Money And Debt Firehose.

Financial Distortions.

Policy Instability And Failure.

Staggering general misallocation to gold.

How to survive reaccelerating inflation.

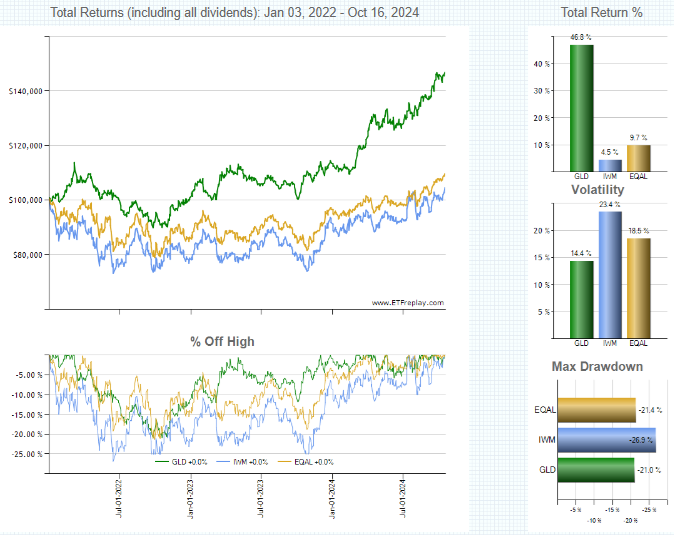

The Chart above shows that the equal weighted top 1000 US companies has an almost identical performance as the Russell 2000, the next 2000 biggest US companies. On average these top 3000 US equities have had single digit performance over nearly 3 years.

The Mag 7 are, of course, included in EQAL. Gold has substantially outperformed with lower volatility and drawdown, so it has been a far superior allocation. Yet US investors have missed this far better allocation throughout this period.

Gold ETF holdings have been mostly sold since 2022. Most US investors have substantially missed this allocation and are still nowhere close to an optimal allocation.

This is a staggering misallocation of capital.

As is shown below, this way of looking at equity performance far more closely matches the dismal economic performance and policy over the period.

“It is tempting to suggest that the budget problem and its consequences for the performance of the economy could be solved by monetary policy. But excessive money and credit creation to meet the needs of the Government would only risk adding to the uncertainty about future inflation and interest rates. In the end, nothing real would be gained, while hard fought ground in the battle against inflation would be jeopardized.”

Paul Volcker, Fed Chair, January 27, 1983

Currently, the IMF doesn’t even try and disguise its open dismay at current US economic policy.

“Probably Worse Than It Looks” – IMF

“systemically important advanced economies such as the United States, in which the primary deficit is the largest driver of debt-at-risk, three-year-ahead debt-at-risk is estimated to exceed 150 percent of GDP, 20 percentage points higher than the baseline debt projection in the October 2024 World Economic Outlook.”

