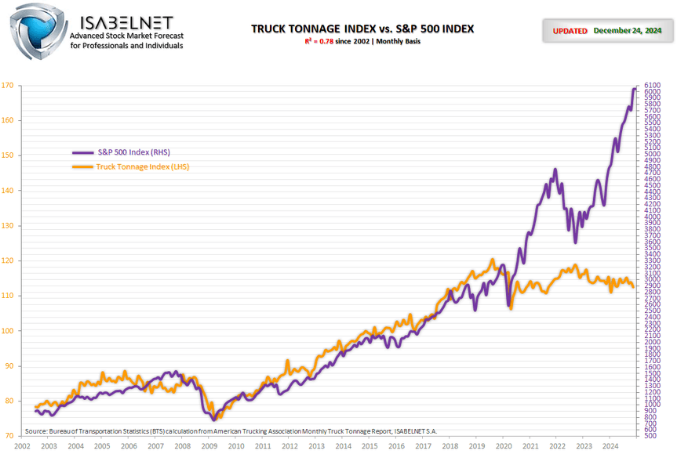

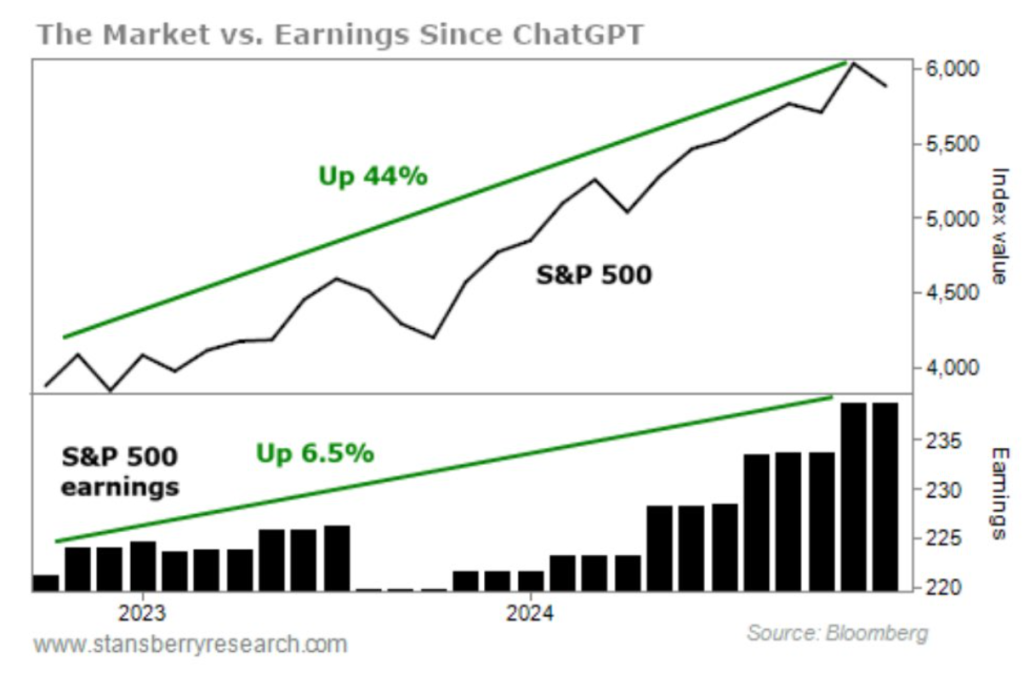

This risk is reinforced by the substantial disconnect of the market from economic values. At some stage there must be a reconnect.

It used to be that the S&P 500 closely correlated with truck tonnage. Then it didn’t anymore:

Or even earnings:

Investors Need To Restore Their Risk Management And Financial Sovereignty With The Ultimate Savings Account And Best Practice Financial Management

This is a setup for a major drawdown for investors. We just don’t know when.

Long term extreme instability is everywhere you look. In particular, the banking system. JPMorgan, the biggest US bank, has a high measure of risk but doesn’t have to adjust its capital like everyone else.

Then consider the compromised access depositors have to their own bank accounts. They must justify their own withdrawals, if the bank has balance sheet problems they may not get their money at all due to legalized bail in clauses. On top of that banks offer poor interest rate products. Investors can do better if they move their savings to an Ultimate Savings Account:

Beyond that it is crucial that investors realize that the markets are at all-time record valuation levels with seemingly everyone fully exposed. This has only been achieved through extraordinary and unsustainable policy measures. To remain passively long in these conditions is to truly say “this time is completely different”!

The drawdown on just a reversion to the mean is substantial and could mean you lose a decade of return. It is therefore crucial to have a very robust approach to investing.

The problem new investors face is that they don’t understand that the equity gains in recent decades have resulted from increasingly destructive economic policy that is not repeatable and has driven the US economy into a stagflationary debt trap. Reversion to what? There are no quick fixes to the current scale of debt and the downside price risk remains substantial.

Rather than leave your financial future exposed to likely substantial drawdown Best Practice Wealth Management can transform your results. Even more so when the outlook becomes challenging.

Comprehensive Best Practice Wealth Management:

Financial and retirement Planning:

Tax returns and planning: