How to upgrade your investment experience for life.

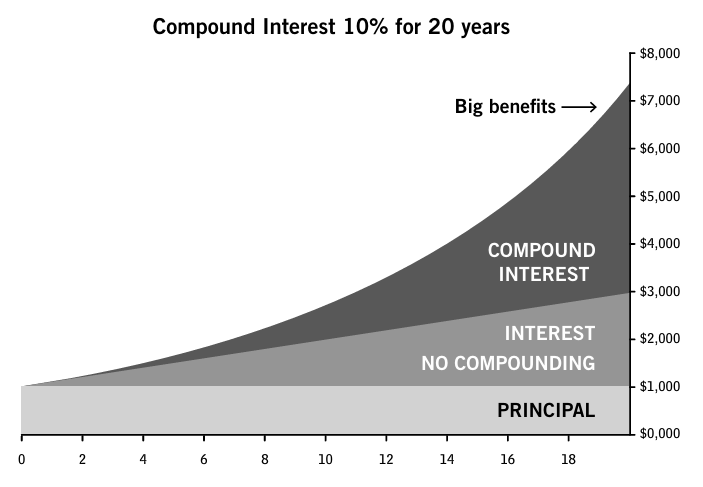

“Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it”.

Einstein

“Simplicity is the ultimate sophistication. It involves digging through the depth of complexity. To be truly simple, you have to go really deep.”

Steve Jobs

How do you compound optimally?

“Diversify But Don’t Drawdown”

Keith McCullough, Founder of Hedgeye.

Why does it beat other methodologies?

Because it harnesses the natural mathematical truth of the universe for optimal results, low risk AND high long term returns. Examples below.

“all great truths are obvious truths but not all obvious truths are great truths,”

Benoit Mandelbrot

————————————————

Compounding is the highest form of investing.

Most investors miss the enormity of that simple statement. Compounding through dynamic asset prices requires a deep understanding of mathematical complexity. Most investors don’t go “digging through the depth of complexity”, to get to the remarkable simplicity and benefits of focusing on compounding their returns.

If you have not fully adopted compounding, you are taking unnecessary risks for a likely lower long-term return.

Here is Warren Buffett’s statement about this.

If you are not compounding your investments, you are missing the most important principle and mechanism for successful long-term investment. The benefit of compounding is that you achieve a HIGHER return, with LOWER risk. Not only is your capital safer but also your long-term return is higher.

- Nothing beats compounding as a process for long term capital security and higher long-term returns. This is why it is the highest standard of investing and is prioritized by ALL the most successful investors. See “Invest Like The Best”.

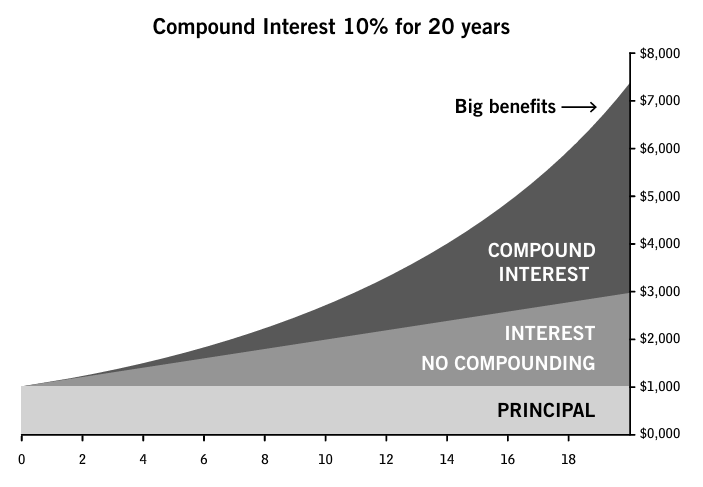

- High risk does not reliably correlate with high long-term returns. This weak assumption is widely used in allocation advice, so capital is being widely misallocated.