IMF

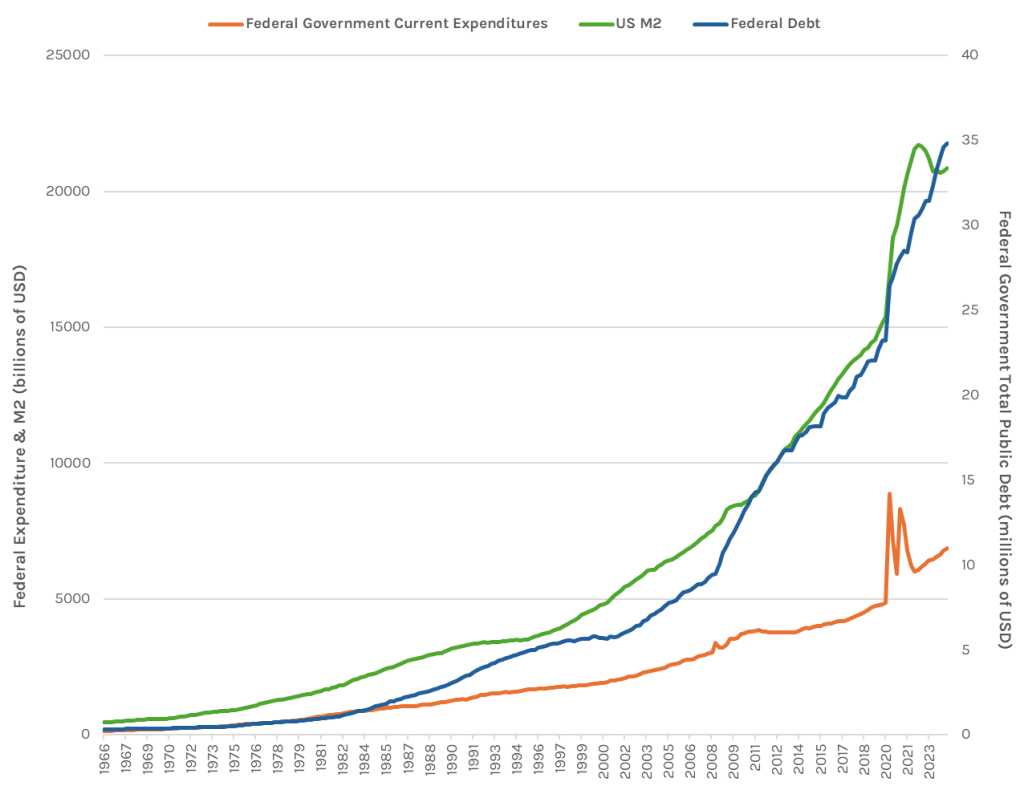

Money And Debt Firehose.

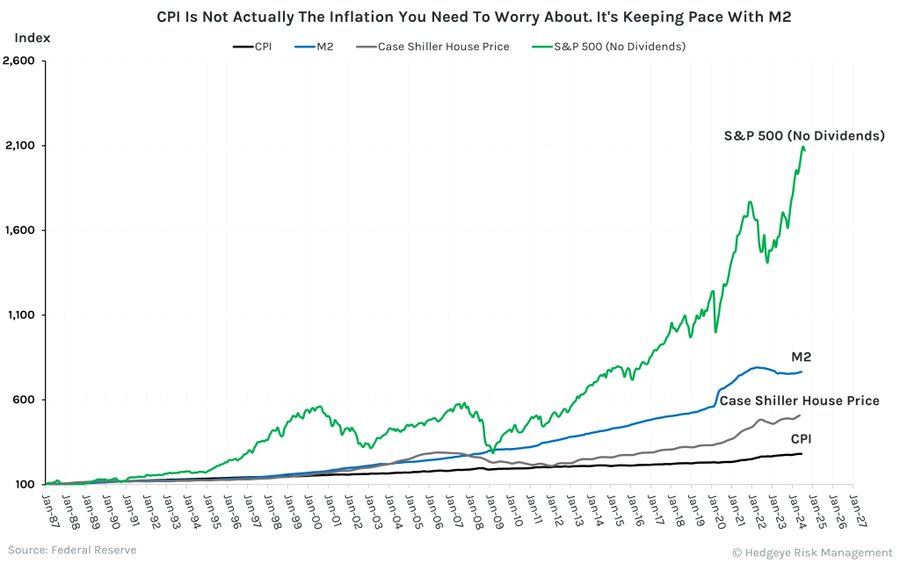

Today, US policy makers clearly have no interest in containing exponentially rising debt. In fact, they are enabling it further through exponentially growing money supply.

The Federal Reserve and the Regime Are One and the Same

Inflation is the easiest policy response to cope with debt, and the market has already started pricing it in within a month of the Federal Reserve’s panic September rate cut. While the 2 year Treasury is still pricing in further rate cuts long maturity Treasuries have reversed and reverted to a bearish trend.

Money supply is rising once again.

Financial Illusion – It should be obvious that this is either a bubble of epic scale or we have entered a crack up boom, which is a bubble taken to the extremes.

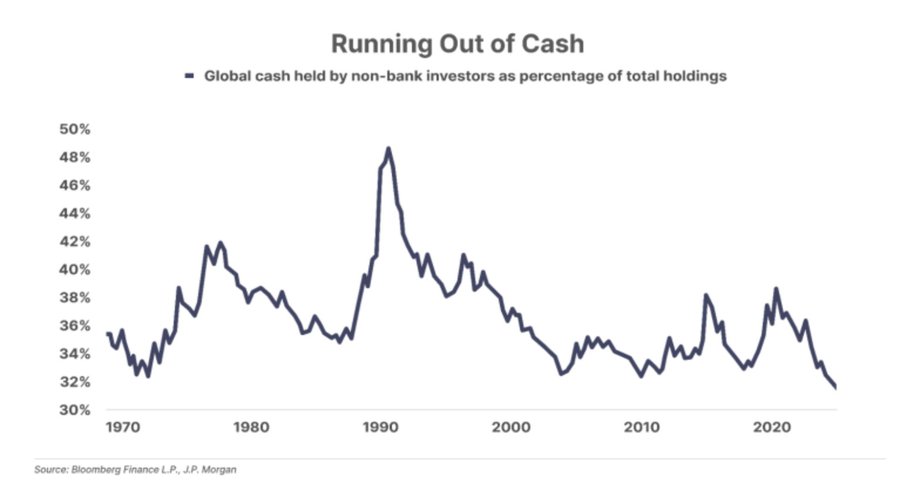

According to their positions, investors currently believe this is the best investment environment in their lifetimes, yet most US investors continue to avoid the best performing asset class – gold. Instead, they prefer “growth” apparently at almost any valuation.

