US investors are badly misallocated.

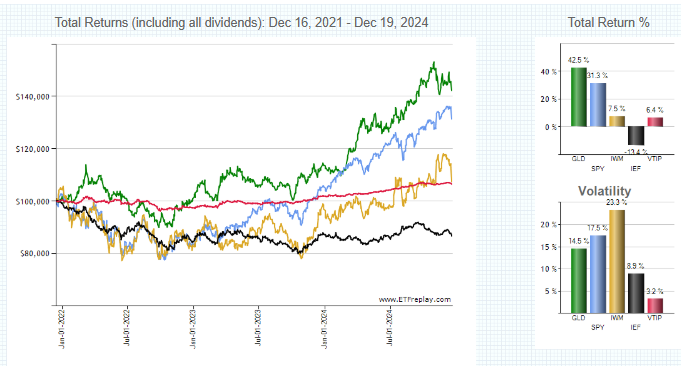

Stagflation Allocations have already outperformed Conventional Stock and Bond allocations over the last 3 years.

Gold has outperformed both the S&P 500 and the Russell 2000 with much LOWER volatility. TIPS have substantially outperformed Treasury bonds again with much LOWER volatility. Gold and TIPS are superior stagflation allocations and provide outstanding return for risk.

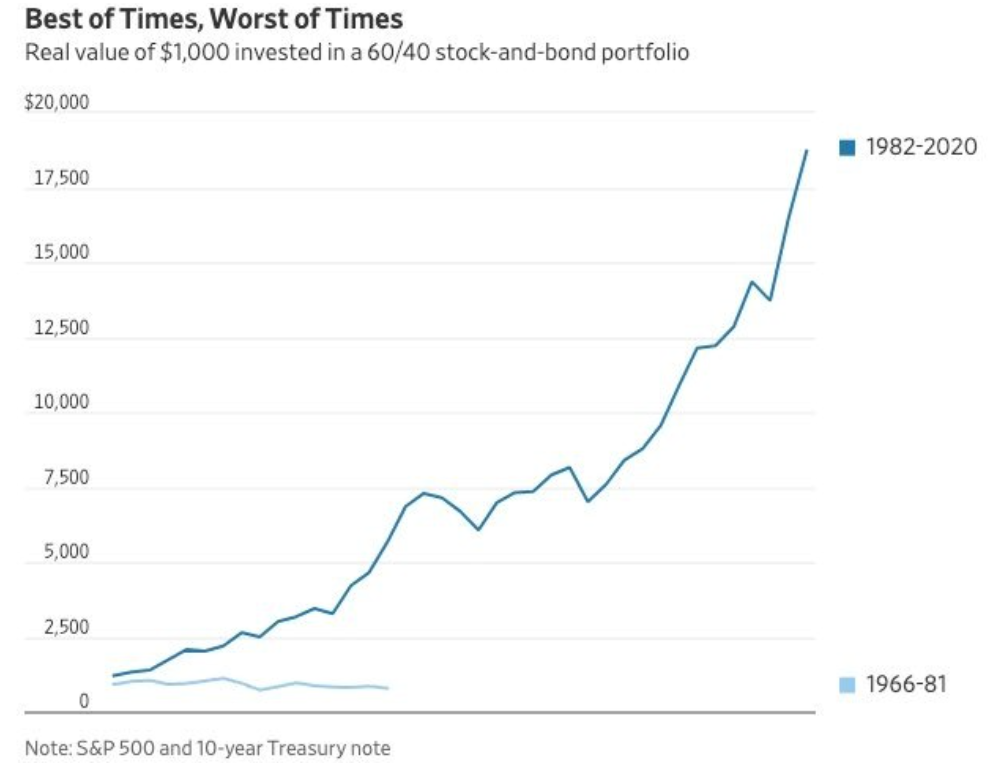

The last time the US experienced stagflation (1966 – 1981) the 60/40 stock/bond portfolio went sideways for 15 years, or down 50% in real terms!

Today the US has 4 times more debt!

MMT Economic Policy Starts Unravelling Into Stagflation

Modern Monetary Theory (MMT) is a macroeconomic theory that suggests that governments can spend without financial constraints if they are the sole issuers of their currency. MMT is based on the idea that governments can print as much money as they need, and that their budgets are not like those of households, so they shouldn’t be concerned about rising national debt.

In the short term, excessive debt and liquidity can support the economy and boost the stock market. However, this is not an everlasting free benefit for investors, nor a long term benefit for the economy. It is disguising and building major long-term problems that typically end up in a stagflationary debt trap. MMT is about to shift from being apparently benign to the challenge of managing excessive debt through an inflationary predicament with weak underlying growth.

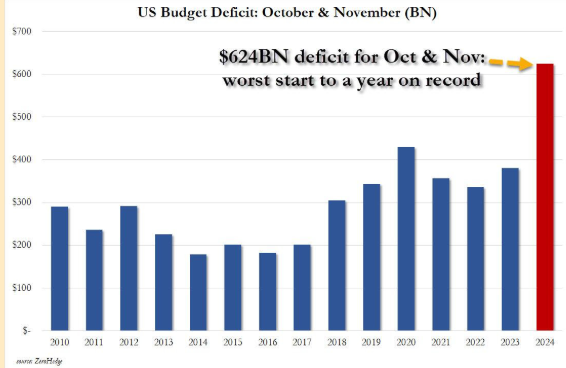

The Federal Deficit is out of control.

Are we now at the point where benign conditions switch to stagflation? Probably!