- Stocks are always better for the long run? What is the long run? There are extended periods where this is not true if you examine deep history. Hardly a credible thesis, and a high risk proposition.

- The long run allocation is governed better instead by thinking in terms of regimes that can last for many years but not for ever. Better to make strategy defined by current investment regime, which means recognizing that regimes do change and allocations need to change with them.

- Passive investing does NOT protect you from a drawdown. Therefore, it fails to ensure either capital security or compounding. For most investors optimal return needs to happen in specific time horizons. Few investors really have time for the “long term”.

- Compounding can be defined mathematically. An investor can know in real time if they are on track for “Best Investor” results. All the other approaches are long-term hopes, where the outcome is unknowable, not managed, and so are out of your control.

- The crucial risk to return assumption, higher risk leads to higher long-term return, used in conventional allocation approaches is just plain wrong.

Risk and Return are a natural function of the markets. By simple observation the assertion of a positive relationship is just dead wrong. Below we provide several examples.

The true relationship between risk and return is more complicated than assumed and even opposite of what is assumed!

In the chart above the least volatile S&P 500 stocks had almost double the return of the highest volatile stocks, even during one of the biggest bull markets in history.

Naturally they would also outperform in a sideways or downward market. So overall the assertion “ high risk equals high return” is just plain wrong.