Investors are consumed with the immediate effects of recklessly excessive liquidity, money supply, and debt growth which are creating an explosion in financial asset prices and the illusion of growth.

US investors have never been more optimistic since the gold link was broken in 1971. They are more fully invested than ever before.

This is not a normal growth environment. It is primarily an inflation environment.

The media oversimplifies the issue about growth. It is not about the latest data point, or whether or not we will have a hard or soft landing or even a recession. It is clear the quarterly GDP growth rate can be gamed by turning government spending up and down.

The real issue is the long-term growth rate which has been declining for decades as I have shown repeatedly. The point is that the exponential growth rate in debt and money supply has already shown it has failed to grow the economy.

It has been spectacular at boosting asset prices above their normal economic value, but that is called a distortion, not growth. Investors need to understand the difference.

Then they will also understand that many asset prices are extremely vulnerable to a correction from the highest US equity values in history. Not all asset values will collapse, some will do exceptionally well. To be successful investors will need to get the allocation right, but just as important, they will need to risk manage their portfolio for long term compounding.

This is key because Investors need to be clear that this level and pace of money supply and debt growth is getting closer to running off the rails. This kind of policy increasingly generates inflation not growth over time.

Stagflation has already begun. And the remaining runway before a reset is getting short. Gold is already beginning to outperform even the Mag 7 US equity stocks.

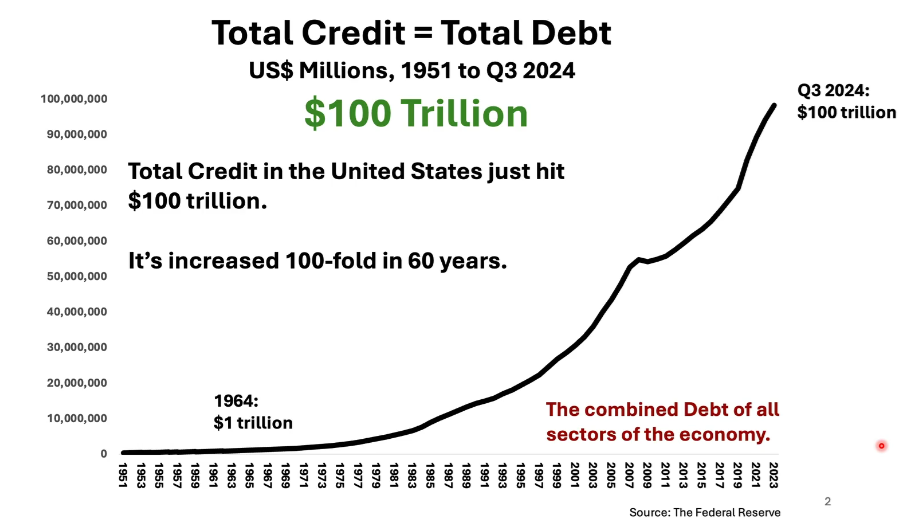

Total Credit in the United States hit $100 trillion during the third quarter, a 100-fold increase in 60 years. This must be viewed as history’s greatest Credit Bubble. Also it has now reached a point of no return. The choice is either a politically unacceptable depression, or a substantial reacceleration of inflation.

The bubble has broken multiple all time records.

The chart below shows how the economy has been transformed from free market capitalism to a policy managed exponential debt, liquidity and money supply driven credit bubble.

The chart above shows that a small hiccup in the credit bubble caused the 2008 great financial crisis. So, the exponential curve started over. Our current financial system has only one playbook apparently. Find the limits of credit growth, collapse and start over again.

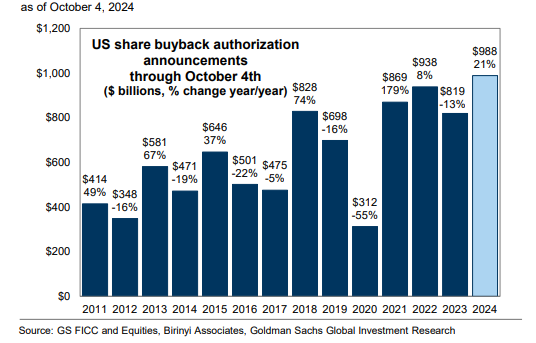

The current bubble has broken the records because, in addition to astonishing debt growth, new tools were also employed. Corporate buybacks have been by far the biggest stock market buyer since 2008. They have been a major factor in the outperformance of the Mag 7.