Corporate insiders have become record sellers while investors have never been so universally bullish. This could signal a major change in market conditions and turn MMT from seemingly benign to unavoidable stagflation.

Policy is now increasingly having to compensate for a weak underlying economy without setting off higher inflation. That is harder to pull off. Stagflation is becoming increasingly unavoidable.

On Inflation Failure

As I have said all year the Fed has clearly failed again on inflation. The Fed Chair admitted as much this week. Fed Chair Jerome Powell this week mentioned that the central bank’s year-end inflation projection has “kind of fallen apart.”

Still the Fed cut rates again anyway at major stock market highs and still projects further rate cuts! Go figure.

The Fed says they are data dependent, but perhaps they missed the simple data in the chart below. Inflation has already troughed far above the Fed’s inflation target and M2 has been rising for 18 months now. Every time Powell cuts interest rates, long term Treasury yields rise higher. That should be a message. Unsurprisingly, the bond markets have lost confidence.

On growth failure

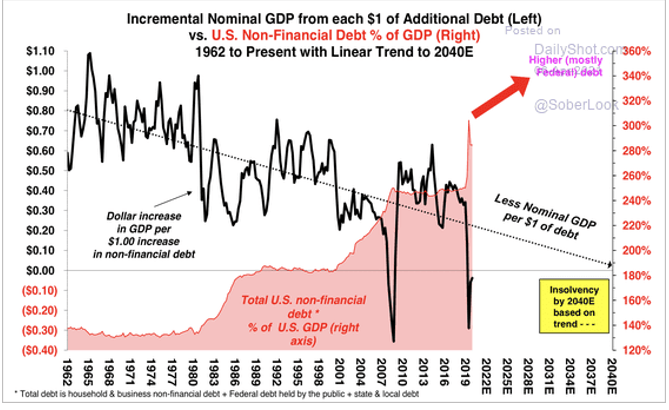

It is clear that over the last 5 decades, the more the debt % of GDP has risen the less impact debt growth has had on boosting GDP growth.

Accelerating debt to GDP generates the illusion of growth in the short term, but if most of the growth comes from deficit spending, this is not a long-term growth strategy. It is a short-term illusion of growth, that consistently damages the long-term growth of the economy.

Now the economy has become almost completely debt dependent, and debt is growing faster than GDP!

A healthy economy does not constantly need infusions of accelerating and unpayable debt. A cleaner take on the underlying growth rate looks at growth adjusted for debt increases.

In a period of peace and recovery, a 6.4% budget deficit indicated the lowest economic growth, adjusted for debt increases since the 1930s. In underlying terms the US is chronically weak ex-debt. It is in a debt trap. The first two months of the current year were a standout record for deficit spending!

What will happen to the stock market if sanity is restored to government spending?

Investors need to be clear whether they are trading or investing. Understand the dynamics of MMT. It is not a one-way ticket to investment heaven. Money flow is bullish for now, but the outlook is deteriorating.

Liquidity support continues but 2025 will become challenging at some stage over the year.

What will the new Trump administration be able to achieve? More questions than answers.

The writing is already on the wall.

The Trump administration has a Catch 22 problem. Containing deficit spending while sustaining growth is going to be challenging. Or practically impossible.

Inflation is rising and underlying growth is weak. Any sustained decline in the rate of growth in debt would immediately weaken the economy possibly into a recession. Recession would boost the deficit to a probably even higher level!

On the other hand, if you don’t decrease the deficit, most likely inflation will take off.

The path to a balanced and healthy economy has become long and narrow. It has become increasingly hard to avoid stagflation. That’s not what you being told but stagflation assets are already outperforming anyway. Imagine how well they will do when more investors realize the predicament

Summary

This is a story that has played out repeatedly throughout history.

Fiat money makes governments and banks beneficial partners in the system.

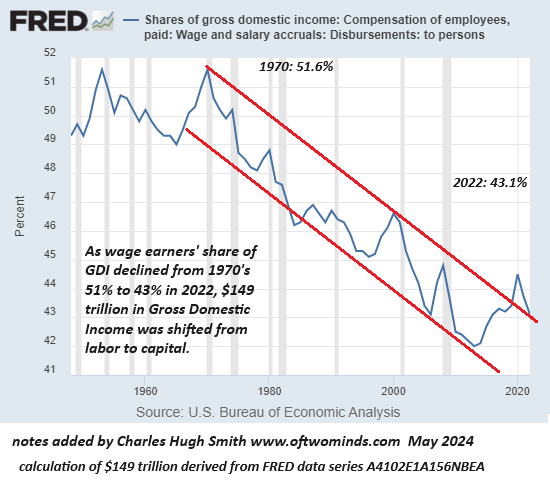

Inflation incentives evolve by increasing the scale of the credit cycle through bailouts. This encourages risk taking and even greater bailouts, as credit increasingly replaces capital. Real wages decline, leading to increasing wealth inequality.

President Grover Cleveland, August 8, 1893: “At times like the present, when the evils of unsound finance threaten us, the speculator may anticipate a harvest gathered from the misfortune of others, the capitalist may protect himself by hoarding or may even find profit in the fluctuations of values; but the wage earner–the first to be injured by a depreciated currency and the last to receive the benefit of its correction–is practically defenseless. He relies for work upon the ventures of confident and contented capital. This failing him, his condition is without alleviation, for he can neither prey on the misfortunes of others nor hoard his labor.

“The very man of all others who has the deepest interest in a sound currency and who suffers most by mischievous legislation in money matters is the man who earns his daily bread by his daily toil.”