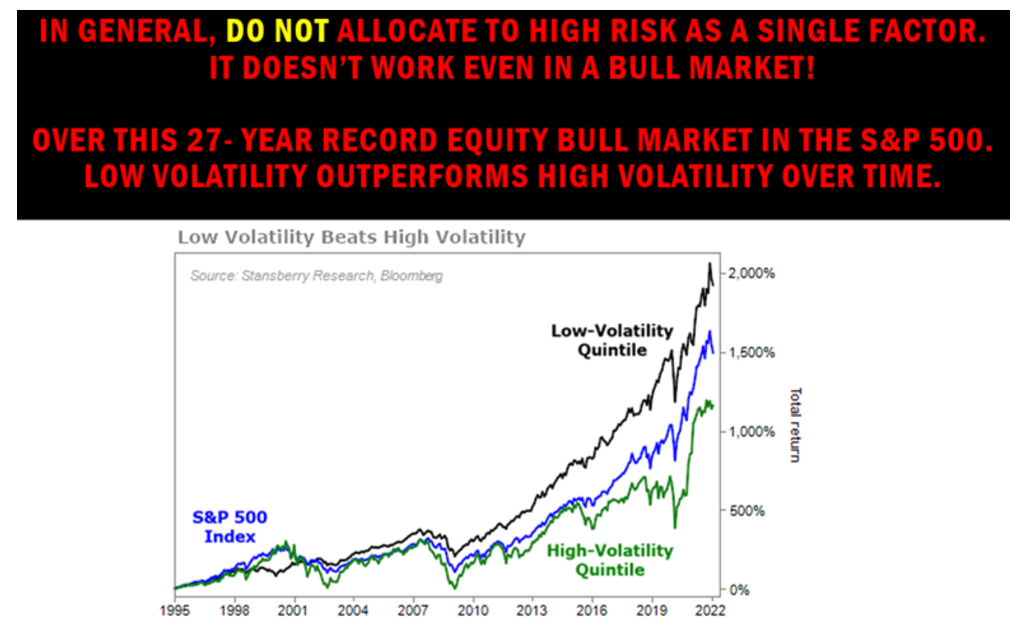

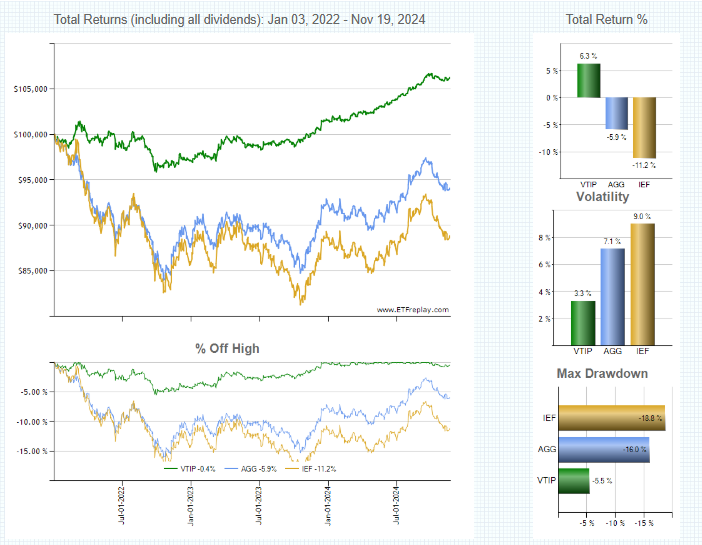

Another recent example of focusing on compounding can be seen in bond markets

In these blogs we have consistently advocated TIPS securities rather than bonds for several years, particularly in short maturities, like VTIP. TIPS are Treasury Inflation Protect Securities.

Over the last 3 years any bond allocation has underperformed VTIP. What you can see is compounding in action.

Compared to AGG or IEF. VTIP had:

- Lower drawdown.

- Consistently lower risk.

- A positive return rather than negative.

- A significantly higher return than bond alternatives.

Investors need to be clear that the benefits of effective compounding are obvious and deliver higher returns with low risk. This is highly desirable for all investors but crucial when it comes to retirement investing.

Get your Objectives and Assessments right

Where investors go wrong is by being so heavily focused on short term returns, rather than long term compounding metrics, which you can monitor in real time! You don’t have to wait to find out whether you are on track.

Why are short term returns the wrong objective and assessment, and compounding metrics more productive?

Once you understand the metrics required for compounding you have new objectives and assessments. This makes you process oriented and puts you in control and your investments accountable in real time. Otherwise, you are assessing outcomes, which involve luck and randomness.

Make sure you are not “Fooled by randomness” in how you view success.

I show in my book that investors who solely focus on short term returns rarely do well in the long term. It is crucial to move on to compounding metrics, for better objectives and assessments, and ultimately results.

There are several periods of near zero rates of return.

Also very extended periods of just poor returns.

In the article linked in the title above, this notion is reinforced by international equity markets. Furthermore. Asset allocation in combination with bonds has also varied a great deal over time. It is an oversimplified assumption that is clearly not optimal. In 2022 stocks AND bonds went down significantly, leading to major drawdowns which are incompatible with compounding.

Using this much wider historical data it seems more realistic to consider regimes of varying periodicity for ongoing modes of behaviour, and be aware that they are changeable.

Overall, the idea that asset allocations should be based on all time rules for various assets and combinations of assets looks like a substantial and non-valid oversimplification of the broad data. Therefore, investors need to realize that they are investing based on very questionable assumptions.

I believe that a better way to look at long term allocation comes from considering a current market regime or environment which is set from policy, economic and other cycles. There are now great services available to help you do that. Learn how for free at Hedgeye University.

Today we have so much more access to information and markets, these notions of all time allocation models look increasingly outdated. New techniques have already largely changed the game with great results.

Passive investing is not low risk investing and is significantly exposed to drawdown.