Now we are in a predicament.

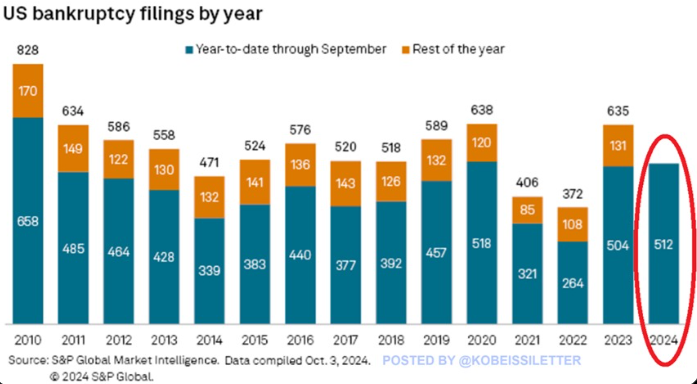

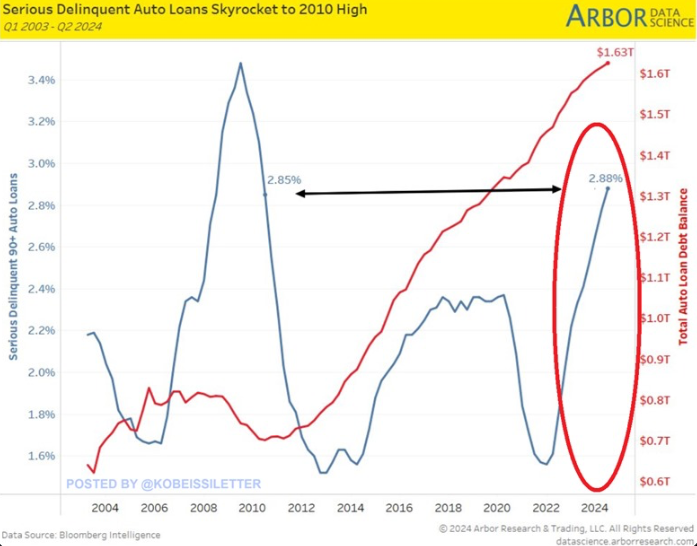

Confusion and delusion about a strong economy continues. We can easily show that even with the most reckless policy we have ever experienced, in underlying terms the economy in still chronically weak. You have to look beyond just asset prices and GDP statistics to see that, but it soon becomes obvious, and even alarming.

The stock market and GDP has continued to rise only because of the force of buybacks, money supply, debt, and liquidity. All at records.

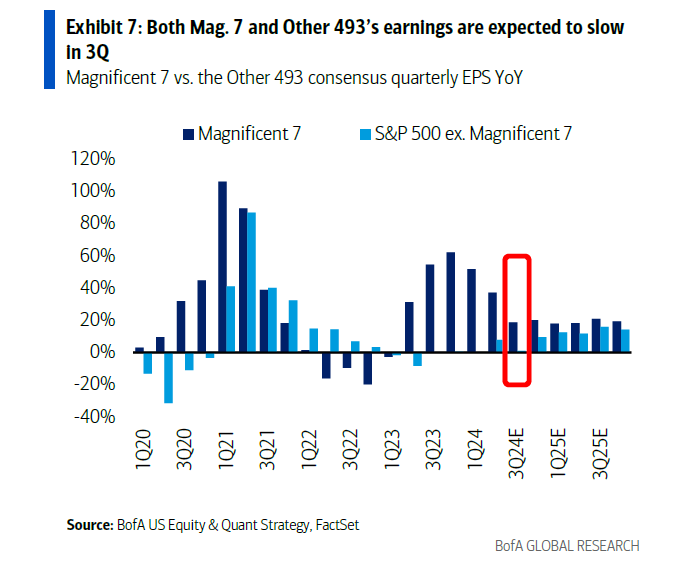

Where are the earnings?

The historic rise in the S&P 500 over the last year is not matched by the equal weighted top 1000 US stocks, EQAL, or the Russell 2000. In fact there has been almost no increase in the earnings of 493 stocks of the S&P 500!