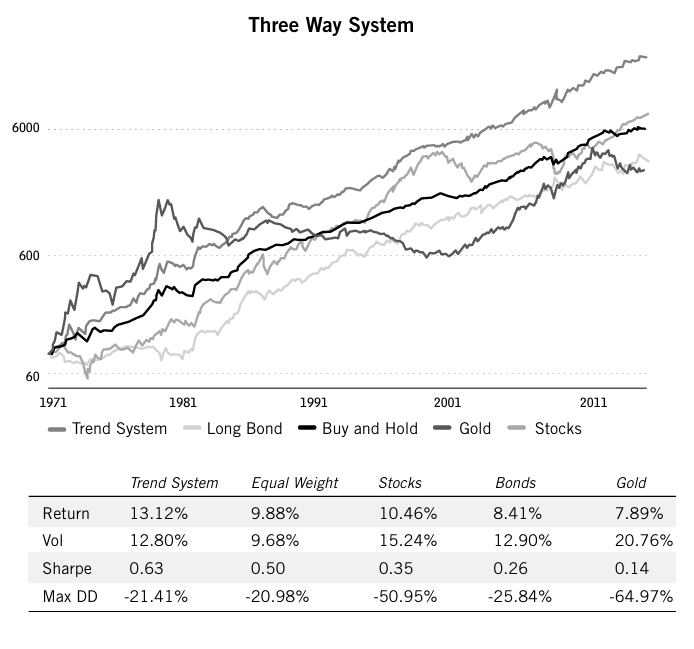

The chart below, taken from my book, shows long term allocation to core assets equities, bonds and gold. It also shows a very simple allocation model (trend system) that allocates away from drawdowns in these core assets.

Simply by introducing a systemic constraint on drawdown risk metrics go down and long term return goes up!

The over a 45 year period reveal much better long-term returns systematically with lower risk and drawdown. Much better results come from improved compounding than any passive allocation that could have been chosen from the three core asset classes.

Compounding requires 4 key metrics

- Minimize Drawdown

- Minimize Risk, measured as the standard deviation of return.

- Maximize Alpha, measures the return relative to volatility of return.

- Maximize Long term compounding rate (At least 3 years, the longer the better) compared to market benchmark returns. Understand the opportunity set for the context of your return.

These metrics are in strict order of priority. This reinforces that compounding is primarily a LOW-risk approach. As we have shown it is also a naturally HIGH long term return approach.

You now have the ideal objective and assessment for investing, which you can monitor in real time. It brings enormous clarity on how to invest optimally and whether that is what you are doing!

Compounding is highly defined in real time, it can be viewed and checked for its 4 key metrics against a range of benchmarks.

In a few seconds you can see whether or not you are on track for great returns.

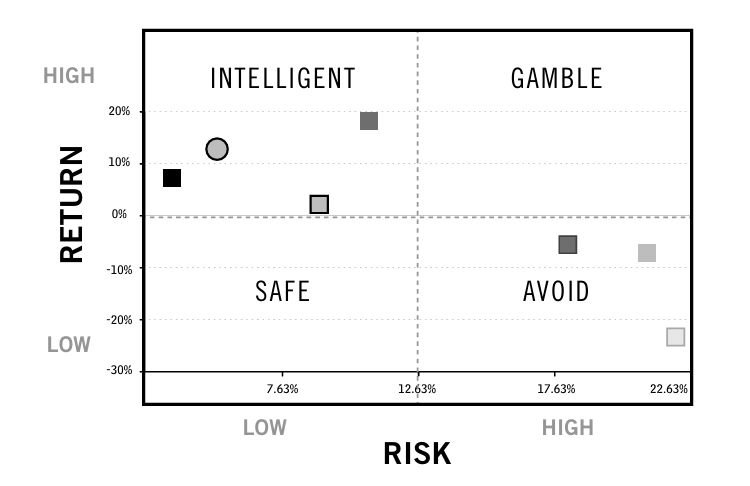

In the chart below the circle is your portfolio, and the squares are benchmarks. Best Investors always choose “safe” or “intelligent”. Investors who embrace risk fall into “gamble” or “avoid” categories for expected return.

Summary

Surprisingly, few investors understand how to optimally assess their performance or align their investment practice and objectives appropriately to the most optimal investment approach, which is compounding.

Whether your investment journey has just begun or you have decades of experience, it is all too easy to fall into commonly quoted and overly simplistic assumptions about investing.

Unfortunately, the crucial complexity of markets lies beyond unsubstantiated myths and mantras.

Compounding focuses optimally on market reality, exposes confused thinking, and reveals a clearer and surprisingly simple structure that can be easily understood and adopted with transformational benefits.