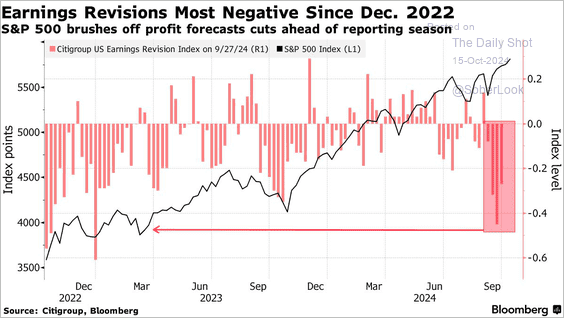

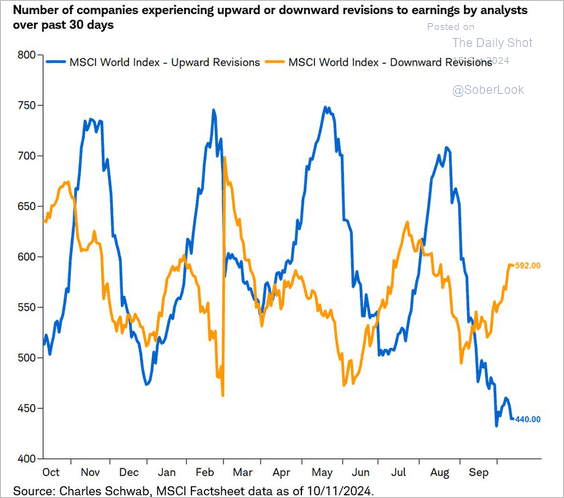

Furthermore, earnings revisions have been weak recently in both the US and globally.

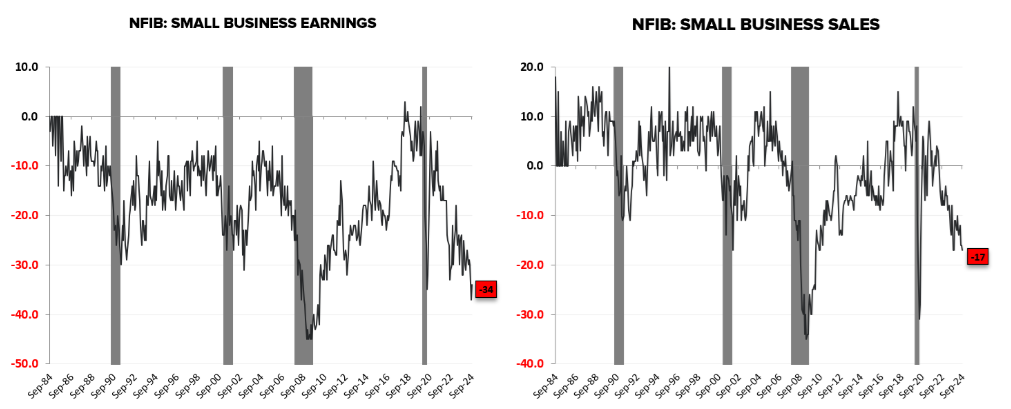

The small business economy is the heartbeat of the US economy, but it is in a depression.

The delusion about a strong economy is made clear every month by the NFIB small business survey which continues to show that the real economic driver of jobs and the economy, small business, remains on its knees.

Summary

US stock market performance over that last 3 years has been a money supply and debt illusion. This representation of the top 3000 stocks makes that clear. As it also does of the massive asset misallocation by US investors in general.

It is crucial that investors understand that US equities markets are not automatic compounding machines. They need careful review at the highest valuation in history and most invested allocation ever. As has been shown before, John Hussman calculates the potential for the biggest drawdown in US equities in history.

The relentless bull market of recent decades, passive investing, a firehose of money and debt has led to simplistic allocations which are in crisis and need attention.

Investors should review the best allocations for the stagflationary 1970s.

Investors should also adopt a compounding methodology in order to manage the inevitable instability of the US.

The US financial system has significant risks as has been highlighted by the IMF. It has almost certainly failed to stabilize inflation back at 2% and will now be compromised by the challenge of balancing, growth, inflation, debt and financial stability, from a position where debt and money supply are out of control. Policy has abandoned any rules based policy, and violently contradicts the advice of Paul Volcker.

In your allocation make sure you understand that there are many different inflations and they are non-linear. The US stock market has had an astonishing performance but may now be losing its lead to gold.

Make sure you are ready for money supply to accelerate significantly at some point, and consider which assets will do well as the environment changes. Here are two videos that may make you realize dramatic changes are likely to take place.